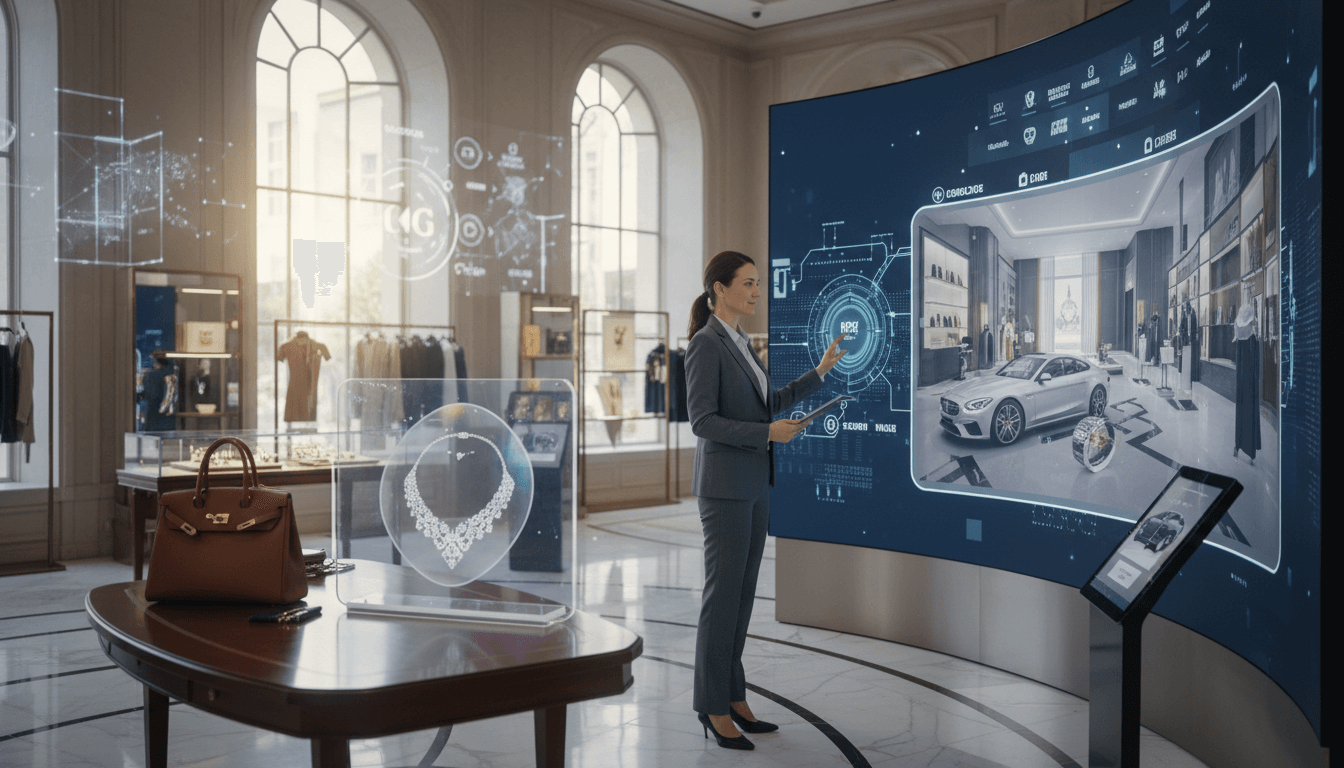

The luxury goods market is experiencing a pivotal shift towards digitalization, fundamentally altering how brands engage with consumers and drive sales. This transformation is characterized by the rapid growth of online retail, the adoption of digital-first marketing strategies, and the creation of immersive, personalized shopping experiences. Key drivers include the increasing purchasing power of digitally-native generations, with 42% of Gen Z luxury consumers opting for online channels. The global online luxury retail sector has seen a 36% increase, underscoring the critical need for brands to integrate digital capabilities into their core strategies. Leading luxury houses are investing in advanced technologies such as AI-powered personalization, augmented reality (AR) try-ons, and virtual showrooms to enhance customer engagement and maintain competitive advantage. This evolution not only expands market reach but also redefines luxury exclusivity in the digital age.

