The luxury jewelry market is characterized by intricate pricing mechanisms that reflect a delicate interplay between heritage, innovation, and consumer demand. With global sales projected to exceed $480 billion by 2030, brands are increasingly adopting flexible and personalized pricing strategies to maintain exclusivity while expanding market reach. This article delves into the core dynamics shaping luxury jewelry valuations, examining how customization, limited editions, and market segmentation redefine value perception and drive competitive advantage.

In-Depth Analysis

Balancing Exclusivity and Accessibility in Pricing

Luxury jewelry brands navigate a complex spectrum where exclusivity must coexist with strategic accessibility. High-end houses like Cartier and Van Cleef & Arpels maintain premium positioning through heritage pricing—where pieces often start at $5,000 and escalate into millions for rare gemstone creations. However, entry-level collections priced between $1,500 and $3,000 allow broader consumer engagement without diluting brand prestige. This tiered approach, reported in Luxury Pricing Strategy Analysis, enables brands to capture 65% of aspirational shoppers while reserving bespoke services for ultra-high-net-worth clients. Market segmentation further refines this balance, with brands deploying geo-specific pricing adjustments of up to 20% to account for regional purchasing power and tax structures.

Customization as a Primary Value Driver

Personalization has emerged as a critical lever in luxury jewelry valuation, with bespoke commissions accounting for over 30% of revenue for leading brands. Customization impacts product value through several dimensions: unique design inputs increase base prices by 40-200%, depending on material rarity and artisan labor. For instance, Tiffany & Co.'s bespoke service incorporates client-specific gemstone selections and engraving, elevating typical transaction values from $10,000 to over $100,000. The emotional connection forged through co-creation enhances perceived value, with 78% of luxury consumers willing to pay premiums for personalized pieces. Technological advancements like 3D rendering and virtual try-ons further streamline this process, reducing customization lead times from 12 weeks to 4 weeks while maintaining artisanal integrity.

Limited Edition Collections and Scarcity Marketing

Limited edition releases amplify luxury jewelry's allure through calculated scarcity. Brands like Bulgari and Boucheron launch capsule collections numbering 50-200 pieces worldwide, often featuring rare materials like Paraíba tourmaline or precision-cut diamonds. These limited runs command prices 3-5 times higher than standard lines, with secondary market valuations appreciating by 15% annually. The marketing strategy leverages urgency and exclusivity, driving 48% higher engagement on digital platforms compared to permanent collections. Successful examples include Chanel's Coco Crush limited editions, which sold out within 72 hours despite price points exceeding $25,000. This approach not only fuels immediate revenue but also strengthens brand mythology, positioning pieces as future heirlooms and investment assets.

