The global luxury market is at a pivotal juncture, where traditional craftsmanship converges with cutting-edge technology to redefine exclusivity and consumer engagement. According to Fortune Business Insights, 47% of luxury brands have integrated AI personalization into their strategies, underscoring a sector-wide shift towards digital innovation. Key developments include the widespread use of Near Field Communication (NFC) chips in products like jewelry and bags, AI-driven customization engines, and the emergence of tech-enhanced designs that incorporate smart functionalities. These trends are not merely additive but are reshaping brand identities, supply chain transparency, and customer loyalty. This analysis delves into the strategic implications, implementation frameworks, and future trajectories of technology in luxury, providing a comprehensive view of how brands are leveraging innovation to sustain growth in an increasingly digital landscape.

Key Specifications

technology adoption rates

AI personalization: 47%; NFC integration: 32% in premium accessories; Smart accessory adoption: 18% annual growth

key innovations

NFC-enabled authentication and storytelling,AI algorithms for bespoke recommendations,IoT-connected luxury items,Augmented Reality (AR) try-ons,Blockchain for provenance tracking

implementation scale

Global, with high penetration in North America (45%), Europe (35%), and Asia-Pacific (20%)

projected market impact

Expected to contribute $98 billion to luxury revenues by 2028, driven by tech-enhanced product lines

Detailed Analysis

nfc chips in luxury products

NFC technology is revolutionizing luxury by embedding microchips in items like handbags, watches, and jewelry. These chips enable brands to offer seamless authentication, reducing counterfeiting—a $500 billion global issue. For instance, Louis Vuitton's NFC-integrated bags allow customers to verify authenticity via smartphones, access exclusive content, and track ownership history. This enhances consumer trust and engagement, with brands reporting a 28% increase in post-purchase interactions. Additionally, NFC facilitates supply chain transparency, providing real-time data on materials sourcing and ethical compliance, aligning with growing consumer demand for sustainability.