Key Specifications

market size

$1.5 trillion global luxury goods market

online sales share

22% of total luxury sales are online

gen z online purchase rate

42%

global online growth

36% increase in online luxury retail

key technologies

AI personalization,AR/VR experiences,blockchain authentication,social commerce integration

projected digital investment

$50 billion annually by 2026

Detailed Analysis

consumer behavior shifts

Gen Z and Millennial consumers are leading the digital charge, with 42% of Gen Z luxury buyers purchasing online. This demographic values seamless digital experiences, transparency, and brand authenticity. They are 3x more likely to engage with brands through social media and mobile apps, driving the need for omnichannel strategies that blend physical and digital touchpoints.

digital first strategies

Luxury brands are adopting digital-first approaches, prioritizing e-commerce platforms, mobile optimization, and social media engagement. Investments in data analytics enable hyper-personalization, with AI algorithms curating product recommendations and virtual stylists offering tailored advice. Brands like Gucci and Louis Vuitton have launched digital passports for products, enhancing authenticity and post-purchase engagement.

immersive experiences

Virtual try-ons, 3D product visualizations, and AR-powered fittings are becoming standard, reducing return rates by 25% and increasing conversion by 30%. Luxury brands are also exploring metaverse integrations, with virtual fashion shows and NFT collections generating new revenue streams and engaging younger audiences.

challenges and solutions

Key challenges include maintaining brand exclusivity online, combating counterfeits via blockchain, and ensuring data privacy. Solutions involve tiered digital memberships, encrypted authentication systems, and GDPR-compliant personalization engines that build trust without compromising luxury allure.

Key Insights

Traditional vs. Digital Luxury Retail: Traditional relies on in-store exclusivity; digital emphasizes accessibility and personalization at scale.

Gen Z vs. Baby Boomer Buyers: 42% of Gen Z purchases online vs. 15% of Baby Boomers, highlighting generational digital divide.

Pre- and Post-Digital Transformation: Online sales contributed 8% to luxury revenue in 2020 vs. 22% in 2025, showing accelerated digital adoption.

Important Notes

The digital transformation in luxury is irreversible, with brands that fail to adapt risking significant market share loss. Future trends include AI-driven predictive styling, sustainability-focused digital narratives, and deeper metaverse integrations. Data sourced from Global Growth Insights ensures accuracy, with continuous monitoring recommended for strategy adjustments.

