Pros

Enhanced consumer engagement through immersive in-store experiences like virtual try-ons and AR fitting rooms

Seamless omnichannel integration allowing consistent brand interactions across online and offline platforms

Advanced personalization using AI and data analytics to tailor product recommendations and services

Increased brand loyalty driven by memorable, technology-enhanced shopping journeys

Superior customer data insights enabling precise targeting and inventory management

Cons

High implementation costs for cutting-edge technologies may limit accessibility for smaller brands

Potential over-reliance on technology risks diminishing the human touch in luxury service

Data privacy concerns arise with increased personalization and consumer tracking

Requires continuous innovation to maintain competitive edge, leading to resource strain

Integration challenges between legacy systems and new digital platforms can slow adoption

Our Experience

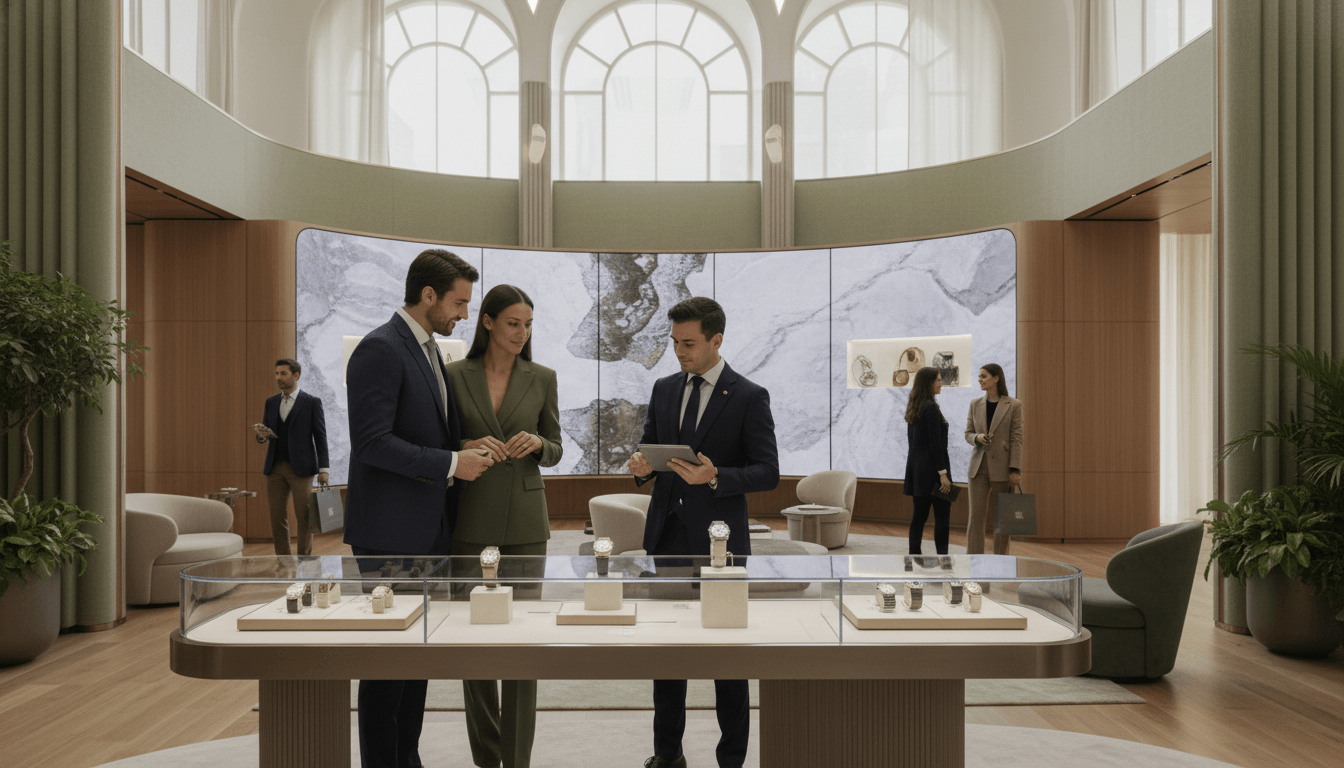

The evolution of luxury retail is marked by a strategic pivot from transactional models to experiential engagements. According to the Simon-Kucher Global Luxury Consumer Trends Study, over 70% of consumers prefer in-person luxury shopping, highlighting the enduring value of physical stores. Brands are responding by creating immersive environments—such as Chanel's augmented reality boutiques and Louis Vuitton's interactive displays—that blend digital and physical elements. Omnichannel strategies ensure a cohesive journey, with features like click-and-collect and virtual consultations. Technology plays a pivotal role; for instance, RFID tags and AI-driven analytics enable hyper-personalization, while IoT devices enhance in-store navigation. However, this shift demands significant investment and poses challenges in balancing innovation with tradition. Overall, the focus on creating memorable brand interactions, as noted in the study's market focus, is driving sustained consumer loyalty and market differentiation.

