Global Luxury

Market Insights

Delivering comprehensive insights into the global luxury industry, exploring market trends, brand strategies, and innovations shaping the future of high-end fashion, jewelry, travel, and lifestyle.

Industry Categories

Explore comprehensive insights across key luxury market segments

Luxury Market Trends

Sustainability and Ethical Sourcing: The New Imperative in Luxury Jewelry

Consumer priorities are shifting towards sustainability and ethical sourcing in luxury jewelry, with 78% of high-net-worth individuals considering these factors in purchasing decisions. Brands are responding by adopting transparent supply chains, using recycled precious metals, and certifying conflict-free gemstones. This trend is reshaping market dynamics, influencing everything from material sourcing to brand storytelling, with 65% of luxury jewelry companies now publishing sustainability reports.

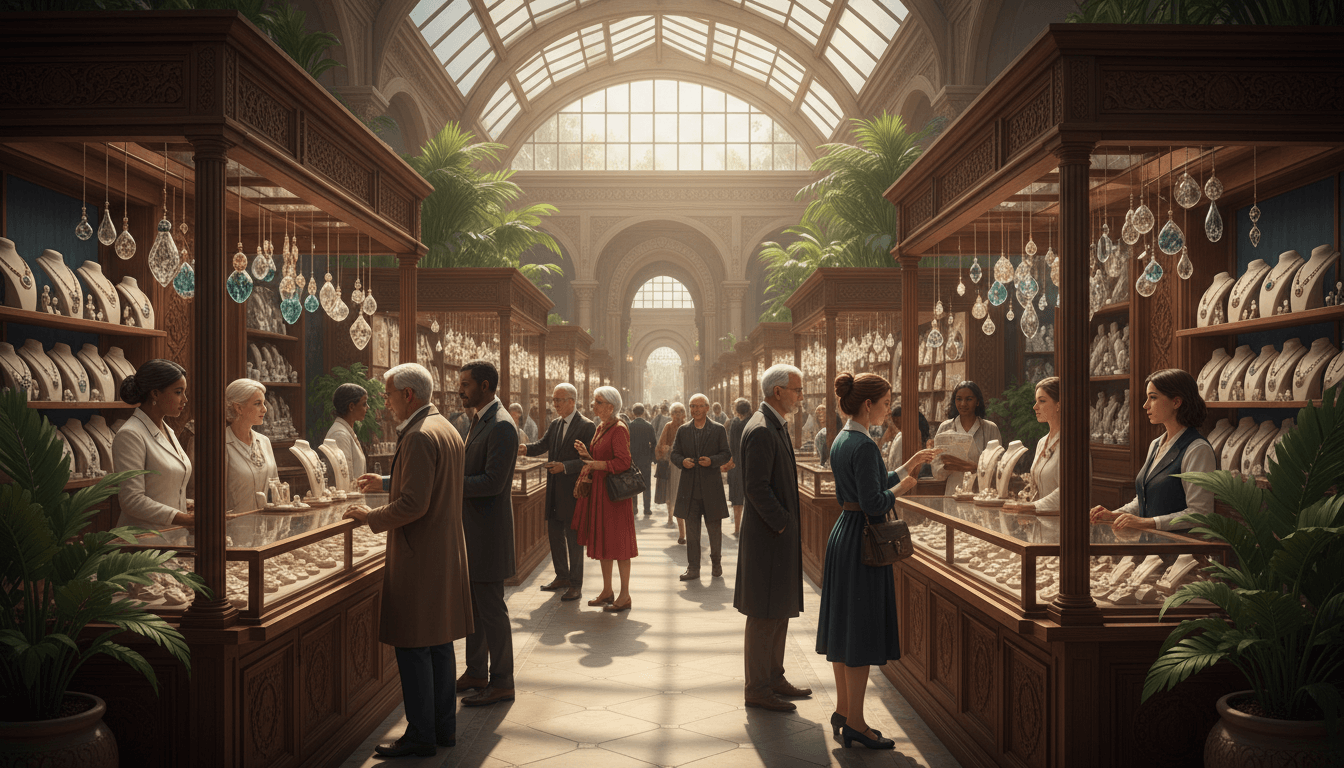

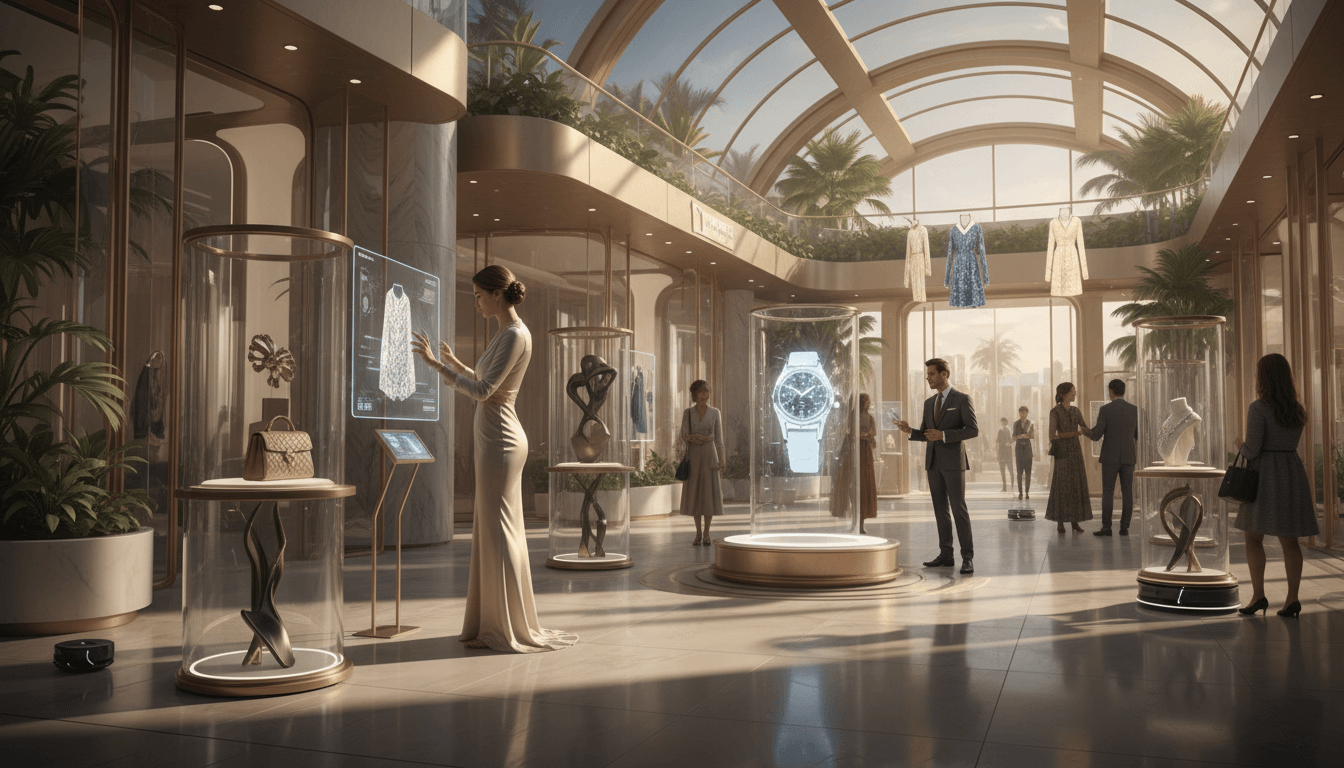

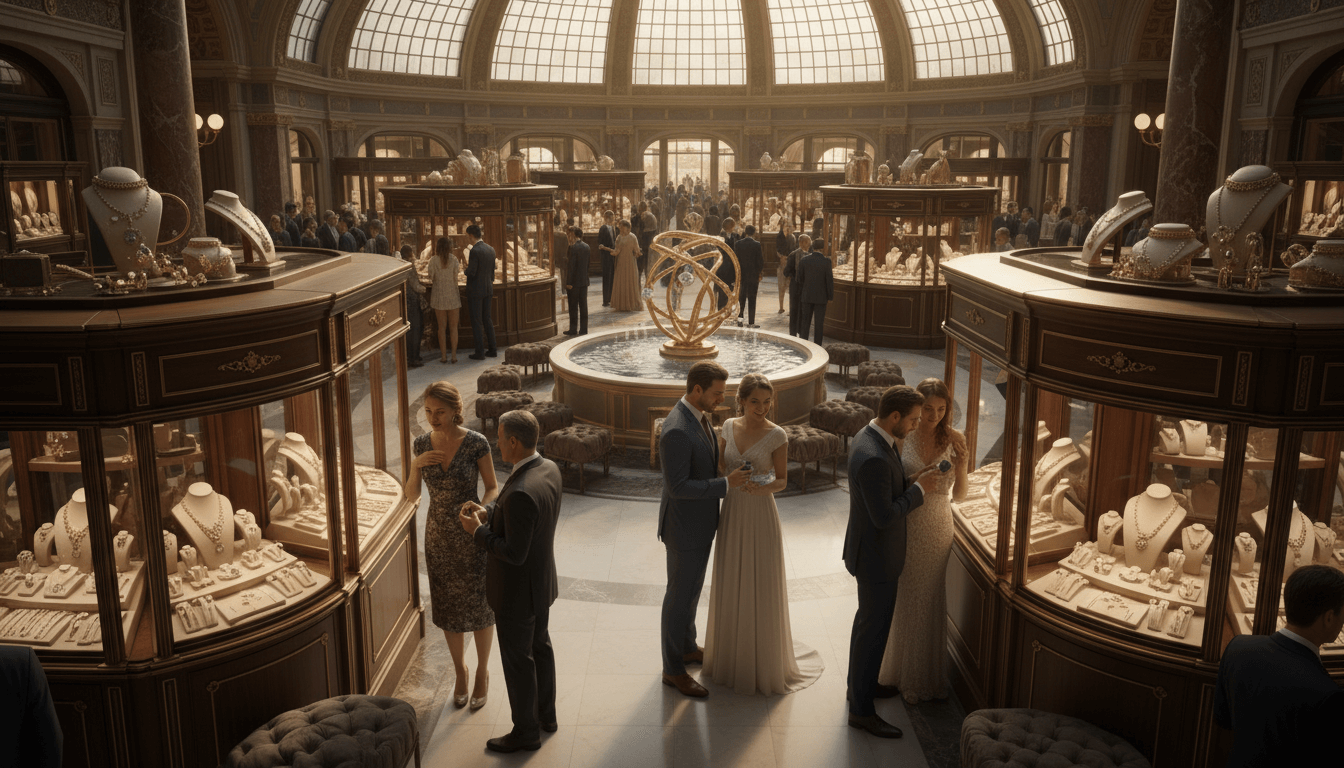

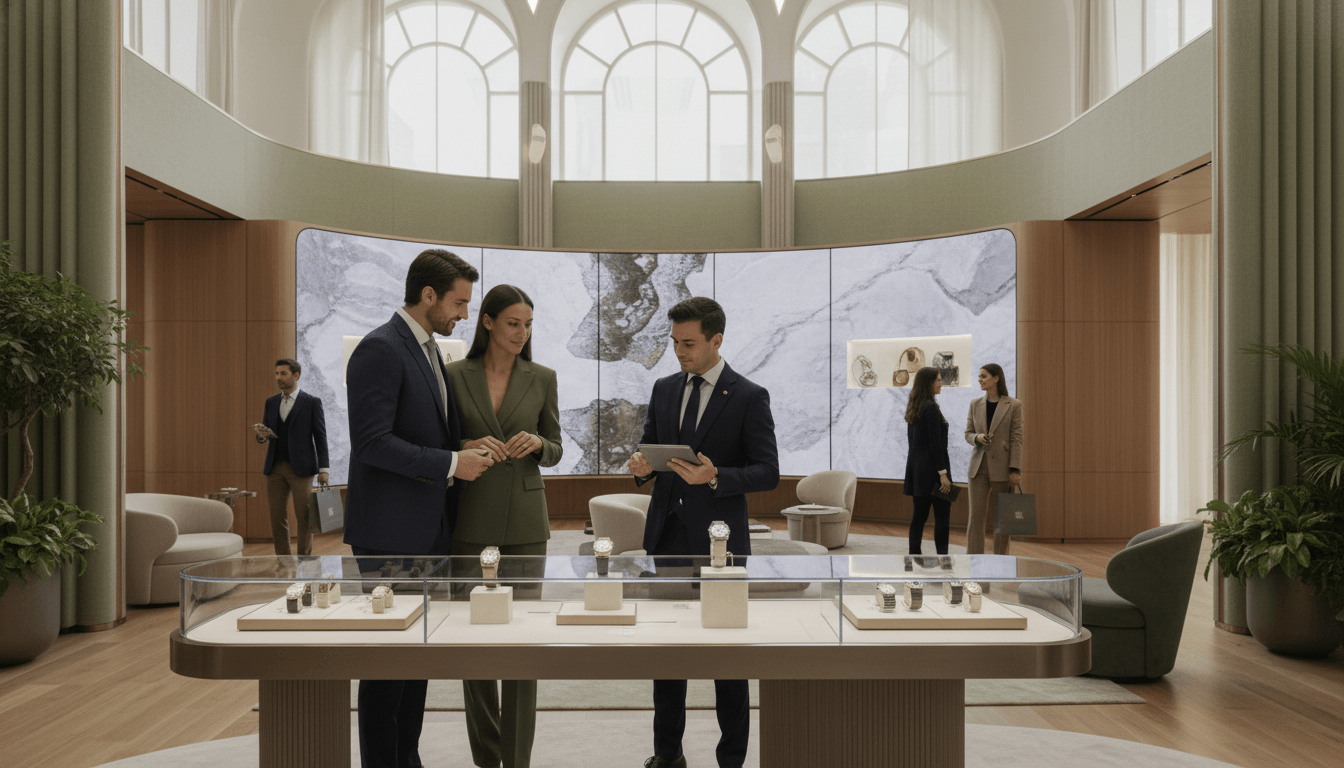

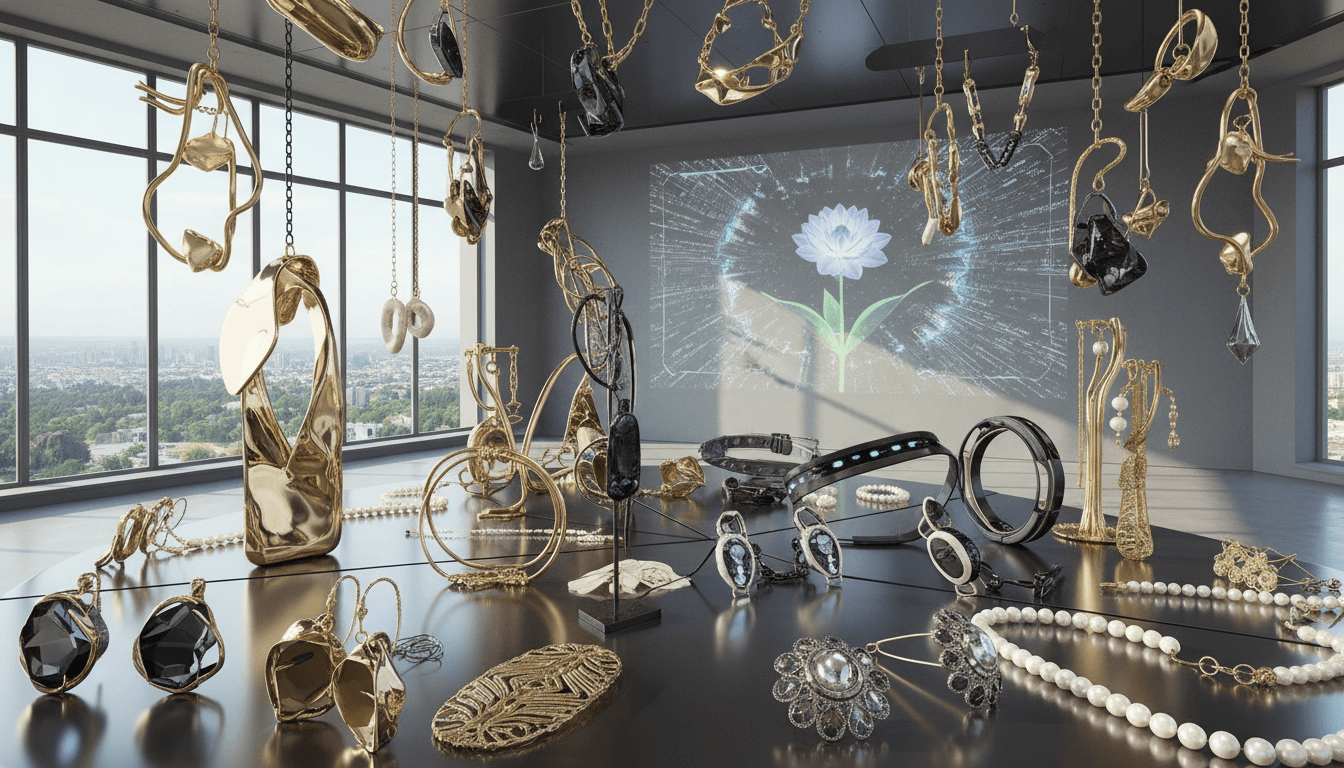

Experiential Retail in Luxury Jewelry: Crafting Unforgettable Customer Journeys

Luxury jewelry retailers are pioneering experiential retail strategies to redefine consumer engagement. By designing immersive in-store environments, offering personalized consultations, and curating bespoke customer journeys, brands like Cartier and Tiffany & Co. foster deep emotional connections and brand loyalty. These approaches, supported by data showing a 40% increase in customer retention for experiential-focused brands, differentiate them in a competitive market. This article explores how these innovations transform traditional retail into memorable, high-value experiences that resonate with modern luxury consumers.

