Luxury Product Reviews

In-depth reviews and expert analysis of luxury products across all categories

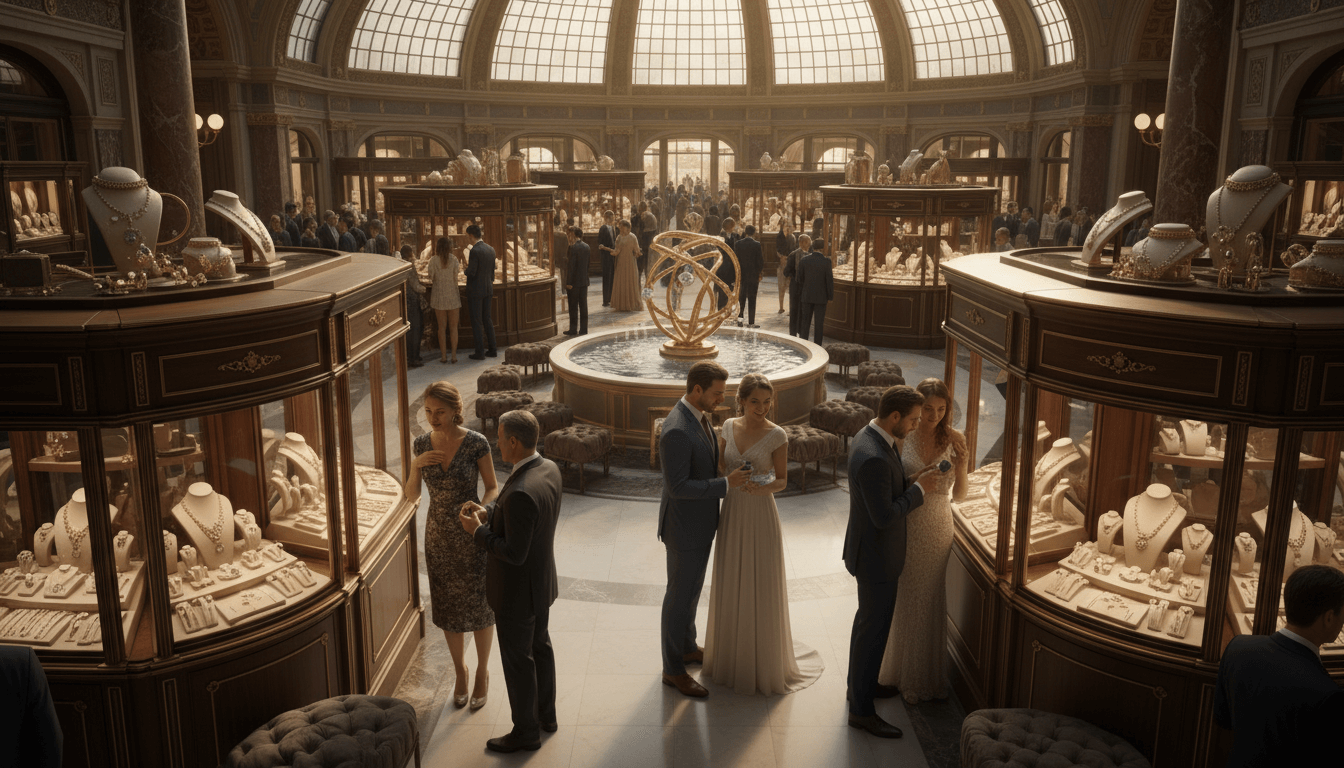

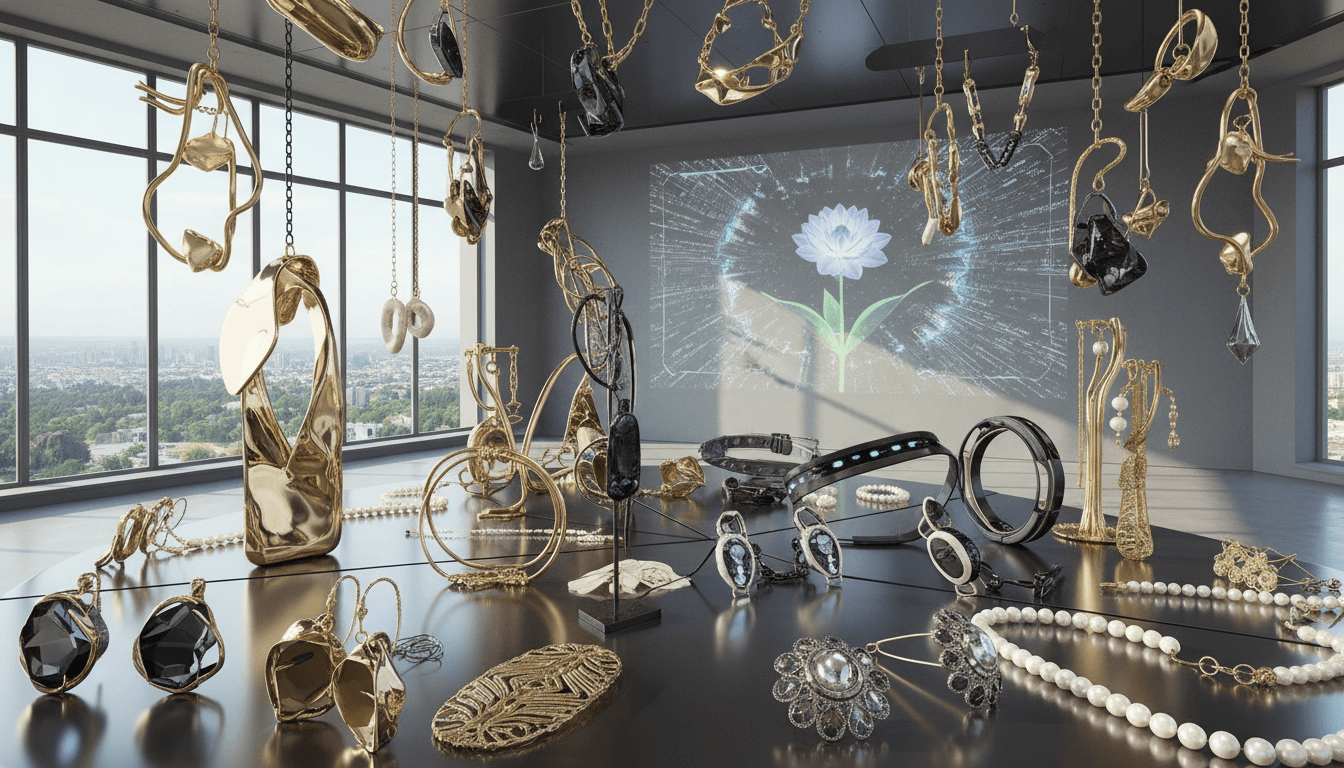

Luxury Jewelry Market Insights: Investment Potential and Growth Trends

The luxury jewelry market demonstrated robust growth of 5-6% in 2023, reaching a valuation of €29 billion, according to Bain & Company. Fine jewelry is increasingly perceived as a stable investment asset, with bespoke and high-end pieces driving demand, particularly among ultra-wealthy consumers. This review explores key market dynamics, investment strategies, and design innovations shaping the industry's future.