Our Recommendation

We highly recommend that luxury brands embrace this evolution by investing in integrated technology and experiential retail. Prioritize omnichannel consistency and data-driven personalization to meet consumer expectations. However, maintain a balance to preserve the human element that defines luxury service.

Tags

Related Reviews

Navigating Economic Headwinds: A Critical Review of Luxury Market Adaptation

The luxury market faces significant economic pressures, including slowing growth projected at low to mid-single digits, heightened price sensitivity, and evolving consumer expectations. Brands must innovate with personalized experiences and strategic repositioning to maintain relevance. This review analyzes how top luxury players are responding to these challenges, focusing on differentiation and value creation in a competitive landscape. Insights are grounded in data from the McKinsey State of Luxury Report, offering actionable strategies for industry stakeholders.

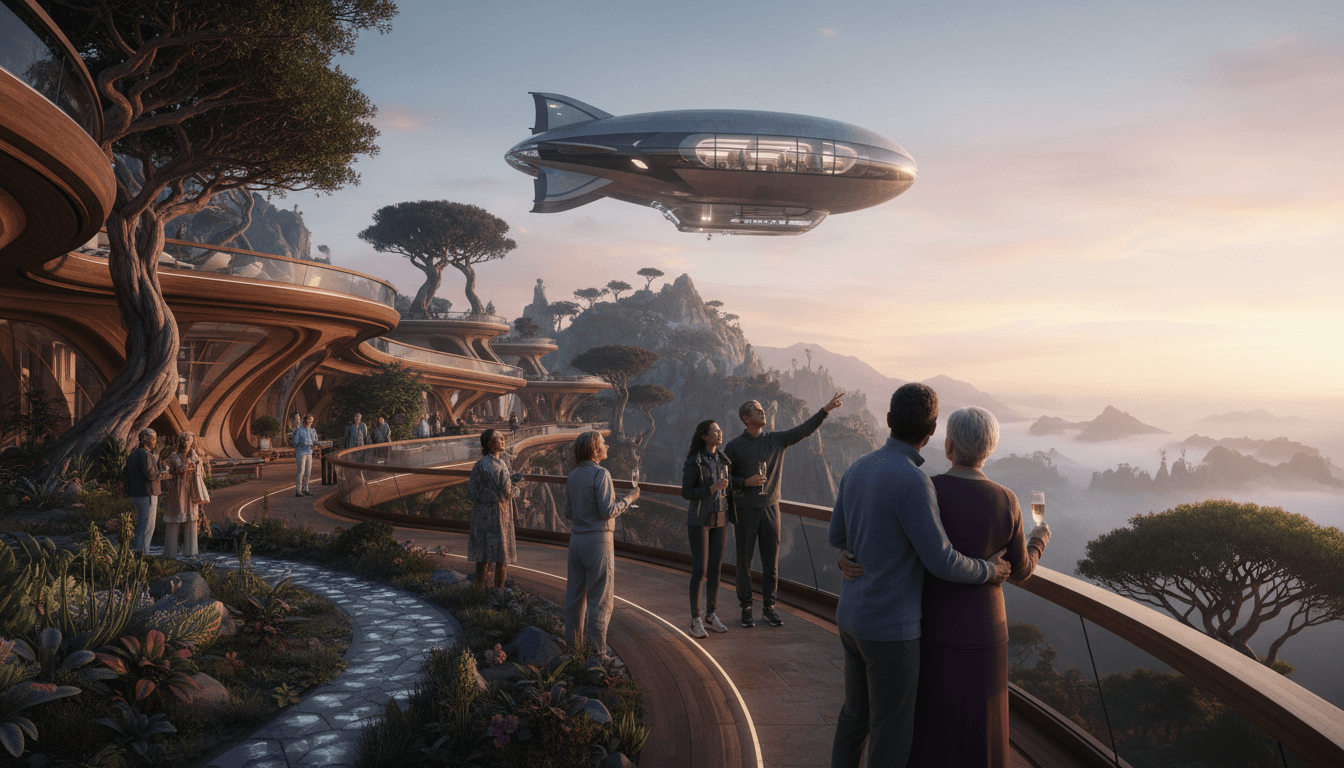

The Rise of Experiential Luxury: Redefining Travel with Personalized, Exclusive Experiences

The luxury travel sector is undergoing a profound transformation, with a marked shift from material acquisitions to experiential indulgence. According to Euromonitor International, 72% of affluent travelers now prioritize unique, personalized journeys over traditional luxury goods. Brands like Ritz-Carlton are pioneering this trend by offering bespoke packages that emphasize exclusivity, privacy, and wellness. This evolution is largely driven by Millennial preferences and a growing collective desire for distinctive, immersive experiences that foster personal growth and well-being, signaling a new era in high-end travel where memories outweigh possessions.

