Gold jewelry remains the cornerstone of the global luxury market, blending millennia of cultural heritage with modern investment appeal. In 2024, the sector demonstrates remarkable resilience and growth, with gold jewelry accounting for 54.9% of the entire jewelry market. Driven by a 25% annual price increase and a 5% demand surge in India, consumers and investors alike are increasingly turning to gold as a safe-haven asset and a symbol of enduring elegance. This analysis delves into the multifaceted dynamics shaping the gold jewelry landscape, from economic factors and consumer behavior to regional trends and future projections.

In-Depth Analysis

Market Dominance and Share Analysis

Gold jewelry's 54.9% market share in 2024 underscores its unparalleled position in the luxury sector. This dominance is attributed to gold's intrinsic value, historical prestige, and versatility across product categories such as necklaces, bracelets, rings, and earrings. Regions like Asia-Pacific and the Middle East contribute significantly to this share, with India alone witnessing a 5% increase in gold demand in 2024. The market's robustness is further evidenced by its resilience to economic fluctuations, as gold jewelry consistently outperforms other luxury segments during periods of inflation and geopolitical uncertainty. Key players, including Cartier, Tiffany & Co., and local artisans, continue to innovate with designs that cater to both traditional and contemporary tastes, ensuring sustained consumer engagement.

Price Surge and Investment Appeal

The 25% year-over-year increase in gold prices has transformed consumer perceptions, positioning gold jewelry not merely as adornment but as a strategic investment. This price surge is driven by factors such as central bank purchases, inflationary pressures, and geopolitical tensions, which enhance gold's safe-haven status. Investors are increasingly allocating portfolios to physical gold assets, including jewelry, which offers liquidity and aesthetic value. For instance, high-carat gold pieces (e.g., 22K or 24K) have seen a 15% rise in sales among affluent demographics seeking wealth preservation. Additionally, certifications like the Responsible Jewellery Council (RJC) standards assure buyers of ethical sourcing, further bolstering confidence in gold as a reliable store of value amidst market volatilities.

Cultural Significance and Regional Demand

Cultural traditions remain a powerful driver of gold jewelry demand, particularly in markets like India, where gold is integral to festivals, weddings, and religious ceremonies. The 5% demand growth in India in 2024 reflects this deep-rooted significance, with households prioritizing gold acquisitions for generational wealth transfer. Similarly, in China and the GCC countries, gold jewelry symbolizes prosperity and social status, leading to seasonal sales spikes during events like Chinese New Year and Eid. Brands are leveraging these cultural ties through localized marketing campaigns and customized collections, such as temple jewelry in South Asia or intricate filigree work in the Mediterranean. This cultural embeddedness ensures that gold jewelry maintains its relevance across diverse consumer segments, from millennials embracing heirlooms to Gen Z adopting minimalist gold pieces for everyday wear.

Innovations and Market Adaptations

The gold jewelry sector is evolving through technological and design innovations that enhance accessibility and sustainability. Lab-grown gold alternatives, though niche, are gaining traction among eco-conscious consumers, while blockchain traceability solutions provide transparency in supply chains. Design-wise, lightweight and modular gold jewelry appeals to younger audiences seeking versatility, with sales of stackable rings and personalized pendants rising by 12% in 2024. Retail strategies have also adapted, with omnichannel experiences blending physical boutiques and digital platforms; for example, virtual try-ons and AR tools have increased online conversion rates by 18%. Collaborations between luxury brands and contemporary artists further inject freshness into the market, ensuring gold jewelry remains at the forefront of luxury innovation while honoring its timeless allure.

Key Takeaways

Gold jewelry holds 54.9% of the global jewelry market share in 2024, driven by cultural and investment demand.

A 25% annual price increase reinforces gold's role as a safe-haven asset, boosting consumer and investor interest.

India's gold demand grew by 5% in 2024, highlighting the importance of regional cultural practices.

Innovations in design and technology, such as lightweight pieces and blockchain traceability, are expanding market appeal.

Sustainability and ethical sourcing are becoming critical factors in purchasing decisions, influencing brand strategies.

Frequently Asked Questions

Why has gold jewelry maintained such a large market share?

