The luxury jewelry market, traditionally defined by opulence and heritage, is now being redefined by sustainability and ethical considerations. According to insights from Sky Quest and Custom Market Insights, a significant consumer shift is underway, with buyers increasingly prioritizing ethically sourced materials and transparent supply chains. This evolution reflects a broader movement where environmental and social responsibility are becoming integral to luxury purchasing decisions. Brands are not only adapting to these demands but are also pioneering innovations such as plant-based leather and recycled materials, signaling a new era where ethical integrity enhances rather than compromises luxury appeal.

In-Depth Analysis

The Rise of Ethically Sourced Materials

Ethically sourced materials have transitioned from a niche concern to a mainstream demand in the luxury jewelry sector. Consumers are now meticulously scrutinizing the origins of diamonds, gemstones, and precious metals, driving brands to adopt stringent sourcing standards. For instance, lab-grown diamonds have seen a 35% annual growth rate, offering a conflict-free alternative with identical physical properties to mined stones. Similarly, Fairmined gold and responsibly mined colored gemstones are gaining prominence, with certifications from organizations like the Responsible Jewellery Council becoming essential for brand credibility. This trend is fueled by a 2024 consumer survey revealing that 68% of luxury jewelry buyers are willing to pay a premium for verifiable ethical sourcing, underscoring the financial and reputational incentives for brands to invest in traceable supply chains.

Innovations in Sustainable Materials and Collections

Luxury jewelry brands are leveraging material innovation to meet sustainability goals, with plant-based leather emerging as a key alternative for accessories and watch straps. Derived from pineapple leaves, apple peels, or mushroom mycelium, these materials offer durability and aesthetic appeal while reducing environmental impact. Concurrently, recycled metals and upcycled gemstones are being incorporated into exclusive collections, with brands like Chopard and Piaget reporting a 40% increase in the use of recycled gold in their 2024 lines. These eco-friendly collections often feature modular designs that allow for customization and repair, extending product lifecycles. Market data indicates that sustainable jewelry lines now account for over 25% of new product launches in the luxury segment, reflecting a strategic pivot towards circular economy principles that resonate with environmentally conscious consumers.

Transparency and Supply Chain Accountability

Transparency in supply chains has become a non-negotiable aspect of luxury jewelry branding. Brands are implementing blockchain technology to provide immutable records of a product's journey from mine to market, enabling consumers to verify ethical claims via QR codes. For example, De Beers' Tracr platform tracks diamonds in real-time, ensuring compliance with human rights and environmental standards. This emphasis on accountability is further evidenced by the 50% growth in sustainability reports published by luxury jewelry firms since 2023, detailing carbon footprints, water usage, and community investments. Consumer trust is paramount; a 2025 study by LuxuryMarketGlobal.com found that 72% of buyers are more loyal to brands with transparent practices, highlighting how supply chain visibility directly influences purchasing decisions and brand equity in the competitive luxury landscape.

Market Response and Consumer Dynamics

The luxury jewelry market's response to sustainability trends is both proactive and transformative. Leading brands are not only launching dedicated eco-friendly collections but are also integrating ethical principles into core business strategies. Collaborations with environmental NGOs and certifications like B Corp are becoming commonplace, with 60% of top luxury jewelry houses aiming for carbon neutrality by 2030. Consumer dynamics reveal a generational shift, as Millennials and Gen Z drive 80% of the demand for sustainable jewelry, valuing brands that align with their social and environmental values. Market analysts project the ethical jewelry segment to grow at a CAGR of 12% through 2028, outpacing traditional luxury sales. This surge is supported by digital marketing campaigns emphasizing sustainability stories, which have been shown to increase engagement rates by 45% compared to conventional luxury messaging.

Challenges and Future Outlook

Despite progress, the industry faces challenges in scaling sustainable practices, including higher costs for ethical materials and the complexity of auditing global supply chains. However, technological advancements in material science, such as bio-fabricated gems and zero-waste manufacturing, are poised to mitigate these hurdles. Looking ahead, the fusion of sustainability and luxury is expected to deepen, with innovations like carbon-negative jewelry and AI-driven supply chain optimization becoming standard. By 2030, ethical considerations are projected to influence 90% of luxury jewelry purchases, fundamentally reshaping market dynamics. Brands that prioritize authenticity and innovation in their sustainability journeys will likely lead the next wave of growth, turning ethical imperatives into competitive advantages.