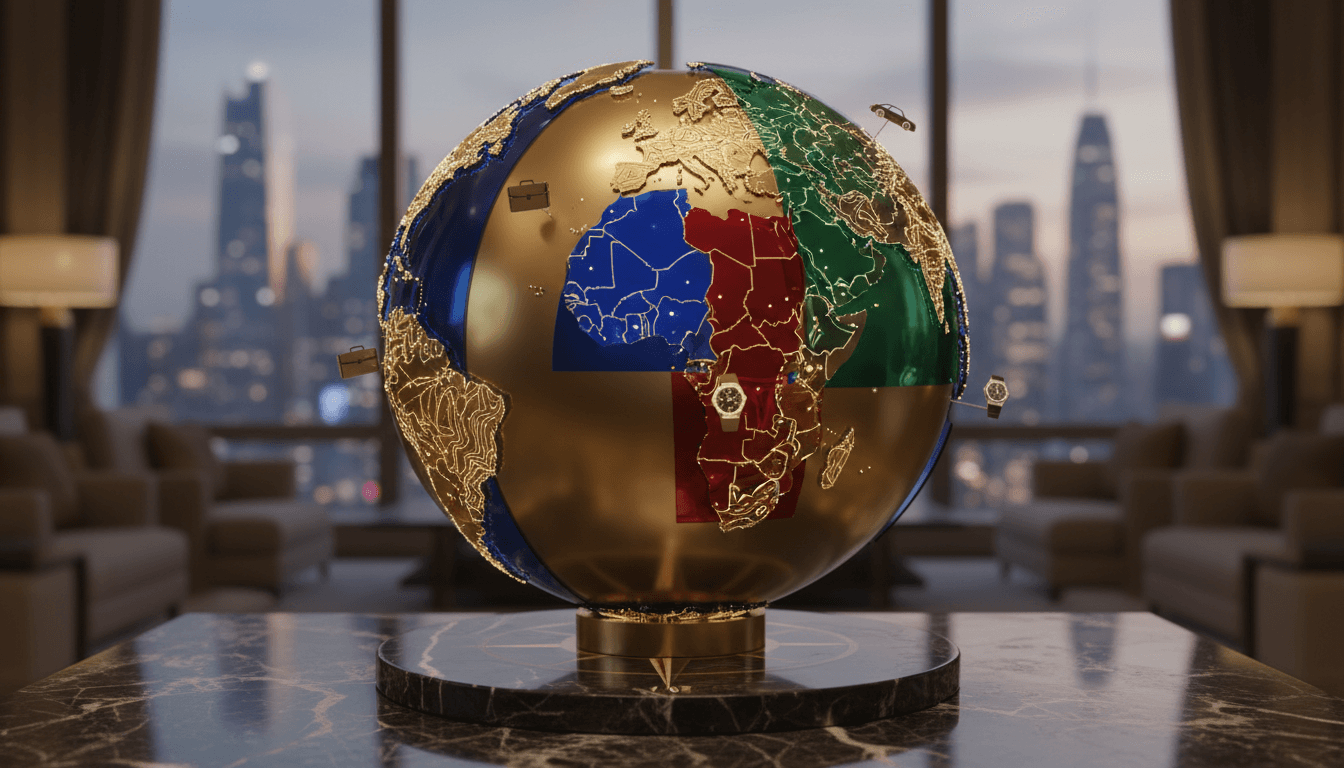

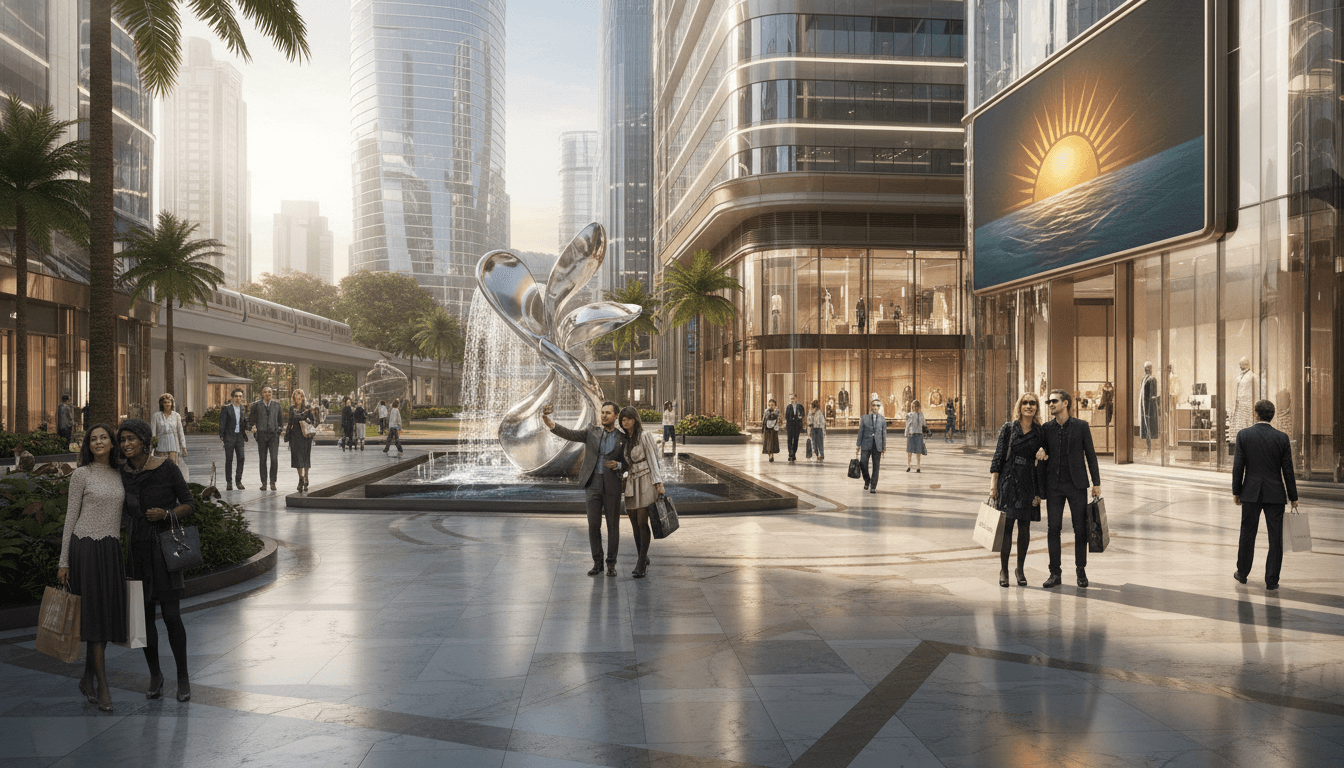

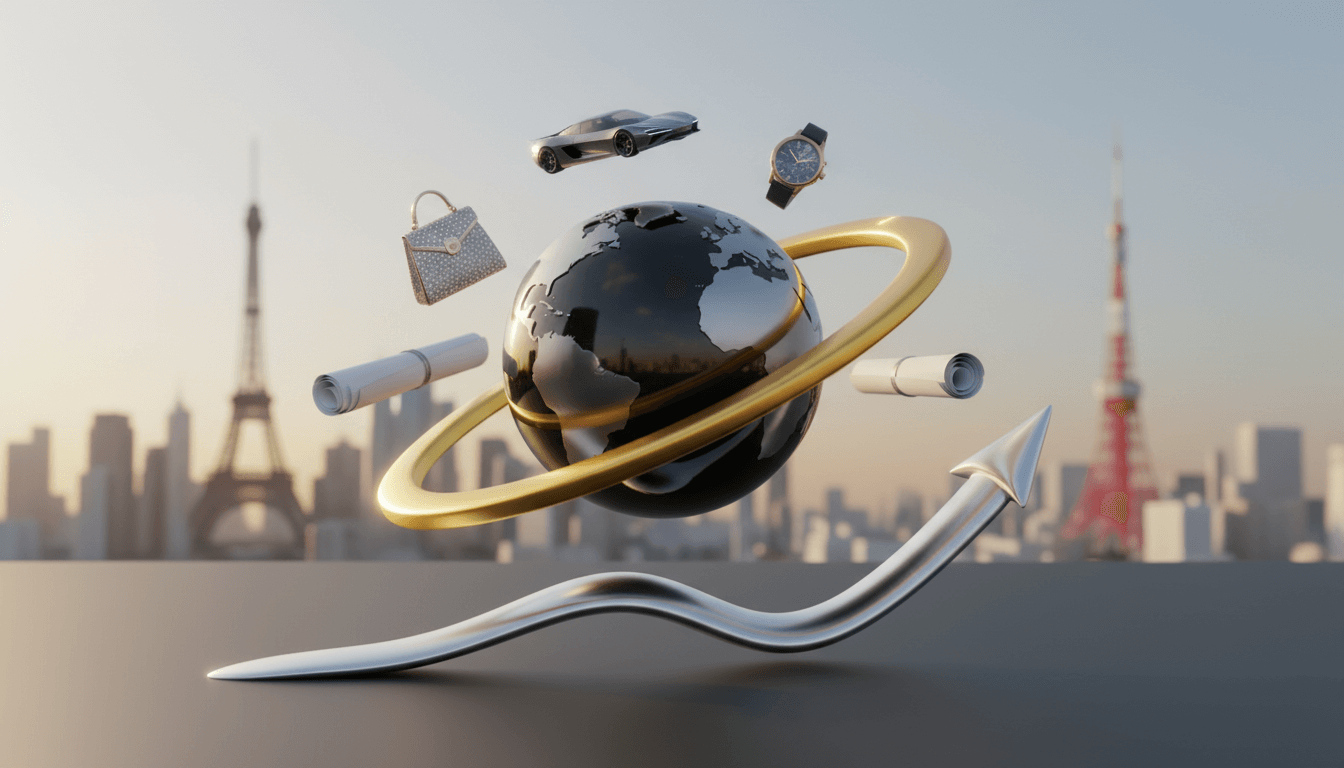

Luxury Market Geographic Insights: Analyzing Regional Dynamics and Growth Patterns

This comprehensive review delves into the geographic dynamics of the global luxury market, valued at €1.5 trillion in 2023 with an annual growth rate of 8-10%. Asia, particularly China, Japan, and South Korea, drives expansion through unique consumer behaviors, while the US and European markets maintain strength with heritage brand loyalty and evolving preferences. The analysis covers regional consumption patterns, market strategies, and innovations shaping luxury fashion, jewelry, travel, and lifestyle sectors, providing actionable insights for industry stakeholders.