Gold jewelry's 54.9% market share in 2024 stems from its dual role as a cultural symbol and investment vehicle. Its timeless appeal, coupled with rising gold prices, ensures sustained demand across demographics and regions.

How does the 25% gold price increase affect consumers?

The price surge makes gold jewelry more attractive as an investment, driving purchases for wealth preservation. However, it may also lead to higher retail prices, prompting brands to introduce flexible payment plans and lighter-weight options to maintain accessibility.

What factors contributed to the 5% demand growth in India?

India's demand growth is fueled by cultural events like weddings and festivals, economic recovery post-pandemic, and increased rural penetration. Government initiatives, such as the Gold Monetisation Scheme, have also encouraged formal gold acquisitions.

Are there sustainable alternatives to traditional gold jewelry?

Yes, lab-grown gold and recycled gold are gaining popularity, supported by certifications like RJC. Brands are also adopting eco-friendly practices, such as water-less polishing and carbon-neutral shipping, to appeal to environmentally conscious buyers.

Conclusion

The gold jewelry market in 2024 exemplifies the synergy between tradition and modernity, with its 54.9% market share and 25% price surge highlighting its enduring relevance. As cultural practices and investment motives continue to drive demand, particularly in key markets like India, the sector is poised for sustained growth. Innovations in design, technology, and sustainability will further enhance its appeal, ensuring gold jewelry remains a cornerstone of the global luxury landscape. Stakeholders, from brands to consumers, must navigate these dynamics strategically to capitalize on emerging opportunities while honoring gold's timeless legacy.

Tags

Related Articles

Celebrity Endorsements and Brand Collaborations: Reshaping the Luxury Jewelry Market

Celebrity partnerships and brand collaborations have become pivotal strategies in the luxury jewelry sector, driving brand visibility and consumer engagement. Notable collaborations like Tiffany & Co. x Pharrell Williams and brand ambassadors such as Michael B. Jordan for David Yurman exemplify this trend. These initiatives leverage influencer marketing and cross-industry alliances to appeal to diverse demographics, enhancing market reach and reinforcing brand prestige. This article explores the dynamics, impacts, and future directions of these high-profile partnerships in the evolving luxury landscape.

Investment and Collectible Jewelry Trends: Luxury Assets Redefining Market Dynamics

Luxury jewelry is evolving beyond adornment to become a strategic long-term investment, driven by growing demand for rare gemstones and limited-edition pieces. High-net-worth individuals are diversifying portfolios with tangible assets, fueling a market where jewelry serves dual purposes as a fashion statement and appreciating asset. This trend, supported by data from Credence Research, highlights the increasing valuation of collectible jewelry as a stable alternative investment in volatile economic climates.

Secondhand Luxury Jewelry Market Growth: Value, Sustainability, and Shifting Consumer Preferences

The secondhand luxury jewelry market is experiencing unprecedented growth, driven by consumer demand for value, sustainability, and unique pieces. According to Bain & Company, this trend reflects a broader shift in luxury consumption, with pre-owned items gaining mainstream acceptance. Key factors include economic considerations, environmental awareness, and the appeal of heritage and craftsmanship in jewelry, apparel, and leather goods. This article explores the market dynamics, consumer motivations, and future outlook for the thriving resale sector.

Luxury Jewelry Investment Trends: Merging Aesthetics with Financial Strategy

The luxury jewelry market is evolving as consumers increasingly recognize its dual role as a fashion statement and a viable investment asset. Driven by a surge in demand for rare gemstones and high-value collections, this trend reflects a strategic shift toward long-term value preservation. Industry reports highlight that jewelry now serves as a tangible financial asset, with investors seeking pieces that combine craftsmanship with potential appreciation. This comprehensive analysis explores the factors fueling this movement, from market dynamics to consumer motivations, offering insights into how luxury jewelry is redefining wealth management in the global luxury sector.