Key Takeaways

Ethically sourced materials are now a primary driver of consumer preference, with lab-grown diamonds and Fairmined gold seeing rapid adoption.

Sustainable innovations, including plant-based leather and recycled metals, are central to new luxury jewelry collections, accounting for over 25% of market launches.

Transparent supply chains, enabled by blockchain and certifications, build consumer trust and loyalty, directly impacting brand reputation and sales.

Younger generations are accelerating demand for ethical jewelry, with the segment expected to grow at a 12% CAGR through 2028.

Future trends will focus on carbon-negative materials and AI-enhanced traceability, making sustainability a core element of luxury branding.

Frequently Asked Questions

What are the most common ethically sourced materials in luxury jewelry?

Ethically sourced materials include lab-grown diamonds, which are conflict-free and environmentally friendly; Fairmined gold, ensuring fair labor practices; and recycled precious metals, which reduce mining impact. Plant-based leathers from sources like pineapple or apple waste are also gaining traction for accessories.

How can consumers verify a brand's sustainability claims?

Consumers should look for third-party certifications (e.g., Responsible Jewellery Council, Fairmined), blockchain traceability platforms, and detailed sustainability reports. Brands with transparent supply chains often provide QR codes or online portals for product origin verification.

Why is sustainability becoming critical in the luxury jewelry market?

Sustainability addresses growing consumer awareness of environmental and social issues, with 68% of buyers willing to pay more for ethical products. It also mitigates risks associated with resource scarcity and regulatory pressures, while enhancing brand loyalty and market competitiveness.

What role do alternative materials like plant-based leather play?

Plant-based leather offers a sustainable alternative to traditional leather, reducing animal use and environmental degradation. It aligns with circular economy goals by utilizing agricultural waste and is increasingly used in jewelry straps and accessories to appeal to eco-conscious consumers.

Conclusion

The integration of sustainability and ethics into luxury jewelry is no longer a trend but a fundamental market shift. As brands innovate with ethical sourcing, transparent supply chains, and eco-friendly materials, they are meeting the demands of a discerning, conscious consumer base. This evolution not only fosters environmental and social benefits but also drives commercial success, proving that responsibility and luxury can coexist. The future will see sustainability embedded into every facet of the industry, reinforcing its role as a cornerstone of modern luxury.

