In recent years, the luxury jewelry market has undergone a significant transformation, shifting from purely aesthetic appreciation to a sophisticated investment paradigm. According to the Luxury Jewelry Investment Market Report, consumers are increasingly viewing high-end jewelry not only as adornments but as strategic financial assets. This trend is fueled by a growing interest in rare gemstones, high-value collections, and pieces with demonstrable appreciation potential. As global economic uncertainties persist, investors are turning to tangible assets like jewelry to preserve and grow wealth, blending artistry with financial acumen. This article delves into the key drivers, market dynamics, and future prospects of luxury jewelry as a compelling investment vehicle.

In-Depth Analysis

The Rise of Jewelry as an Investment Asset

Luxury jewelry has historically symbolized status and elegance, but its role as a financial asset is gaining prominence. The investment perspective, as outlined in market data, positions jewelry alongside traditional assets like real estate and stocks. Key factors driving this shift include its tangible nature, which offers inflation hedging, and its limited supply, particularly for pieces featuring rare materials. For instance, auction houses like Sotheby's and Christie's have reported record-breaking sales, with investment-grade jewelry appreciating by an average of 5-10% annually over the past decade. High-net-worth individuals and institutional investors are allocating portions of their portfolios to jewelry, recognizing its potential for capital preservation and diversification. This section explores the economic principles underpinning jewelry's value, including scarcity, craftsmanship, and historical significance, and how these elements contribute to its stability in volatile markets.

Growing Demand for Rare Gemstones: A Market Analysis

The market trend emphasizing rare gemstones is reshaping luxury jewelry investments. Diamonds, colored gemstones like rubies, sapphires, and emeralds, and unconventional stones such as paraiba tourmaline and alexandrite are seeing unprecedented demand. Data indicates that rare gemstones have outperformed many financial indices, with certain categories experiencing up to 15% annual appreciation. For example, fancy vivid pink diamonds from the Argyle mine, now closed, have seen values soar by over 300% in the last five years. This surge is driven by their geological rarity, ethical sourcing certifications, and increasing consumer awareness. Market analysts attribute this trend to global economic shifts, where investors seek assets less correlated to stock markets. Additionally, advancements in gemological certification, such as reports from the Gemological Institute of America (GIA), enhance transparency and trust, making rare gemstones a reliable investment. This section details the specific types of gemstones in demand, their market performance, and the role of certification in mitigating risks.

High-Value Collections: Strategic Investment Approaches

Investing in high-value jewelry collections involves curating pieces with proven historical appreciation, brand legacy, and artistic merit. Collections from renowned houses like Cartier, Van Cleef & Arpels, and Bulgari often include limited-edition items that gain value over time. For instance, vintage Cartier Tutti Frutti pieces have appreciated by over 20% annually due to their rarity and cultural significance. The consumer motivation for these investments centers on long-term value preservation, with many buyers focusing on pieces that tell a story or represent milestones. Market data shows that collections featuring signed pieces or those with provenance documentation can yield returns of 8-12% per year. This section examines the criteria for selecting investment-worthy collections, including brand reputation, craftsmanship, and market liquidity. It also covers the role of auctions, private sales, and digital platforms in facilitating these transactions, highlighting how collectors leverage expert appraisals and market insights to build diversified portfolios.

Market Dynamics and Consumer Behavior in Jewelry Investing

The luxury jewelry investment landscape is influenced by evolving consumer behaviors and macroeconomic factors. According to the Luxury Jewelry Investment Market Report, key drivers include geopolitical stability, currency fluctuations, and generational shifts, with millennials and Gen Z showing a 40% higher inclination toward ethical and sustainable jewelry investments. Digitalization has also played a crucial role, with online platforms enabling global access to investment-grade pieces. For example, blockchain technology is being used to verify authenticity and provenance, reducing fraud risks. Market trends indicate a 25% annual growth in online jewelry investment platforms, making it easier for investors to track value and liquidate assets. This section analyzes how consumer preferences for transparency, sustainability, and digital engagement are shaping market offerings, and it includes case studies of successful investment strategies, such as focusing on emerging designers or culturally significant pieces.

Key Takeaways

Luxury jewelry is increasingly recognized as a stable financial asset, offering diversification and inflation protection.

Rare gemstones, particularly those with certified rarity and ethical sourcing, show strong appreciation potential.

