The global luxury jewelry market is a dynamic and multifaceted sector, characterized by pronounced regional variations that shape its trajectory. In 2024, Asia-Pacific emerged as the undisputed leader, capturing 39.8% of the global market share, driven by economic prosperity and deep-rooted cultural appreciation for fine jewelry. This article delves into the intricate dynamics across key regions, examining how cultural preferences, economic factors, and consumer behavior shifts influence market performance. By understanding these regional nuances, industry stakeholders can better strategize for growth and innovation in an increasingly competitive landscape.

In-Depth Analysis

Asia-Pacific: The Epicenter of Luxury Jewelry Consumption

Asia-Pacific's dominance in the luxury jewelry market is underscored by its 39.8% share in 2024, a testament to the region's rapid economic development and expanding affluent class. Countries like China, India, and Japan are pivotal, with China alone contributing over 60% of the regional market revenue. The growth is propelled by increasing disposable incomes, urbanization, and a cultural heritage that values jewelry as both a status symbol and an investment. In China, for instance, gold jewelry remains highly sought after for its cultural significance in weddings and festivals, while in Japan, consumers show a preference for minimalist and high-quality designs from brands like Mikimoto and Tasaki. The region's luxury jewelry sales are projected to grow at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2029, far exceeding the global average of 5.7%. This growth is further fueled by digital adoption, with e-commerce platforms and social media influencers playing a critical role in shaping consumer preferences and driving sales.

North America and Europe: Mature Markets with Evolving Trends

North America and Europe represent mature yet evolving segments of the luxury jewelry market. In North America, the United States holds the largest share, accounting for approximately 85% of regional sales, with a market value of $42 billion in 2024. Consumer behavior here is influenced by a blend of tradition and innovation, where classic pieces from brands like Tiffany & Co. coexist with demand for personalized and sustainable jewelry. Europe, led by markets in France, Italy, and the UK, maintains its heritage of craftsmanship and luxury branding. Italy, for example, is renowned for its goldsmithing expertise, contributing to 30% of Europe's luxury jewelry exports. However, both regions face challenges from economic uncertainties and shifting consumer priorities, such as the growing emphasis on ethical sourcing and environmental sustainability. In response, brands are increasingly adopting blockchain for traceability and incorporating lab-grown diamonds to appeal to conscious consumers, driving a 4.5% CAGR in Europe through 2029.