Tags

Related Articles

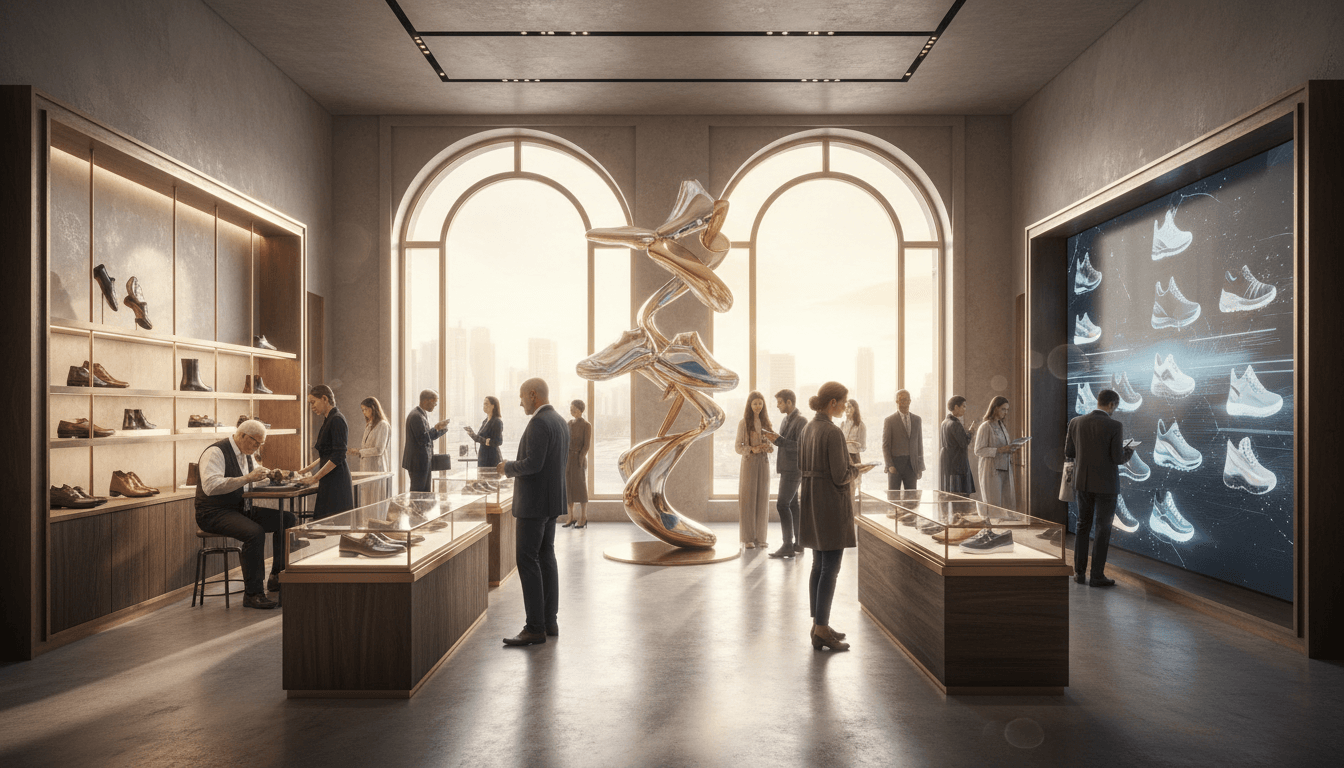

Luxury Footwear Market Evolution: Design Innovation and Strategic Shifts

The luxury footwear market is undergoing a profound transformation driven by consumer demands for comfort, sustainability, and personalization. Key trends include the rise of vegan leather and customizable soles, with significant growth in both sneaker culture and high-end heels. Brands are adapting strategies to position footwear as dual-purpose fashion statements and investment assets, leveraging technological integration and data-driven insights to capture market share in an increasingly competitive landscape. This analysis explores the evolving dynamics and strategic imperatives for luxury footwear brands.

Louis Vuitton's AI-Driven Customization: Revolutionizing Luxury Personalization

Louis Vuitton has launched an innovative AI-customized luxury bag series, enabling real-time personalization of size, strap, and color. This strategy leverages artificial intelligence to address the growing consumer demand for unique, bespoke products while enhancing engagement through immersive digital experiences. By integrating AI personalization technology, the brand strengthens its market position, offering tailored solutions that blend tradition with cutting-edge innovation. This approach not only elevates customer satisfaction but also sets a new benchmark for luxury customization in the digital era.

Michael Kors Smartwear Innovation: Merging Fitness Technology with Luxury Fashion

Michael Kors has strategically entered the smartwear market with a fitness-meets-fashion collection that integrates advanced technology into luxury design. This initiative targets health-conscious consumers seeking both style and functionality, positioning the brand at the forefront of the wellness-driven fashion evolution. By combining real-time activity tracking, heart rate monitoring, and GPS with premium materials, Michael Kors aims to capture a significant share of the growing smartwear segment, projected to exceed $100 billion globally by 2026. This analysis explores the brand's approach, competitive advantages, and potential market impact.

