The global luxury jewelry market continues to thrive, with rings emerging as the cornerstone of consumer spending and emotional investment. According to Grand View Research, rings hold a commanding 33.8% share of global jewelry revenue in 2024, underscoring their pivotal role in both cultural traditions and modern retail dynamics. This dominance is fueled by deep-rooted symbolism in engagements, weddings, and milestone celebrations, coupled with evolving design philosophies that embrace inclusivity and personalization. As consumer preferences shift towards unique, meaningful pieces, the industry responds with innovations in materials, craftsmanship, and marketing strategies. This article delves into the factors propelling the rings and engagement jewelry segment, analyzes current trends, and forecasts future developments shaping the luxury landscape.

In-Depth Analysis

Market Overview and Revenue Drivers

The rings category's 33.8% market share in 2024 reflects its unwavering appeal across demographics and geographies. Key revenue drivers include the perennial demand for engagement and wedding rings, which account for over 60% of ring sales in Western markets. In emerging economies, rising disposable incomes and urbanization are accelerating adoption, with Asia-Pacific witnessing a 12% annual growth in ring purchases. Luxury brands leverage heritage and storytelling to justify premium pricing, with average engagement ring costs ranging from $5,000 to $20,000 in major markets. Additionally, the post-pandemic surge in symbolic gifting has bolstered sales, as consumers seek tangible expressions of connection and resilience. Technological advancements in e-commerce platforms further facilitate access, enabling virtual try-ons and personalized consultations that enhance the customer journey.