Market Segmentation and Flexible Pricing Structures

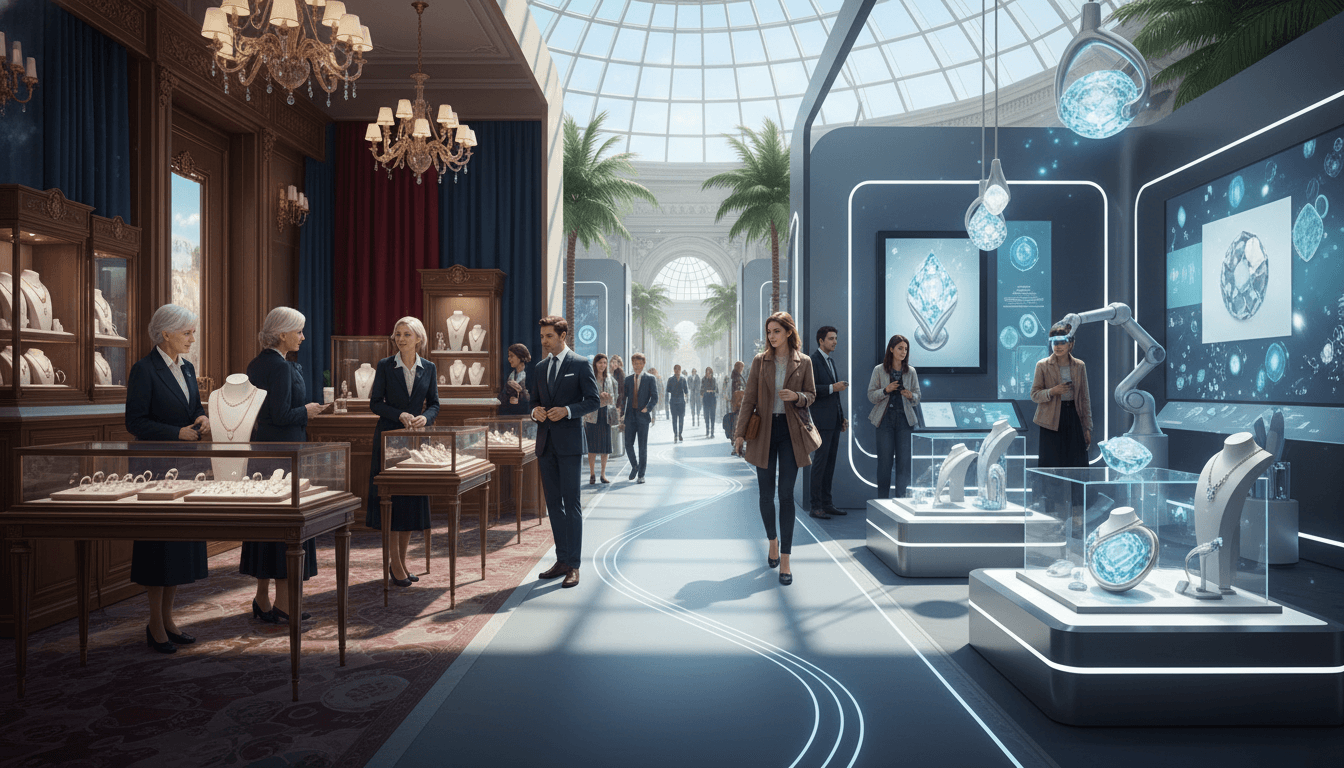

Sophisticated market segmentation enables luxury jewelry brands to implement diverse pricing levels across consumer cohorts. Analysis reveals three primary segments: iconic collections (40% of revenue) maintain stable pricing with annual 5-7% increases; seasonal lines (35% of revenue) employ dynamic pricing based on material cost fluctuations; and haute joaillerie (25% of revenue) utilizes completely personalized pricing. Geographic segmentation further diversifies strategies—European markets emphasize heritage value with 10-15% higher base prices, while Asian markets prioritize novelty and social signaling with limited-edition premiums. The flexible pricing strategy identified in source data allows brands to adjust margins between 55-80% while responding to currency volatility, supply chain disruptions, and shifting consumer preferences in real-time.

Craftsmanship and Material Innovation in Value Proposition

Beyond marketing strategies, intrinsic value drivers like craftsmanship and material innovation substantiate luxury jewelry pricing. Master artisans command fees exceeding $300 per hour for techniques such as serti neige snow setting or invisible gemstone mounting, adding $2,000-$15,000 to final prices. Material innovations include lab-grown colored diamonds with identical chemical properties to mined stones but 30% lower cost bases, enabling premium positioning at accessible price points. Sustainability certifications now influence 42% of purchase decisions, with responsibly sourced emeralds and recycled gold carrying 25% price premiums. These elements collectively reinforce the value narrative, justifying price points that transcend mere material worth to encompass artistic merit and ethical considerations.

Key Takeaways

Customization increases jewelry value by 40-200% through emotional connection and unique design

Limited edition collections drive 48% higher consumer engagement and secondary market appreciation

Market segmentation enables flexible pricing across geographic and demographic consumer cohorts

Craftsmanship and material innovation justify premium pricing beyond raw material costs

Balancing exclusivity with accessibility captures both aspirational and high-net-worth markets

Frequently Asked Questions

How does customization affect luxury jewelry pricing?

Customization significantly elevates pricing through bespoke design inputs, specialized craftsmanship, and unique material selections. Bespoke commissions typically increase base prices by 40-200%, with ultra-personalized pieces commanding premiums exceeding 300% for incorporating client heritage stories or rare gemstones.

Why are limited edition collections more valuable?

Limited editions leverage scarcity principles to create urgency and exclusivity. With production runs restricted to 50-200 pieces globally, these collections often appreciate 15% annually on secondary markets and command 3-5x price multiples compared to standard lines due to their collectible nature and brand narrative significance.

How do luxury jewelry brands balance exclusivity and market accessibility?