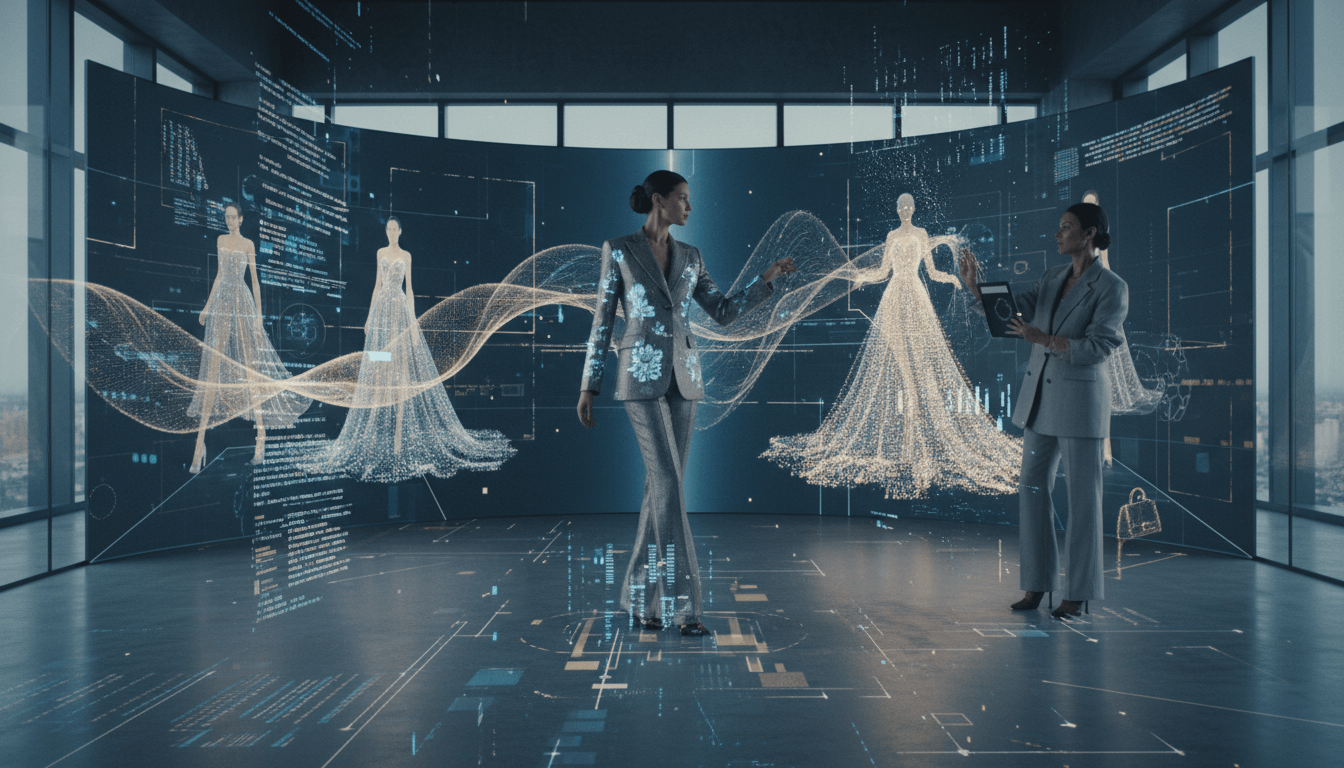

Luxury Fashion's Digital Transformation: A Comprehensive Review of Market Evolution

The luxury fashion industry is undergoing a profound digital and strategic transformation, with global market growth projected at 8-10% in 2023. Brands are leveraging AI and technology to enhance personalization while emphasizing sustainable production and omnichannel retail experiences. This shift addresses changing consumer expectations through digital innovation, ethical practices, and seamless customer engagement, as highlighted in the McKinsey State of Luxury Report.

Luxury Brand Digital Strategy: Transforming High-End Experiences Through Technology

This review examines how digital transformation is revolutionizing luxury brand strategies, with a focus on AI-driven personalization, advanced digital marketing, and technology as a key differentiator. Drawing from McKinsey's State of Luxury Report, we explore how brands are investing in sophisticated online experiences and data analytics to deliver seamless, personalized interactions. The analysis covers market trends, strategic implementations, and the growing emphasis on digital capabilities to maintain competitive advantage in the global luxury sector.

Navigating the Evolving Luxury Watch Market: Trends, Innovations, and Consumer Shifts

The luxury watch market is undergoing significant transformation, marked by a slowdown in traditional segments and a surge in demand for innovative designs and technology integration. Brands are adapting to shifting consumer preferences, particularly among younger demographics seeking unique, meaningful timepieces. This review explores key dynamics, including market performance data from Bain & Company, the impact of economic uncertainties, and strategies employed by leading manufacturers to maintain relevance and drive growth in a competitive landscape.

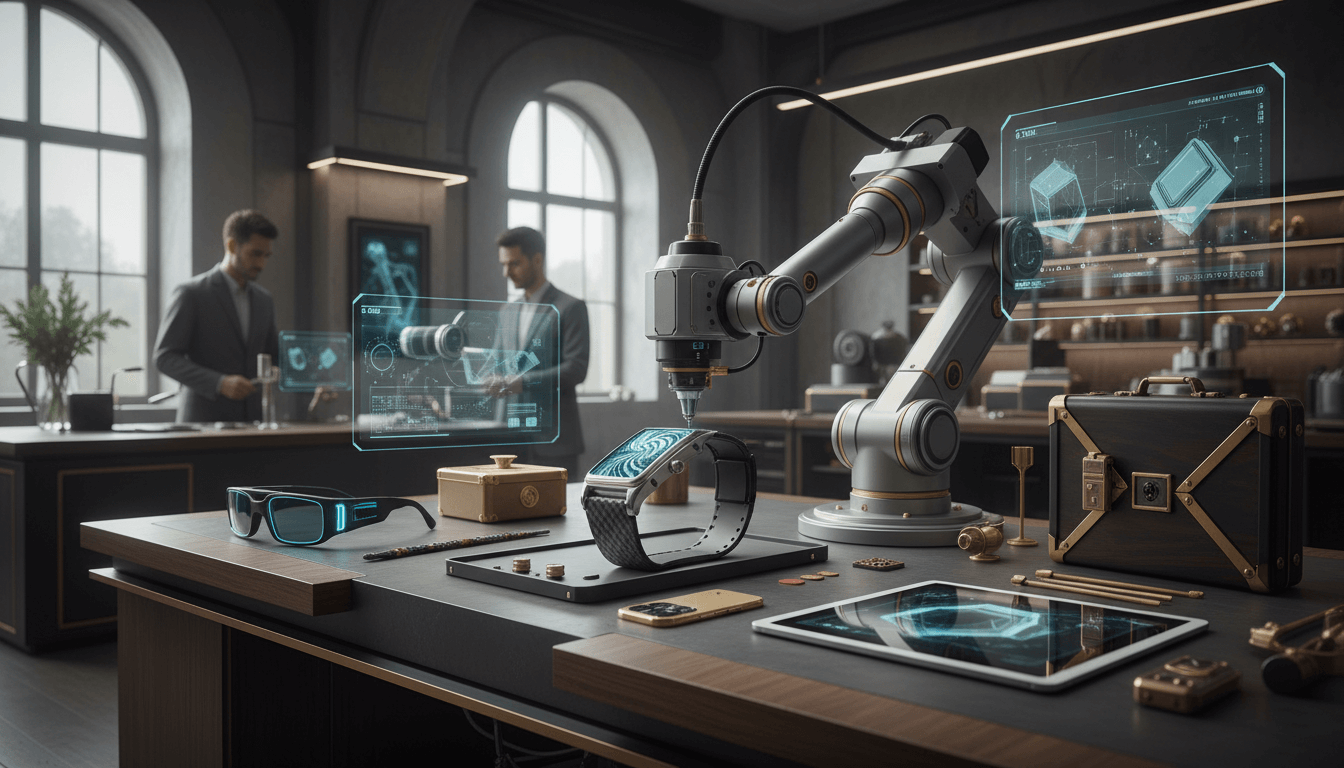

Luxury Technology Integration: NFC and Digital Authentication Reshape High-End Products

Luxury brands are embracing advanced technologies, with NFC chips and digital authentication systems becoming integral in products like jewelry, bags, and accessories. Pioneers such as Coach and VerseLux are leading this innovation, enhancing customer engagement through tech-enabled features that offer unique experiences, product verification, and added value. This trend reflects a broader shift in the luxury market towards integrating digital solutions to meet evolving consumer expectations for authenticity and interactivity.