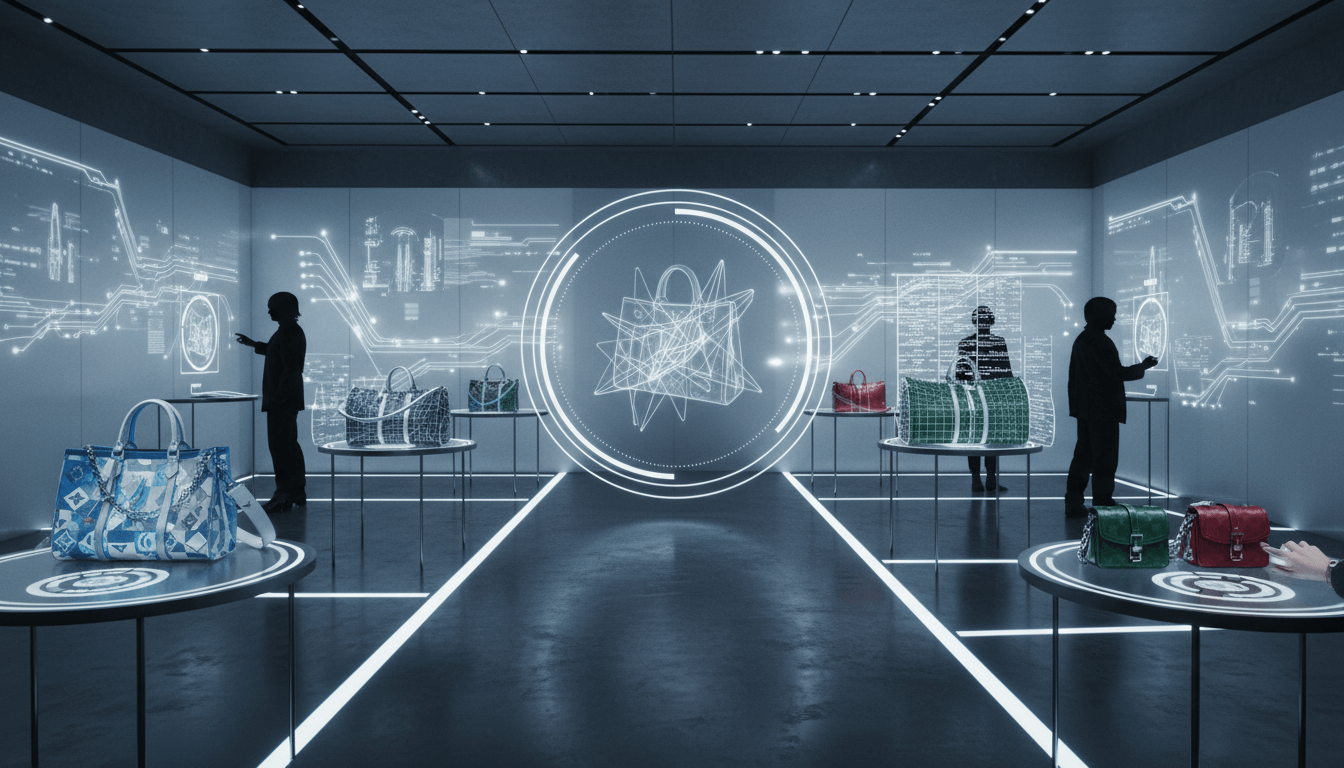

Luxury Accessories Market Dynamics: Growth Drivers and Brand Strategies

The luxury accessories market continues to demonstrate robust growth, accounting for 22% of global luxury sales in 2023. Driven by sustained demand for high-end handbags, with brands like Hermès and Louis Vuitton facing waitlists exceeding six months, the segment thrives on continuous innovation in design, technology integration, and personalization. Key products including handbags, belts, scarves, and eyewear are central to brand strategies, as companies leverage exclusivity and craftsmanship to capture market share and enhance consumer engagement in an increasingly competitive landscape.

