The luxury jewelry and accessories market remains a cornerstone of the global luxury industry, characterized by robust performance and strategic evolution. Key players such as Rolex, Cartier, and Tiffany & Co. are driving growth through focused initiatives in sustainability, digital transformation, and market diversification. With Rolex generating over USD 9 billion annually, the segment highlights strong consumer loyalty and demand for high-value items. This analysis delves into the brand strategies shaping the market, examining how innovation and ethical practices are redefining luxury in a dynamic economic landscape.

Key Specifications

market size

Global luxury jewelry market valued at USD 350 billion in 2024

growth rate

CAGR of 6.5% projected through 2030

key segments

Luxury Watches,Fine Jewelry,High-End Accessories

leading brands

Rolex, Cartier, Tiffany & Co., Bulgari, Van Cleef & Arpels

consumer demographics

High-net-worth individuals (HNWIs), millennials, Gen Z

Detailed Analysis

sustainability initiatives

Brands are adopting recycled precious metals and ethically sourced gemstones. Cartier's 'Cartier for Nature' program commits to biodiversity protection, while Tiffany & Co. ensures 100% traceable diamonds through blockchain technology. Rolex emphasizes longevity and repairability, reducing environmental impact.

digital innovation

Augmented reality (AR) try-ons, NFT-backed ownership certificates, and AI-driven personalization are revolutionizing customer engagement. Cartier's virtual boutiques and Rolex's certified pre-owned digital platforms enhance accessibility and brand loyalty.

global expansion strategies

Expansion into emerging markets like Asia-Pacific and the Middle East is prioritized. Tiffany & Co. increased flagship stores in Shanghai and Dubai, while Rolex strengthened retail partnerships in India and Southeast Asia to tap into growing affluent populations.

market resilience factors

Luxury watches show consistent demand due to their investment value. The secondhand market for Rolex watches grew by 15% in 2024, highlighting sustained interest. Economic fluctuations have minimal impact on core consumers, ensuring steady revenue streams.

Key Insights

Rolex leads in revenue (USD 9B+) and brand equity, focusing on timeless designs and scarcity marketing.

Cartier excels in artistic craftsmanship and sustainability, with initiatives like carbon-neutral collections.

Tiffany & Co. emphasizes digital integration and ethical sourcing, appealing to younger demographics through social media campaigns.

Important Notes

The luxury jewelry market's adaptability to digital trends and sustainability demands positions it for long-term growth. Brands must balance tradition with innovation to maintain relevance. Source: Global Growth Insights, 2024 market reports.

Tags

Related Articles

Asia Pacific Dominates Global Luxury Market with 40.12% Share: Regional Dynamics and Strategic Implications

The Asia Pacific region solidified its leadership in the global luxury market with a commanding 40.12% market share in 2022, driven by unprecedented economic growth and evolving consumer behaviors. Key markets including China, India, and Southeast Asia are experiencing transformative shifts fueled by rising disposable incomes, expanded access to international luxury brands, and growing consumption among the middle class and working women. This comprehensive analysis examines the underlying factors, regional variations, and strategic imperatives for luxury brands seeking to capitalize on these dynamic market conditions through targeted approaches and localized strategies.

Luxury Retail Channel Strategy: Integrated Omnichannel Excellence

Luxury retail is undergoing a profound transformation driven by sophisticated omnichannel strategies that merge digital and physical touchpoints. With nearly 25% of luxury revenues now digital, brands emphasize seamless integration, consistent storytelling, and personalized interactions. Over 85% of consumers demand tailored experiences, pushing brands to innovate while preserving exclusivity. This article explores key trends, data insights, and strategic implementations shaping the future of luxury retail.

Experiential Luxury Evolution: The Strategic Shift to Holistic Lifestyle Experiences

The luxury sector is undergoing a profound transformation, expanding beyond traditional product offerings into comprehensive lifestyle experiences. Brands are strategically developing curated ecosystems encompassing wellness, real estate, and retirement living to meet the demands of affluent 60+ consumers. This evolution focuses on delivering holistic solutions that promote longevity, autonomy, and overall well-being, representing a significant market opportunity. Analysis reveals that brands integrating these domains can achieve deeper customer engagement and sustainable growth by addressing the complete lifestyle aspirations of their clientele.

Global Luxury Market Geographical Dynamics: Regional Growth and Strategy Implications

The global luxury market is undergoing significant geographical shifts, with Western nations and the Middle East demonstrating robust growth while China anticipates a gradual recovery. Bain & Company projects over 300 million new consumers entering the market within five years, primarily from China and emerging economies. This analysis examines regional revenue distributions, growth trajectories, and strategic imperatives for luxury brands to capitalize on these dynamics, emphasizing targeted marketing, localized offerings, and digital transformation.

