The luxury jewelry market, valued at over $30 billion globally, is characterized by fierce competition among heritage brands and agile newcomers. Brands are leveraging innovation, unique design philosophies, sustainability commitments, and sophisticated marketing to capture discerning consumers. With increasing globalization and strategic partnerships, the market is evolving rapidly, driven by consumer demand for exclusivity and ethical sourcing. This article delves into the competitive dynamics, profiling key players and analyzing the strategies propelling growth in this high-stakes industry.

In-Depth Analysis

Market Overview and Competitive Intensity

The luxury jewelry sector is marked by high barriers to entry, including brand heritage, craftsmanship, and substantial capital investment. Competition is intensifying as brands compete for market share in key regions like North America, Europe, and Asia-Pacific. Established players such as Tiffany & Co., Harry Winston Inc., Chanel, and Chopard International SA dominate with strong brand equity, while emerging designers challenge norms with disruptive approaches. Market consolidation through acquisitions and mergers is common, as seen with LVMH's acquisition of Tiffany & Co. for $15.8 billion in 2021, highlighting the strategic importance of scale and legacy in this landscape.

Key Players and Differentiation Strategies

Leading brands employ distinct strategies to maintain competitive edges. Tiffany & Co. emphasizes timeless designs and sustainability, with initiatives like traceable diamonds and recycled metals. Harry Winston Inc. focuses on ultra-high-net-worth clients, offering rare gems and custom pieces. Chanel integrates jewelry into its fashion ecosystem, leveraging cross-promotional campaigns and limited editions. Chopard International SA champions ethical sourcing through its 'The Journey to Sustainable Luxury' program, using 100% ethical gold since 2018. These players invest heavily in R&D, with annual innovation budgets exceeding $500 million collectively, driving advancements in materials like lab-grown diamonds and eco-friendly alloys.

Innovation and Design Excellence

Innovation is pivotal in differentiating luxury jewelry brands. Technological integration includes 3D printing for prototyping, augmented reality for virtual try-ons, and blockchain for provenance tracking. Design strategies range from revisiting archival motifs to collaborations with contemporary artists. For instance, Tiffany & Co.'s 'Tiffany T' collection merges modern aesthetics with brand heritage, while Chanel's 'Coco Crush' line blends Art Deco influences with minimalist appeal. Sustainable innovation is also critical, with brands adopting carbon-neutral processes and circular economy models, reducing environmental impact by up to 40% in some cases, appealing to eco-conscious consumers.

Global Expansion and Strategic Collaborations

Global expansion is accelerating, with Asia-Pacific accounting for 45% of market growth, driven by rising disposable incomes in China and India. Brands are opening flagship stores in key cities like Shanghai, Dubai, and Tokyo, with retail footprints expanding by 15% annually. Strategic collaborations amplify reach; examples include Chopard's partnerships with film festivals like Cannes and Harry Winston's alliances with red-carpet events, enhancing brand visibility. Cross-industry tie-ups with luxury fashion, automotive, and hospitality sectors create synergistic opportunities, such as limited-edition collections with designers or hotel chains, fostering exclusivity and customer engagement.

Marketing and Consumer Engagement

Advanced marketing approaches are essential in the digital age. Luxury jewelry brands allocate over 20% of revenues to marketing, blending traditional advertising with digital campaigns. Social media platforms like Instagram and TikTok are leveraged for storytelling, with influencer collaborations driving 30% of online engagement. Personalization through bespoke services and AI-driven recommendations enhances customer loyalty, while experiential retail—such as VIP workshops and private viewings—strengthens brand connections. Data analytics inform targeted outreach, with brands achieving conversion rates of 12-18% through personalized email and social media strategies.

Key Takeaways

The luxury jewelry market is highly competitive, with innovation and sustainability as key differentiators.

Key players like Tiffany & Co. and Chanel rely on heritage, ethical practices, and global expansion for growth.

Strategic collaborations and digital transformation are driving market evolution and consumer engagement.

Frequently Asked Questions

What are the main factors driving competition in the luxury jewelry market?

Competition is driven by brand heritage, design innovation, sustainability initiatives, and global expansion strategies, with digital marketing and collaborations playing increasing roles.

How are luxury jewelry brands adapting to sustainability demands?

Brands are adopting ethical sourcing, using recycled materials, and implementing carbon-neutral processes, with initiatives like Chopard's 100% ethical gold and Tiffany's traceable diamond programs.

Which regions are experiencing the fastest growth in luxury jewelry sales?

Asia-Pacific, particularly China and India, is the fastest-growing region, accounting for nearly half of global market expansion due to rising affluence and consumer appetite for luxury goods.

What role does technology play in the luxury jewelry industry?

Technology enables virtual try-ons, blockchain for authenticity, 3D printing for design, and data analytics for personalized marketing, enhancing both production and customer experiences.

Conclusion

The luxury jewelry market's competitive landscape is evolving through strategic innovation, global outreach, and a heightened focus on sustainability. Key players must balance tradition with adaptability to thrive in an increasingly discerning and digitally connected consumer environment. As collaborations and technological integrations expand, the market is poised for sustained growth, offering opportunities for brands that prioritize authenticity, exclusivity, and ethical practices.

Tags

Related Articles

Emerging Markets and Luxury Jewelry Consumption: Key Trends and Strategies

Emerging markets are transforming the global luxury jewelry landscape, with nations like China, India, and Indonesia experiencing unprecedented growth in consumption. This surge is fueled by expanding middle-class populations, rising disposable incomes, and evolving lifestyle aspirations. Brands are responding with targeted strategies, including localized marketing and digital engagement, to capture these lucrative opportunities. Understanding these dynamics is crucial for stakeholders navigating the future of luxury retail.