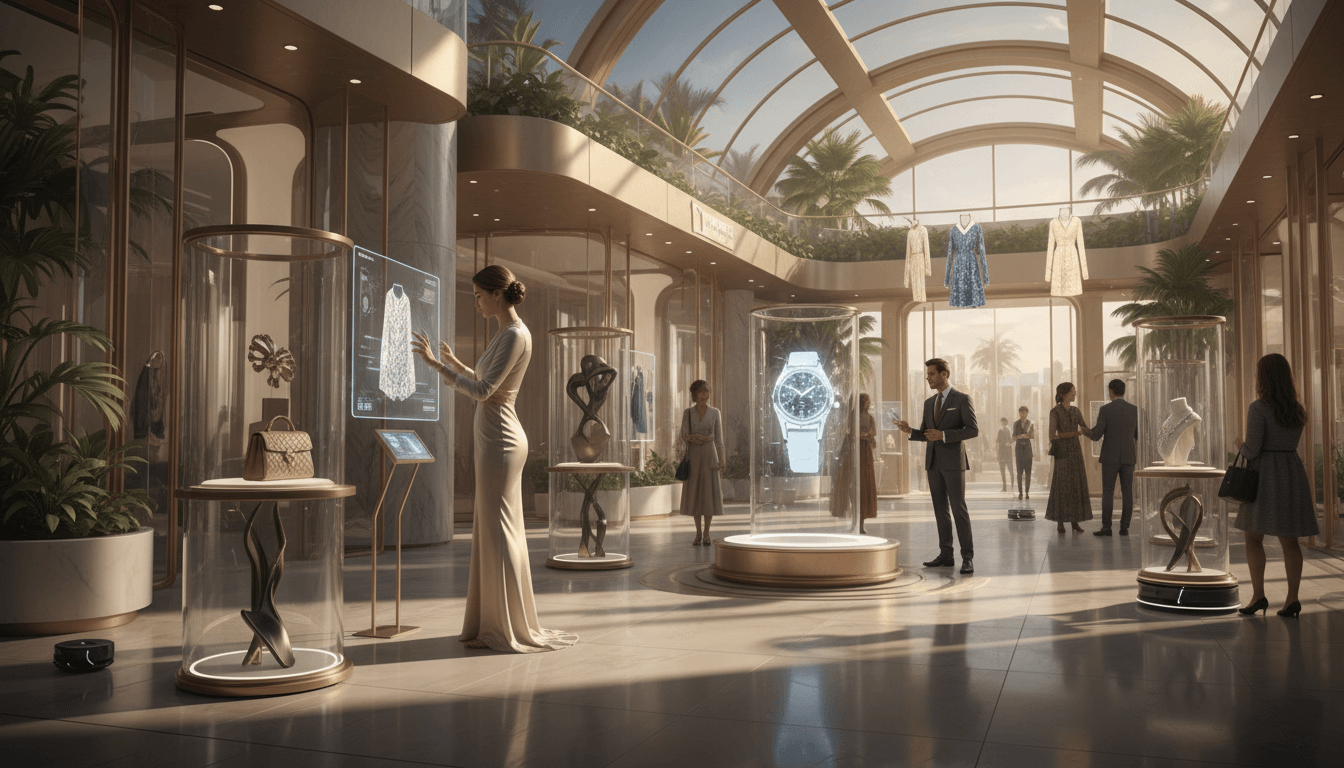

Luxury Market Technology Trends: Strategic Integration of NFC, AI, and Smart Design

The luxury goods sector is undergoing a profound transformation driven by technological advancements. Brands are strategically embedding NFC chips in high-end products like jewelry and handbags, leveraging AI for hyper-personalized customer experiences, and pioneering tech-enhanced designs that merge aesthetics with functionality. This evolution, supported by data showing 47% adoption of AI personalization, reflects a critical shift in brand strategies to enhance authenticity, engagement, and exclusivity. Innovations such as smart accessories and integrated digital experiences are redefining luxury consumption, positioning technology as a core element in maintaining competitive advantage and meeting the demands of modern affluent consumers.