Brands employ tiered pricing strategies featuring entry-level collections ($1,500-$3,000) alongside haute joaillerie (starting at $50,000). This approach captures 65% of aspirational consumers while maintaining exclusivity for high-net-worth clients through bespoke services and limited availability, supported by geographic pricing adjustments of up to 20%.

What role does craftsmanship play in pricing dynamics?

Master craftsmanship constitutes 30-60% of final pricing through specialized techniques like invisible setting and hand-engraving. Artisan labor fees exceeding $300/hour, combined with years of training and unique artistic vision, transform raw materials into wearable art justifying substantial price premiums beyond material value alone.

Conclusion

The luxury jewelry market's pricing dynamics reflect an sophisticated evolution where tradition intersects with contemporary consumer expectations. Through strategic balancing of exclusivity and accessibility, leveraging customization as a value accelerator, and harnessing the power of limited editions, brands create multifaceted valuation frameworks. As market segmentation and flexible pricing strategies continue to mature, success will depend on maintaining artistic integrity while adapting to global economic shifts and sustainability demands. The future points toward even greater personalization and technological integration, ensuring luxury jewelry remains both emotionally resonant and economically viable in an increasingly competitive landscape.

Tags

Related Articles

Luxury Jewelry Market Evolution 2024-2032: Trends, Drivers, and Future Projections

The global luxury jewelry market is set for robust expansion, projected to grow from USD 61 billion in 2024 to USD 109 billion by 2032 at a CAGR of 7.55%. This growth is fueled by increasing consumer demand for sustainable, ethically sourced materials, gender-neutral designs, and personalized jewelry. Technological advancements and shifting market dynamics are reshaping the industry, offering opportunities for innovation and strategic brand positioning.

Luxury Jewelry Production and Sourcing: Navigating Ethical and Sustainable Transformations

The luxury jewelry industry is experiencing a paradigm shift driven by consumer demand for ethical sourcing, sustainable production methods, and supply chain transparency. Brands are increasingly adopting responsible manufacturing practices, with over 65% of luxury consumers prioritizing sustainability in purchasing decisions. This article explores how ethical frameworks, technological innovations, and transparent operations are reshaping production landscapes, enhancing brand loyalty, and meeting rigorous environmental standards. Key trends include blockchain for traceability, artisanal collaborations, and circular economy initiatives that reduce waste and carbon footprints.

Gold and Precious Metals in Luxury Jewelry: Market Dynamics, Investment Appeal, and Cultural Significance

Gold continues to dominate the luxury jewelry sector, serving dual roles as a premier material for high-end adornment and a robust investment vehicle. The market has witnessed a surge in demand, with gold prices increasing over 25% in the past year and key regions like India reporting a 5% rise in 2024. This growth is underpinned by gold's enduring cultural importance, economic stability, and a global market valuation of USD 59.7 billion in 2024. As per the World Gold Council Report, these trends highlight gold's resilience and appeal in an evolving luxury landscape.

Digital Innovation in Luxury Jewelry: Transforming Design, Personalization, and Engagement

Digital technologies are revolutionizing the luxury jewelry sector by enabling advanced design processes, immersive customer experiences, and unprecedented levels of personalization. Innovations such as 3D printing and augmented reality are driving rapid adoption, allowing brands to enhance craftsmanship and deepen consumer connections. This article examines how these tools are reshaping market strategies and setting new standards for luxury in the digital age.

Women's Role in Luxury Jewelry Market: Driving Growth and Redefining Design

Women are the dominant force in the luxury jewelry market, propelled by rising economic empowerment and shifting social dynamics. This article explores how women's increasing disposable income and evolving lifestyle needs are reshaping consumption patterns, fueling demand for versatile, meaningful designs that reflect personal identity and aspirations. From investment pieces to everyday luxury, female consumers are dictating market trends, with brands responding through collections that emphasize storytelling, sustainability, and individual expression.

Luxury Jewelry Market Transformation 2024-2032: Trends, Growth, and Future Outlook

The global luxury jewelry market is undergoing a profound transformation, projected to grow from USD 61.01 billion in 2024 to USD 109.22 billion by 2032 at a CAGR of 7.55%. Key drivers include evolving consumer demands for personalized, sustainable, and gender-neutral designs, alongside advancements in digital engagement and ethical sourcing. This article provides an in-depth analysis of market dynamics, regional trends, and strategic insights shaping the future of high-end jewelry.