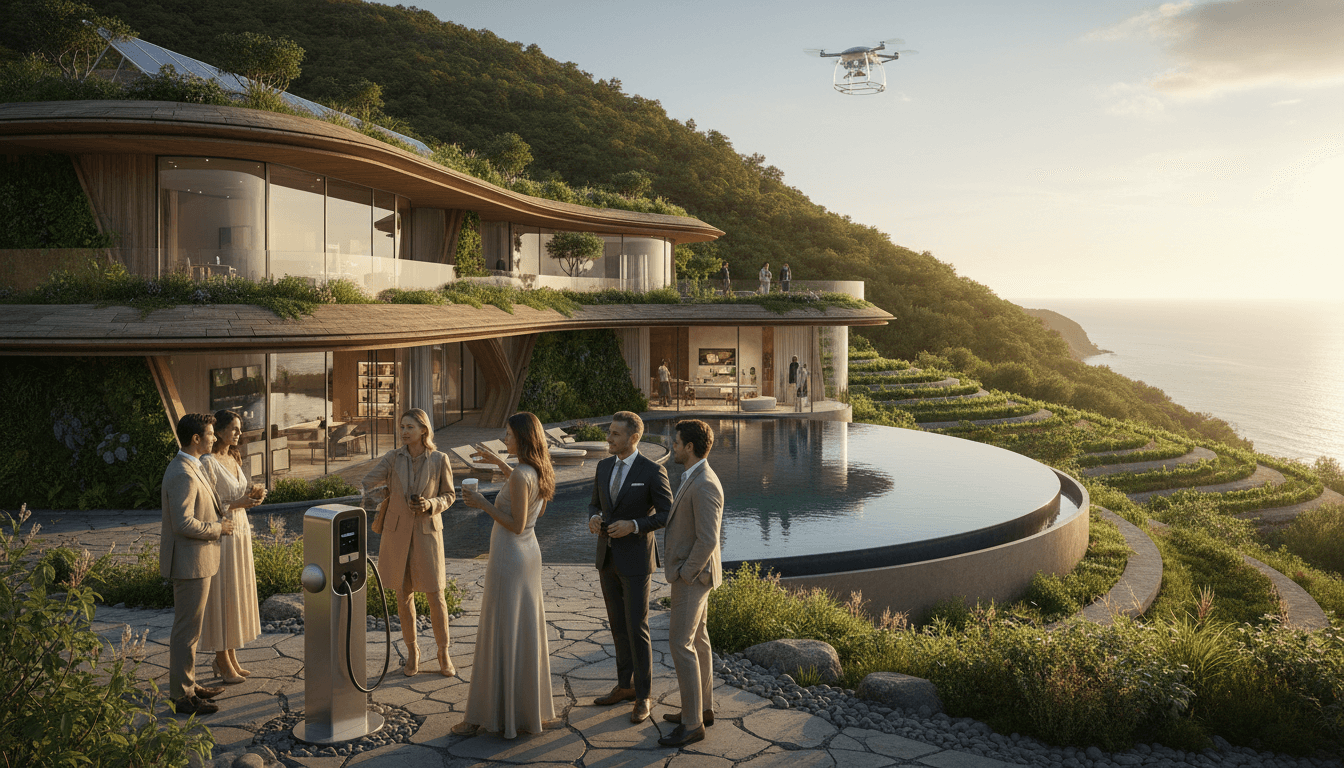

The Luxury Sustainability Movement: How High-End Brands Are Embracing Eco-Conscious Practices

The luxury sector is undergoing a transformative shift towards sustainability, driven by rising consumer demand for ethical and environmentally responsible products. Brands are adopting sustainable materials, transparent supply chains, and circular economy models, including pre-owned markets. This review explores key trends, brand initiatives, and market data from the Mediaboom Luxury Trends Report, highlighting how sustainability is redefining luxury without compromising quality or exclusivity.

The Sustainable Luxury Movement: A Comprehensive Review of Ethical Practices in High-End Fashion

This review examines the growing sustainable luxury movement, spotlighting how leading brands like Stella McCartney are responding to consumer demands for transparency and eco-friendly practices. Key developments include the adoption of recycled materials, ethical manufacturing, and a shift in consumer focus toward environmental responsibility, as detailed in the Kadence Luxury Market Report. The analysis covers market trends, brand strategies, and the implications for the future of luxury fashion, jewelry, and lifestyle sectors, emphasizing the balance between opulence and sustainability.

Luxury Technology Integration: Revolutionizing High-End Products with NFC and Smart Features

Luxury brands are seamlessly merging traditional craftsmanship with advanced technologies like NFC chips, creating interactive and personalized experiences. Products such as Coach Coachtopia and VerseLux collections demonstrate how technology enhances value through authentication, storytelling, and exclusivity. This trend, supported by Fortune Business Insights, reflects a market shift toward tech-infused luxury goods that appeal to modern consumers seeking innovation and sustainability. The integration bridges heritage with digital transformation, offering brands new avenues for engagement and revenue.

Women's Luxury Market Dominance: The Rise of Female Financial Power and Personal Expression

The women's luxury goods segment continues to lead the global market, driven by a significant increase in female financial independence and wealth, with 337 billionaire women in 2023. This article explores how this demographic shift fuels demand for high-end fashion items that emphasize personal style and identity, supported by data from Grand View Research. Key motivations include financial empowerment and the desire for unique self-expression through luxury products.

The Luxury Personalization Revolution: Data-Driven Strategies Redefining High-End Experiences

The luxury sector is undergoing a transformative shift toward hyper-personalization, driven by advanced data analytics and consumer demand for unique experiences. According to McKinsey's Luxury Consumer Trends Study, personalization boosts customer engagement by up to 80%, with brands deploying tailored marketing and bespoke product offerings. This article reviews how luxury leaders are leveraging technology to create individualized connections, examining the pros, cons, and real-world impact of personalization strategies in high-end markets.

Luxury Market Global Insights 2024: Resilience and Transformation in High-End Goods

The global luxury goods market achieved a valuation of €1.5 trillion in 2023, growing by 8-10%, according to the Bain-Altagamma Luxury Goods Worldwide Market Study. Jewelry and apparel categories led with 5-6% growth, driven by technological integration, sustainability efforts, and personalized consumer experiences. This review explores key trends, brand strategies, and innovations shaping the industry's future, emphasizing digital transformation and evolving consumer preferences.

Luxury Beauty and Fragrance Market: Resilience, Sustainability, and Emotional Connections

The luxury beauty and fragrance market exhibits robust growth, driven by consumer demand for high-quality, sustainable, and ethically produced items. According to Bain & Company's Luxury Report, this sector emphasizes small, meaningful indulgences that foster emotional connections, with sustained performance in beauty categories and a clear shift toward eco-conscious purchasing. Key trends include increased investment in transparent supply chains, innovative formulations, and personalized experiences, positioning luxury beauty as a resilient segment in the global luxury industry.

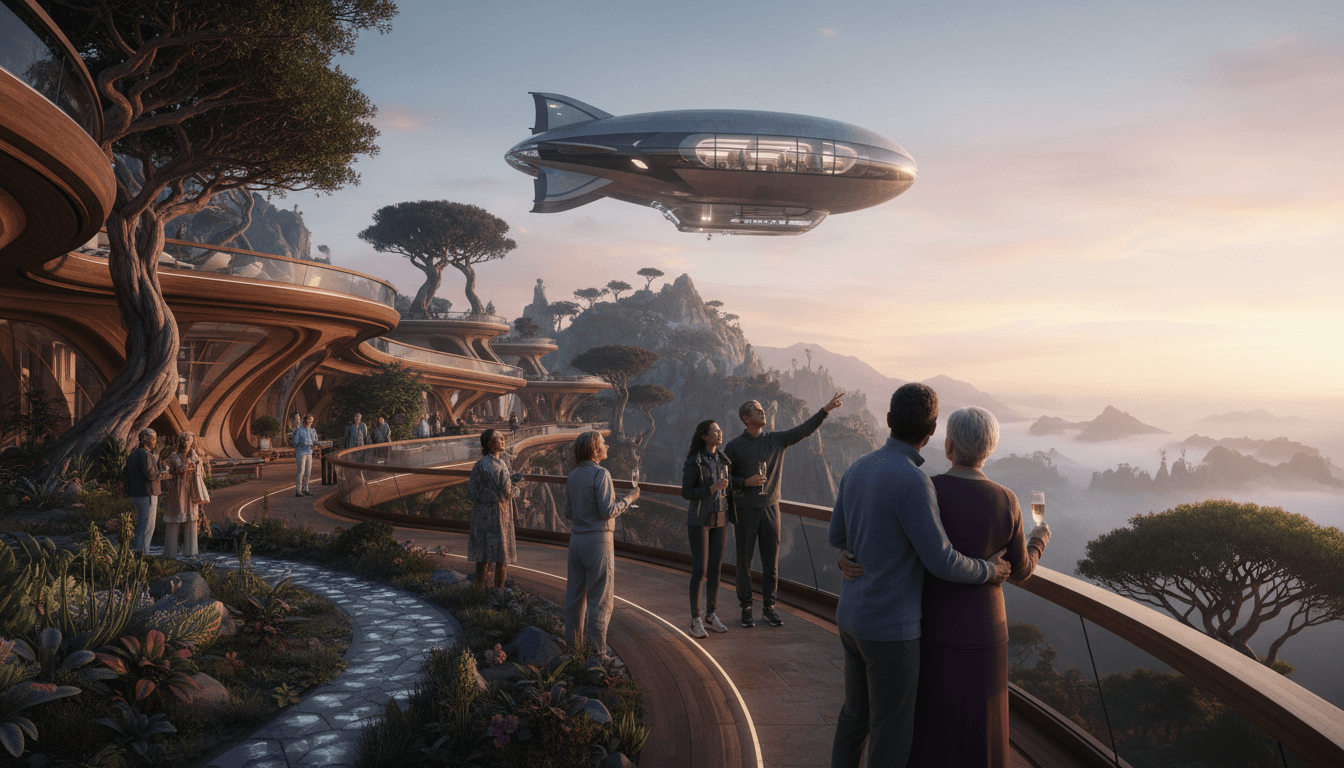

Luxury Travel Experiences Redefined: The Shift from Material to Immersive Journeys