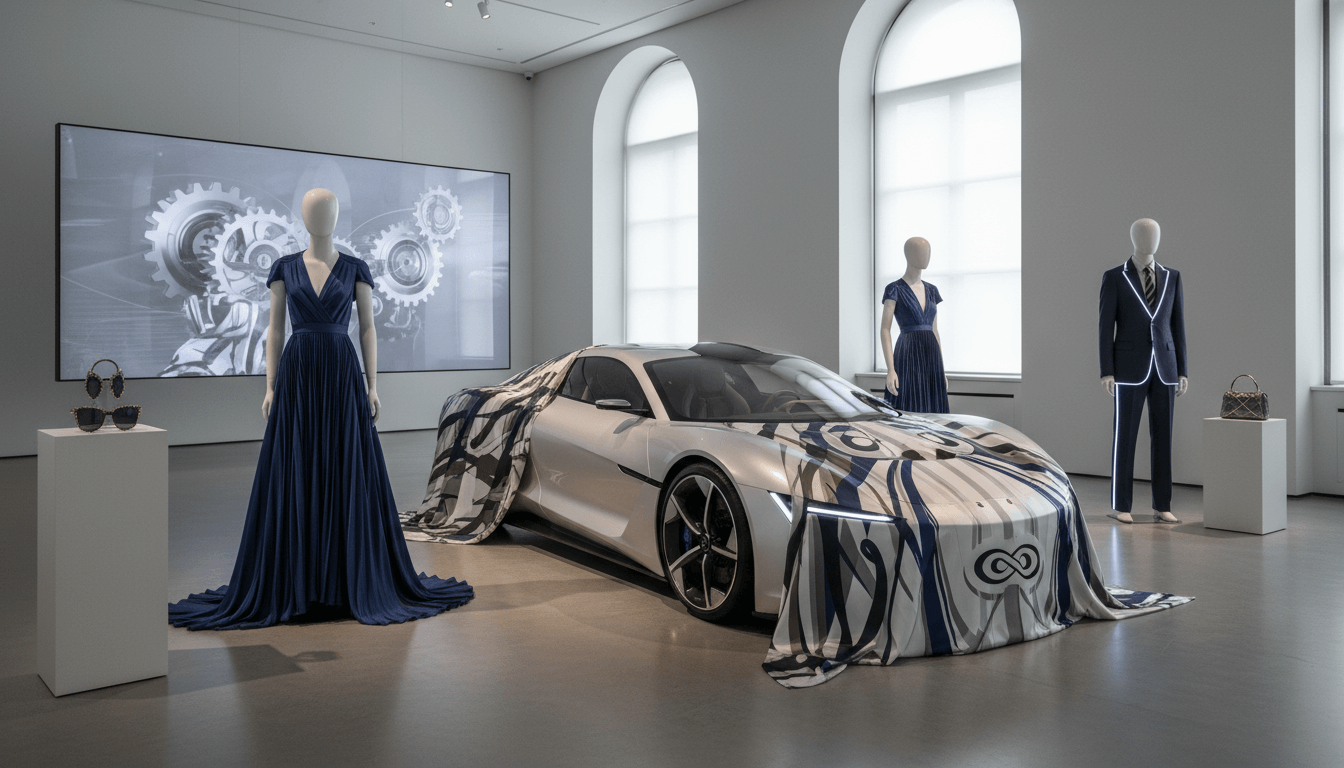

Luxury Brand Collaborations and Innovation: Strategic Partnerships Reshaping the Industry

Luxury brands are increasingly leveraging collaborations and innovative partnerships to maintain relevance and engage younger demographics like Gen Z and Millennials. These strategic initiatives include artist and influencer collaborations, limited-edition collections, and cross-industry partnerships that focus on cultural relevance and innovation. By offering unique, meaningful experiences, brands drive consumer engagement and adapt to evolving market demands. Insights from Global Bay Insights highlight how these approaches are critical for sustained growth in the competitive luxury sector.

Luxury Market Pricing Dynamics: Navigating 2025's Complex Landscape

In 2025, luxury brands face intricate pricing challenges as price increases reach saturation in key markets, particularly impacting aspirational consumers. Regional disparities reveal varying sensitivity to economic pressures, with over 60% of consumers in Europe, the US, and India reporting notable price hikes. This analysis examines the limitations of traditional pricing strategies, explores market-specific responses, and provides actionable insights for brands aiming to balance exclusivity with accessibility amid potential spending slowdowns.