Gold Jewelry Market Dynamics: Investment, Culture, and Surging Demand in 2024

The gold jewelry market continues to lead the luxury sector, commanding 54.9% of the global jewelry market share in 2024. Fueled by a 25% annual price surge and heightened demand in key regions like India, gold jewelry serves dual purposes as both a timeless fashion statement and a robust investment asset. This article explores the drivers behind this growth, including cultural traditions, price dynamics, and strategic market adaptations.

Celebrity Endorsements and Brand Collaborations: Reshaping the Luxury Jewelry Market

Celebrity partnerships and brand collaborations have become pivotal strategies in the luxury jewelry sector, driving brand visibility and consumer engagement. Notable collaborations like Tiffany & Co. x Pharrell Williams and brand ambassadors such as Michael B. Jordan for David Yurman exemplify this trend. These initiatives leverage influencer marketing and cross-industry alliances to appeal to diverse demographics, enhancing market reach and reinforcing brand prestige. This article explores the dynamics, impacts, and future directions of these high-profile partnerships in the evolving luxury landscape.

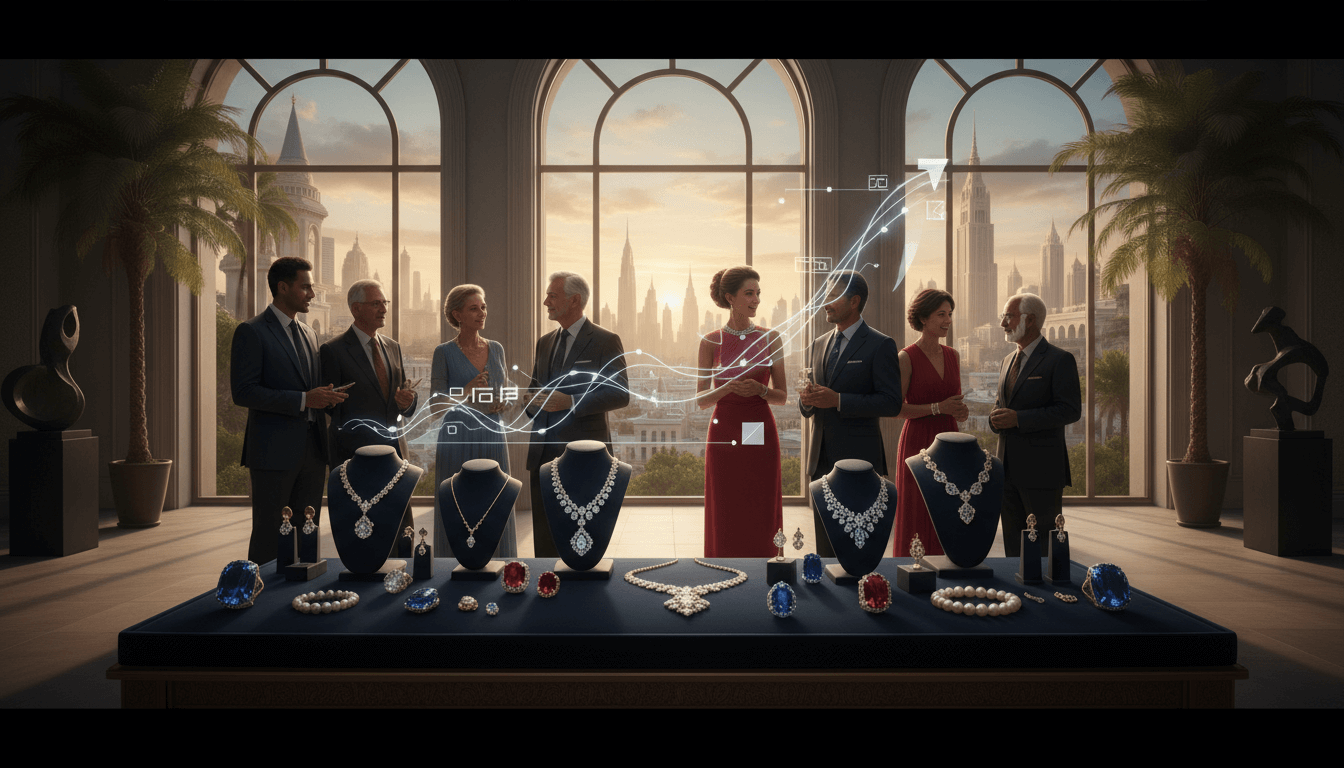

Investment and Collectible Jewelry Trends: Luxury Assets Redefining Market Dynamics

Luxury jewelry is evolving beyond adornment to become a strategic long-term investment, driven by growing demand for rare gemstones and limited-edition pieces. High-net-worth individuals are diversifying portfolios with tangible assets, fueling a market where jewelry serves dual purposes as a fashion statement and appreciating asset. This trend, supported by data from Credence Research, highlights the increasing valuation of collectible jewelry as a stable alternative investment in volatile economic climates.

Secondhand Luxury Jewelry Market Growth: Value, Sustainability, and Shifting Consumer Preferences

The secondhand luxury jewelry market is experiencing unprecedented growth, driven by consumer demand for value, sustainability, and unique pieces. According to Bain & Company, this trend reflects a broader shift in luxury consumption, with pre-owned items gaining mainstream acceptance. Key factors include economic considerations, environmental awareness, and the appeal of heritage and craftsmanship in jewelry, apparel, and leather goods. This article explores the market dynamics, consumer motivations, and future outlook for the thriving resale sector.

Luxury Jewelry Investment Trends: Merging Aesthetics with Financial Strategy

The luxury jewelry market is evolving as consumers increasingly recognize its dual role as a fashion statement and a viable investment asset. Driven by a surge in demand for rare gemstones and high-value collections, this trend reflects a strategic shift toward long-term value preservation. Industry reports highlight that jewelry now serves as a tangible financial asset, with investors seeking pieces that combine craftsmanship with potential appreciation. This comprehensive analysis explores the factors fueling this movement, from market dynamics to consumer motivations, offering insights into how luxury jewelry is redefining wealth management in the global luxury sector.

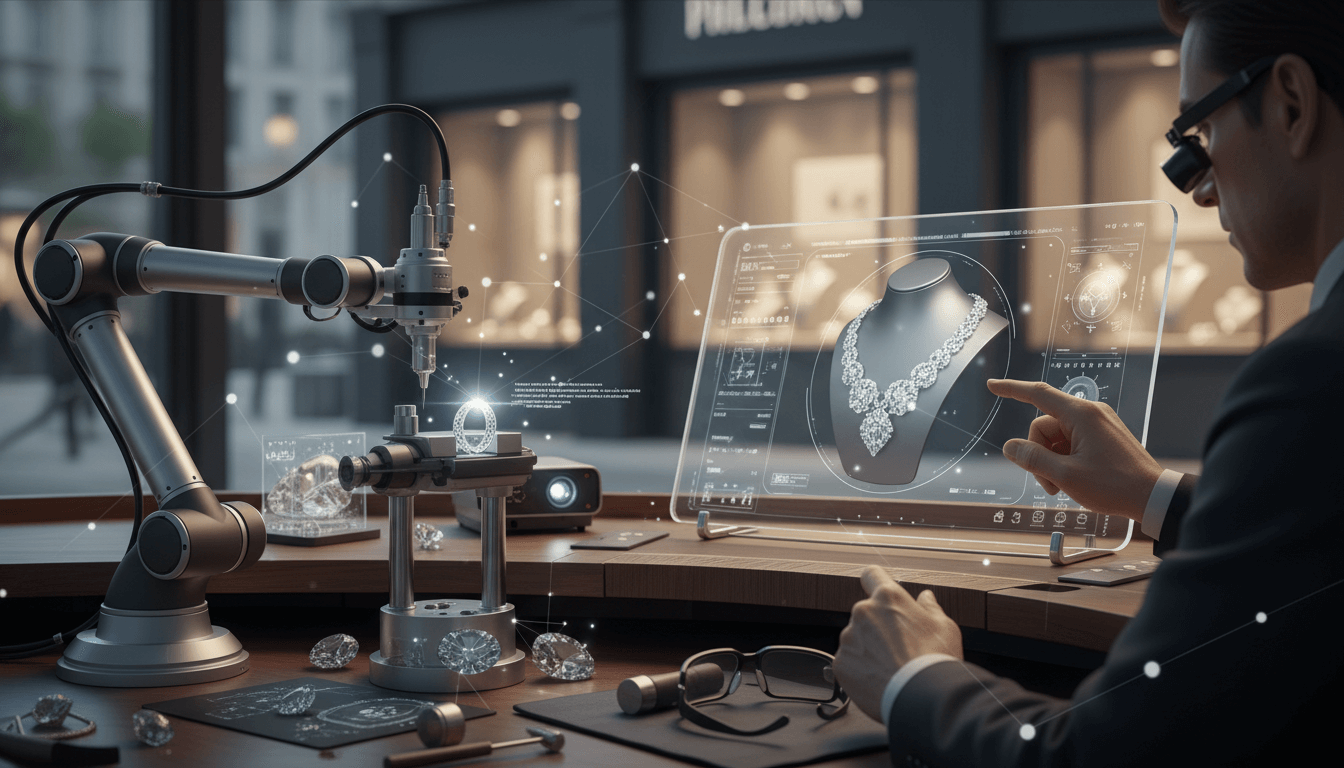

Technology Integration in Luxury Jewelry: Blending Craftsmanship with Innovation

The luxury jewelry market is undergoing a transformative shift as brands increasingly embed technology into their designs, merging traditional craftsmanship with cutting-edge digital elements. Innovations include smart jewelry with health monitoring and connectivity features, tech-enhanced designs using advanced materials like lab-grown diamonds and sustainable alloys, and revolutionary manufacturing techniques such as 3D printing and AI-driven customization. This trend not only enhances functionality and personalization but also appeals to a new generation of tech-savvy consumers, positioning the sector for sustained growth and innovation. According to Stellar Market Research, this integration is reshaping market dynamics and consumer expectations.

Digital Transformation in Luxury Jewelry Retail: Navigating E-Commerce, AR, and Influencer Marketing

The luxury jewelry sector is undergoing a profound digital transformation, driven by the expansion of e-commerce platforms, integration of augmented reality try-on features, and the rising influence of social media and influencer marketing. These innovations are reshaping consumer engagement, with personalized online experiences and advanced technologies enhancing accessibility and driving sales. Brands that adapt to these trends are poised to capture a larger share of the evolving market, as highlighted in the Global Luxury Market Digital Trends Report.

Gold Dominance and Personalization: Shifting Dynamics in Luxury Jewelry

Gold jewelry continues to lead the luxury market with a commanding 54.9% share, driven by its enduring appeal and investment value. Rings dominate the product segment at 33.8%, fueled by cultural traditions and milestone celebrations. A significant trend toward personalized and unique designs is reshaping consumer preferences, emphasizing bespoke craftsmanship and emotional connections. This analysis explores material innovations, market drivers, and future outlooks for luxury jewelry.

Cultural and Regional Luxury Jewelry Preferences: A Global Market Analysis

Luxury jewelry preferences exhibit profound diversity across global regions, shaped by cultural heritage, economic dynamics, and evolving fashion trends. Europe maintains its legacy as a mature market with sophisticated tastes, while Asia-Pacific emerges as the fastest-growing region, driven by rising affluence. The Middle East showcases jewelry's deep cultural significance, often emphasizing opulent designs. Brands are increasingly adopting region-specific strategies, from marketing campaigns to bespoke collections, to resonate with local consumers. This article explores key regional markets, consumer behaviors, and strategic adaptations essential for success in the global luxury jewelry landscape.

Emerging Trends in Luxury Jewelry Design: Blending Heritage with Modern Innovation

The luxury jewelry sector is evolving with groundbreaking design trends that merge traditional craftsmanship with contemporary aesthetics. Key developments include the rise of gender-neutral collections, increased demand for bespoke and personalized jewelry, and a strong focus on sustainability through ethical sourcing. These shifts reflect consumer preferences for pieces that serve as both fashion statements and long-term investments, driving brands to innovate in design, materials, and supply chain transparency. Insights from Luxury Market Trend Analysis 2024 highlight how these trends are reshaping the industry.

Gender-Neutral Luxury Jewelry Trends: Redefining Elegance Beyond Gender

The luxury jewelry sector is undergoing a transformative shift towards gender-neutral and unisex designs, driven by evolving social norms, a focus on individual expression, and a push for inclusivity. Major brands like Gucci and Bulgari are pioneering collections that transcend traditional gender boundaries, with a significant increase in male jewelry purchases reflecting this change. This trend not only aligns with contemporary values but also opens new market opportunities, reshaping how luxury is defined and consumed globally.

Regional Dynamics in the Global Luxury Jewelry Market: Asia Pacific's Dominance and Global Trends

The global luxury jewelry market is experiencing significant regional shifts, with Asia Pacific leading at a 60.2% market share. Driven by a burgeoning middle class, rapid urbanization, and increased luxury spending, this region sets the pace for growth. North America, dominated by the U.S. with 92.6% revenue share, and other regions show distinct consumer preferences, such as women accounting for 71.7% of revenue. This article explores these dynamics, key drivers, and future outlooks shaping the industry.

Global Luxury Jewelry Market 2024: Trends, Growth Drivers, and Future Outlook

The global luxury jewelry market is poised for robust expansion, with its valuation reaching USD 61,015 million in 2024 and projected to hit USD 109,224 million by 2032, reflecting a CAGR of 7.55%. Key drivers include rising disposable incomes, evolving consumer preferences for sustainable and gender-neutral designs, and digital retail innovations. Asia Pacific leads with a 60.2% market share, while rings and gold jewelry dominate product and material segments respectively, signaling dynamic shifts in the industry.

Luxury Jewelry Market Global Trends 2024-2032: An In-Depth Analysis

The global luxury jewelry market is poised for significant growth, projected to expand from USD 61.02 billion in 2024 to USD 109.22 billion by 2032 at a CAGR of 7.55%. Key trends driving this transformation include a heightened focus on sustainable and ethically sourced materials, personalized and gender-neutral designs, and the integration of digital technologies into the shopping experience. Evolving consumer preferences and technological innovations are reshaping the industry, offering new opportunities for brands and investors alike.

Luxury Jewelry Market Regional Dynamics: Asia-Pacific Dominance and Global Trends

The global luxury jewelry market is experiencing significant regional shifts, with Asia-Pacific leading at 60.2% market share due to rising disposable incomes, urbanization, and a growing middle class. Key growth regions include China, India, and Southeast Asia, each displaying unique design preferences from traditional to modern styles. This article explores market drivers, regional variations, and strategic insights shaping the future of luxury jewelry consumption worldwide.