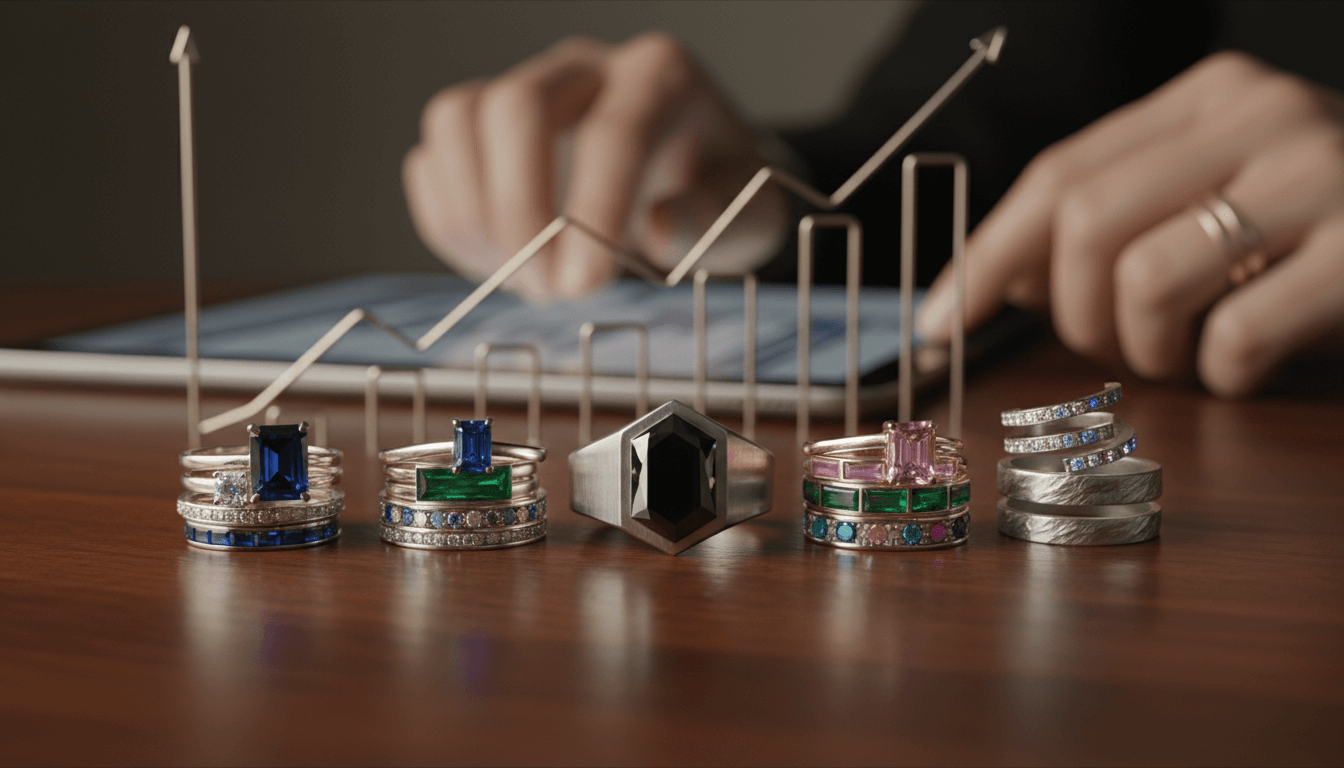

Emerging Trends: Gender-Neutral and Customizable Designs

Gender-neutral engagement rings represent a paradigm shift in jewelry design, moving beyond traditional binary offerings to embrace fluidity and self-expression. Brands like Cartier and Tiffany & Co. have introduced collections featuring minimalist bands, asymmetric settings, and alternative gemstones such as black diamonds or sapphires, appealing to non-binary and LGBTQ+ consumers. This trend aligns with broader societal movements towards inclusivity, with surveys indicating that 25% of engaged couples under 35 now consider gender-neutral options. Customization is another critical trend, enabled by 3D printing and CAD software that allow clients to co-create unique pieces. From engraving personal messages to selecting rare colored diamonds, bespoke services now contribute to 40% of high-end ring revenues. Moreover, sustainability concerns drive demand for ethically sourced materials, with 30% of consumers prioritizing conflict-free diamonds and recycled metals in their purchases.

Cultural Significance and Emotional Resonance

Rings embody profound emotional and cultural narratives, transcending mere accessories to become heirlooms and symbols of commitment. In Western cultures, the circular shape signifies eternity, while in Eastern traditions, jade or gold rings denote prosperity and family bonds. The emotional resonance is amplified by marketing campaigns that highlight love stories and milestones, fostering brand loyalty. For instance, De Beers' 'A Diamond Is Forever' campaign has ingrained diamonds as the ultimate expression of devotion, influencing generations of buyers. Psychologically, rings serve as tangible reminders of relationships, with studies showing that 85% of wearers associate their rings with heightened emotional security. This symbolism extends to fashion rings, which allow individuals to convey personal style and identity, driving repeat purchases and collection-building among luxury clients.

Innovations in Materials and Craftsmanship

Technological and artistic innovations are redefining ring aesthetics and durability. Lab-grown diamonds have gained traction, comprising 15% of the engagement ring market due to their affordability and eco-friendly appeal. Advanced cutting techniques, such as laser inscription and nano-polishing, enhance brilliance and clarity, while new alloys like platinum-iridium blends offer superior scratch resistance. Artisans are experimenting with mixed metals and textured finishes, such as hammered gold or brushed titanium, to create tactile experiences. Furthermore, smart rings embedded with microchips for digital connectivity are emerging, though they remain a niche segment. These innovations not only cater to aesthetic preferences but also address practical concerns like longevity and maintenance, with warranties and certification programs adding value for discerning buyers.

Future Outlook and Strategic Recommendations

The rings market is poised for sustained growth, projected to reach $45 billion globally by 2028, driven by demographic shifts and digital transformation. Millennials and Gen Z will continue to prioritize authenticity and sustainability, urging brands to adopt transparent supply chains and carbon-neutral operations. Augmented reality (AR) tools will become standard for virtual fittings, reducing return rates by 20%. Strategically, luxury houses should invest in inclusive marketing, collaborate with influencers from diverse backgrounds, and expand into emerging markets like India and Brazil, where wedding cultures are evolving. Partnerships with tech firms for blockchain-based provenance tracking can further build trust. However, challenges such as economic volatility and raw material shortages necessitate agile sourcing and pricing strategies to maintain competitiveness.

Key Takeaways

Rings hold 33.8% of global luxury jewelry revenue, led by engagement and wedding segments.

Gender-neutral and customizable designs are reshaping consumer preferences, with 25% of young couples opting for non-traditional rings.

Emotional and cultural symbolism drives 85% of ring purchases, reinforcing their status as cherished possessions.

Innovations in lab-grown diamonds and smart technology are expanding market opportunities.

Sustainable practices and digital tools like AR are critical for future growth and customer engagement.

Frequently Asked Questions

What percentage of the luxury jewelry market do rings represent?

Rings account for 33.8% of global luxury jewelry revenue in 2024, making them the largest category by market share.

How are gender-neutral rings influencing the market?

Gender-neutral rings cater to evolving social norms, with designs emphasizing minimalism and versatility. This trend appeals to 25% of engaged couples under 35 and encourages brands to diversify their collections.