Emerging Markets: Latin America and Middle East & Africa

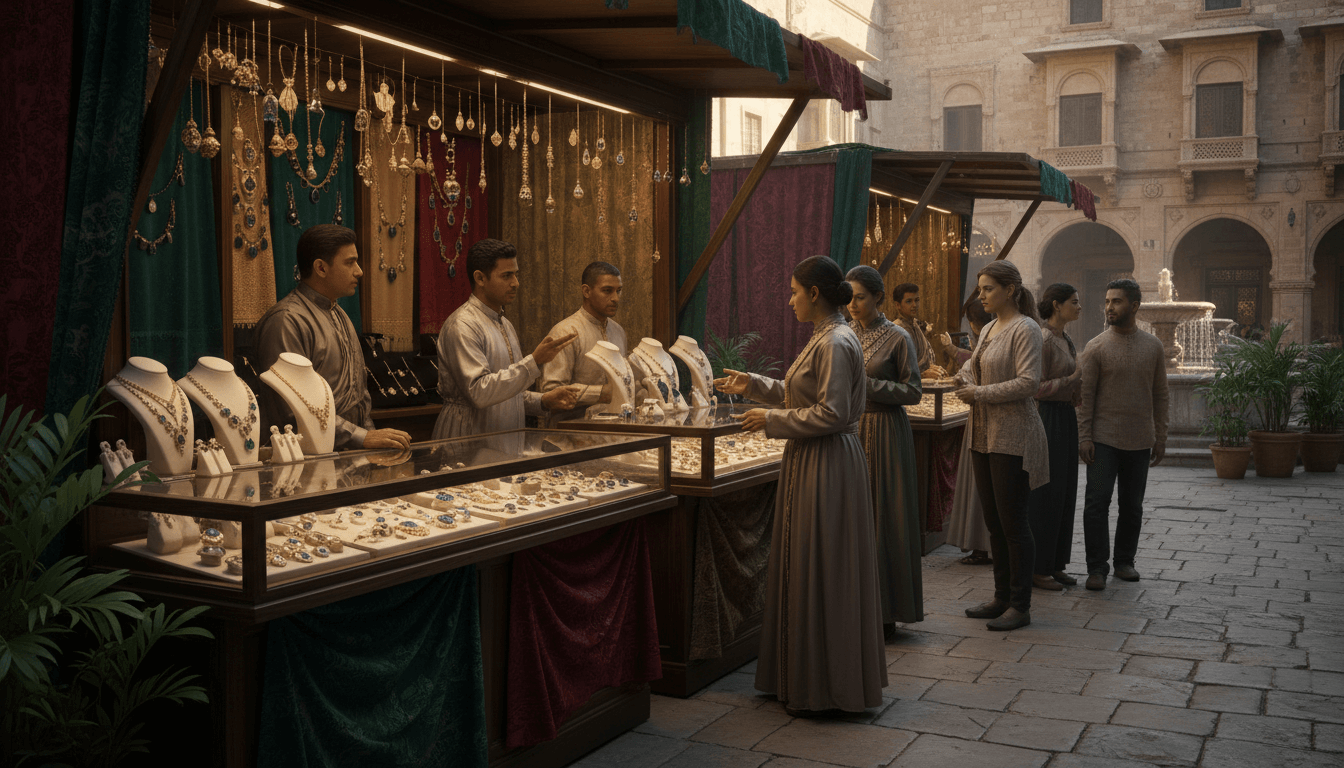

Emerging regions like Latin America and the Middle East & Africa exhibit unique growth trajectories in the luxury jewelry sector. In Latin America, Brazil and Mexico are key markets, with Brazil's jewelry industry valued at $3.8 billion in 2024, driven by a rich cultural affinity for colorful gemstones and artisan designs. The Middle East, particularly the UAE and Saudi Arabia, boasts a long-standing tradition of luxury jewelry consumption, often linked to gifting and celebratory occasions. The UAE's market, for instance, grew by 6.1% in 2024, fueled by tourism and high net-worth individuals. Africa, while smaller in scale, shows potential with markets like South Africa embracing both local designs and international brands. However, these regions contend with economic volatility and infrastructural gaps, which necessitate tailored strategies such as localized marketing and partnerships with local artisans to harness growth opportunities effectively.

Key Drivers and Challenges in Regional Market Dynamics

Economic growth remains a primary driver of luxury jewelry consumption globally, with regions experiencing GDP growth rates above 5% seeing corresponding increases in luxury spending. In Asia-Pacific, rising disposable incomes have enabled middle-class consumers to enter the luxury market, while in developed regions, wealth accumulation among high-net-worth individuals sustains demand. Cultural preferences also play a critical role; for example, in India, jewelry is integral to cultural and religious ceremonies, accounting for 40% of household gold purchases. However, challenges such as geopolitical tensions, supply chain disruptions, and fluctuating raw material costs pose risks. Additionally, the industry must address sustainability concerns, with 68% of consumers in a 2024 survey expressing preference for brands with transparent ethical practices. Innovations like digital customization tools and augmented reality try-ons are emerging as solutions to enhance consumer engagement and mitigate these challenges.

Key Takeaways

Asia-Pacific leads the global luxury jewelry market with a 39.8% share in 2024, driven by economic growth and cultural factors.

Regional consumption patterns vary significantly, with mature markets in North America and Europe focusing on sustainability and innovation.

Economic factors, including rising disposable incomes, are key growth drivers, particularly in emerging regions like Latin America and the Middle East.

Challenges such as supply chain issues and consumer demand for ethical practices require adaptive strategies from industry players.

Frequently Asked Questions

What factors contribute to Asia-Pacific's dominance in the luxury jewelry market?

Asia-Pacific's leadership is attributed to rapid economic growth, increasing disposable incomes, cultural traditions valuing jewelry, and robust digital adoption, with China and India as major contributors.

How do cultural preferences influence luxury jewelry consumption in different regions?

Cultural preferences shape demand; for example, gold is favored in Asia for its symbolic value, while Europe emphasizes craftsmanship, and the Middle East prioritizes ornate designs for gifting occasions.