Luxury travel is evolving beyond opulent accommodations and high-end amenities, with a clear pivot toward experiential, sustainable, and wellness-focused journeys. According to the Mediaboom Luxury Trends Report, 78% of millennials now prioritize experiences over products, fueling market growth in bespoke workshops, private events, and eco-friendly itineraries. This review explores how brands are innovating to meet demand for personalized, meaningful travel, emphasizing sustainability and immersive interactions that redefine luxury.

Secondhand Luxury Market Expansion: Growth, Drivers, and Brand Strategies

The pre-owned luxury market is transforming the high-end sector, projected to reach $30 billion by 2025. Fueled by 41% sales growth at platforms like The RealReal in 2023, younger consumers and sustainability priorities are accelerating demand. Luxury brands are responding with official resale programs, authentication services, and digital engagement to capture this lucrative segment. This review analyzes market dynamics, consumer behavior shifts, and strategic adaptations reshaping luxury accessibility and sustainability.

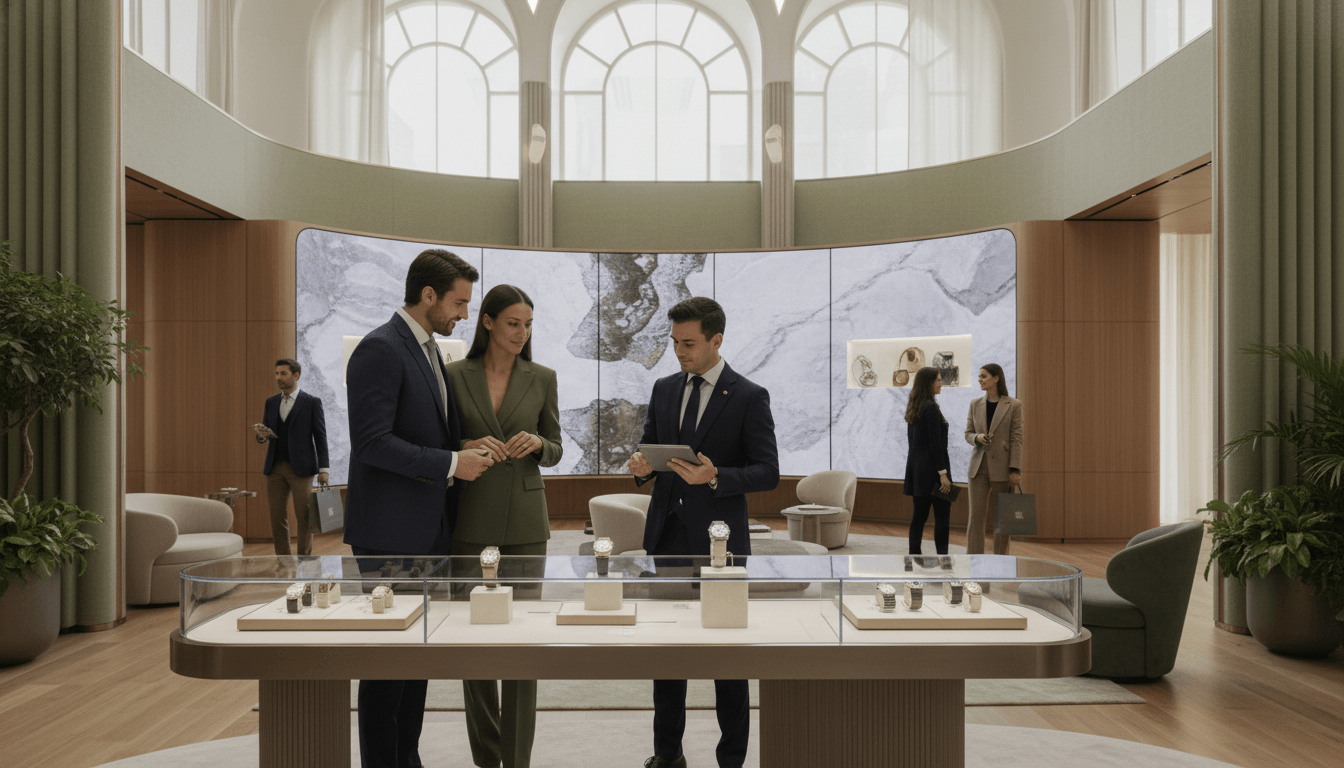

Luxury Retail Experience Evolution: The Shift to Immersive and Technology-Enhanced Shopping

The luxury retail sector is undergoing a profound transformation, driven by evolving consumer expectations and technological advancements. Over 70% of luxury consumers prefer in-person shopping experiences, emphasizing the need for brands to create immersive, personalized interactions. This review explores key trends such as omnichannel strategies, technology integration, and experiential retail, supported by data from the Simon-Kucher Global Luxury Consumer Trends Study. We analyze how leading brands are leveraging these innovations to foster memorable brand interactions and sustain growth in a competitive market.

Navigating Economic Headwinds: A Critical Review of Luxury Market Adaptation

The luxury market faces significant economic pressures, including slowing growth projected at low to mid-single digits, heightened price sensitivity, and evolving consumer expectations. Brands must innovate with personalized experiences and strategic repositioning to maintain relevance. This review analyzes how top luxury players are responding to these challenges, focusing on differentiation and value creation in a competitive landscape. Insights are grounded in data from the McKinsey State of Luxury Report, offering actionable strategies for industry stakeholders.

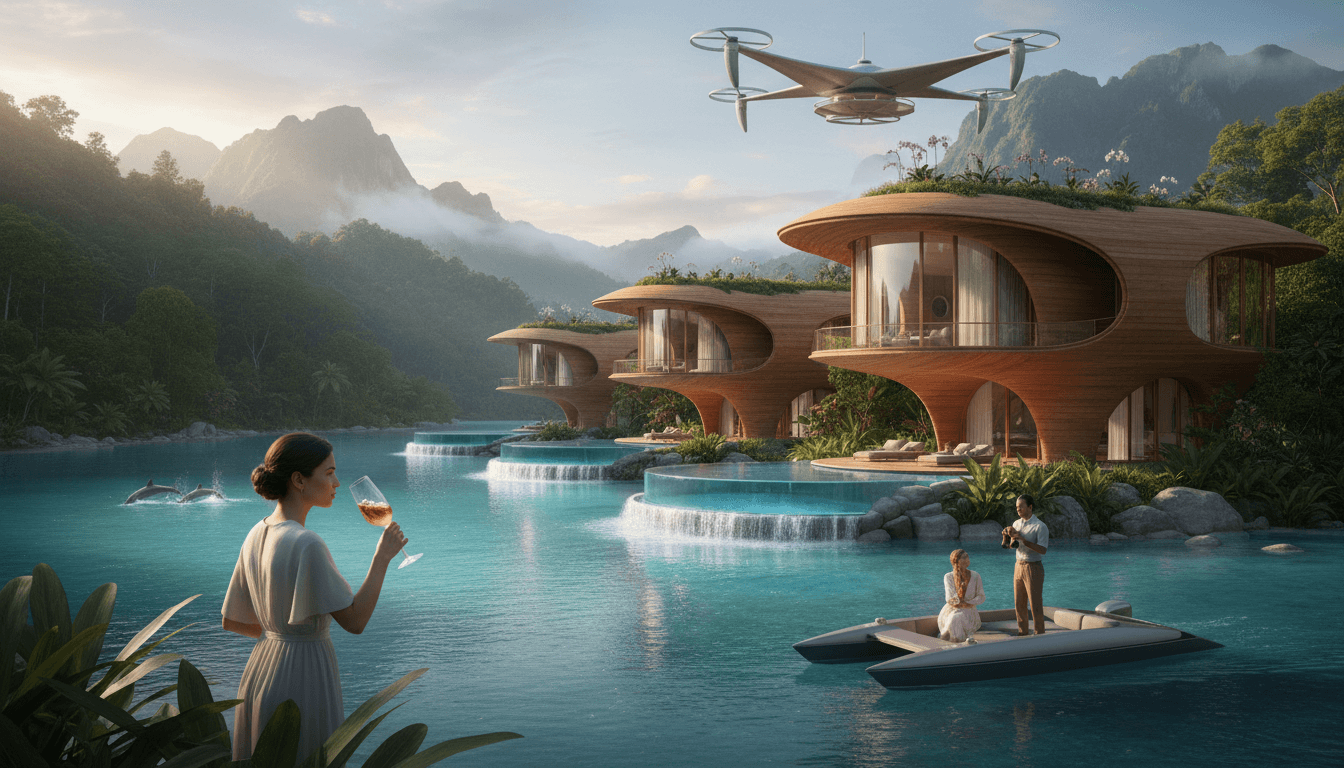

The Rise of Experiential Luxury: Redefining Travel with Personalized, Exclusive Experiences