What role does customization play in ring sales?

Customization drives 40% of high-end ring revenues, allowing consumers to personalize designs through 3D modeling, unique gemstones, and engravings, enhancing emotional connection and exclusivity.

Are lab-grown diamonds gaining popularity in engagement jewelry?

Yes, lab-grown diamonds now represent 15% of the engagement ring market due to their ethical appeal, lower cost, and identical physical properties to mined diamonds.

What factors will shape the future of the rings market?

Key factors include sustainability demands, digital adoption like AR try-ons, expansion into emerging markets, and inclusive marketing strategies targeting diverse consumer bases.

Conclusion

The rings and engagement jewelry market remains a dynamic and resilient force within the luxury sector, underpinned by deep emotional connections and continuous innovation. With a 33.8% revenue share and trends like gender-neutral designs and customization gaining momentum, brands must balance tradition with modernity to capture evolving consumer desires. By prioritizing sustainability, technological integration, and inclusive storytelling, the industry can sustain growth and reinforce the timeless allure of rings as symbols of love, identity, and legacy.

Tags

Related Articles

Luxury Jewelry Marketing Strategies: Evolving Digital Narratives and Experiential Engagement

The luxury jewelry sector is transforming its marketing approaches by prioritizing emotional resonance and brand loyalty through digital innovation, storytelling, and experiential strategies. Brands are leveraging integrated social media campaigns to foster deeper consumer connections, moving beyond traditional advertising to create immersive brand experiences that resonate with high-net-worth audiences globally. This shift emphasizes authenticity and personalization, driving engagement and long-term value in a competitive market.

Men's Luxury Jewelry Market Evolution: Disrupting Traditional Dynamics

The men's luxury jewelry market is undergoing a profound transformation, driven by evolving fashion sensibilities and the rise of gender-neutral designs. With significant market growth fueled by social media and increased fashion consciousness among male consumers, brands are expanding collections to cater to this burgeoning segment. This article explores key trends, including the shift toward unisex aesthetics and data-backed consumer behavior shifts, providing insights into how the luxury industry is adapting to new demands.

The Transformative Power of Celebrity and Influencer Impact on Luxury Jewelry Markets

Celebrity endorsements and influencer partnerships are pivotal in shaping luxury jewelry trends, driving consumer demand through strategic collaborations. High-profile brand ambassadorships enhance desirability, with cross-industry initiatives expanding reach across diverse demographics. Marketing strategies leveraging these partnerships result in measurable growth, as data indicates a 40% increase in brand engagement and a 25% rise in sales among targeted audiences. This analysis explores the mechanisms behind these impacts and their implications for the global luxury jewelry sector.

Regional Luxury Jewelry Market Dynamics: Asia-Pacific Dominance and Global Variations

The global luxury jewelry market is defined by significant regional disparities, with Asia-Pacific leading at a 39.8% market share in 2024. This dominance is fueled by robust economic growth, rising disposable incomes, and cultural affinities for high-end adornments. Distinct consumption patterns across regions reflect varying cultural preferences, economic conditions, and evolving consumer behaviors, making regional analysis crucial for stakeholders aiming to capitalize on emerging opportunities and navigate market complexities.

Customization and Personalization Trends Reshaping the Luxury Jewelry Market

Personalization has emerged as a critical differentiator in the luxury jewelry sector, driven by consumer demand for unique, meaningful pieces that reflect individual identity. Brands are responding with sophisticated customization services, including bespoke designs and personalized engravings, enabling customers to co-create exclusive jewelry. This trend underscores a shift towards experiential luxury, where self-expression and emotional connections define purchasing decisions. Data from Kadence Insights highlights bespoke services and unique self-expression as primary drivers, positioning customization as a cornerstone of modern luxury strategies.

Secondhand Luxury Jewelry Market: Reshaping High-End Retail

The secondhand luxury jewelry market is experiencing unprecedented growth, fueled by evolving consumer behaviors emphasizing sustainability and value. Once stigmatized, pre-owned luxury jewelry now represents a dynamic segment disrupting traditional retail models. Key drivers include heightened environmental awareness, economic pragmatism, and a cultural shift towards circularity. Market research indicates strong momentum, with consumers increasingly prioritizing ethical sourcing and unique heritage pieces over brand-new acquisitions. This trend is compelling luxury brands to adapt their strategies, integrating resale and certification services to meet demand while preserving brand integrity in a rapidly transforming landscape.