Women's Luxury Jewelry Market Dominance: Driving Forces and Future Outlook

Women hold a commanding position in the luxury jewelry market, generating 71.7% of total revenue according to Grand View Research. This dominance is fueled by increased workforce participation, rising disposable income, and evolving lifestyle preferences. Brands are responding with personalized, empowering designs and targeted marketing strategies. With women contributing approximately 40% of global wealth, their influence reshapes product innovation and market growth trajectories in the high-end jewelry sector.

Men's Jewelry Market Expansion: Challenging Traditional Luxury Dynamics

The men's jewelry market is undergoing unprecedented growth, with the global market projected to reach $96.2 billion by 2030, growing at a CAGR of 8.3%. This expansion is driven by shifting gender norms, increasing fashion consciousness among male consumers, and powerful social media influence. Luxury brands are responding with sophisticated gender-neutral collections and innovative marketing strategies that redefine masculine adornment. The market transformation represents a fundamental shift in luxury consumption patterns, with male jewelry purchases increasing by 42% over the past five years alone.

High Jewelry and Luxury Segment Insights: Resilience, Growth, and Strategic Shifts in 2024

The high jewelry segment demonstrates remarkable resilience in 2024, with the haute joaillerie category significantly outperforming lower-tier markets. According to Bain & Company, this segment is growing 0-2% at current exchange rates, contributing to a total market valuation of €31 billion. Brands are differentiating through unique designs, exceptional craftsmanship, and precious materials, while facing increasing competition from luxury fashion houses expanding into fine jewelry. This article explores the strategic approaches driving success in this exclusive market segment.

Luxury Jewelry Market Competitive Landscape: Innovation, Expansion, and Strategic Differentiation

The global luxury jewelry market is experiencing intense competition, with established leaders like Tiffany & Co. and emerging brands vying for dominance. Differentiation is achieved through innovation in design, sustainable practices, and advanced marketing strategies. Key trends include global expansion into Asia-Pacific and Middle Eastern markets, strategic collaborations with fashion houses, and digital transformation. This analysis explores market dynamics, key players’ strategies, and future growth opportunities shaping the $30+ billion industry.

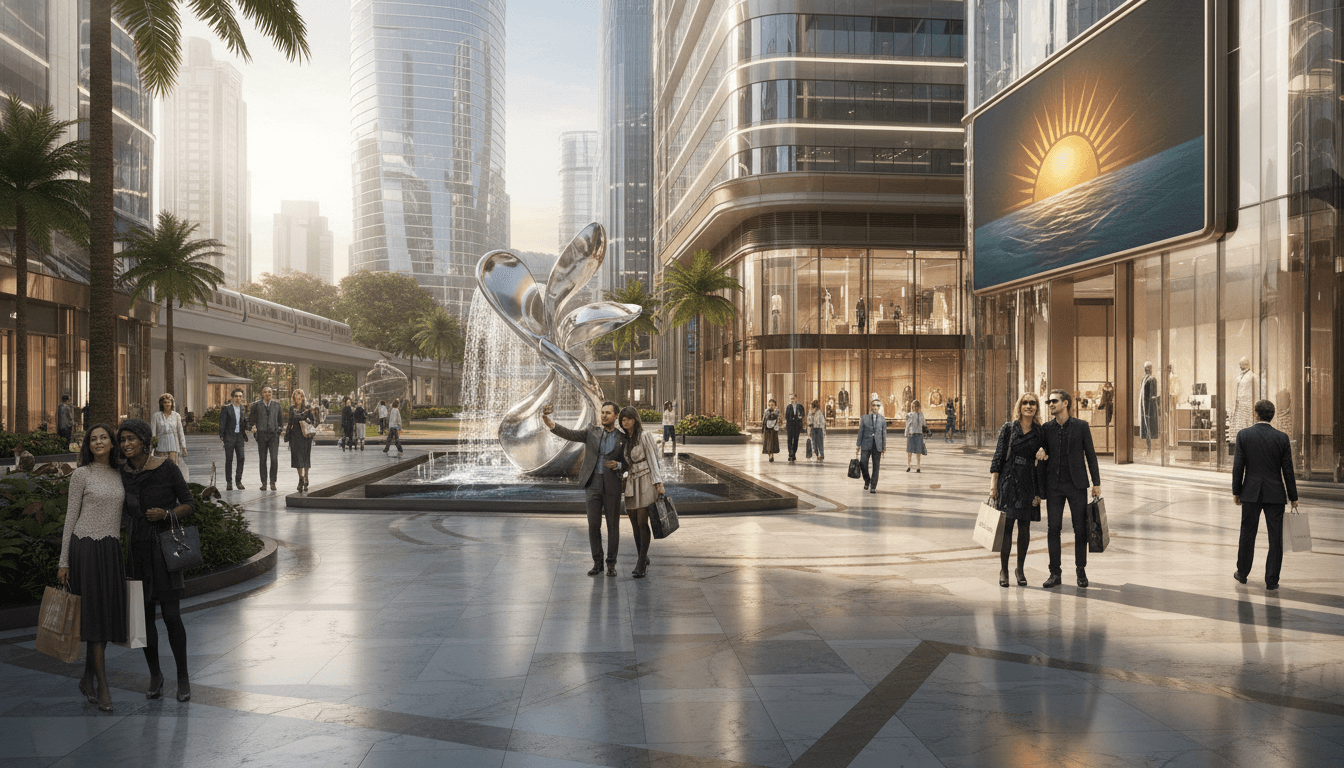

Emerging Markets and Luxury Jewelry Consumption: Key Trends and Strategies

Emerging markets are transforming the global luxury jewelry landscape, with nations like China, India, and Indonesia experiencing unprecedented growth in consumption. This surge is fueled by expanding middle-class populations, rising disposable incomes, and evolving lifestyle aspirations. Brands are responding with targeted strategies, including localized marketing and digital engagement, to capture these lucrative opportunities. Understanding these dynamics is crucial for stakeholders navigating the future of luxury retail.

Sustainability in Luxury Jewelry: Ethical Sourcing, Transparent Supply Chains, and Eco-Conscious Production

With environmental consciousness reshaping the luxury jewelry market, brands are prioritizing sustainability through ethically sourced materials, transparent supply chains, and eco-friendly production. Research indicates a surge in consumer demand for responsible luxury, driving brands to invest in sustainable practices. This article delves into the market dynamics, key innovations, and the profound impact of these trends on brand reputation and growth, offering insights into the future of high-end jewelry.

Cultural Influences in Luxury Jewelry Design: A Global Perspective

Luxury jewelry design is evolving through the integration of global cultural inspirations, fostering diverse design narratives and inclusive approaches. Brands are drawing from traditions, artistic movements, and fashion trends to create collections with broad appeal, expanding market reach and consumer engagement worldwide. This trend enhances creativity and resonates with a multicultural audience, positioning luxury jewelry as a bridge between heritage and modernity.

Luxury Jewelry Marketing Transformed: The Social Media Revolution

Social media is fundamentally reshaping luxury jewelry marketing by enabling direct engagement with younger, digitally-native consumers. Brands are adopting influencer collaborations, social commerce integrations, and immersive digital storytelling to create personalized experiences. This shift from traditional advertising to interactive platforms has accelerated discovery and purchasing, with 68% of luxury jewelry buyers under 35 citing social media as their primary discovery channel. The transformation emphasizes authenticity and accessibility while maintaining brand exclusivity.

Brand Strategy Analysis

Navigating Luxury Market Challenges: Strategic Adaptations for a New Era

The luxury market confronts significant challenges including heightened price sensitivity, market saturation, and evolving consumer demands for inclusivity and sustainability. Brands are pivoting towards creative innovation and strategic inclusivity to uphold exclusivity while expanding appeal. This analysis delves into actionable strategies, leveraging insights from Bain & Company, to balance tradition with transformation in the high-end sector.

Prada Smart Sneakers: Integrating Health Tracking Technology in Luxury Footwear

Prada's entry into the smart sneaker market with embedded health tracking chips marks a strategic pivot towards technology-enhanced luxury. This innovation combines high-fashion design with advanced functionality, targeting health-conscious, affluent consumers. By merging real-time biometric monitoring with premium materials, Prada positions itself at the forefront of the wearable tech revolution in luxury fashion, demonstrating a commitment to evolving consumer demands for style, performance, and personal data insights.

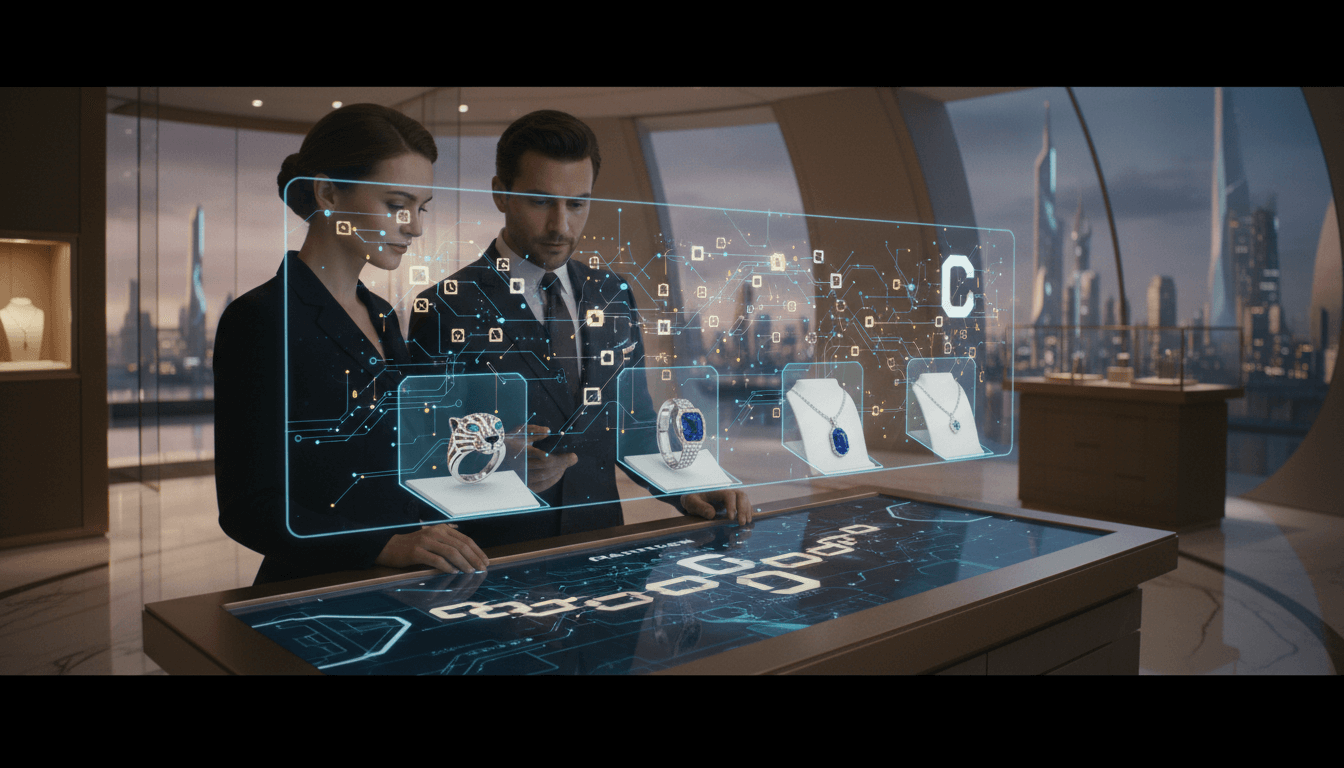

Tiffany & Co.: Advancing Sustainable Jewelry Strategy Through Blockchain Authentication

Tiffany & Co. is pioneering sustainable luxury with blockchain-backed authentication, ensuring full supply chain transparency. This strategy integrates ethical sourcing, technological innovation, and market leadership in luxury jewelry, reinforcing consumer trust and competitive differentiation. By leveraging blockchain, Tiffany verifies diamond origins and material sustainability, aligning with global ESG standards while enhancing brand value.

Hermès: Limited Edition Innovation in Equestrian-Inspired Handbags

Hermès reinforces its luxury dominance through a limited series of equestrian-inspired handbags featuring interchangeable accessories. This strategic innovation marries heritage craftsmanship with modern versatility, emphasizing exclusivity and collectibility. By leveraging its equestrian roots, Hermès enhances brand storytelling while offering unique, customizable pieces that appeal to discerning consumers seeking both functionality and investment value in luxury goods.

Dolce & Gabbana: Strategic Lifestyle Expansion into Luxury Petwear

Dolce & Gabbana's entry into the luxury petwear market exemplifies a sophisticated market diversification strategy. Leveraging their iconic design heritage, the brand introduces high-end pet accessories, including custom collars, apparel, and feeding sets, targeting affluent pet owners. This expansion taps into the growing $4.7 billion global luxury pet market, enhancing brand relevance while mitigating risks associated with traditional fashion volatility. Through collaborations with artisans and digital marketing initiatives, Dolce & Gabbana reinforces its innovative approach to capturing emerging consumer segments, setting a benchmark for luxury brand evolution.

Gucci's Sustainability and Innovation Strategy: Pioneering Eco-Conscious Luxury

Gucci has strategically positioned itself at the forefront of luxury innovation through aggressive sustainability initiatives and cutting-edge design approaches. The brand's introduction of a low-carbon capsule collection utilizing regenerated nylon has driven a 27% increase in engagement among eco-conscious consumers. This demonstrates a sophisticated commitment to environmental responsibility while preserving Gucci's premium brand positioning, showcasing how luxury brands can integrate sustainability into core business strategies effectively.

Chanel's Lifestyle Expansion Strategy: Wellness-Focused Fashion Innovation

Chanel has launched a wellness-focused fashion line as part of its strategic lifestyle expansion, moving beyond traditional luxury to address modern consumer demands for holistic experiences. This diversification reflects the brand's adaptability, leveraging its heritage to integrate wellness principles into high-end fashion. By embracing lifestyle diversification, Chanel aims to strengthen brand loyalty and capture new market segments, aligning with broader industry trends where luxury brands are expanding into wellness, sustainability, and experiential offerings to maintain relevance and growth in a competitive global market.