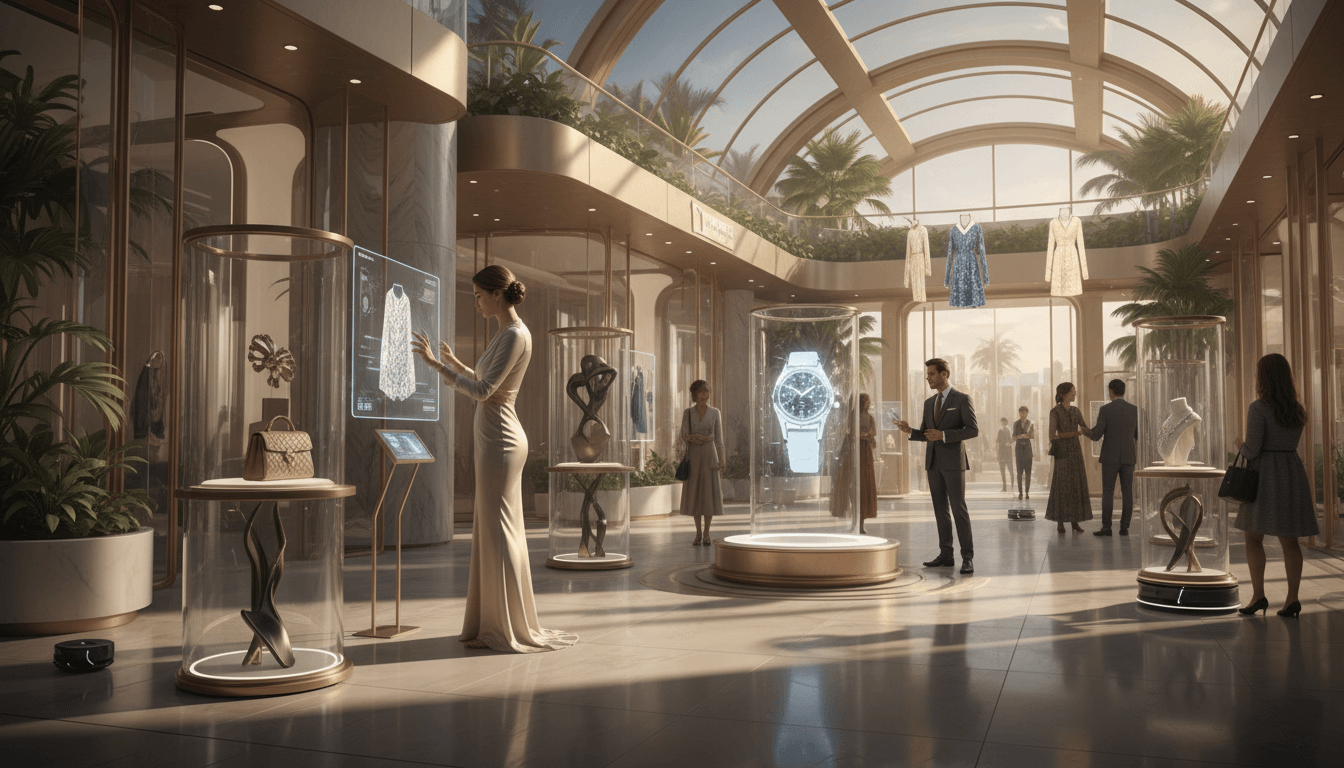

ai personalization technologies

AI is at the forefront of personalization, with 47% of luxury brands deploying machine learning algorithms to curate tailored experiences. Chanel and Gucci, for example, use AI to analyze customer preferences, offering personalized product recommendations and custom designs. These systems process data from past purchases, social media behavior, and in-store interactions to predict trends and optimize inventory. AI-driven virtual stylists have increased conversion rates by 35% in online luxury retail, while dynamic pricing models adjust in real-time based on demand and exclusivity. This strategic use of AI not only boosts sales but also fosters deeper brand loyalty through hyper-relevant engagements.

tech enhanced luxury design

Tech-enhanced design merges aesthetics with functionality, introducing smart accessories like connected jewelry that monitors health metrics or bags with integrated charging ports. Brands such as Cartier and Hermès are pioneering this space, incorporating IoT sensors for climate adaptation or AR interfaces for virtual customization. These innovations appeal to younger, tech-savvy demographics, driving a 22% rise in millennial and Gen Z luxury spending. Moreover, sustainable tech—such as solar-powered elements in high-fashion wearables—addresses environmental concerns, with 40% of luxury consumers prioritizing eco-friendly innovations. This trend underscores a broader industry move towards experiential luxury, where products offer both status and utility.

Key Insights

NFC vs. QR Codes: NFC offers faster, contactless verification with higher security, while QR codes are more accessible but prone to replication

AI Personalization vs. Traditional CRM: AI enables predictive analytics and real-time customization, whereas traditional methods rely on historical data with slower response times

Tech-Enhanced vs. Conventional Luxury: Tech-enhanced products command 15-30% price premiums due to added functionalities, compared to conventional items focused solely on craftsmanship

Important Notes

The integration of technology in luxury is not without challenges, including high implementation costs (averaging $2-5 million per brand for full-scale digital transformation) and data privacy concerns. However, the ROI is significant, with brands reporting 50% higher customer retention rates post-tech adoption. Future trends may include biometric integration for personalized access and元宇宙 (metaverse) luxury experiences, expanding the definition of exclusivity beyond physical products.