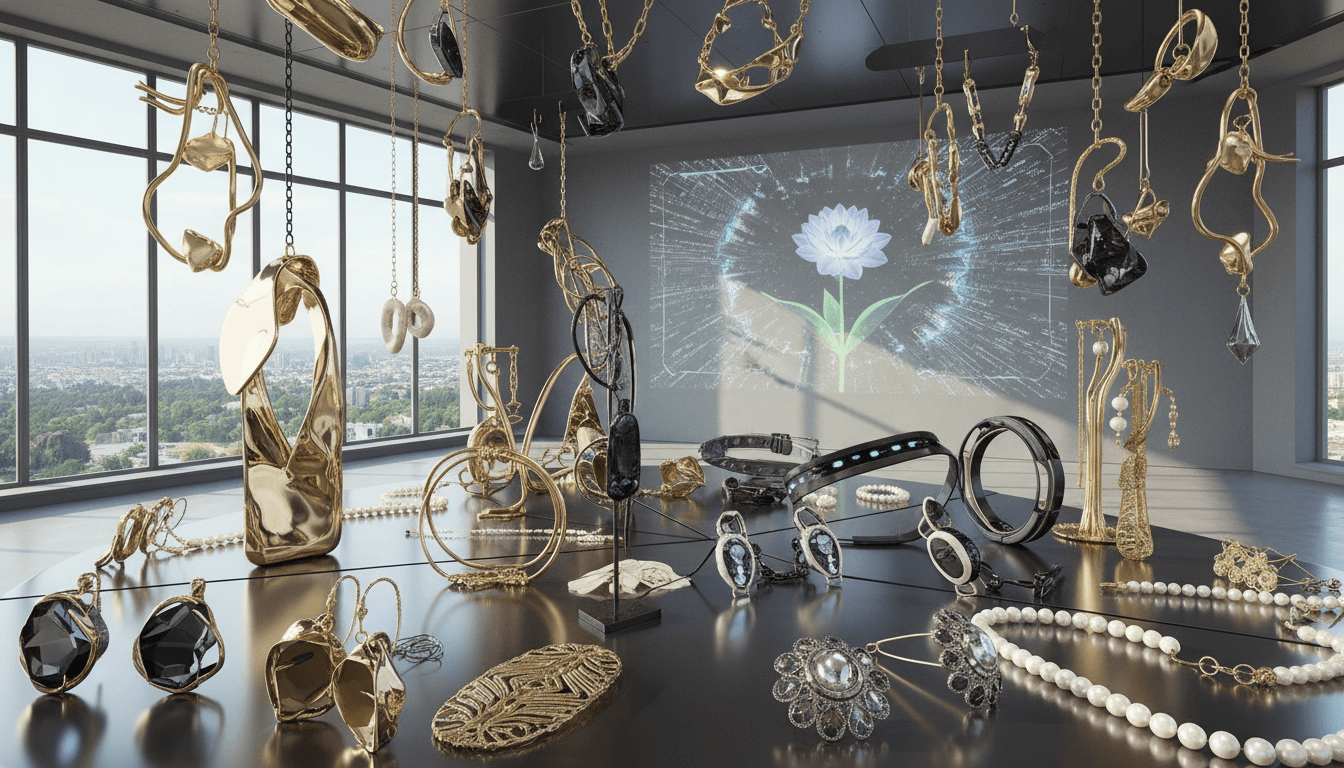

The Evolving Luxury Jewelry Market: A Comprehensive Review of Trends and Innovations

The luxury jewelry sector is undergoing a profound transformation, marked by a 5-6% market growth in 2023 and key shifts in consumer behavior. Gold maintains dominance with a 33.1% market share, while brands like Gucci, Bulgari, Graff, and MIKIMOTO lead innovations in gender-neutral designs and personalized shopping experiences. Technological integration is reshaping product offerings and customer engagement, with unisex collections and tech-enhanced pieces emerging as pivotal trends. This review delves into the strategic moves by top luxury houses, backed by data from Grand View Research and Bain & Company, offering insights for industry stakeholders and enthusiasts.