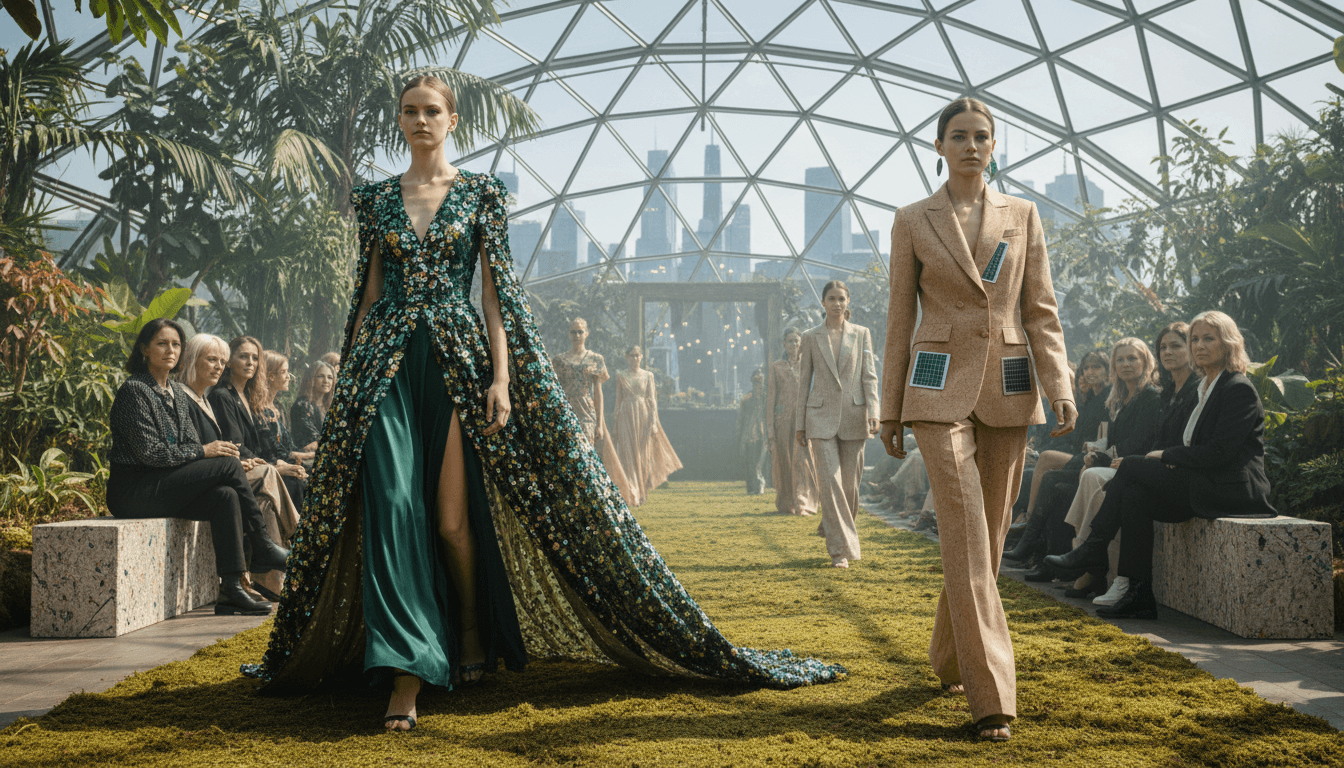

Sustainability as a Core Strategy in the Luxury Market

Sustainability has evolved from a niche concern to a central strategic pillar in the luxury sector, with 43% of luxury brands now offering sustainable collections and 56% of consumers prioritizing eco-friendly luxury purchases. This comprehensive analysis explores how leading brands are integrating eco-friendly material innovations, traceable supply chains, and responsible manufacturing processes into their core operations while maintaining premium positioning. The shift reflects both consumer demand and industry-wide recognition that environmental responsibility enhances brand value and long-term competitiveness in the global luxury market.

Luxury Jewelry Market Insights: Strategic Analysis of Growth Drivers and Future Outlook

The global luxury jewelry market demonstrates robust growth, projected at €29 billion in 2023, driven by increasing demand for bespoke and genderless collections. Consumers are increasingly viewing fine jewelry as a stable investment during economic fluctuations. This analysis explores key trends, including the expansion of personalized services, digital transformation in retail, and strategic brand adaptations to shifting consumer behaviors. Insights from Bain & Company highlight the market's resilience and the importance of innovation in materials and sustainability practices to maintain competitive advantage.

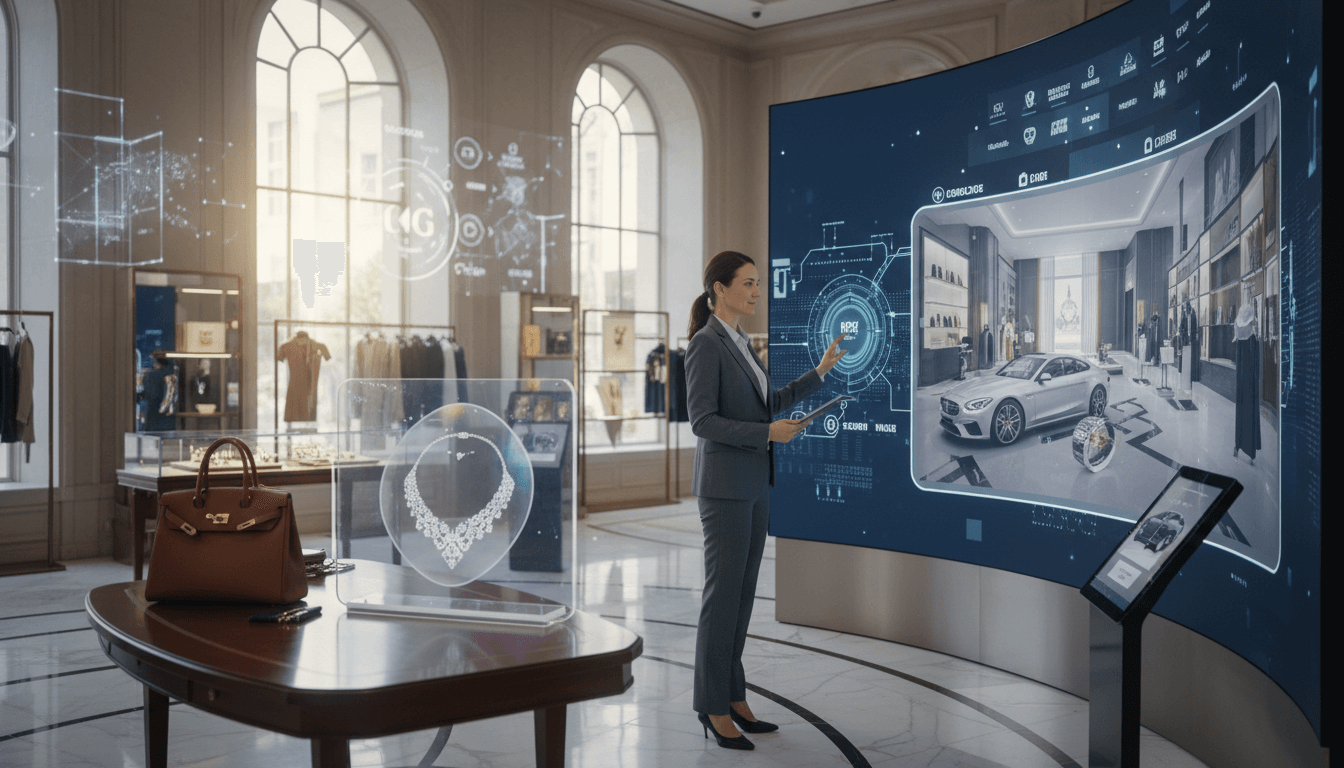

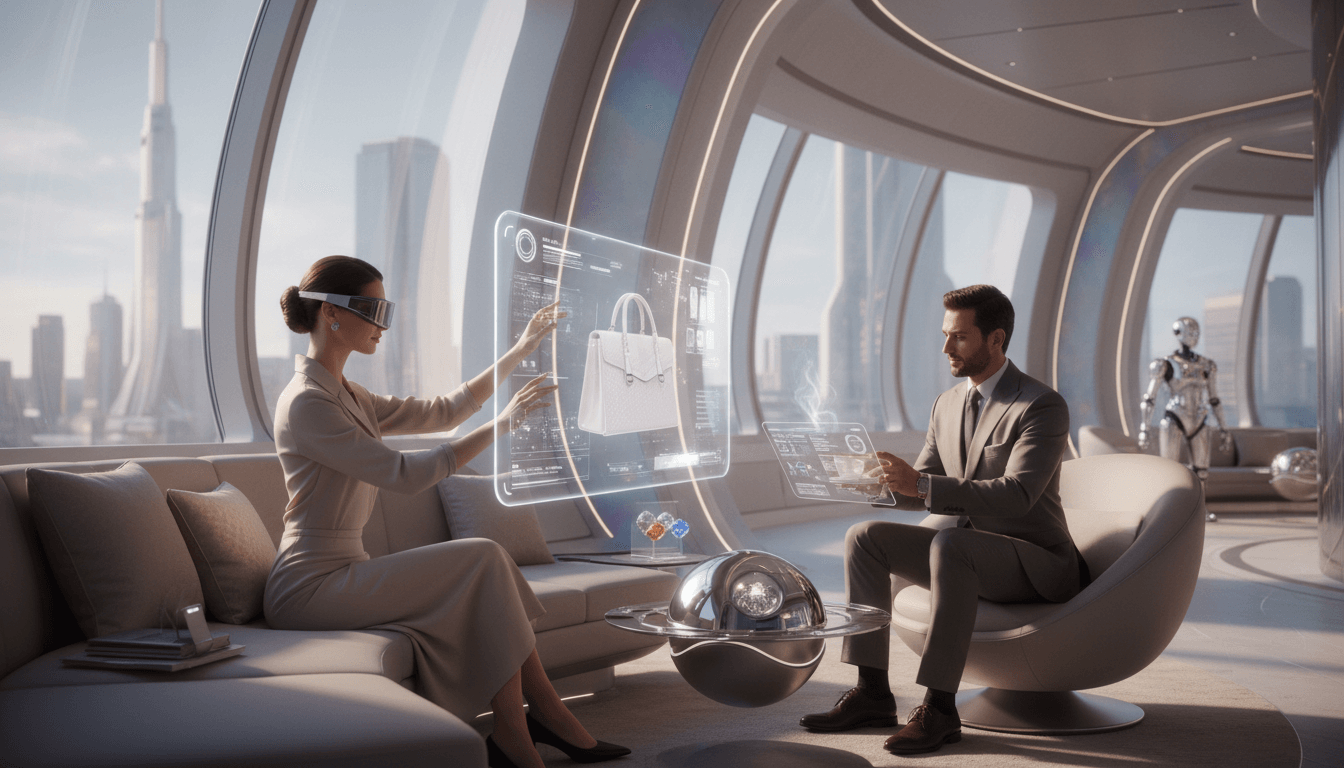

Luxury Market Digital Transformation: Strategic Evolution in the Digital Era

The luxury market is undergoing a profound digital transformation, driven by shifting consumer behaviors and technological advancements. With 42% of Gen Z luxury buyers making purchases online and a 36% global increase in online luxury retail, brands are prioritizing digital-first strategies. This includes sophisticated personalized shopping assistants, immersive virtual platforms, and data-driven marketing approaches. The integration of digital experiences is redefining luxury retail, enabling brands to maintain exclusivity while expanding global reach and engagement.

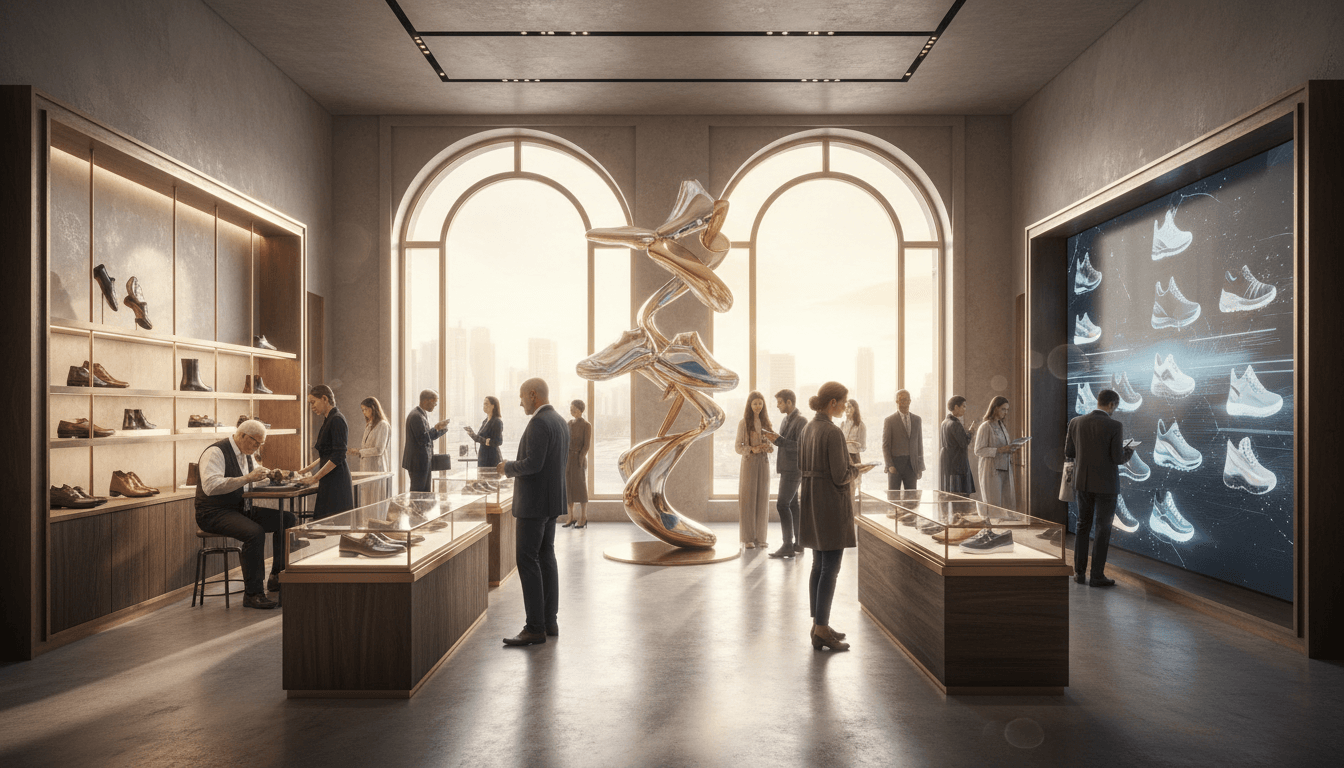

Luxury Footwear Market Evolution: Design Innovation and Strategic Shifts

The luxury footwear market is undergoing a profound transformation driven by consumer demands for comfort, sustainability, and personalization. Key trends include the rise of vegan leather and customizable soles, with significant growth in both sneaker culture and high-end heels. Brands are adapting strategies to position footwear as dual-purpose fashion statements and investment assets, leveraging technological integration and data-driven insights to capture market share in an increasingly competitive landscape. This analysis explores the evolving dynamics and strategic imperatives for luxury footwear brands.