Tags

Related Articles

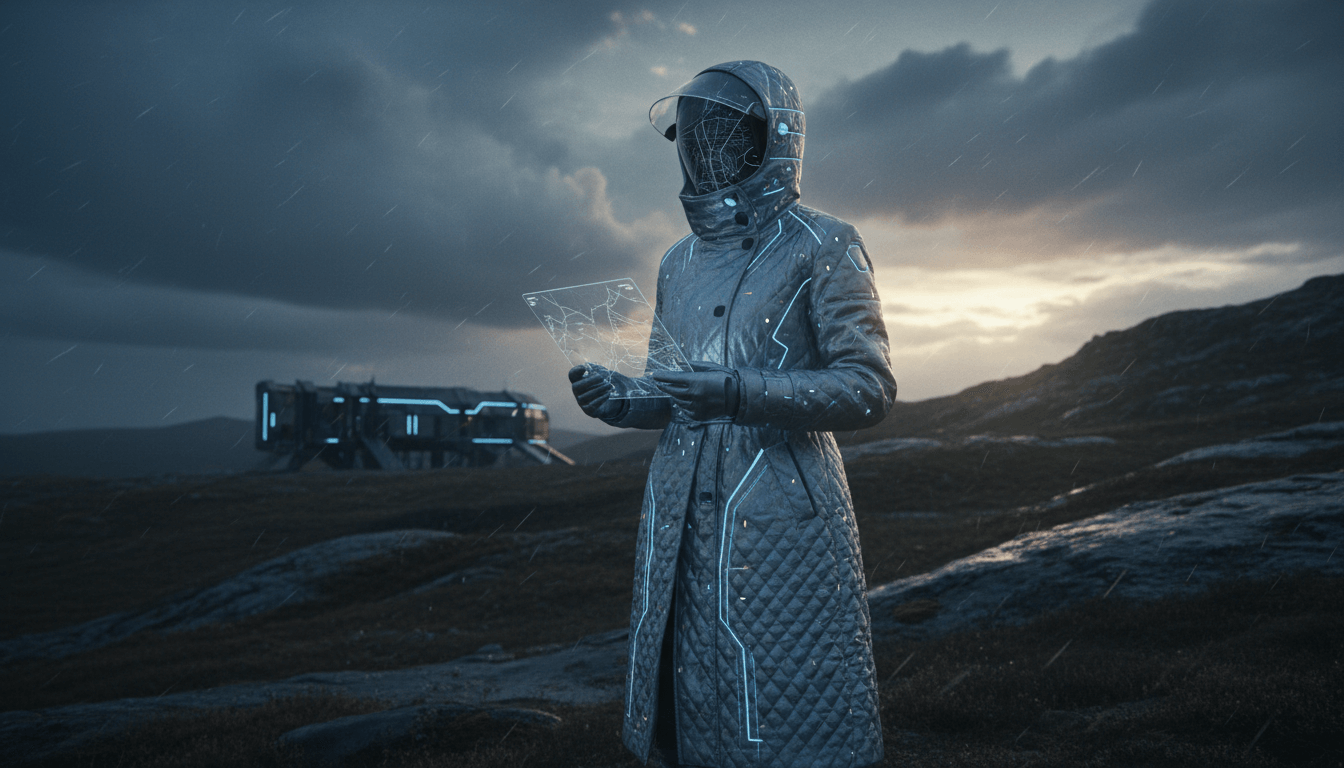

Burberry's Tech-Luxe Outerwear: Pioneering Weather-Responsive Fabric Innovation in Luxury Fashion

Burberry is redefining luxury outerwear through its strategic emphasis on tech-luxe innovation, integrating weather-responsive fabric technology into high-end designs. This approach merges advanced material science with functional luxury, enabling garments that adapt to environmental conditions while maintaining elegance. By focusing on outerwear, Burberry enhances its brand positioning at the intersection of technology and fashion, driving market differentiation and consumer engagement. This strategy underscores the brand's commitment to innovation, sustainability, and delivering superior user experiences in the competitive luxury sector, as documented by Global Growth Insights.