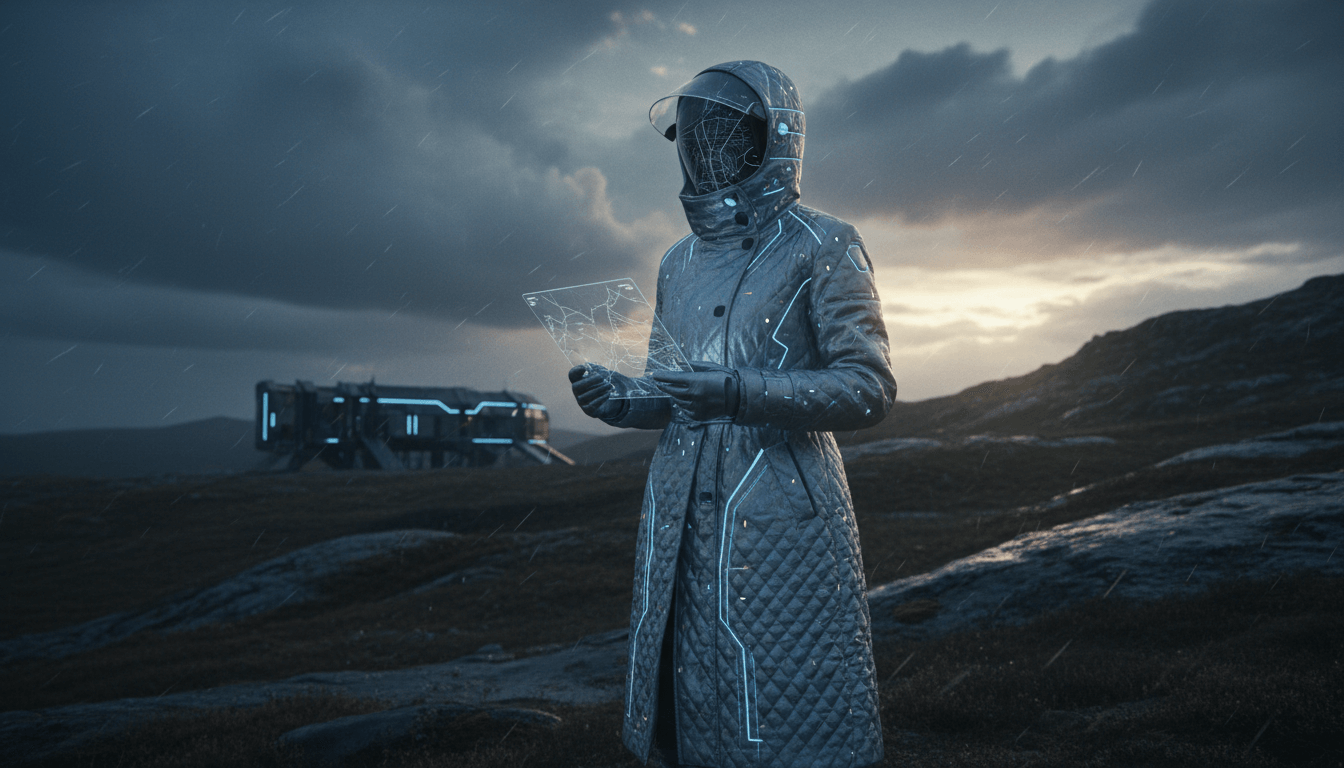

Burberry's Tech-Luxe Outerwear: Pioneering Weather-Responsive Fabric Innovation in Luxury Fashion

Burberry is redefining luxury outerwear through its strategic emphasis on tech-luxe innovation, integrating weather-responsive fabric technology into high-end designs. This approach merges advanced material science with functional luxury, enabling garments that adapt to environmental conditions while maintaining elegance. By focusing on outerwear, Burberry enhances its brand positioning at the intersection of technology and fashion, driving market differentiation and consumer engagement. This strategy underscores the brand's commitment to innovation, sustainability, and delivering superior user experiences in the competitive luxury sector, as documented by Global Growth Insights.