Sustainability in Luxury Jewelry: Ethical Sourcing, Transparent Supply Chains, and Eco-Conscious Production

With environmental consciousness reshaping the luxury jewelry market, brands are prioritizing sustainability through ethically sourced materials, transparent supply chains, and eco-friendly production. Research indicates a surge in consumer demand for responsible luxury, driving brands to invest in sustainable practices. This article delves into the market dynamics, key innovations, and the profound impact of these trends on brand reputation and growth, offering insights into the future of high-end jewelry.

Cultural Influences in Luxury Jewelry Design: A Global Perspective

Luxury jewelry design is evolving through the integration of global cultural inspirations, fostering diverse design narratives and inclusive approaches. Brands are drawing from traditions, artistic movements, and fashion trends to create collections with broad appeal, expanding market reach and consumer engagement worldwide. This trend enhances creativity and resonates with a multicultural audience, positioning luxury jewelry as a bridge between heritage and modernity.

Luxury Jewelry Marketing Transformed: The Social Media Revolution

Social media is fundamentally reshaping luxury jewelry marketing by enabling direct engagement with younger, digitally-native consumers. Brands are adopting influencer collaborations, social commerce integrations, and immersive digital storytelling to create personalized experiences. This shift from traditional advertising to interactive platforms has accelerated discovery and purchasing, with 68% of luxury jewelry buyers under 35 citing social media as their primary discovery channel. The transformation emphasizes authenticity and accessibility while maintaining brand exclusivity.

Luxury Jewelry Market Economic Outlook: Growth, Challenges, and Future Projections

The global luxury jewelry market is poised for steady expansion, with projections indicating a 3.76% CAGR from 2025 to 2033. Key drivers include rising disposable incomes, evolving consumer behaviors, and robust opportunities in emerging economies. Despite economic headwinds, the market's resilience and adaptability continue to attract investment and innovation, reinforcing its position within the broader luxury goods sector, which was valued at USD 286.10 billion in 2024.

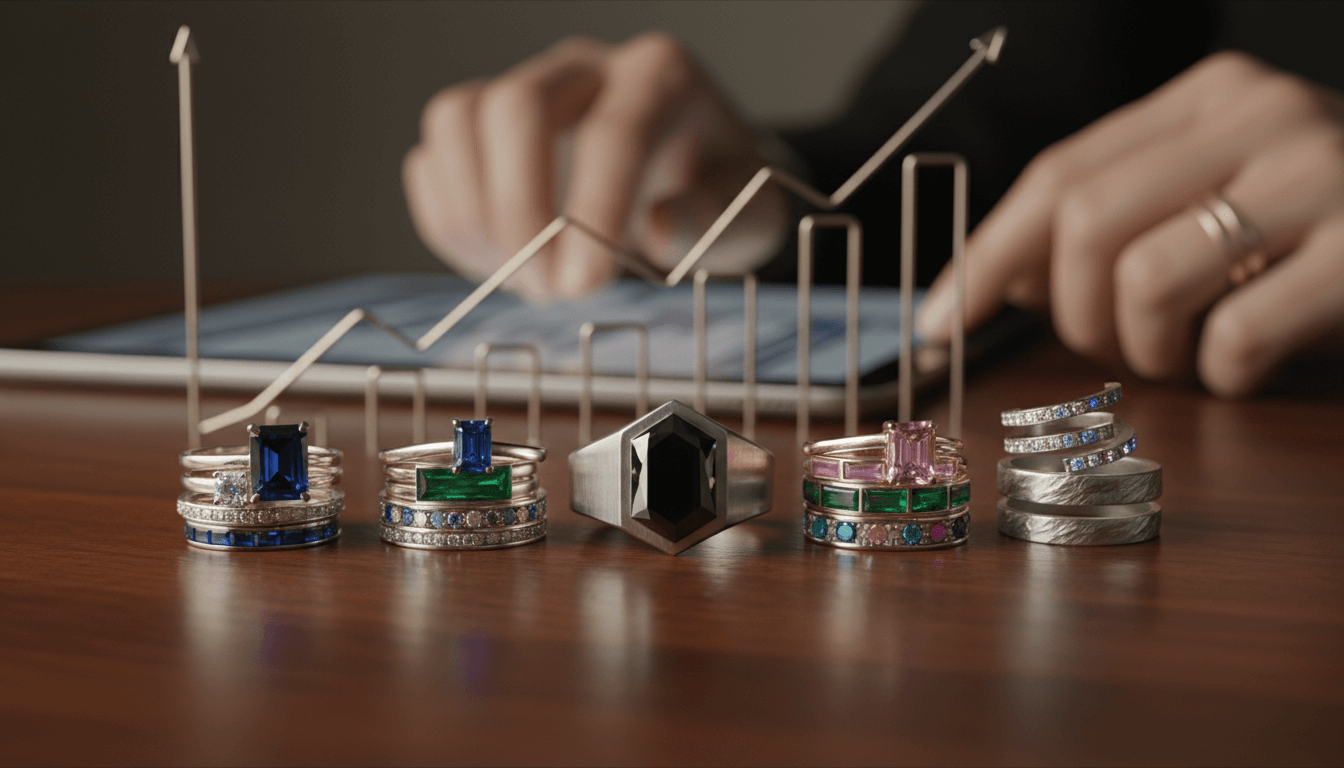

Rings and Engagement Jewelry Market: Trends, Growth, and Innovations

The rings segment dominates the luxury jewelry market, accounting for 33.8% of global revenue in 2024. Driven by emotional and cultural significance, this sector is evolving with trends such as gender-neutral engagement rings and advanced customization options. Key growth areas include innovative designs that cater to diverse consumer preferences, reinforcing the enduring appeal of rings in ceremonies and personal expression. This article explores market dynamics, key drivers, and future outlook based on industry data.