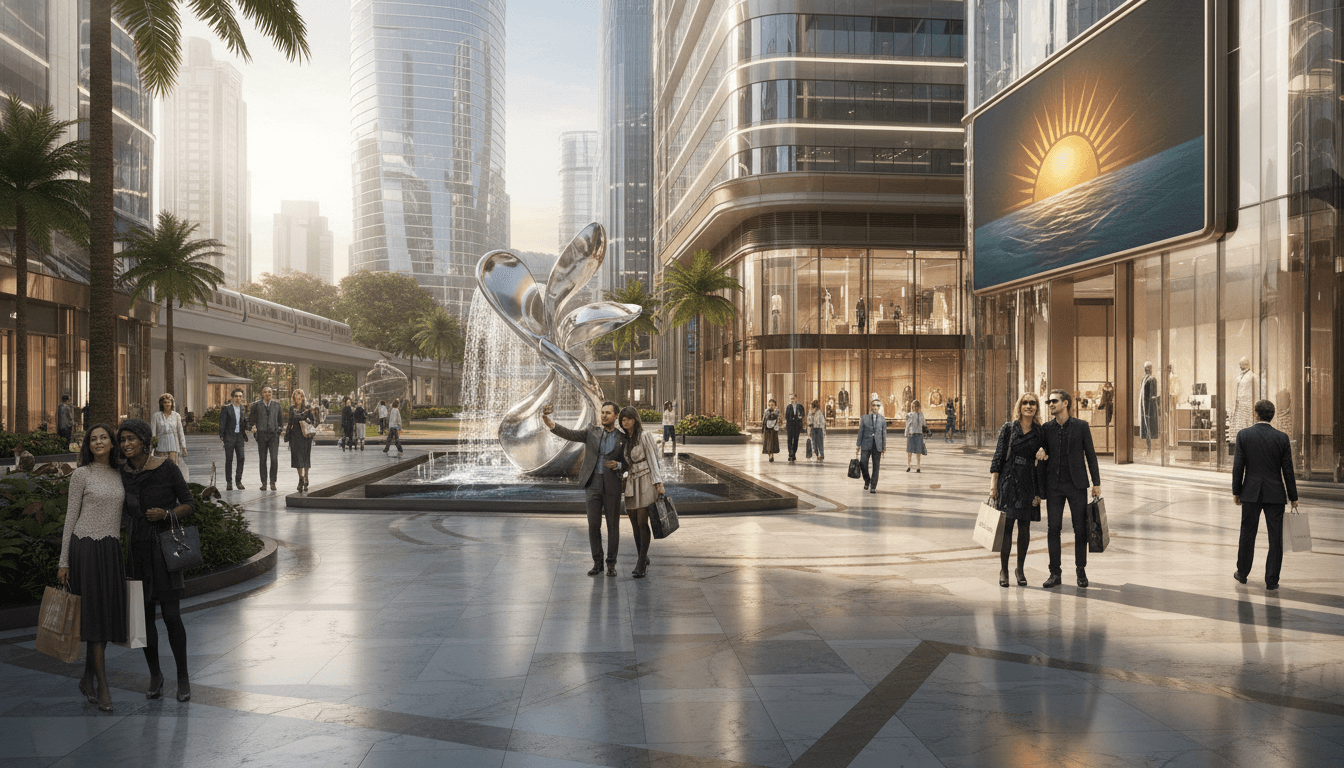

Asia Pacific Luxury Market Leadership: Dominating Global Luxury with Strategic Growth

The Asia Pacific region commands a 37.7% share of the global luxury market, valued at $93.3 billion in 2024. Driven by rising disposable incomes and evolving consumer preferences in key markets like China, Japan, and South Korea, this dominance reflects deeper shifts in luxury consumption patterns. This review analyzes market dynamics, growth drivers, and regional impacts, providing insights for stakeholders navigating this lucrative landscape.

Luxury Footwear Market Trends: An In-Depth Analysis of Designer Shoes and Consumer Preferences

The luxury footwear market holds a significant 16.2% share of the global luxury industry in 2024, driven by consumer demand for exclusive designer shoes that emphasize superior quality and style. Brands are innovating with high-fashion trends and durable materials, focusing on attributes like exclusivity and craftsmanship to maintain market leadership. This review explores key growth factors, including the influence of designer trends and fashion-forward consumers, providing insights into why luxury footwear remains a cornerstone of the high-end fashion sector.

High-End Personalized Luxury Services: Revolutionizing Bespoke Consumer Experiences

Personalized luxury services are transforming high-end consumer engagement by offering bespoke designs, tailored shopping experiences, and data-driven recommendations. According to the Business2Consumer Luxury Trends Report, these strategies can increase customer engagement by up to 80%, targeting high-net-worth individuals with custom clothing, accessories, and exclusive consultations. This review examines the efficacy, implementation, and consumer impact of these services in the global luxury market.