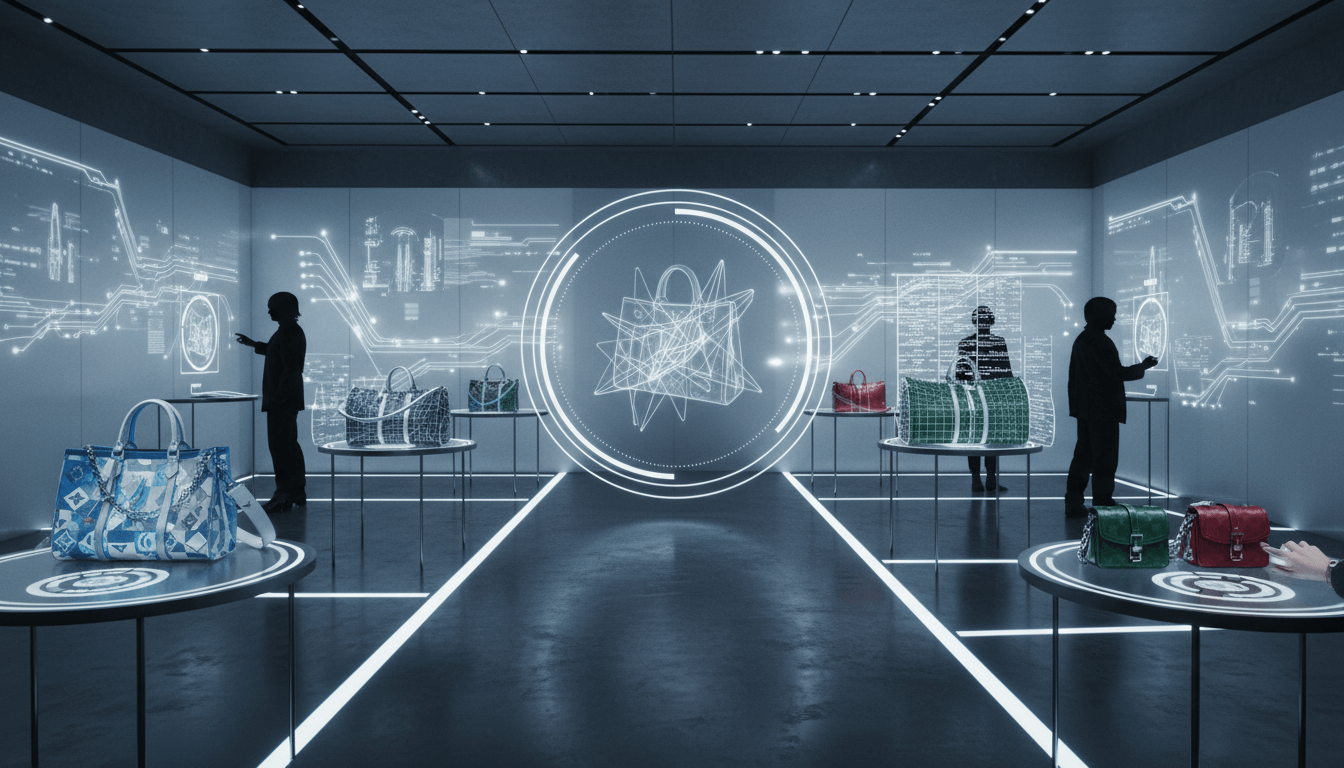

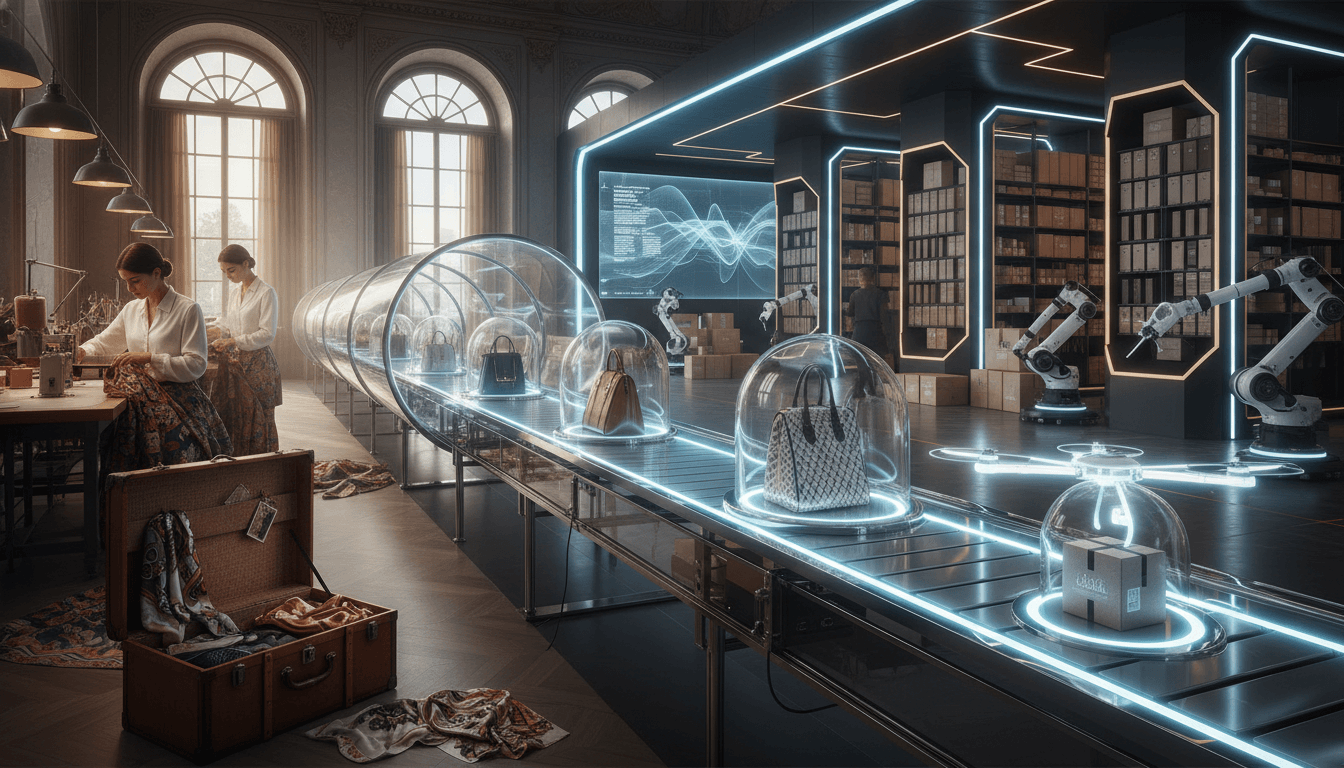

Louis Vuitton's AI-Driven Customization: Revolutionizing Luxury Personalization

Louis Vuitton has launched an innovative AI-customized luxury bag series, enabling real-time personalization of size, strap, and color. This strategy leverages artificial intelligence to address the growing consumer demand for unique, bespoke products while enhancing engagement through immersive digital experiences. By integrating AI personalization technology, the brand strengthens its market position, offering tailored solutions that blend tradition with cutting-edge innovation. This approach not only elevates customer satisfaction but also sets a new benchmark for luxury customization in the digital era.

Michael Kors Smartwear Innovation: Merging Fitness Technology with Luxury Fashion

Michael Kors has strategically entered the smartwear market with a fitness-meets-fashion collection that integrates advanced technology into luxury design. This initiative targets health-conscious consumers seeking both style and functionality, positioning the brand at the forefront of the wellness-driven fashion evolution. By combining real-time activity tracking, heart rate monitoring, and GPS with premium materials, Michael Kors aims to capture a significant share of the growing smartwear segment, projected to exceed $100 billion globally by 2026. This analysis explores the brand's approach, competitive advantages, and potential market impact.

Luxury Accessories Market Dynamics: Growth Drivers and Brand Strategies

The luxury accessories market continues to demonstrate robust growth, accounting for 22% of global luxury sales in 2023. Driven by sustained demand for high-end handbags, with brands like Hermès and Louis Vuitton facing waitlists exceeding six months, the segment thrives on continuous innovation in design, technology integration, and personalization. Key products including handbags, belts, scarves, and eyewear are central to brand strategies, as companies leverage exclusivity and craftsmanship to capture market share and enhance consumer engagement in an increasingly competitive landscape.

Luxury Market Technology Trends: Strategic Integration of NFC, AI, and Smart Design

The luxury goods sector is undergoing a profound transformation driven by technological advancements. Brands are strategically embedding NFC chips in high-end products like jewelry and handbags, leveraging AI for hyper-personalized customer experiences, and pioneering tech-enhanced designs that merge aesthetics with functionality. This evolution, supported by data showing 47% adoption of AI personalization, reflects a critical shift in brand strategies to enhance authenticity, engagement, and exclusivity. Innovations such as smart accessories and integrated digital experiences are redefining luxury consumption, positioning technology as a core element in maintaining competitive advantage and meeting the demands of modern affluent consumers.

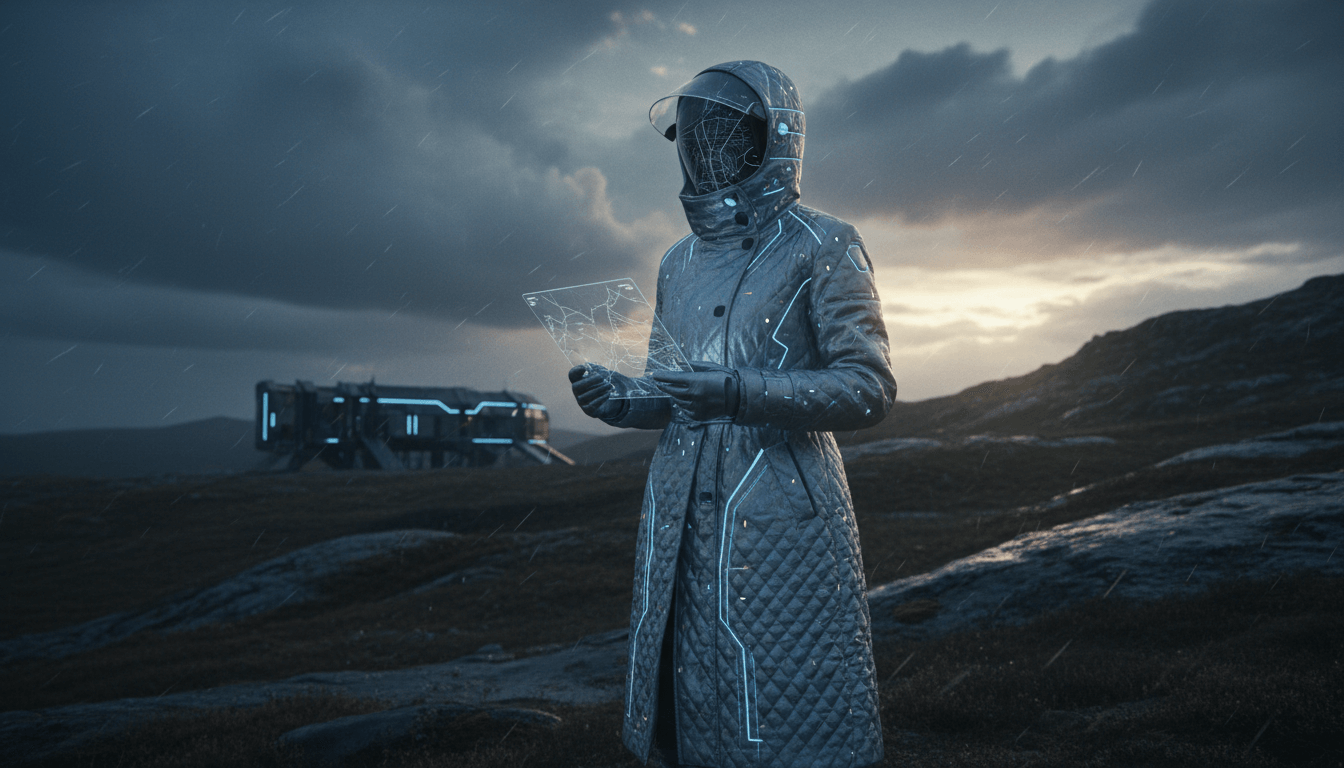

Burberry's Tech-Luxe Outerwear: Pioneering Weather-Responsive Fabric Innovation in Luxury Fashion

Burberry is redefining luxury outerwear through its strategic emphasis on tech-luxe innovation, integrating weather-responsive fabric technology into high-end designs. This approach merges advanced material science with functional luxury, enabling garments that adapt to environmental conditions while maintaining elegance. By focusing on outerwear, Burberry enhances its brand positioning at the intersection of technology and fashion, driving market differentiation and consumer engagement. This strategy underscores the brand's commitment to innovation, sustainability, and delivering superior user experiences in the competitive luxury sector, as documented by Global Growth Insights.

Cartier: Pioneering Blockchain Authentication in Luxury Jewelry

Cartier is revolutionizing the luxury jewelry sector by integrating blockchain technology for product authentication. This strategic initiative directly addresses escalating consumer concerns regarding counterfeit goods, enhancing verification processes and fostering unprecedented trust. By leveraging immutable digital ledgers, Cartier ensures each piece's provenance and authenticity, setting a new industry standard. This innovation not only safeguards brand integrity but also elevates the customer experience, positioning Cartier at the forefront of technological adoption in luxury markets. The move reflects a broader trend of digital transformation, reinforcing Cartier's commitment to quality and innovation.

LVMH Group: Pioneering Luxury Market Leadership Through Strategic Diversification and Innovation

LVMH Moët Hennessy Louis Vuitton SE stands as the undisputed leader in the global luxury goods market, leveraging a meticulously curated portfolio of over 75 prestigious brands across fashion, jewelry, cosmetics, and wines & spirits. The group's strategic framework combines aggressive acquisitions with deep brand heritage preservation, driving an estimated €86.2 billion in revenue in 2024. Through continuous innovation in product development, digital transformation, and sustainable practices, LVMH maintains its market dominance while setting industry standards for luxury brand management and customer experience excellence.

AI-Driven Personalization in Luxury: Strategic Imperatives and Market Transformation

Personalization has evolved into a critical competitive differentiator in the luxury sector, with 47% of luxury brands adopting AI-powered personalization technologies. This strategic shift responds to consumer expectations for bespoke experiences, driving an 80% increase in engagement metrics. Leading luxury houses now deploy sophisticated algorithms for custom product design, hyper-personalized shopping journeys, and predictive analytics to enhance exclusivity and brand loyalty in an increasingly digital marketplace.

Luxury Market Generational Transformation: Gen Z and Millennial Dominance Reshaping Industry Dynamics

The luxury market is undergoing unprecedented generational transformation, with Generation Z and Millennials projected to account for 75-85% of luxury purchases by 2030. These digital-native consumers are fundamentally reshaping consumption patterns, prioritizing experiential luxury, sustainability commitments, and value alignment over traditional status symbols. Bain & Company research indicates Gen Z will represent 25-30% and Millennials 50-55% of market share within the decade, forcing luxury brands to radically rethink their strategic approaches to product development, marketing, and customer engagement to remain relevant in this new era.

Luxury Brand Positioning Strategies: Balancing Heritage with Modern Innovation

Luxury brands are adopting holistic positioning strategies that masterfully blend heritage with innovation to resonate across multiple generations. By leveraging unique brand narratives and emotional connections, these brands extend their appeal beyond product functionality to immersive experiences. Key attributes like craftsmanship, exclusivity, and storytelling define success, as seen with leaders like Louis Vuitton, which balances classic appeal with cutting-edge design to maintain relevance in evolving markets.

Digital Innovation in Luxury Brands: AI, VR, and Blockchain Strategies

Luxury brands are embracing digital transformation to revolutionize customer experiences through artificial intelligence, virtual reality, and blockchain technology. By 2026, most luxury fashion leaders will implement AI-driven strategies, with digital sales accounting for nearly 25% of total industry revenues. This shift addresses consumer demands for hyper-personalization, immersive shopping, and product authenticity. Key innovations include AI-powered personalization engines, virtual try-on experiences, and blockchain-based authentication systems that enhance engagement while preserving brand exclusivity. The integration of these technologies represents a fundamental evolution in luxury brand strategy and customer relationship management.

Sustainability in Luxury Sector: How Eco-Conscious Strategies Are Redefining Luxury

Sustainability has transformed from a niche differentiator to a core business imperative in the luxury sector, driven by demand from Millennial and Gen Z consumers. Over 65% of luxury shoppers in Europe and North America prioritize ethical sourcing and production. This article explores how brands are leveraging circular models, digital product passports, and environmental alignment as strategic levers, while wellness and sustainability credentials show strong growth since 2020, reshaping brand strategies globally.

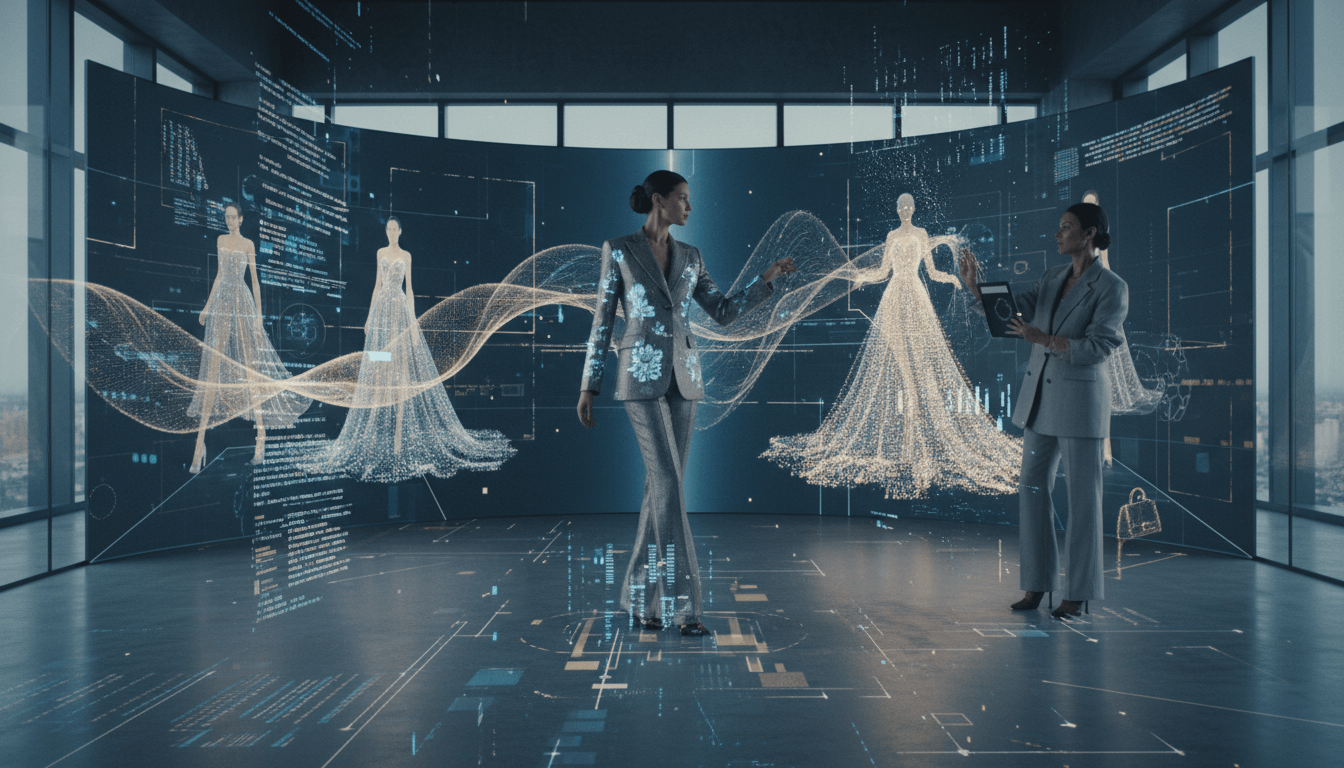

Advanced Luxury Technology Integration: Transforming Brand Strategy Through Digital Innovation

This analysis delves into the strategic integration of cutting-edge technologies within the luxury sector, highlighting how AI, virtual reality, and blockchain are revolutionizing customer engagement and brand authenticity. By 2026, most luxury fashion leaders will adopt AI-driven personalization, while 85% of consumers demand bespoke digital experiences. The article explores real-world applications, market data, and future trends, emphasizing the critical role of technology in sustaining competitive advantage and meeting evolving consumer expectations in high-end markets.