The luxury travel sector is undergoing a profound transformation, with a marked shift from material acquisitions to experiential indulgence. According to Euromonitor International, 72% of affluent travelers now prioritize unique, personalized journeys over traditional luxury goods. Brands like Ritz-Carlton are pioneering this trend by offering bespoke packages that emphasize exclusivity, privacy, and wellness. This evolution is largely driven by Millennial preferences and a growing collective desire for distinctive, immersive experiences that foster personal growth and well-being, signaling a new era in high-end travel where memories outweigh possessions.

The Evolving Luxury Jewelry Market: A Comprehensive Review of Trends and Innovations

The luxury jewelry sector is undergoing a profound transformation, marked by a 5-6% market growth in 2023 and key shifts in consumer behavior. Gold maintains dominance with a 33.1% market share, while brands like Gucci, Bulgari, Graff, and MIKIMOTO lead innovations in gender-neutral designs and personalized shopping experiences. Technological integration is reshaping product offerings and customer engagement, with unisex collections and tech-enhanced pieces emerging as pivotal trends. This review delves into the strategic moves by top luxury houses, backed by data from Grand View Research and Bain & Company, offering insights for industry stakeholders and enthusiasts.

Asia Pacific Luxury Market Leadership: Dominating Global Luxury with Strategic Growth

The Asia Pacific region commands a 37.7% share of the global luxury market, valued at $93.3 billion in 2024. Driven by rising disposable incomes and evolving consumer preferences in key markets like China, Japan, and South Korea, this dominance reflects deeper shifts in luxury consumption patterns. This review analyzes market dynamics, growth drivers, and regional impacts, providing insights for stakeholders navigating this lucrative landscape.

Luxury Footwear Market Trends: An In-Depth Analysis of Designer Shoes and Consumer Preferences

The luxury footwear market holds a significant 16.2% share of the global luxury industry in 2024, driven by consumer demand for exclusive designer shoes that emphasize superior quality and style. Brands are innovating with high-fashion trends and durable materials, focusing on attributes like exclusivity and craftsmanship to maintain market leadership. This review explores key growth factors, including the influence of designer trends and fashion-forward consumers, providing insights into why luxury footwear remains a cornerstone of the high-end fashion sector.

High-End Personalized Luxury Services: Revolutionizing Bespoke Consumer Experiences

Personalized luxury services are transforming high-end consumer engagement by offering bespoke designs, tailored shopping experiences, and data-driven recommendations. According to the Business2Consumer Luxury Trends Report, these strategies can increase customer engagement by up to 80%, targeting high-net-worth individuals with custom clothing, accessories, and exclusive consultations. This review examines the efficacy, implementation, and consumer impact of these services in the global luxury market.

Hermès Birkin Bag: The Ultimate Luxury Investment and Status Symbol

The Hermès Birkin Bag is the pinnacle of luxury handbags, celebrated for its unparalleled craftsmanship, exclusivity, and investment value. With consistently high demand among ultra-wealthy collectors, it retains and appreciates in value over time, making it a cornerstone of high-end fashion portfolios. This review delves into its market dynamics, artisanal quality, and the experience of owning a Birkin, supported by insights from the Who What Wear Luxury Report 2023.

The Rise of Female Self-Purchasers in the Luxury Market

The global luxury market is witnessing a significant shift as women increasingly purchase high-end items for themselves, driven by financial independence and evolving social norms. Industry reports highlight a 76% increase in female self-purchasing, with notable growth in jewelry, fashion, and accessories. This trend reflects broader changes in consumer behavior, emphasizing empowerment and personal fulfillment over traditional gifting practices. As brands adapt to this demographic, understanding their preferences and values becomes crucial for market success.

Luxury Smartwatch with NFC Technology: Redefining High-End Wearables

This comprehensive review explores luxury smartwatches integrating NFC technology, blending sophisticated craftsmanship with cutting-edge digital capabilities. We analyze market growth, technological innovations, and consumer appeal for tech-savvy luxury buyers. Key findings highlight seamless payment integration, premium materials, and the convergence of traditional watchmaking with smart features, positioning these timepieces as essential accessories in the rapidly expanding luxury wearable market.

Quiet Luxury Fashion: The Definitive Guide to Understated Elegance

Quiet luxury fashion represents a paradigm shift towards refined sophistication, emphasizing exceptional craftsmanship and timeless design over conspicuous branding. This comprehensive review explores the philosophy behind understated elegance, profiles leading brands like Loro Piana and Bottega Veneta, and analyzes consumer preferences for subtle luxury. Drawing from the Who What Wear Luxury Report 2023, we examine how this trend is reshaping the global luxury market and why discerning consumers are increasingly choosing quality and discretion over ostentatious displays.

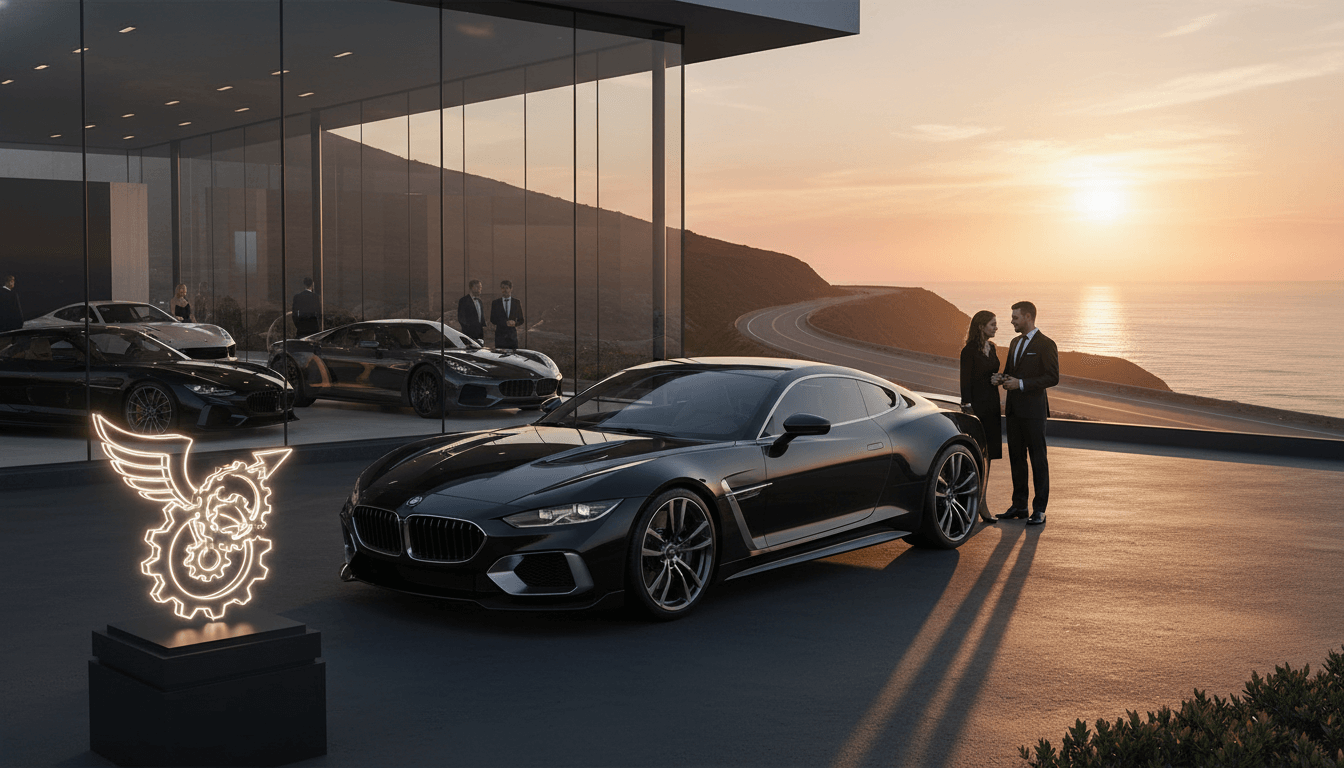

Luxury Automotive Experiences: Where Performance Meets Exclusive Lifestyle

This review explores the dynamic world of luxury automotive experiences, emphasizing their role within the broader luxury market segment. With insights from Bain & Company's Luxury Market Study, we analyze how high-net-worth individuals and affluent collectors drive demand for vehicles that blend peak performance, technological innovation, and exclusivity. Covering market trends, consumer profiles, and key industry developments, this article provides a comprehensive overview of how premium cars transcend mere transportation to deliver immersive lifestyle enhancements.

