Pros

Hard luxury segment maintains strong market share with 80-85% of sales, ensuring sector stability.

Beauty and eyewear categories show impressive 3-5% growth, indicating emerging consumer preferences.

Total market value of €1.48 trillion reflects sustained high-end consumer demand despite macroeconomic pressures.

Diverse product categories provide investment diversification opportunities within the luxury sector.

Data sourced from Bain-Altagamma ensures credibility and industry-standard benchmarking.

Cons

Overall market experienced a 1-3% decline at current exchange rates, signaling potential volatility.

Personal luxury goods faced their first contraction in 15 years, highlighting shifting consumer behaviors.

Exchange rate fluctuations significantly impact reported figures, complicating cross-border comparisons.

Limited growth in traditional segments may indicate market saturation in certain luxury categories.

Economic uncertainties and geopolitical factors continue to pose risks to sustained market expansion.

Our Experience

The 2024 luxury market demonstrates resilience amid global economic headwinds, with the total valuation reaching €1.48 trillion. Hard luxury, particularly watches and jewelry, continues to be the cornerstone of the industry, commanding an impressive 80-85% market share. This segment's dominance is driven by timeless appeal, investment value, and brand heritage that resonates with affluent consumers globally. The beauty and eyewear sectors emerged as the fastest-growing categories, expanding by 3-5%, propelled by innovation, digital engagement, and evolving consumer lifestyles. However, the personal luxury goods segment experienced its first contraction in 15 years, reflecting changing consumption patterns and economic pressures. Market performance varied significantly by region, with Asia-Pacific maintaining strong growth while European markets showed mixed results. The decline of 1-3% at current exchange rates underscores the impact of currency fluctuations on global luxury valuations. Key drivers included digital transformation, sustainability initiatives, and experiential luxury offerings. Leading brands adapted through omnichannel strategies, personalized experiences, and product innovation to navigate the challenging landscape. The market's evolution points toward increased polarization between accessible and ultra-luxury segments, with consumers prioritizing quality, craftsmanship, and brand values over mere logos.

Our Recommendation

Based on the comprehensive 2024 data, we recommend continued investment in hard luxury segments while strategically expanding into high-growth beauty and eyewear categories. Brands should focus on digital transformation, sustainability, and personalized experiences to navigate market volatility. Investors should monitor exchange rate impacts and regional performance variations when making portfolio decisions. The contraction in personal luxury goods warrants careful analysis of consumer trends and potential market repositioning.

Tags

Related Reviews

Luxury Jewelry Market Insights 2024: Investment Trends and Growth Projections

The global luxury jewelry market, valued at $48.97 billion in 2023, is projected to reach $97.05 billion by 2032, growing at a 7.9% CAGR. Key drivers include rising disposable incomes, demand for personalized and gender-neutral designs, and the increasing perception of fine jewelry as a stable investment. This analysis explores market dynamics, consumer behavior shifts, and strategic brand innovations shaping the industry's future, offering insights into investment-quality pieces and status-driven purchasing trends.

The Luxury Experiences Revolution: Why Millennials Are Choosing Memories Over Material Goods

The luxury market is undergoing a fundamental transformation as 78% of millennials now prioritize experiences over traditional products. This comprehensive analysis explores the shift toward personalized, exclusive offerings including bespoke workshops and private events. Based on the Business2Consumer Luxury Trends Report, we examine how luxury brands are adapting to consumer demand for memorable moments, customized services, and authentic engagements that create lasting emotional connections rather than mere material possessions.

Luxury Resale Market Growth: A Comprehensive Review of the Pre-Owned Revolution

The pre-owned luxury market is undergoing unprecedented expansion, driven by a 41% sales surge on platforms like The RealReal and a projected value of $30 billion by 2025. This review examines how luxury brands are responding with dedicated resale platforms and authentication services, catering to growing consumer demand for sustainable, accessible luxury. We analyze market dynamics, key players, and the strategic shifts shaping the industry's future.

Luxury Jewelry Market Insights: Investment Potential and Growth Trends

The luxury jewelry market demonstrated robust growth of 5-6% in 2023, reaching a valuation of €29 billion, according to Bain & Company. Fine jewelry is increasingly perceived as a stable investment asset, with bespoke and high-end pieces driving demand, particularly among ultra-wealthy consumers. This review explores key market dynamics, investment strategies, and design innovations shaping the industry's future.

