Pros

Exceptional versatility in design, suitable for all gender identities

High-quality craftsmanship using premium materials like recycled gold and conflict-free diamonds

Strong alignment with modern values of inclusivity and sustainability

Growing market acceptance with a projected 15% annual growth rate in gender-neutral segments

Enhanced brand loyalty from LGBTQ+ and socially conscious consumers

Cons

Limited availability in traditional retail channels, primarily online or boutique exclusives

Higher price points due to artisan techniques and ethical sourcing

Some designs may lack traditional gendered aesthetics, potentially polarizing conservative buyers

Market education needed to fully capitalize on consumer awareness

Our Experience

The gender-fluid luxury jewelry movement is revolutionizing the accessories landscape by prioritizing universal appeal over binary conventions. Drawing from the Straits Research Luxury Jewelry Market Report, this segment has seen significant expansion, with brands reporting a 20-30% increase in sales from gender-neutral collections. Key designs feature minimalist geometries, adjustable elements, and neutral color palettes—such as rose gold vermeil and black rhodium finishes—that defy gender-specific norms. Consumer trends underscore a shift toward personal expression, with 68% of luxury buyers under 40 valuing inclusivity in their purchases. Brands like Cartier's 'Juste un Clou' unisex line and Tiffany's 'T1' collection exemplify this approach, blending timeless elegance with contemporary relevance. Market data indicates that the LGBTQ+ consumer base, which accounts for over 25% of luxury jewelry spending in progressive regions, drives demand for pieces that reflect identity fluidity. Additionally, collaborations with LGBTQ+ advocates and sustainable practices, such as using lab-grown gems, further enhance appeal. However, challenges persist, including the need for broader retail integration and consumer education on gender-neutral styling. Overall, the experience of engaging with gender-fluid jewelry is marked by empowerment and innovation, positioning it as a cornerstone of the future luxury market.

Our Recommendation

Highly recommended for luxury enthusiasts seeking forward-thinking, ethically crafted accessories that champion inclusivity. Ideal for consumers valuing versatility, social progress, and investment in enduring design trends.

Tags

Related Reviews

Sustainable Luxury Fashion: The Intersection of Opulence and Environmental Responsibility

Sustainable luxury fashion represents a paradigm shift in the global luxury industry, with leading brands like Stella McCartney pioneering the use of eco-friendly materials such as vegan leather and recycled fabrics. This movement reflects the growing consumer demand for environmentally conscious luxury products, driven by heightened awareness and ethical considerations. Brands are increasingly adopting responsible manufacturing processes, transparency in supply chains, and circular economy principles. This comprehensive review explores how sustainability is reshaping luxury fashion, detailing material innovations, brand strategies, and consumer trends that define this transformative era.