Asian Luxury Market Expansion: A Comprehensive Review of Growth Drivers and Brand Opportunities

The Asia-Pacific luxury market has emerged as a dominant force, capturing 40.12% of the global market share in 2022. Fueled by rising disposable incomes, a burgeoning middle class, and robust growth in key economies like China, India, and Southeast Asia, this region presents unparalleled opportunities for luxury brands. This review analyzes market dynamics, consumer behavior shifts, and strategic imperatives for success in high-growth Asian markets, offering insights into product innovations and regional trends shaping the future of luxury consumption.

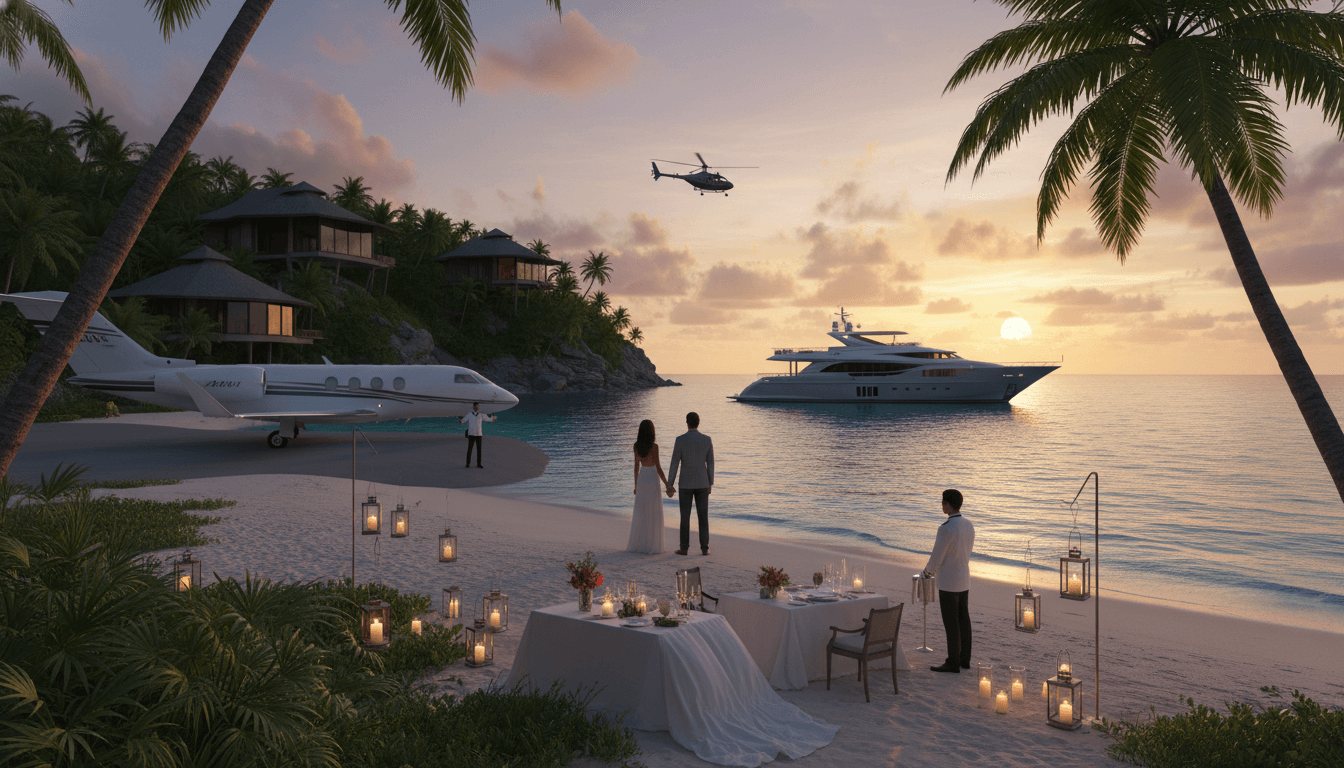

Ultra-Personalized Luxury Travel: Redefining Bespoke Experiences for Discerning Travelers

This in-depth analysis explores the paradigm shift in luxury travel toward ultra-personalized experiences, as detailed in the Kadence Luxury Market Trends Report. Catering primarily to Millennials and experience-seekers, these bespoke packages offer customized itineraries, exclusive access to private events, and specialized workshops. With the market trend showing a marked rise in experiential luxury and a consumer preference for experiences over physical products, this review evaluates how these offerings deliver unique, memorable journeys that surpass traditional luxury tourism standards.

Gender-Fluid Luxury Jewelry: Pioneering Inclusivity and Redefining Luxury Accessories

Gender-fluid luxury jewelry represents a paradigm shift in the high-end accessories market, driven by evolving social norms and a demand for inclusivity. These innovative designs transcend traditional gender binaries, offering versatile pieces that appeal to a diverse consumer base, including the LGBTQ+ community. With the luxury jewelry market experiencing significant expansion, brands are adopting genderless styling approaches to meet the growing emphasis on personal expression. This review explores key trends, market dynamics, and standout products, highlighting how this movement is reshaping the future of luxury jewelry.

Sustainable Luxury Fashion: The Intersection of Opulence and Environmental Responsibility

Sustainable luxury fashion represents a paradigm shift in the global luxury industry, with leading brands like Stella McCartney pioneering the use of eco-friendly materials such as vegan leather and recycled fabrics. This movement reflects the growing consumer demand for environmentally conscious luxury products, driven by heightened awareness and ethical considerations. Brands are increasingly adopting responsible manufacturing processes, transparency in supply chains, and circular economy principles. This comprehensive review explores how sustainability is reshaping luxury fashion, detailing material innovations, brand strategies, and consumer trends that define this transformative era.

Redefining Luxury: The Evolution of High-End Hospitality and Bespoke Travel Experiences

The luxury hospitality and travel sector is experiencing unprecedented growth, outpacing the broader luxury market. According to Bain & Company's Luxury Market Study, this expansion is driven by a demand for exclusive, personalized experiences beyond traditional accommodations. Discerning travelers now seek bespoke travel packages and private events tailored to their unique preferences, emphasizing personalization and exclusivity. This review explores the key trends, market dynamics, and innovations shaping this industry, offering insights for experience-seeking travelers and industry stakeholders alike.

Luxury Fine Jewelry Investment: A Deep Dive into the €29 Billion Market

The luxury fine jewelry market, valued at €29 billion in 2023, is increasingly recognized as a stable and appreciating asset class. Driven by a 5-6% annual growth rate, this sector appeals to ultra-wealthy collectors and discerning consumers seeking bespoke, investment-worthy pieces. This review explores market dynamics, key trends like the demand for personalized collections, and the strategic factors that position fine jewelry as a resilient component of a diversified investment portfolio, backed by insights from the Bain & Company Luxury Report.

Luxury Beauty and Cosmetics: A Comprehensive Review of the High-End Market

The luxury beauty and cosmetics market achieved a valuation of €72 billion in 2023, demonstrating 4-5% annual growth driven by consumer demand for premium ingredients, sophisticated formulations, and affordable indulgence. This sector thrives during economic uncertainty, with entry-level luxury purchases fueling expansion. Innovations in sustainable packaging, personalized skincare, and digital engagement are shaping future trends, emphasizing the enduring appeal of high-end beauty as an accessible luxury experience.

Luxury Brand Digital Innovation: Transforming E-commerce and Virtual Experiences

Luxury brands are undergoing a digital revolution, with online sales projected to comprise 25% of the luxury market by 2025. This comprehensive analysis explores how high-end brands are enhancing digital customer experiences through personalized marketing strategies, seamless e-commerce platforms, and immersive virtual touchpoints. Drawing from the Business2Consumer Luxury Trends Report, we examine key innovations in websites, social media, and virtual shopping that are redefining luxury retail, offering insights into successful strategies and emerging challenges in the digital landscape.

Strategic Luxury Market Price Elevation: Analyzing Premium Brand Positioning and Consumer Impact

The luxury market is witnessing a deliberate price elevation strategy by leading brands to reinforce exclusivity and target ultra-high-net-worth individuals. This review examines continuous price increases across categories like fashion, jewelry, and accessories, emphasizing shifts toward higher-priced product mixes. While this approach enhances brand prestige and margins, it risks reducing sales volumes and alienating aspirational consumers. Based on Bain & Company's Luxury Report insights, we explore the implications for consumer behavior, market dynamics, and long-term brand sustainability in an evolving economic landscape.