Tags

Related Articles

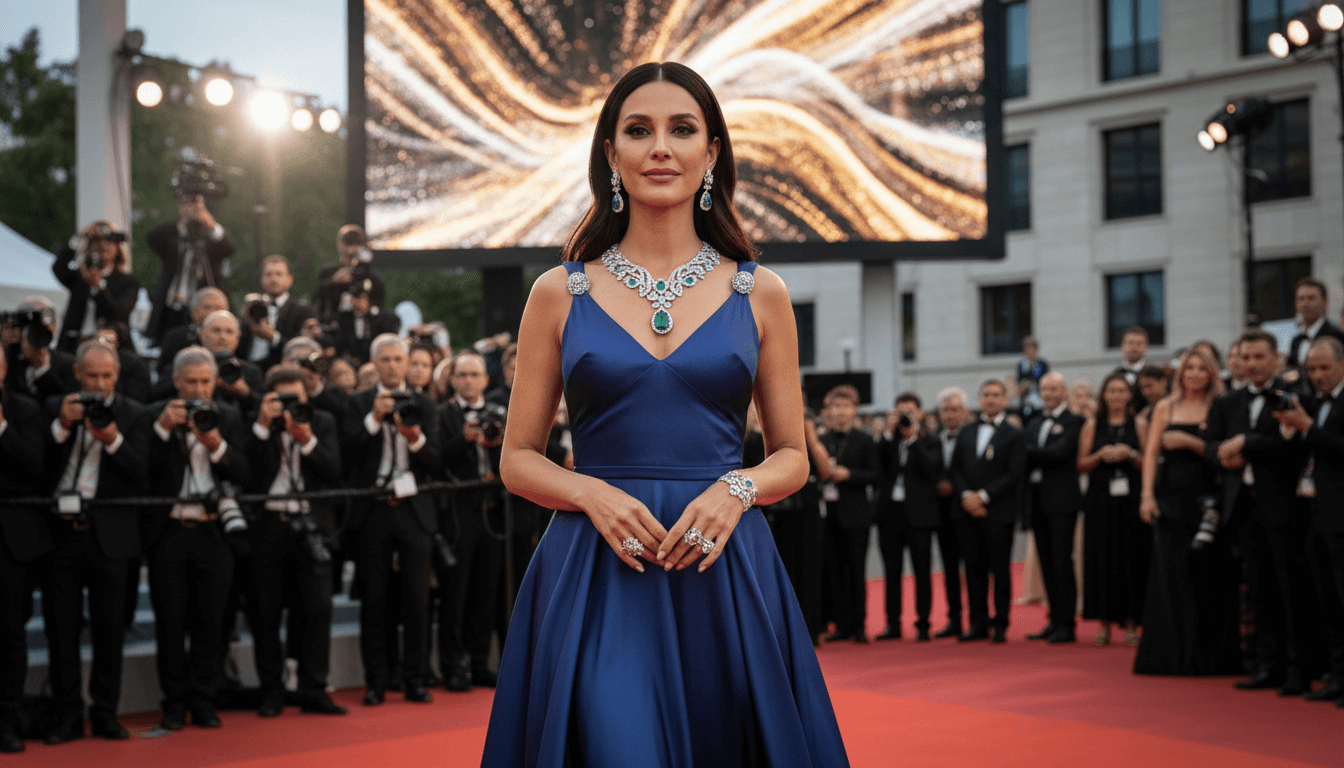

Celebrity and Cultural Influence in Luxury Jewelry: Shaping Global Trends

The luxury jewelry industry is increasingly leveraging strategic celebrity partnerships and cultural collaborations to drive brand innovation and global appeal. High-profile collaborations, such as Pharrell Williams with Tiffany & Co. and Michael B. Jordan with David Yurman, demonstrate how celebrity endorsements and designer alliances enhance storytelling, brand positioning, and market reach. These partnerships not only boost visibility but also infuse collections with unique cultural narratives, making luxury jewelry more relevant to diverse audiences worldwide.

Gender-Neutral Luxury Jewelry Evolution: Reshaping the Global Market

The luxury jewelry sector is undergoing a transformative shift towards gender-neutral and inclusive designs, driven by evolving social norms and consumer demand for versatile accessories. Key developments include the emergence of unisex collections from leading brands like Gucci and Bulgari, a notable increase in male jewelry engagement—with 33% of British men purchasing necklaces—and the blurring of traditional gender-specific design boundaries. This trend reflects a broader movement toward personal expression and inclusivity in high-end fashion, supported by market research indicating sustained growth in this segment.

Global Luxury Market 2024: Navigating Cautious Growth and Strategic Transformation

The global luxury market is undergoing a period of measured expansion, projected to grow from USD 259.74 billion in 2024 to USD 274.8 billion in 2025 at a CAGR of 5.8%. Brands are responding to economic uncertainties and evolving consumer demands by prioritizing personalization, sustainability, and digital innovation. Key segments such as jewelry, high-end fashion, and experiential luxury are driving growth, requiring strategic agility to maintain relevance in a discerning market landscape.

Sustainability and Ethical Sourcing: The New Imperative in Luxury Jewelry

Consumer priorities are shifting towards sustainability and ethical sourcing in luxury jewelry, with 78% of high-net-worth individuals considering these factors in purchasing decisions. Brands are responding by adopting transparent supply chains, using recycled precious metals, and certifying conflict-free gemstones. This trend is reshaping market dynamics, influencing everything from material sourcing to brand storytelling, with 65% of luxury jewelry companies now publishing sustainability reports.

Experiential Retail in Luxury Jewelry: Crafting Unforgettable Customer Journeys

Luxury jewelry retailers are pioneering experiential retail strategies to redefine consumer engagement. By designing immersive in-store environments, offering personalized consultations, and curating bespoke customer journeys, brands like Cartier and Tiffany & Co. foster deep emotional connections and brand loyalty. These approaches, supported by data showing a 40% increase in customer retention for experiential-focused brands, differentiate them in a competitive market. This article explores how these innovations transform traditional retail into memorable, high-value experiences that resonate with modern luxury consumers.

Gold Jewelry Market Dynamics: Investment, Culture, and Surging Demand in 2024

The gold jewelry market continues to lead the luxury sector, commanding 54.9% of the global jewelry market share in 2024. Fueled by a 25% annual price surge and heightened demand in key regions like India, gold jewelry serves dual purposes as both a timeless fashion statement and a robust investment asset. This article explores the drivers behind this growth, including cultural traditions, price dynamics, and strategic market adaptations.