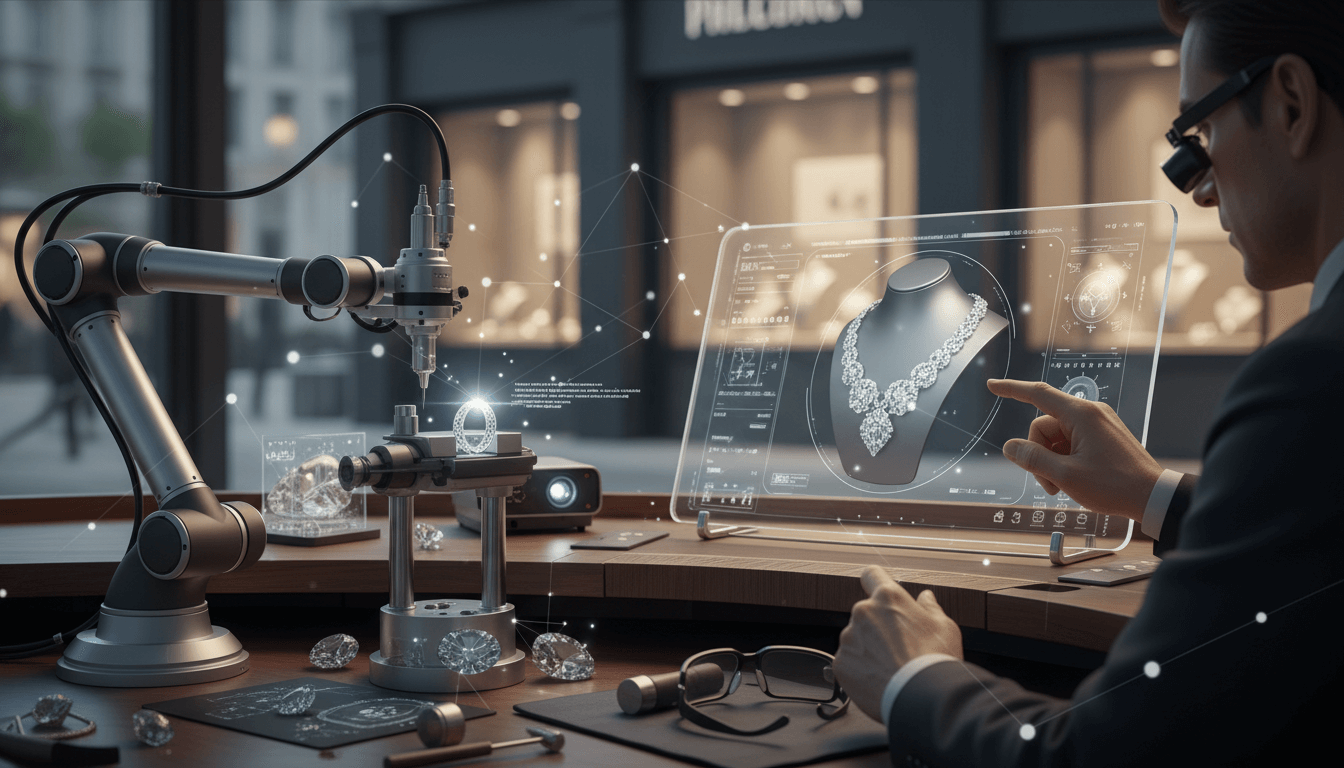

Technology Integration in Luxury Jewelry: Blending Craftsmanship with Innovation

The luxury jewelry market is undergoing a transformative shift as brands increasingly embed technology into their designs, merging traditional craftsmanship with cutting-edge digital elements. Innovations include smart jewelry with health monitoring and connectivity features, tech-enhanced designs using advanced materials like lab-grown diamonds and sustainable alloys, and revolutionary manufacturing techniques such as 3D printing and AI-driven customization. This trend not only enhances functionality and personalization but also appeals to a new generation of tech-savvy consumers, positioning the sector for sustained growth and innovation. According to Stellar Market Research, this integration is reshaping market dynamics and consumer expectations.

Digital Transformation in Luxury Jewelry Retail: Navigating E-Commerce, AR, and Influencer Marketing

The luxury jewelry sector is undergoing a profound digital transformation, driven by the expansion of e-commerce platforms, integration of augmented reality try-on features, and the rising influence of social media and influencer marketing. These innovations are reshaping consumer engagement, with personalized online experiences and advanced technologies enhancing accessibility and driving sales. Brands that adapt to these trends are poised to capture a larger share of the evolving market, as highlighted in the Global Luxury Market Digital Trends Report.