High-value collections from established brands provide reliable long-term returns, driven by craftsmanship and provenance.

Consumer demand is shifting toward sustainable and digitally accessible investment options, influencing market trends.

Frequently Asked Questions

What makes luxury jewelry a good investment compared to other assets?

Luxury jewelry offers tangible value, scarcity, and historical appreciation, often outperforming traditional assets during economic downturns. Its dual role as a wearable art piece and financial store of value provides unique diversification benefits.

Which types of gemstones are most sought after for investment purposes?

Rare colored diamonds (e.g., pinks and blues), untreated rubies and sapphires, and exceptional emeralds are highly sought after due to their limited supply and strong market demand, with certified stones from reputable sources showing the highest returns.

How can investors verify the authenticity and value of jewelry pieces?

Investors should rely on gemological certifications from institutions like the GIA, provenance documentation, and expert appraisals. Digital tools, such as blockchain-based tracking, are also emerging to enhance transparency and reduce fraud risks.

What are the risks associated with investing in luxury jewelry?

Key risks include market volatility, liquidity challenges, and potential for counterfeit items. Mitigation strategies involve diversifying across types of jewelry, investing in insured pieces, and staying informed about market trends through reputable sources.

Conclusion

The convergence of luxury and investment in the jewelry sector represents a paradigm shift, where aesthetic appeal and financial strategy seamlessly integrate. As highlighted by the Luxury Jewelry Investment Market Report, the rising demand for rare gemstones and high-value collections underscores a broader trend toward tangible, long-term assets. For investors, this offers an opportunity to diversify portfolios while owning pieces of enduring beauty and significance. Moving forward, advancements in certification, digital platforms, and sustainable practices will further solidify jewelry's role in wealth management. By understanding market dynamics and consumer motivations, stakeholders can navigate this evolving landscape to capitalize on the enduring value of luxury jewelry.