Luxury Jewelry and Accessories Market: Brand Strategies Driving Growth

The luxury jewelry and accessories market demonstrates resilience and growth, led by iconic brands like Rolex, Cartier, and Tiffany & Co. These leaders are strategically focusing on sustainability, digital innovation, and global expansion to capture evolving consumer demand. Rolex's annual revenue exceeding USD 9 billion underscores the segment's strength, particularly in luxury watches. Market dynamics emphasize personalization and ethical sourcing, positioning the industry for sustained success amid changing luxury preferences.

Luxury Product Reviews

Luxury Resale Market Growth: A Comprehensive Review of the Pre-Owned Revolution

The pre-owned luxury market is undergoing unprecedented expansion, driven by a 41% sales surge on platforms like The RealReal and a projected value of $30 billion by 2025. This review examines how luxury brands are responding with dedicated resale platforms and authentication services, catering to growing consumer demand for sustainable, accessible luxury. We analyze market dynamics, key players, and the strategic shifts shaping the industry's future.

Luxury Jewelry Market Insights: Investment Potential and Growth Trends

The luxury jewelry market demonstrated robust growth of 5-6% in 2023, reaching a valuation of €29 billion, according to Bain & Company. Fine jewelry is increasingly perceived as a stable investment asset, with bespoke and high-end pieces driving demand, particularly among ultra-wealthy consumers. This review explores key market dynamics, investment strategies, and design innovations shaping the industry's future.

Luxury Market Geographic Insights: Analyzing Regional Dynamics and Growth Patterns

This comprehensive review delves into the geographic dynamics of the global luxury market, valued at €1.5 trillion in 2023 with an annual growth rate of 8-10%. Asia, particularly China, Japan, and South Korea, drives expansion through unique consumer behaviors, while the US and European markets maintain strength with heritage brand loyalty and evolving preferences. The analysis covers regional consumption patterns, market strategies, and innovations shaping luxury fashion, jewelry, travel, and lifestyle sectors, providing actionable insights for industry stakeholders.

Luxury Fashion's Digital Transformation: A Comprehensive Review of Market Evolution

The luxury fashion industry is undergoing a profound digital and strategic transformation, with global market growth projected at 8-10% in 2023. Brands are leveraging AI and technology to enhance personalization while emphasizing sustainable production and omnichannel retail experiences. This shift addresses changing consumer expectations through digital innovation, ethical practices, and seamless customer engagement, as highlighted in the McKinsey State of Luxury Report.

Luxury Brand Digital Strategy: Transforming High-End Experiences Through Technology

This review examines how digital transformation is revolutionizing luxury brand strategies, with a focus on AI-driven personalization, advanced digital marketing, and technology as a key differentiator. Drawing from McKinsey's State of Luxury Report, we explore how brands are investing in sophisticated online experiences and data analytics to deliver seamless, personalized interactions. The analysis covers market trends, strategic implementations, and the growing emphasis on digital capabilities to maintain competitive advantage in the global luxury sector.

Navigating the Evolving Luxury Watch Market: Trends, Innovations, and Consumer Shifts

The luxury watch market is undergoing significant transformation, marked by a slowdown in traditional segments and a surge in demand for innovative designs and technology integration. Brands are adapting to shifting consumer preferences, particularly among younger demographics seeking unique, meaningful timepieces. This review explores key dynamics, including market performance data from Bain & Company, the impact of economic uncertainties, and strategies employed by leading manufacturers to maintain relevance and drive growth in a competitive landscape.

Luxury Technology Integration: NFC and Digital Authentication Reshape High-End Products

Luxury brands are embracing advanced technologies, with NFC chips and digital authentication systems becoming integral in products like jewelry, bags, and accessories. Pioneers such as Coach and VerseLux are leading this innovation, enhancing customer engagement through tech-enabled features that offer unique experiences, product verification, and added value. This trend reflects a broader shift in the luxury market towards integrating digital solutions to meet evolving consumer expectations for authenticity and interactivity.

The Luxury Sustainability Movement: How High-End Brands Are Embracing Eco-Conscious Practices

The luxury sector is undergoing a transformative shift towards sustainability, driven by rising consumer demand for ethical and environmentally responsible products. Brands are adopting sustainable materials, transparent supply chains, and circular economy models, including pre-owned markets. This review explores key trends, brand initiatives, and market data from the Mediaboom Luxury Trends Report, highlighting how sustainability is redefining luxury without compromising quality or exclusivity.

The Sustainable Luxury Movement: A Comprehensive Review of Ethical Practices in High-End Fashion

This review examines the growing sustainable luxury movement, spotlighting how leading brands like Stella McCartney are responding to consumer demands for transparency and eco-friendly practices. Key developments include the adoption of recycled materials, ethical manufacturing, and a shift in consumer focus toward environmental responsibility, as detailed in the Kadence Luxury Market Report. The analysis covers market trends, brand strategies, and the implications for the future of luxury fashion, jewelry, and lifestyle sectors, emphasizing the balance between opulence and sustainability.

Luxury Technology Integration: Revolutionizing High-End Products with NFC and Smart Features

Luxury brands are seamlessly merging traditional craftsmanship with advanced technologies like NFC chips, creating interactive and personalized experiences. Products such as Coach Coachtopia and VerseLux collections demonstrate how technology enhances value through authentication, storytelling, and exclusivity. This trend, supported by Fortune Business Insights, reflects a market shift toward tech-infused luxury goods that appeal to modern consumers seeking innovation and sustainability. The integration bridges heritage with digital transformation, offering brands new avenues for engagement and revenue.

Women's Luxury Market Dominance: The Rise of Female Financial Power and Personal Expression

The women's luxury goods segment continues to lead the global market, driven by a significant increase in female financial independence and wealth, with 337 billionaire women in 2023. This article explores how this demographic shift fuels demand for high-end fashion items that emphasize personal style and identity, supported by data from Grand View Research. Key motivations include financial empowerment and the desire for unique self-expression through luxury products.

The Luxury Personalization Revolution: Data-Driven Strategies Redefining High-End Experiences

The luxury sector is undergoing a transformative shift toward hyper-personalization, driven by advanced data analytics and consumer demand for unique experiences. According to McKinsey's Luxury Consumer Trends Study, personalization boosts customer engagement by up to 80%, with brands deploying tailored marketing and bespoke product offerings. This article reviews how luxury leaders are leveraging technology to create individualized connections, examining the pros, cons, and real-world impact of personalization strategies in high-end markets.

Luxury Market Global Insights 2024: Resilience and Transformation in High-End Goods

The global luxury goods market achieved a valuation of €1.5 trillion in 2023, growing by 8-10%, according to the Bain-Altagamma Luxury Goods Worldwide Market Study. Jewelry and apparel categories led with 5-6% growth, driven by technological integration, sustainability efforts, and personalized consumer experiences. This review explores key trends, brand strategies, and innovations shaping the industry's future, emphasizing digital transformation and evolving consumer preferences.

Luxury Beauty and Fragrance Market: Resilience, Sustainability, and Emotional Connections

The luxury beauty and fragrance market exhibits robust growth, driven by consumer demand for high-quality, sustainable, and ethically produced items. According to Bain & Company's Luxury Report, this sector emphasizes small, meaningful indulgences that foster emotional connections, with sustained performance in beauty categories and a clear shift toward eco-conscious purchasing. Key trends include increased investment in transparent supply chains, innovative formulations, and personalized experiences, positioning luxury beauty as a resilient segment in the global luxury industry.

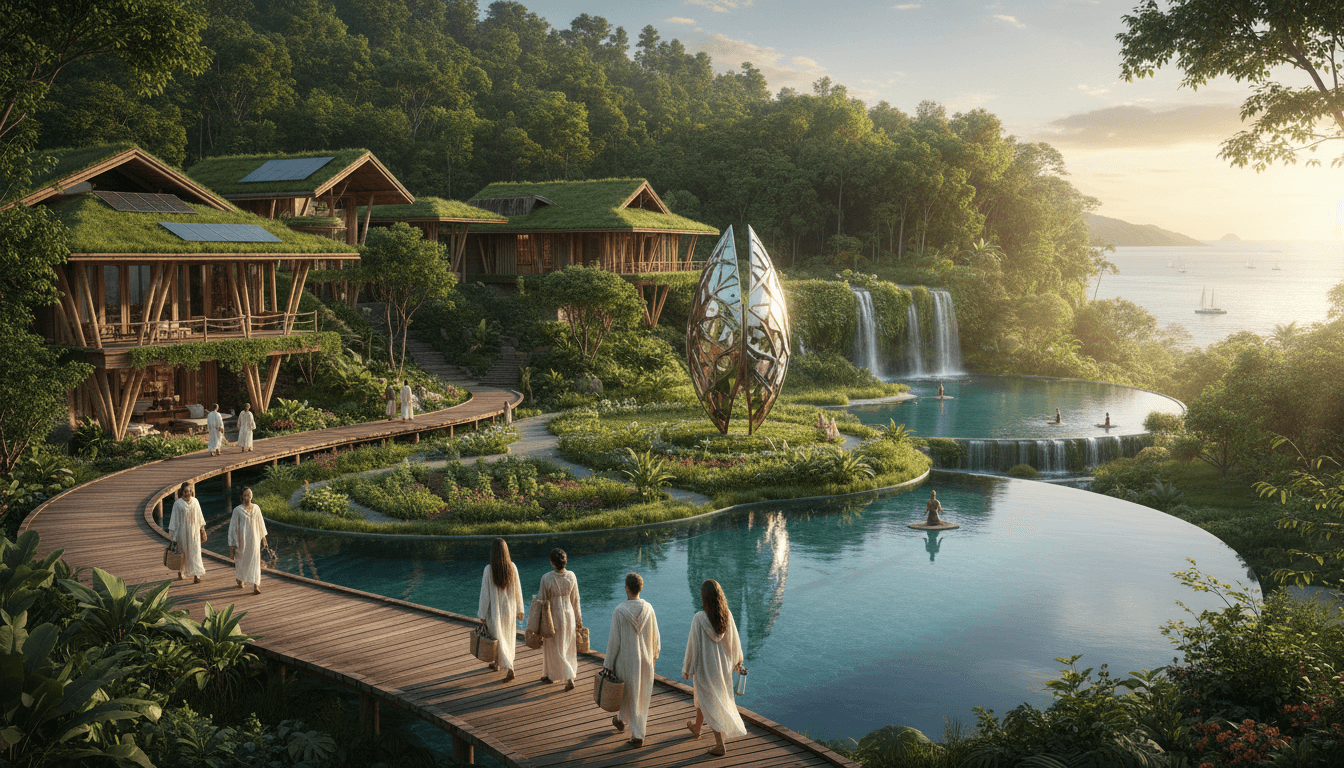

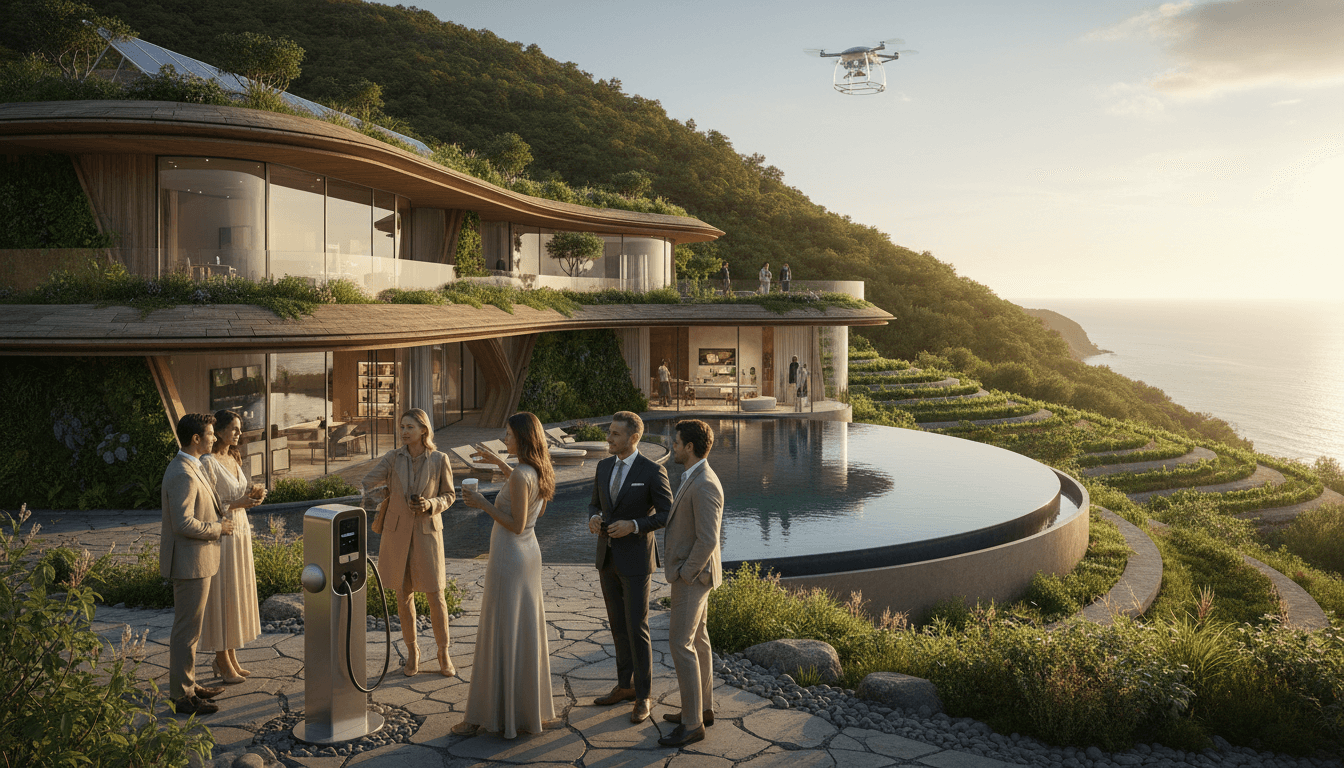

Luxury Travel Experiences Redefined: The Shift from Material to Immersive Journeys

Luxury travel is evolving beyond opulent accommodations and high-end amenities, with a clear pivot toward experiential, sustainable, and wellness-focused journeys. According to the Mediaboom Luxury Trends Report, 78% of millennials now prioritize experiences over products, fueling market growth in bespoke workshops, private events, and eco-friendly itineraries. This review explores how brands are innovating to meet demand for personalized, meaningful travel, emphasizing sustainability and immersive interactions that redefine luxury.