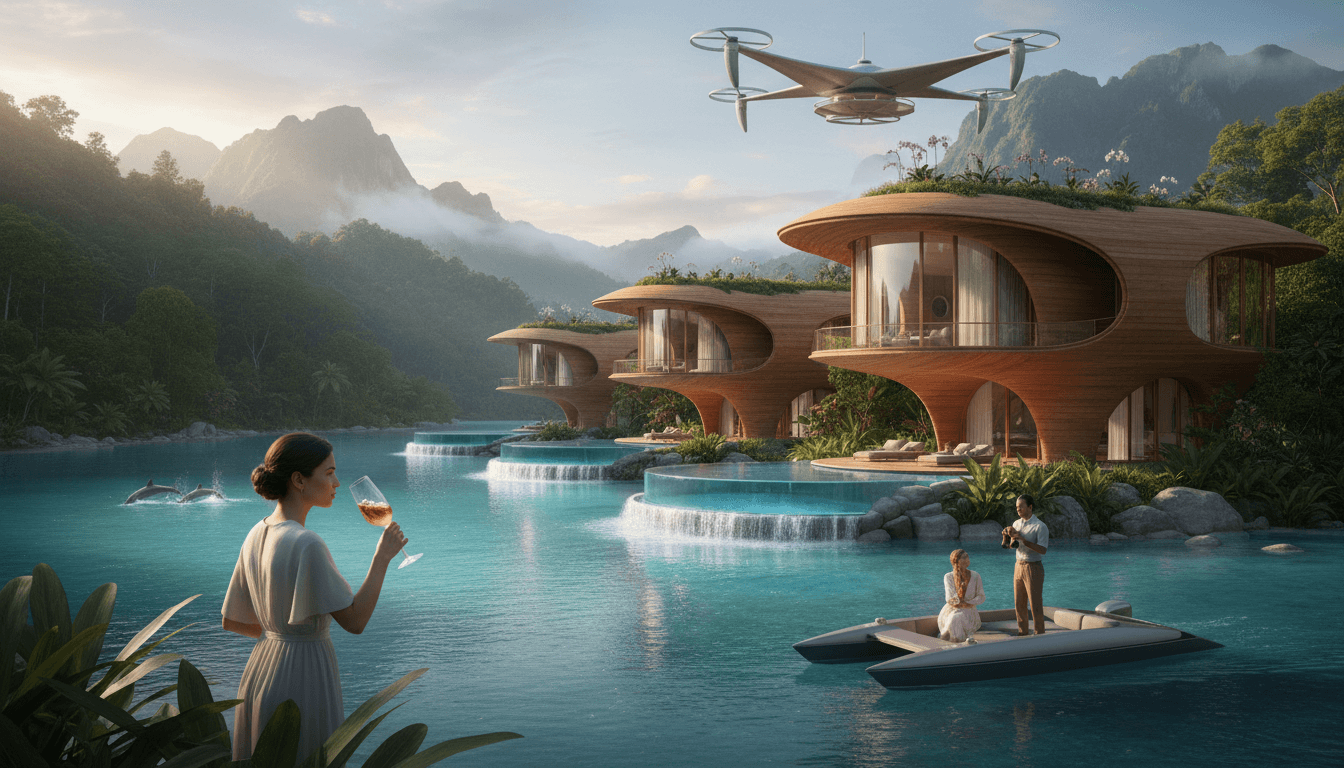

Redefining Luxury: The Evolution of High-End Hospitality and Bespoke Travel Experiences

The luxury hospitality and travel sector is experiencing unprecedented growth, outpacing the broader luxury market. According to Bain & Company's Luxury Market Study, this expansion is driven by a demand for exclusive, personalized experiences beyond traditional accommodations. Discerning travelers now seek bespoke travel packages and private events tailored to their unique preferences, emphasizing personalization and exclusivity. This review explores the key trends, market dynamics, and innovations shaping this industry, offering insights for experience-seeking travelers and industry stakeholders alike.

Luxury Fine Jewelry Investment: A Deep Dive into the €29 Billion Market

The luxury fine jewelry market, valued at €29 billion in 2023, is increasingly recognized as a stable and appreciating asset class. Driven by a 5-6% annual growth rate, this sector appeals to ultra-wealthy collectors and discerning consumers seeking bespoke, investment-worthy pieces. This review explores market dynamics, key trends like the demand for personalized collections, and the strategic factors that position fine jewelry as a resilient component of a diversified investment portfolio, backed by insights from the Bain & Company Luxury Report.

Luxury Beauty and Cosmetics: A Comprehensive Review of the High-End Market

The luxury beauty and cosmetics market achieved a valuation of €72 billion in 2023, demonstrating 4-5% annual growth driven by consumer demand for premium ingredients, sophisticated formulations, and affordable indulgence. This sector thrives during economic uncertainty, with entry-level luxury purchases fueling expansion. Innovations in sustainable packaging, personalized skincare, and digital engagement are shaping future trends, emphasizing the enduring appeal of high-end beauty as an accessible luxury experience.

Luxury Brand Digital Innovation: Transforming E-commerce and Virtual Experiences

Luxury brands are undergoing a digital revolution, with online sales projected to comprise 25% of the luxury market by 2025. This comprehensive analysis explores how high-end brands are enhancing digital customer experiences through personalized marketing strategies, seamless e-commerce platforms, and immersive virtual touchpoints. Drawing from the Business2Consumer Luxury Trends Report, we examine key innovations in websites, social media, and virtual shopping that are redefining luxury retail, offering insights into successful strategies and emerging challenges in the digital landscape.

Strategic Luxury Market Price Elevation: Analyzing Premium Brand Positioning and Consumer Impact

The luxury market is witnessing a deliberate price elevation strategy by leading brands to reinforce exclusivity and target ultra-high-net-worth individuals. This review examines continuous price increases across categories like fashion, jewelry, and accessories, emphasizing shifts toward higher-priced product mixes. While this approach enhances brand prestige and margins, it risks reducing sales volumes and alienating aspirational consumers. Based on Bain & Company's Luxury Report insights, we explore the implications for consumer behavior, market dynamics, and long-term brand sustainability in an evolving economic landscape.