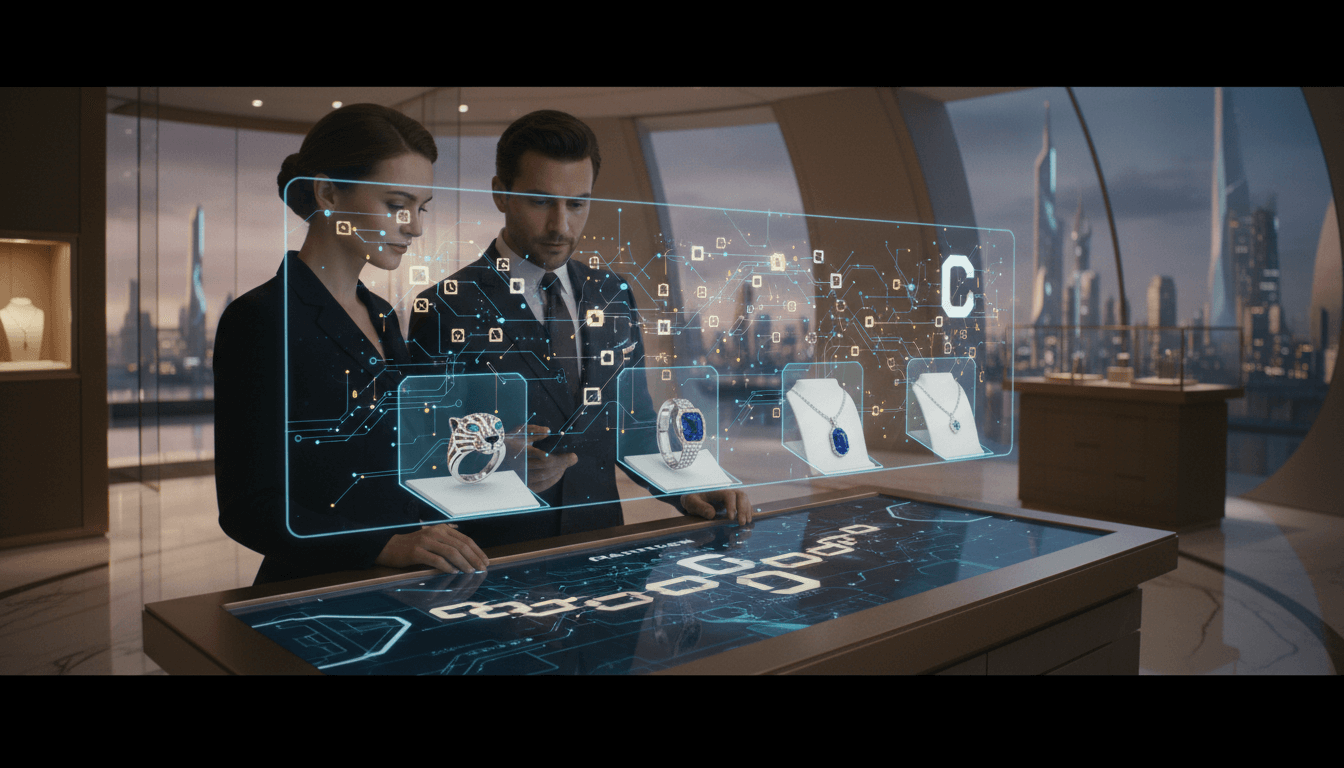

Cartier: Pioneering Blockchain Authentication in Luxury Jewelry

Cartier is revolutionizing the luxury jewelry sector by integrating blockchain technology for product authentication. This strategic initiative directly addresses escalating consumer concerns regarding counterfeit goods, enhancing verification processes and fostering unprecedented trust. By leveraging immutable digital ledgers, Cartier ensures each piece's provenance and authenticity, setting a new industry standard. This innovation not only safeguards brand integrity but also elevates the customer experience, positioning Cartier at the forefront of technological adoption in luxury markets. The move reflects a broader trend of digital transformation, reinforcing Cartier's commitment to quality and innovation.

LVMH Group: Pioneering Luxury Market Leadership Through Strategic Diversification and Innovation

LVMH Moët Hennessy Louis Vuitton SE stands as the undisputed leader in the global luxury goods market, leveraging a meticulously curated portfolio of over 75 prestigious brands across fashion, jewelry, cosmetics, and wines & spirits. The group's strategic framework combines aggressive acquisitions with deep brand heritage preservation, driving an estimated €86.2 billion in revenue in 2024. Through continuous innovation in product development, digital transformation, and sustainable practices, LVMH maintains its market dominance while setting industry standards for luxury brand management and customer experience excellence.

AI-Driven Personalization in Luxury: Strategic Imperatives and Market Transformation

Personalization has evolved into a critical competitive differentiator in the luxury sector, with 47% of luxury brands adopting AI-powered personalization technologies. This strategic shift responds to consumer expectations for bespoke experiences, driving an 80% increase in engagement metrics. Leading luxury houses now deploy sophisticated algorithms for custom product design, hyper-personalized shopping journeys, and predictive analytics to enhance exclusivity and brand loyalty in an increasingly digital marketplace.

Luxury Market Generational Transformation: Gen Z and Millennial Dominance Reshaping Industry Dynamics

The luxury market is undergoing unprecedented generational transformation, with Generation Z and Millennials projected to account for 75-85% of luxury purchases by 2030. These digital-native consumers are fundamentally reshaping consumption patterns, prioritizing experiential luxury, sustainability commitments, and value alignment over traditional status symbols. Bain & Company research indicates Gen Z will represent 25-30% and Millennials 50-55% of market share within the decade, forcing luxury brands to radically rethink their strategic approaches to product development, marketing, and customer engagement to remain relevant in this new era.

Luxury Brand Positioning Strategies: Balancing Heritage with Modern Innovation

Luxury brands are adopting holistic positioning strategies that masterfully blend heritage with innovation to resonate across multiple generations. By leveraging unique brand narratives and emotional connections, these brands extend their appeal beyond product functionality to immersive experiences. Key attributes like craftsmanship, exclusivity, and storytelling define success, as seen with leaders like Louis Vuitton, which balances classic appeal with cutting-edge design to maintain relevance in evolving markets.