Sustainable Luxury Jewelry: Ethical Elegance Redefining High-End Fashion

This review explores the burgeoning sustainable luxury jewelry market, where ethical sourcing, environmental responsibility, and high-end design converge. With the market experiencing 5-6% annual growth, brands are increasingly adopting practices like using ethically sourced gems and recycled metals. This shift is driven by a growing cohort of environmentally conscious consumers who demand transparency and sustainability without compromising on luxury. We analyze key materials, consumer trends, and how leading brands are innovating to meet these expectations, providing a comprehensive look at the future of conscientious luxury.

Luxury Vintage and Secondhand Market: A Sustainable Revolution in High-End Retail

The luxury vintage and secondhand market, valued at €45 billion in 2023, is reshaping the global luxury sector with remarkable growth of 4-6% annually. This segment merges sustainability with exclusivity, offering authenticated pre-owned luxury goods from brands like Chanel, Hermès, and Rolex. Key platforms such as The RealReal lead in authentication and digital innovation, attracting younger consumers and prompting traditional brands to develop circular strategies. Bain & Company's insights highlight its role as a gateway for aspirational buyers and a pivotal force in luxury's sustainable evolution.

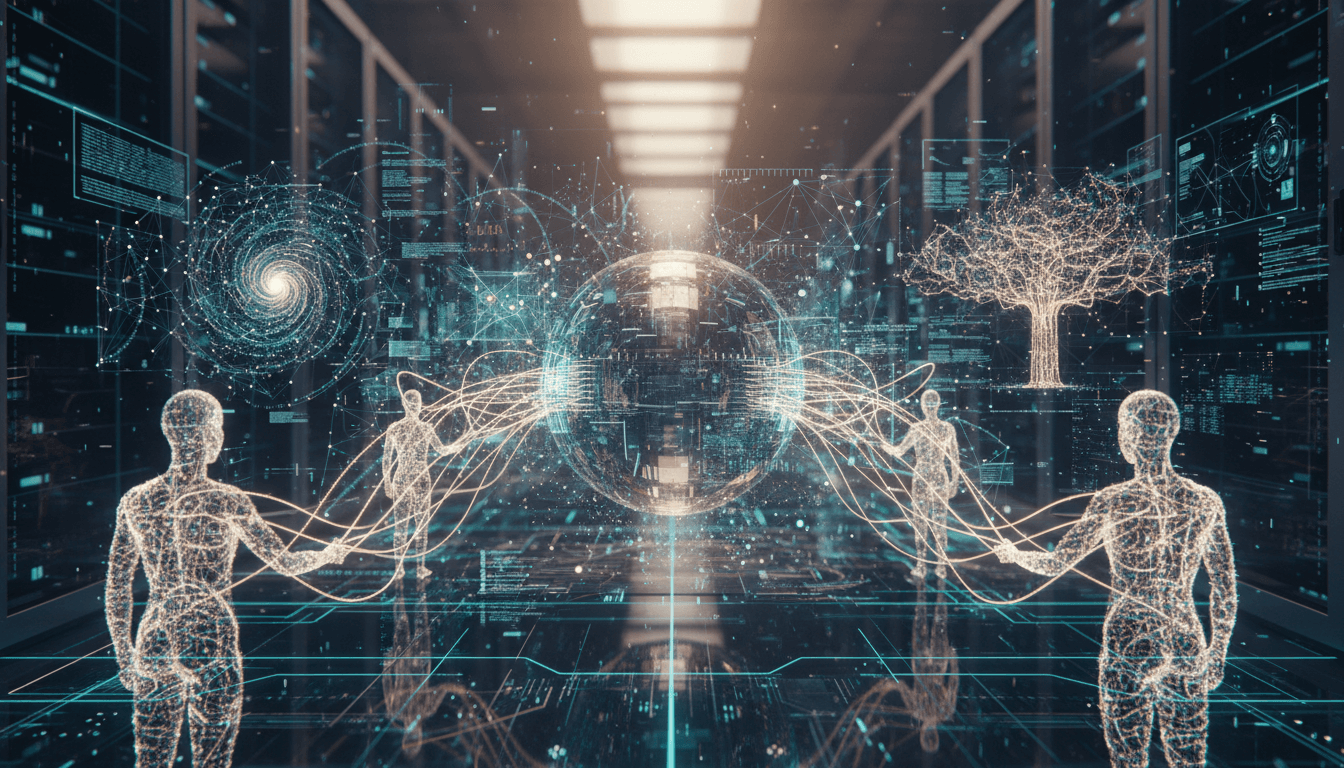

AI and Machine Learning: Revolutionizing Personalization in Luxury Markets

Advanced technologies like artificial intelligence (AI) and machine learning are fundamentally transforming the luxury sector by enabling highly personalized customer experiences. Brands leverage data analytics to deliver tailored product recommendations, exclusive offers, and bespoke shopping journeys, resulting in up to 80% increased customer engagement. This review examines how these innovations enhance brand loyalty and drive market growth, with insights from McKinsey's luxury market analysis.

Luxury Market Regional Variations: A Comprehensive Analysis

This in-depth review examines regional variations in global luxury markets, focusing on Asia-Pacific's dominant 40.12% market share and distinct consumer behaviors across China, the United States, and Europe. The analysis explores how cultural differences, economic factors, and evolving preferences shape luxury consumption patterns and brand strategies worldwide. Based on Fortune Business Insights data, this review provides actionable insights for luxury brands navigating diverse international markets.

Luxury Resale Market Evolution: A Comprehensive Review

The luxury resale market, valued at €45 billion in 2023 and growing 4-6% annually, is revolutionizing high-end consumption by offering authenticated pre-owned items through platforms like The RealReal. This evolution enables younger, budget-conscious consumers to access luxury goods while brands enhance credibility with authentication services. Insights from Bain & Company highlight strategic shifts and sustainability benefits, making resale a pivotal segment in the global luxury industry.

Luxury Technology and Personalization: Revolutionizing High-End Experiences with 80% Engagement Growth

The luxury sector is undergoing a transformative shift through technology integration and personalization. NFC chips in jewelry and accessories enable enhanced authenticity and interactive experiences, while tailored marketing strategies are driving customer engagement up to 80%. Brands are leveraging data analytics to create bespoke offerings, aligning with modern consumer demands for exclusivity and customization, as highlighted in recent McKinsey studies.

Luxury Travel and Experiences: A Deep Dive into the Shift from Products to Personalization

The luxury market is undergoing a profound transformation as 78% of millennials now prioritize unique experiences over tangible goods. This trend reflects a post-pandemic demand for authenticity, with brands responding through exclusive travel packages, private event access, and bespoke workshops. By focusing on personalized, memorable interactions, luxury companies are forging deeper connections and driving industry innovation, signaling a long-term shift in consumer behavior.

Sustainable Luxury and Secondhand Market: Growth, Trends, and Brand Strategies

The pre-owned luxury market is rapidly expanding, projected to reach $30 billion by 2025, driven by sustainability initiatives and consumer demand for eco-conscious options. Leading brands are launching resale platforms and integrating recycled materials, with The RealReal reporting a 41% sales increase in 2023. This review examines market dynamics, brand innovations, and consumer behaviors shaping the future of sustainable luxury.

Luxury Market Global Performance 2024: In-Depth Analysis and Trends

The global luxury market in 2024 reached €1.48 trillion, experiencing a slight decline of 1-3% at current exchange rates. Hard luxury, encompassing watches and jewelry, dominates with 80-85% of total sales. The beauty and eyewear sectors demonstrated the most robust growth, expanding by 3-5%, while personal luxury goods faced their first contraction in 15 years. This comprehensive review examines the driving factors, key segments, and strategic implications for brands and investors.

Luxury Jewelry Market Insights 2024: Investment Trends and Growth Projections

The global luxury jewelry market, valued at $48.97 billion in 2023, is projected to reach $97.05 billion by 2032, growing at a 7.9% CAGR. Key drivers include rising disposable incomes, demand for personalized and gender-neutral designs, and the increasing perception of fine jewelry as a stable investment. This analysis explores market dynamics, consumer behavior shifts, and strategic brand innovations shaping the industry's future, offering insights into investment-quality pieces and status-driven purchasing trends.

The Luxury Experiences Revolution: Why Millennials Are Choosing Memories Over Material Goods

The luxury market is undergoing a fundamental transformation as 78% of millennials now prioritize experiences over traditional products. This comprehensive analysis explores the shift toward personalized, exclusive offerings including bespoke workshops and private events. Based on the Business2Consumer Luxury Trends Report, we examine how luxury brands are adapting to consumer demand for memorable moments, customized services, and authentic engagements that create lasting emotional connections rather than mere material possessions.

Explore More Categories

Discover insights across all luxury market segments