Secondhand Luxury Market Expansion: Growth, Drivers, and Brand Strategies

The pre-owned luxury market is transforming the high-end sector, projected to reach $30 billion by 2025. Fueled by 41% sales growth at platforms like The RealReal in 2023, younger consumers and sustainability priorities are accelerating demand. Luxury brands are responding with official resale programs, authentication services, and digital engagement to capture this lucrative segment. This review analyzes market dynamics, consumer behavior shifts, and strategic adaptations reshaping luxury accessibility and sustainability.

Luxury Retail Experience Evolution: The Shift to Immersive and Technology-Enhanced Shopping

The luxury retail sector is undergoing a profound transformation, driven by evolving consumer expectations and technological advancements. Over 70% of luxury consumers prefer in-person shopping experiences, emphasizing the need for brands to create immersive, personalized interactions. This review explores key trends such as omnichannel strategies, technology integration, and experiential retail, supported by data from the Simon-Kucher Global Luxury Consumer Trends Study. We analyze how leading brands are leveraging these innovations to foster memorable brand interactions and sustain growth in a competitive market.

Navigating Economic Headwinds: A Critical Review of Luxury Market Adaptation

The luxury market faces significant economic pressures, including slowing growth projected at low to mid-single digits, heightened price sensitivity, and evolving consumer expectations. Brands must innovate with personalized experiences and strategic repositioning to maintain relevance. This review analyzes how top luxury players are responding to these challenges, focusing on differentiation and value creation in a competitive landscape. Insights are grounded in data from the McKinsey State of Luxury Report, offering actionable strategies for industry stakeholders.

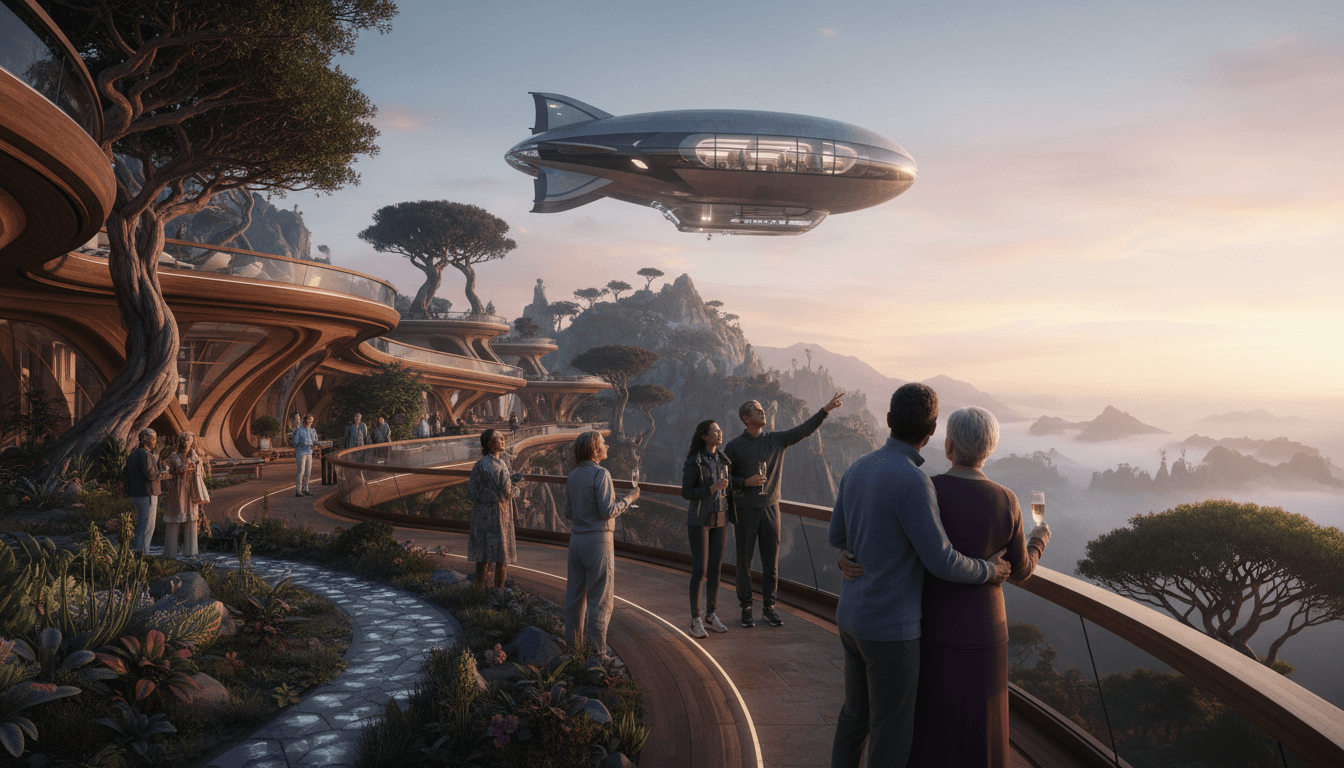

The Rise of Experiential Luxury: Redefining Travel with Personalized, Exclusive Experiences

The luxury travel sector is undergoing a profound transformation, with a marked shift from material acquisitions to experiential indulgence. According to Euromonitor International, 72% of affluent travelers now prioritize unique, personalized journeys over traditional luxury goods. Brands like Ritz-Carlton are pioneering this trend by offering bespoke packages that emphasize exclusivity, privacy, and wellness. This evolution is largely driven by Millennial preferences and a growing collective desire for distinctive, immersive experiences that foster personal growth and well-being, signaling a new era in high-end travel where memories outweigh possessions.

The Evolving Luxury Jewelry Market: A Comprehensive Review of Trends and Innovations

The luxury jewelry sector is undergoing a profound transformation, marked by a 5-6% market growth in 2023 and key shifts in consumer behavior. Gold maintains dominance with a 33.1% market share, while brands like Gucci, Bulgari, Graff, and MIKIMOTO lead innovations in gender-neutral designs and personalized shopping experiences. Technological integration is reshaping product offerings and customer engagement, with unisex collections and tech-enhanced pieces emerging as pivotal trends. This review delves into the strategic moves by top luxury houses, backed by data from Grand View Research and Bain & Company, offering insights for industry stakeholders and enthusiasts.

Asia Pacific Luxury Market Leadership: Dominating Global Luxury with Strategic Growth

The Asia Pacific region commands a 37.7% share of the global luxury market, valued at $93.3 billion in 2024. Driven by rising disposable incomes and evolving consumer preferences in key markets like China, Japan, and South Korea, this dominance reflects deeper shifts in luxury consumption patterns. This review analyzes market dynamics, growth drivers, and regional impacts, providing insights for stakeholders navigating this lucrative landscape.

Luxury Footwear Market Trends: An In-Depth Analysis of Designer Shoes and Consumer Preferences

The luxury footwear market holds a significant 16.2% share of the global luxury industry in 2024, driven by consumer demand for exclusive designer shoes that emphasize superior quality and style. Brands are innovating with high-fashion trends and durable materials, focusing on attributes like exclusivity and craftsmanship to maintain market leadership. This review explores key growth factors, including the influence of designer trends and fashion-forward consumers, providing insights into why luxury footwear remains a cornerstone of the high-end fashion sector.

High-End Personalized Luxury Services: Revolutionizing Bespoke Consumer Experiences

Personalized luxury services are transforming high-end consumer engagement by offering bespoke designs, tailored shopping experiences, and data-driven recommendations. According to the Business2Consumer Luxury Trends Report, these strategies can increase customer engagement by up to 80%, targeting high-net-worth individuals with custom clothing, accessories, and exclusive consultations. This review examines the efficacy, implementation, and consumer impact of these services in the global luxury market.

Hermès Birkin Bag: The Ultimate Luxury Investment and Status Symbol

The Hermès Birkin Bag is the pinnacle of luxury handbags, celebrated for its unparalleled craftsmanship, exclusivity, and investment value. With consistently high demand among ultra-wealthy collectors, it retains and appreciates in value over time, making it a cornerstone of high-end fashion portfolios. This review delves into its market dynamics, artisanal quality, and the experience of owning a Birkin, supported by insights from the Who What Wear Luxury Report 2023.

The Rise of Female Self-Purchasers in the Luxury Market

The global luxury market is witnessing a significant shift as women increasingly purchase high-end items for themselves, driven by financial independence and evolving social norms. Industry reports highlight a 76% increase in female self-purchasing, with notable growth in jewelry, fashion, and accessories. This trend reflects broader changes in consumer behavior, emphasizing empowerment and personal fulfillment over traditional gifting practices. As brands adapt to this demographic, understanding their preferences and values becomes crucial for market success.

Innovation Showcase

Inclusive Luxury Fashion: Redefining Elegance Through Diversity and Representation in 2025

Luxury fashion in 2025 is undergoing a transformative shift toward diversity and inclusivity, driven by evolving consumer demands for authenticity. Brands are integrating inclusive design principles, developing collections for diverse body types, and embedding representation into their core missions. According to the Firework Diversity in Luxury Fashion Report 2025, this trend reflects a broader industry movement where inclusivity is no longer optional but essential for brand relevance and growth. This article explores how luxury brands are innovating to meet these expectations, ensuring that high fashion is accessible and reflective of global diversity.

Personalized Luxury Experiences: The Future of High-End Brand Engagement in 2025

In 2025, luxury brands are revolutionizing customer interactions by integrating advanced AI and data analytics to deliver bespoke experiences. This strategy includes AI-powered styling recommendations, custom-fitted garments, exclusive access to events, and tailored concierge services, all designed to foster unique individual interactions. According to the Luxury Market Global Personalization Report 2025, this shift enhances emotional connections and sets brands apart through advanced customer experience technologies, moving beyond traditional product offerings to meet the demands of discerning clients.

Luxury Brand Authenticity and Purpose: Redefining Success in 2025

By 2025, luxury brands are pivoting from traditional aesthetics to purpose-driven strategies that merge digital innovation with authentic values. According to the World Economic Forum Luxury Trends Report 2025, success is now measured by a brand's ability to demonstrate social impact, environmental stewardship, and compelling storytelling. Consumers increasingly favor brands that embody authenticity and social consciousness, demanding luxury experiences that transcend material consumption and foster meaningful connections.

Digital Passports and Blockchain Authentication: Revolutionizing Luxury Product Integrity

The luxury industry is undergoing a transformative shift with the integration of digital passports and blockchain authentication. By 2025, the European Union will mandate digital product certification, requiring fashion brands to embed verifiable digital credentials. These tools provide immutable records of provenance, materials, and ownership history, drastically reducing counterfeiting and enhancing consumer trust. Pioneering brands like Vacheron Constantin are already leveraging blockchain to ensure authenticity, setting new standards for transparency and accountability in the high-end market.

Augmented Reality in Luxury Retail: Transforming High-End Shopping Experiences

Augmented Reality (AR) is revolutionizing luxury retail by enabling virtual try-ons, interactive product demonstrations, and immersive brand engagements. Leading luxury brands like Burberry are integrating AR technologies into flagship stores and digital platforms to bridge physical and digital retail environments. This Innovation Showcase explores how AR enhances customer personalization, increases engagement, and drives sales through data-driven insights, supported by findings from the Luxury Tech Trends Report 2025.

Internet of Things in Fashion: Revolutionizing Luxury and Personalization in 2025

The Internet of Things (IoT) is profoundly transforming the fashion industry in 2025, creating interconnected ecosystems where technology enhances every facet of luxury fashion. From smart garments that monitor health and adapt to environmental conditions to immersive retail environments offering hyper-personalized experiences, IoT enables unprecedented data exchange and connectivity. This innovation is elevating consumer interactions, providing responsive, tailored solutions that merge high-end aesthetics with cutting-edge technology, ultimately redefining the future of fashion as detailed in the TechPacker IoT in Fashion Report 2025.

Sustainable Luxury Fashion Innovations: Pioneering Eco-Conscious High Fashion in 2025

In 2025, luxury fashion brands are leading a transformative shift towards sustainability, driven by consumer demand for ethical and environmentally responsible products. Key innovations include the adoption of advanced eco-materials like mushroom leather and upcycled silk, waterless dyeing technologies, and circular fashion systems that promote recycling and biodegradability. This movement, documented in the Fashinnovation Sustainable Luxury Report 2025, highlights how brands are integrating circular fashion and eco-innovations to minimize environmental impact while meeting the preferences of younger, conscious consumers.

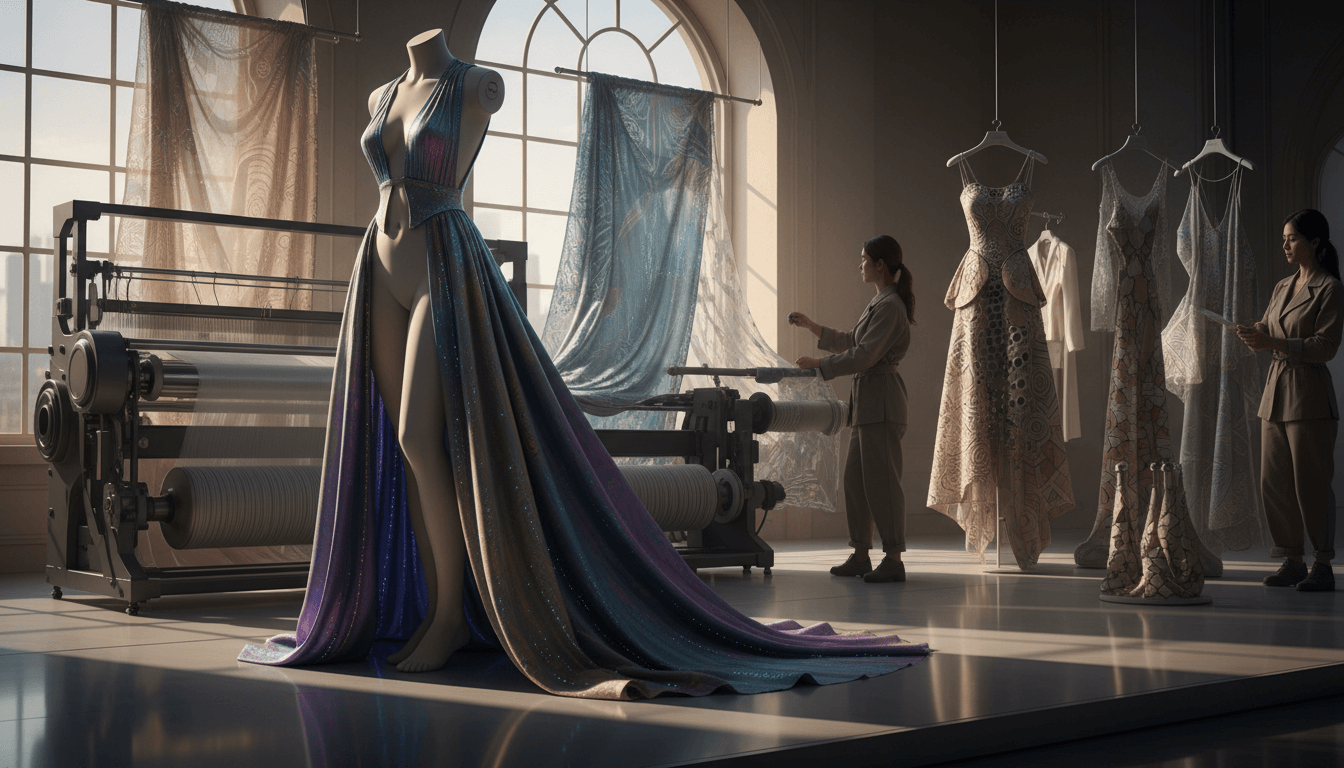

Novel Fabric Innovations Shaping Luxury Fashion in 2025

The luxury fashion industry is undergoing a fabric innovation revolution in 2025, driven by advanced sustainable textile technologies. These novel materials combine biodegradability, recyclability, and bio-based components with unprecedented performance and style. Brands are adopting high-performance fabrics that reduce environmental impact while enhancing functionality, aligning with the TechPacker Fabric Innovation Report 2025's focus on eco-friendly material development. This transformation is setting new benchmarks for environmental responsibility and design excellence in luxury fashion.