Tags

Related Articles

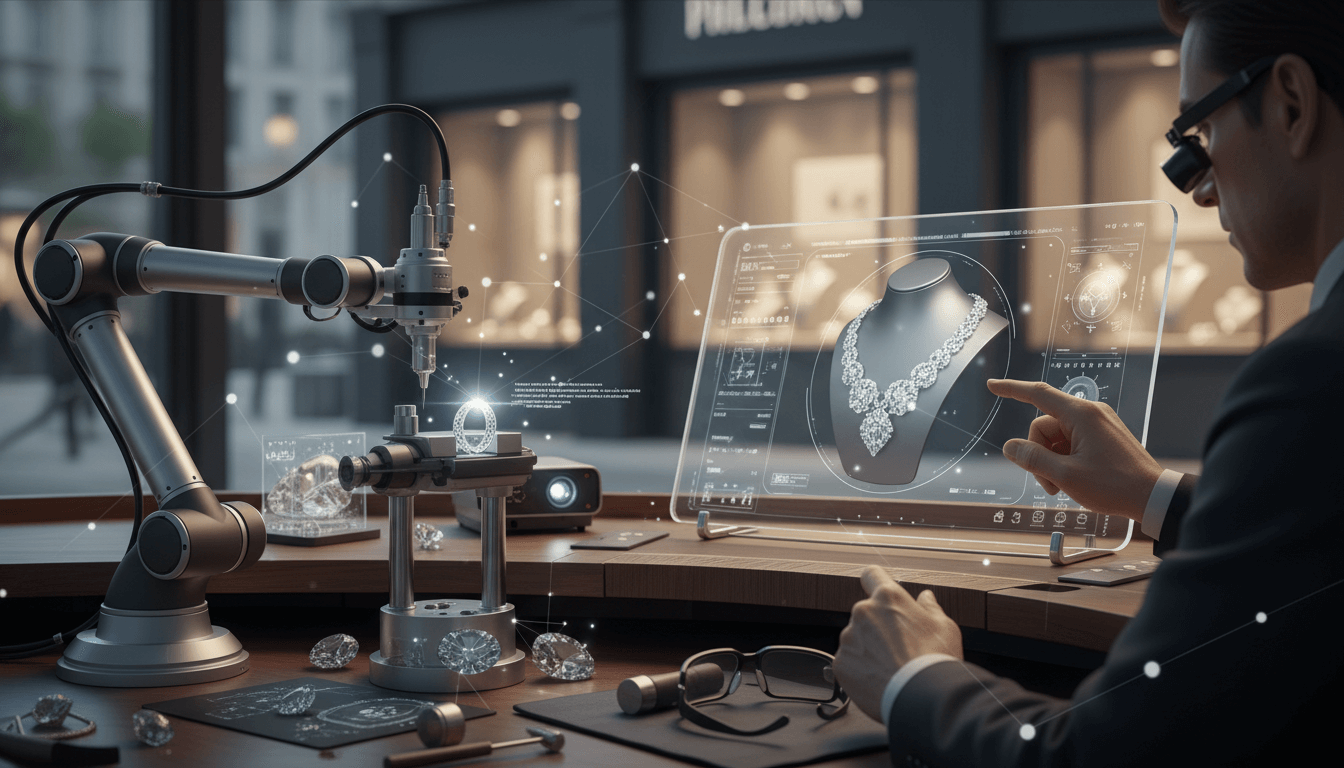

Technology Integration in Luxury Jewelry: Blending Craftsmanship with Innovation

The luxury jewelry market is undergoing a transformative shift as brands increasingly embed technology into their designs, merging traditional craftsmanship with cutting-edge digital elements. Innovations include smart jewelry with health monitoring and connectivity features, tech-enhanced designs using advanced materials like lab-grown diamonds and sustainable alloys, and revolutionary manufacturing techniques such as 3D printing and AI-driven customization. This trend not only enhances functionality and personalization but also appeals to a new generation of tech-savvy consumers, positioning the sector for sustained growth and innovation. According to Stellar Market Research, this integration is reshaping market dynamics and consumer expectations.

Digital Transformation in Luxury Jewelry Retail: Navigating E-Commerce, AR, and Influencer Marketing

The luxury jewelry sector is undergoing a profound digital transformation, driven by the expansion of e-commerce platforms, integration of augmented reality try-on features, and the rising influence of social media and influencer marketing. These innovations are reshaping consumer engagement, with personalized online experiences and advanced technologies enhancing accessibility and driving sales. Brands that adapt to these trends are poised to capture a larger share of the evolving market, as highlighted in the Global Luxury Market Digital Trends Report.

Gold Dominance and Personalization: Shifting Dynamics in Luxury Jewelry

Gold jewelry continues to lead the luxury market with a commanding 54.9% share, driven by its enduring appeal and investment value. Rings dominate the product segment at 33.8%, fueled by cultural traditions and milestone celebrations. A significant trend toward personalized and unique designs is reshaping consumer preferences, emphasizing bespoke craftsmanship and emotional connections. This analysis explores material innovations, market drivers, and future outlooks for luxury jewelry.

Cultural and Regional Luxury Jewelry Preferences: A Global Market Analysis

Luxury jewelry preferences exhibit profound diversity across global regions, shaped by cultural heritage, economic dynamics, and evolving fashion trends. Europe maintains its legacy as a mature market with sophisticated tastes, while Asia-Pacific emerges as the fastest-growing region, driven by rising affluence. The Middle East showcases jewelry's deep cultural significance, often emphasizing opulent designs. Brands are increasingly adopting region-specific strategies, from marketing campaigns to bespoke collections, to resonate with local consumers. This article explores key regional markets, consumer behaviors, and strategic adaptations essential for success in the global luxury jewelry landscape.

Emerging Trends in Luxury Jewelry Design: Blending Heritage with Modern Innovation

The luxury jewelry sector is evolving with groundbreaking design trends that merge traditional craftsmanship with contemporary aesthetics. Key developments include the rise of gender-neutral collections, increased demand for bespoke and personalized jewelry, and a strong focus on sustainability through ethical sourcing. These shifts reflect consumer preferences for pieces that serve as both fashion statements and long-term investments, driving brands to innovate in design, materials, and supply chain transparency. Insights from Luxury Market Trend Analysis 2024 highlight how these trends are reshaping the industry.

Gender-Neutral Luxury Jewelry Trends: Redefining Elegance Beyond Gender

The luxury jewelry sector is undergoing a transformative shift towards gender-neutral and unisex designs, driven by evolving social norms, a focus on individual expression, and a push for inclusivity. Major brands like Gucci and Bulgari are pioneering collections that transcend traditional gender boundaries, with a significant increase in male jewelry purchases reflecting this change. This trend not only aligns with contemporary values but also opens new market opportunities, reshaping how luxury is defined and consumed globally.