What are the main challenges facing the global luxury jewelry market?

Key challenges include economic volatility, supply chain disruptions, rising raw material costs, and growing consumer demand for ethical and sustainable practices.

How is technology impacting the luxury jewelry industry?

Technology is revolutionizing the sector through e-commerce platforms, augmented reality for virtual try-ons, blockchain for supply chain transparency, and AI-driven personalization, enhancing consumer experiences and operational efficiency.

Conclusion

The global luxury jewelry market is characterized by distinct regional dynamics, with Asia-Pacific at the forefront due to economic and cultural forces. Understanding these variations is essential for brands to tailor strategies that resonate with local consumers while addressing universal trends like sustainability and digital transformation. As the market evolves, leveraging data-driven insights and innovative approaches will be key to sustaining growth and maintaining competitiveness across diverse regions.

Tags

Related Articles

Customization and Personalization Trends Reshaping the Luxury Jewelry Market

Personalization has emerged as a critical differentiator in the luxury jewelry sector, driven by consumer demand for unique, meaningful pieces that reflect individual identity. Brands are responding with sophisticated customization services, including bespoke designs and personalized engravings, enabling customers to co-create exclusive jewelry. This trend underscores a shift towards experiential luxury, where self-expression and emotional connections define purchasing decisions. Data from Kadence Insights highlights bespoke services and unique self-expression as primary drivers, positioning customization as a cornerstone of modern luxury strategies.

Secondhand Luxury Jewelry Market: Reshaping High-End Retail

The secondhand luxury jewelry market is experiencing unprecedented growth, fueled by evolving consumer behaviors emphasizing sustainability and value. Once stigmatized, pre-owned luxury jewelry now represents a dynamic segment disrupting traditional retail models. Key drivers include heightened environmental awareness, economic pragmatism, and a cultural shift towards circularity. Market research indicates strong momentum, with consumers increasingly prioritizing ethical sourcing and unique heritage pieces over brand-new acquisitions. This trend is compelling luxury brands to adapt their strategies, integrating resale and certification services to meet demand while preserving brand integrity in a rapidly transforming landscape.

Building Unshakeable Consumer Confidence in Luxury Jewelry

In the high-stakes luxury jewelry market, consumer trust is the ultimate currency. Leading brands are implementing comprehensive certification processes, rigorous product testing, and transparent communication strategies to establish authenticity as a critical market differentiator. With over 68% of luxury consumers citing trust as their primary purchasing factor, investments in quality control and verification systems are yielding measurable returns in customer loyalty and market share.

Luxury Jewelry Price Dynamics: Navigating Exclusivity and Value in Modern Markets

The luxury jewelry sector employs sophisticated pricing strategies that balance exclusivity with market accessibility. Key factors driving value include customization, limited edition collections, and craftsmanship, with brands adopting flexible approaches to cater to diverse consumer segments. This article explores how these dynamics influence product valuation, consumer perception, and long-term brand equity in the global luxury landscape, supported by industry data and strategic insights.

Luxury Jewelry Market Evolution 2024-2032: Trends, Drivers, and Future Projections

The global luxury jewelry market is set for robust expansion, projected to grow from USD 61 billion in 2024 to USD 109 billion by 2032 at a CAGR of 7.55%. This growth is fueled by increasing consumer demand for sustainable, ethically sourced materials, gender-neutral designs, and personalized jewelry. Technological advancements and shifting market dynamics are reshaping the industry, offering opportunities for innovation and strategic brand positioning.

Luxury Jewelry Production and Sourcing: Navigating Ethical and Sustainable Transformations

The luxury jewelry industry is experiencing a paradigm shift driven by consumer demand for ethical sourcing, sustainable production methods, and supply chain transparency. Brands are increasingly adopting responsible manufacturing practices, with over 65% of luxury consumers prioritizing sustainability in purchasing decisions. This article explores how ethical frameworks, technological innovations, and transparent operations are reshaping production landscapes, enhancing brand loyalty, and meeting rigorous environmental standards. Key trends include blockchain for traceability, artisanal collaborations, and circular economy initiatives that reduce waste and carbon footprints.