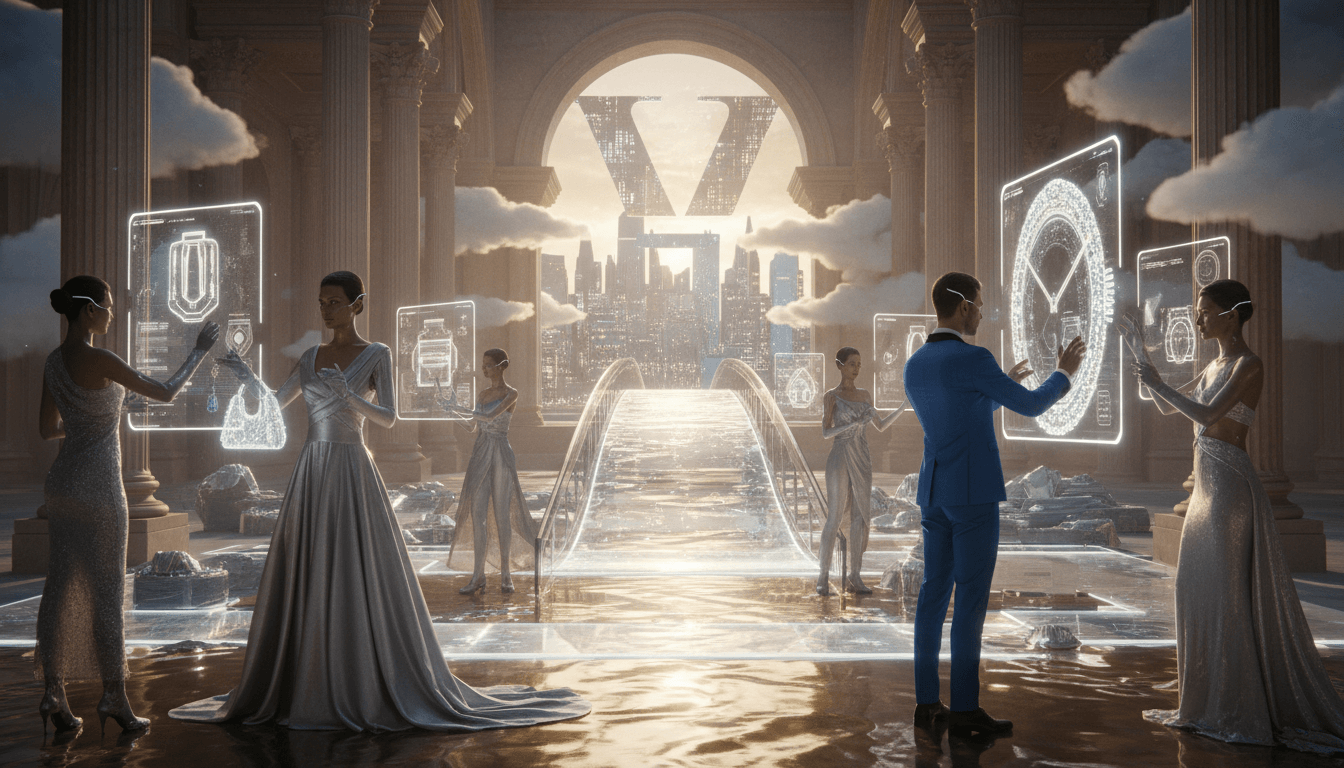

Luxury Brand Metaverse Experiences: Redefining Digital Engagement in 2025

Luxury brands in 2025 are pioneering immersive metaverse experiences that transcend traditional marketing, leveraging virtual showrooms and avatar-driven interactions. These digital environments enable consumers to explore exclusive collections, customize virtual fashion, and engage with brands in unprecedented ways. According to the World Economic Forum Digital Luxury Report 2025, this evolution represents a fundamental shift in consumer interaction, blending digital innovation with luxury identity. The metaverse offers infinite customization possibilities, positioning virtual brand engagement as a critical strategy for high-end fashion, jewelry, and lifestyle sectors.

Video Commerce and Interactive Shopping: Revolutionizing Luxury Fashion Retail in 2025

Video commerce is transforming luxury fashion retail by integrating interactive shopping experiences directly into video platforms. This innovation enables dynamic product showcases, real-time styling consultations, and immersive brand storytelling. With the global influencer marketing platform projected to exceed $337 million by 2027, brands are leveraging video-driven engagement to enhance consumer connections and drive sales. Key trends include interactive video shopping, personalized styling sessions, and the strategic use of influencer collaborations to build authenticity and trust.

Supply Chain Transformation in Luxury Fashion: Nearshoring and Strategic Partnerships Reshaping 2025

The luxury fashion industry is undergoing a profound supply chain transformation in 2025, driven by the dual forces of nearshoring and strategic supplier partnerships. According to the Firework Fashion Industry Trends Report 2025, 65% of businesses are actively exploring nearshoring by relocating manufacturing closer to key markets, while 61% are forging deeper collaborations with suppliers to enhance flexibility, sustainability, and operational efficiency. These innovations address critical challenges such as supply chain disruptions, environmental impact, and consumer demands for transparency, positioning brands for greater resilience and responsiveness in an evolving global landscape.

The Luxury Wearable Technology Revolution: Merging High Fashion with Advanced AI and Sustainability

In 2025, the luxury wearable technology market is undergoing a seismic shift, projected to expand by $100 billion from 2025 to 2029. Brands are integrating AI-driven personalization, blockchain authentication, and sustainable manufacturing into high-end accessories. These innovations not only enhance health tracking and user experience but also redefine luxury through smart sensors and ethical production. The smart clothing sector alone is expected to reach $275 billion by 2034, signaling a transformative era where craftsmanship meets cutting-edge technology.

Virtual Fashion and Digital Ownership: Revolutionizing Luxury Retail

The luxury fashion sector is undergoing a profound digital transformation, with virtual fashion and NFT-based ownership leading the charge. As detailed in the World Economic Forum Digital Fashion Report 2025, brands such as Louis Vuitton and Gucci are pioneering virtual showrooms and digital-only collections, enabling avatar-based shopping and exclusive virtual item ownership. This shift merges cutting-edge technology with personal expression, offering immersive experiences that redefine consumer engagement and asset ownership in the luxury market.

Minimalist Luxury and Conscious Consumption: Redefining High-End Fashion in 2025

The luxury fashion industry is undergoing a profound transformation, with 79% of consumers actively reducing clothing purchases in favor of high-quality, durable items. This shift towards minimalist luxury emphasizes timeless design, sustainability, and conscious consumption, moving decisively away from fast fashion. Leading brands like Everlane and COS are pioneering this movement with curated collections that prioritize functionality, elegance, and ethical production. Rooted in data from the Fashinnovation Consumer Trends Report 2025, this trend reflects a broader cultural movement towards mindful living and responsible ownership in the global luxury market.

Phygital Fashion Experiences: The 2025 Revolution in Luxury Ownership

Phygital fashion represents the seamless integration of digital and physical luxury experiences, fundamentally transforming consumer interactions with high-end brands. Through blockchain-authenticated digital assets linked to physical products, companies like RTFKT and Nike are pioneering new ownership models where consumers can collect, trade, and verify exclusive fashion items across both realms. This innovation, documented in the World Economic Forum Digital Fashion Report 2025, introduces unprecedented value creation through limited-edition digital twins, smart contracts, and immersive AR try-ons, redefining luxury as both tangible and virtual possessions with verifiable scarcity and provenance.

AR Glasses: The Future of Fashion Tech - Luxury Meets Innovation

Luxury fashion brands are pioneering the next wave of wearable technology with augmented reality glasses that merge haute couture design with cutting-edge functionality. Leaders like Gucci, Ray-Ban, and Dior are creating sophisticated eyewear featuring virtual displays, real-time navigation, and seamless communication capabilities. With smart glasses shipments reaching 1.8 million units in 2024 and a remarkable 73% year-over-year growth rate, these devices represent the seamless integration of fashion aesthetics and technological innovation, setting new standards for personal expression and digital interaction in the luxury sector.

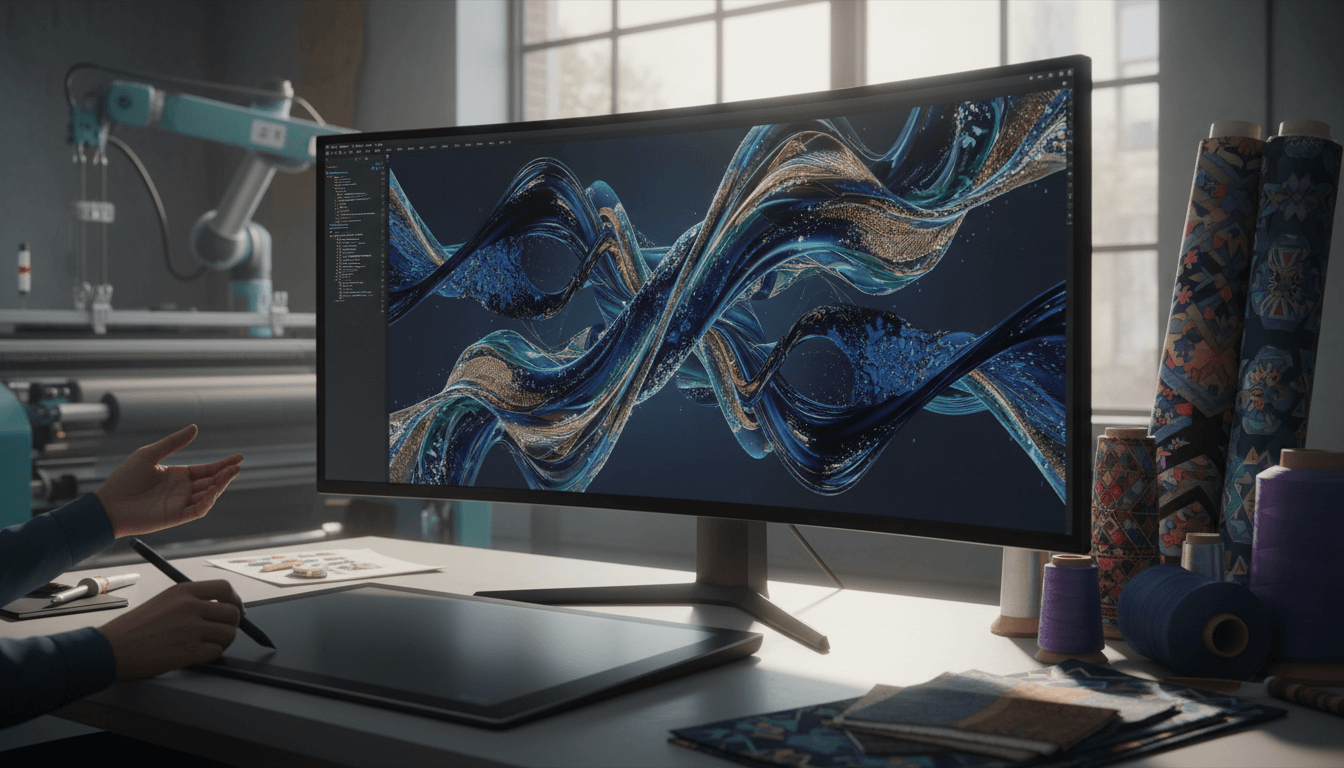

AI-Generated Fashion Collections: Revolutionizing Luxury Design in 2025

Artificial Intelligence is fundamentally transforming luxury fashion design in 2025, with generative AI systems creating complete collections by analyzing global trends, social media data, and consumer preferences. Leading luxury brands are leveraging this technology to achieve unprecedented speed in trend forecasting, hyper-personalized collection development, and creative innovation that transcends traditional design boundaries. The Vogue College of Fashion Innovation Report 2025 documents how AI-driven processes enable designers to explore new aesthetic territories while maintaining brand DNA and exclusivity.

Digital Fabric Design and Production: The 3D Revolution Transforming Luxury Fashion

Advanced 3D design software is fundamentally reshaping luxury fashion production in 2025, with technologies like CLO enabling designers to create entire collections digitally before physical production. This paradigm shift dramatically accelerates design iterations by up to 70%, enhances collaborative decision-making across global teams, and reduces environmental waste from traditional sample production by approximately 85%. Designers now leverage virtual spaces for experimentation, refinement, and real-time collaboration, while luxury brands achieve unprecedented sustainability and efficiency in their creative workflows.

AI-Driven Personalization in Luxury Fashion: Revolutionizing High-End Retail Through Artificial Intelligence

Artificial intelligence is fundamentally transforming luxury fashion by creating hyper-personalized experiences that anticipate customer needs. Advanced AI systems analyze millions of data points from global trends to individual preferences, enabling brands to develop tailored collections and intelligent shopping assistants. According to the Glance AI Fashion Technology Report 2025, 73% of fashion executives now prioritize generative AI for business operations, signaling a major industry shift toward data-driven personalization that enhances customer engagement and product development.

The Smart Clothing and E-Textiles Revolution: Redefining Luxury Fashion Through Technology

The smart clothing and e-textiles market is projected to surpass $5.5 billion by 2025, transforming luxury fashion through temperature-regulating fabrics, augmented reality capabilities, and interactive designs. Leading brands like Levi's and Google are pioneering collaborations that merge fashion with functional innovation, creating garments that monitor health metrics, adapt to environmental conditions, and deliver personalized user experiences. These advancements represent a fundamental shift in how luxury consumers interact with their clothing, offering unprecedented levels of comfort, functionality, and technological integration.

Customizable Luxury Wearables: The Future of Personalized High-End Technology

The luxury wearable technology market in 2025 is defined by unprecedented customization capabilities, enabling consumers to personalize devices through bespoke materials, colors, and engravings. Brands are adopting modular designs that facilitate technology upgrades while preserving core luxury aesthetics, aligning with growing consumer demand for personalized experiences. With price points ranging from $5,100 to $8,100, these innovations represent a sustainable approach to luxury, merging craftsmanship with cutting-edge technology to create unique, long-lasting wearable solutions.

Genderless and Inclusive Fashion Technology: Redefining Luxury in 2025

The luxury fashion technology sector is undergoing a transformative shift in 2025, embracing genderless and inclusive designs that challenge traditional binary concepts. This evolution is driven by a growing demand for fluid and adaptable fashion, with brands integrating advanced technologies to create versatile clothing solutions. Innovations such as smart textiles, AI-driven customization, and modular designs are enabling more personalized and inclusive experiences, reflecting a broader societal move towards diversity and fluidity in fashion. This report explores key trends, technological advancements, and industry impacts shaping the future of inclusive luxury fashion.

Ethical and Transparent Fashion Technology: The New Luxury Standard in 2025

The luxury fashion technology sector in 2025 is undergoing a profound transformation, prioritizing ethical production, transparency, and social responsibility. With blockchain and AI technologies leading the charge, brands are implementing traceable supply chains and monitoring labor practices to meet consumer demands for accountability. This movement reflects a 45% increase in market interest for responsible brands, as reported in the Ethical Fashion Technology Report 2025, underscoring a shift toward sustainable manufacturing and ethical innovation in high-end fashion.

Luxury Health-Monitoring Wearables: The 2025 Evolution of Personalized Wellness

In 2025, luxury wearable technology has achieved unprecedented sophistication in health monitoring, integrating advanced biometric sensors into high-end clothing and accessories. These innovations track vital signs, manage chronic conditions, and deliver personalized wellness insights, particularly benefiting fitness enthusiasts and health-conscious individuals. With the smartwatch market projected to reach $62.46 billion by 2028, the health wearables segment is experiencing significant growth, driven by luxury brands blending cutting-edge technology with premium design to redefine personal health management.

Luxury Fashion Data Privacy and Security: Advanced Protection in the Age of Wearable Tech

In 2025, luxury fashion brands are intensifying their focus on data privacy and security, driven by the proliferation of sophisticated wearable technologies. This article explores how advanced encryption, transparent data management, and secure personalization methods are becoming integral to luxury tech products. Brands are implementing cutting-edge security technologies to safeguard user information while delivering bespoke, high-tech experiences. The Luxury Tech Data Privacy Report 2025 highlights these trends, emphasizing the critical role of user consent and data protection in maintaining consumer trust and brand integrity in the competitive luxury market.