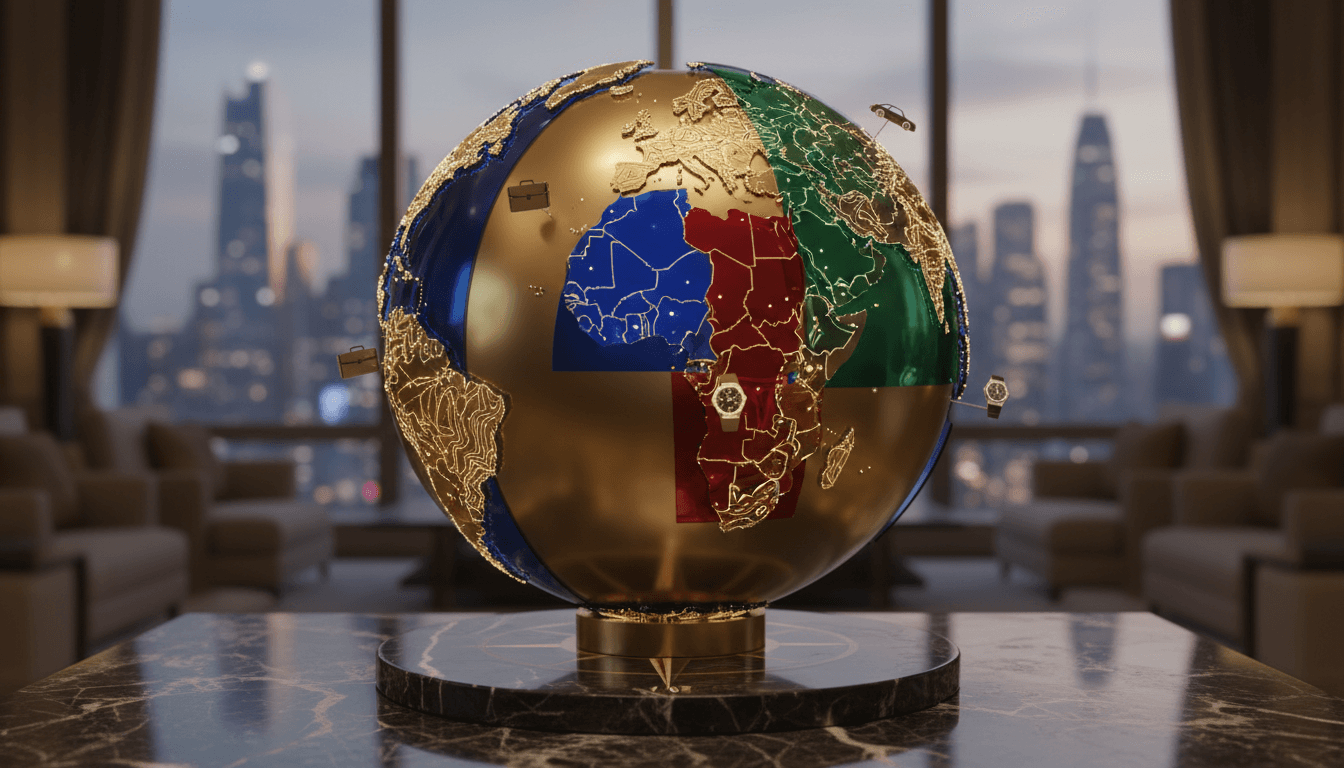

Luxury Market Geographic Insights: Analyzing Regional Dynamics and Growth Patterns

This comprehensive review delves into the geographic dynamics of the global luxury market, valued at €1.5 trillion in 2023 with an annual growth rate of 8-10%. Asia, particularly China, Japan, and South Korea, drives expansion through unique consumer behaviors, while the US and European markets maintain strength with heritage brand loyalty and evolving preferences. The analysis covers regional consumption patterns, market strategies, and innovations shaping luxury fashion, jewelry, travel, and lifestyle sectors, providing actionable insights for industry stakeholders.

Luxury Fashion's Digital Transformation: A Comprehensive Review of Market Evolution

The luxury fashion industry is undergoing a profound digital and strategic transformation, with global market growth projected at 8-10% in 2023. Brands are leveraging AI and technology to enhance personalization while emphasizing sustainable production and omnichannel retail experiences. This shift addresses changing consumer expectations through digital innovation, ethical practices, and seamless customer engagement, as highlighted in the McKinsey State of Luxury Report.