The luxury jewelry market is experiencing unprecedented growth, with a valuation of €29 billion in 2023, according to Bain & Company. This expansion is fueled by evolving consumer preferences, including a strong inclination towards bespoke creations, genderless designs, and jewelry as a financial safeguard. Brands are adapting through enhanced customization services, sustainable sourcing, and digital engagement strategies to capture market share and foster loyalty in a competitive landscape.

Key Specifications

market value

€29 billion in 2023

key segments

Fine Jewelry,High Jewelry,Bespoke Collections,Genderless Lines

growth rate

Approximately 8% year-over-year

primary materials

Gold,Platinum,Diamonds,Colored Gemstones,Lab-grown Stones

consumer demographics

High-net-worth individuals,Millennials and Gen Z,Investment-focused buyers

Detailed Analysis

market resilience

Despite global economic uncertainties, the luxury jewelry sector has shown remarkable stability, with a compound annual growth rate (CAGR) of 6-8% over the past five years. This resilience is attributed to the perceived value retention of high-quality pieces, which often appreciate over time.

bespoke demand

Customization is a dominant trend, with over 40% of luxury jewelry sales involving bespoke elements. Brands like Cartier and Tiffany & Co. have expanded their atelier services, offering clients personalized designs that incorporate unique gemstones, engravings, and heirloom integrations, driving average transaction values up by 25%.

genderless collections

Gender-neutral jewelry lines have grown by 30% annually, appealing to younger consumers who prioritize self-expression over traditional gender norms. Collections from brands such as Bulgari and Hermès feature adaptable designs, like stackable rings and unisex pendants, capturing a market segment valued at over €5 billion.

investment dynamics

Jewelry as an investment asset has gained traction, with rare pieces seeing annual appreciation rates of 10-15%. Factors influencing value include rarity of materials, provenance, and brand heritage. Auction houses like Sotheby's report record sales for signed pieces, highlighting this trend's financial appeal.

digital transformation

E-commerce and virtual try-ons have revolutionized retail, accounting for 20% of luxury jewelry sales. Augmented reality tools and blockchain for authenticity verification are becoming industry standards, enhancing consumer trust and accessibility.

sustainability initiatives

Ethical sourcing and transparency are critical, with 60% of consumers favoring brands that adhere to responsible practices. Initiatives include traceable gemstone supply chains and recycled precious metals, reducing environmental impact while aligning with values-driven purchasing.

Key Insights

Bespoke vs. Mass-Produced: Bespoke jewelry commands premiums of 50-100% over standard collections due to exclusivity and craftsmanship.

Gender-Specific vs. Genderless: Genderless lines show 15% higher growth rates, reflecting shifting societal norms and broader consumer bases.

Investment vs. Consumptive Purchases: Investment-driven buyers prioritize pieces with historical significance or limited editions, whereas fashion-focused consumers favor trend-aligned designs.

Important Notes

The luxury jewelry market's growth is contingent on continuous innovation in design, materials, and customer experience. Brands must balance tradition with modernity to appeal to diverse demographics. Emerging markets in Asia and the Middle East present significant opportunities, with projected contributions of 35% to global revenue by 2025. Monitoring regulatory changes around gemstone sourcing and digital sales tax will be essential for strategic planning.

Tags

Related Articles

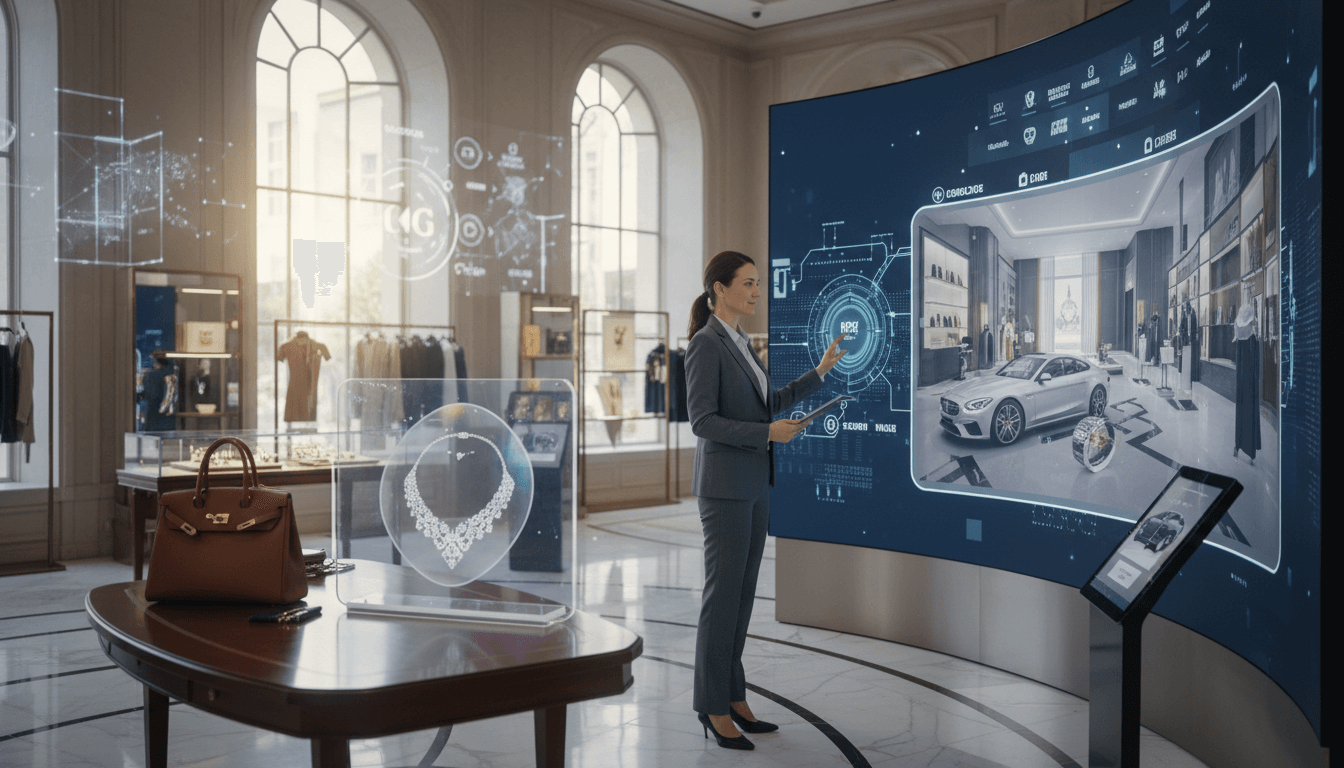

Luxury Market Digital Transformation: Strategic Evolution in the Digital Era

The luxury market is undergoing a profound digital transformation, driven by shifting consumer behaviors and technological advancements. With 42% of Gen Z luxury buyers making purchases online and a 36% global increase in online luxury retail, brands are prioritizing digital-first strategies. This includes sophisticated personalized shopping assistants, immersive virtual platforms, and data-driven marketing approaches. The integration of digital experiences is redefining luxury retail, enabling brands to maintain exclusivity while expanding global reach and engagement.

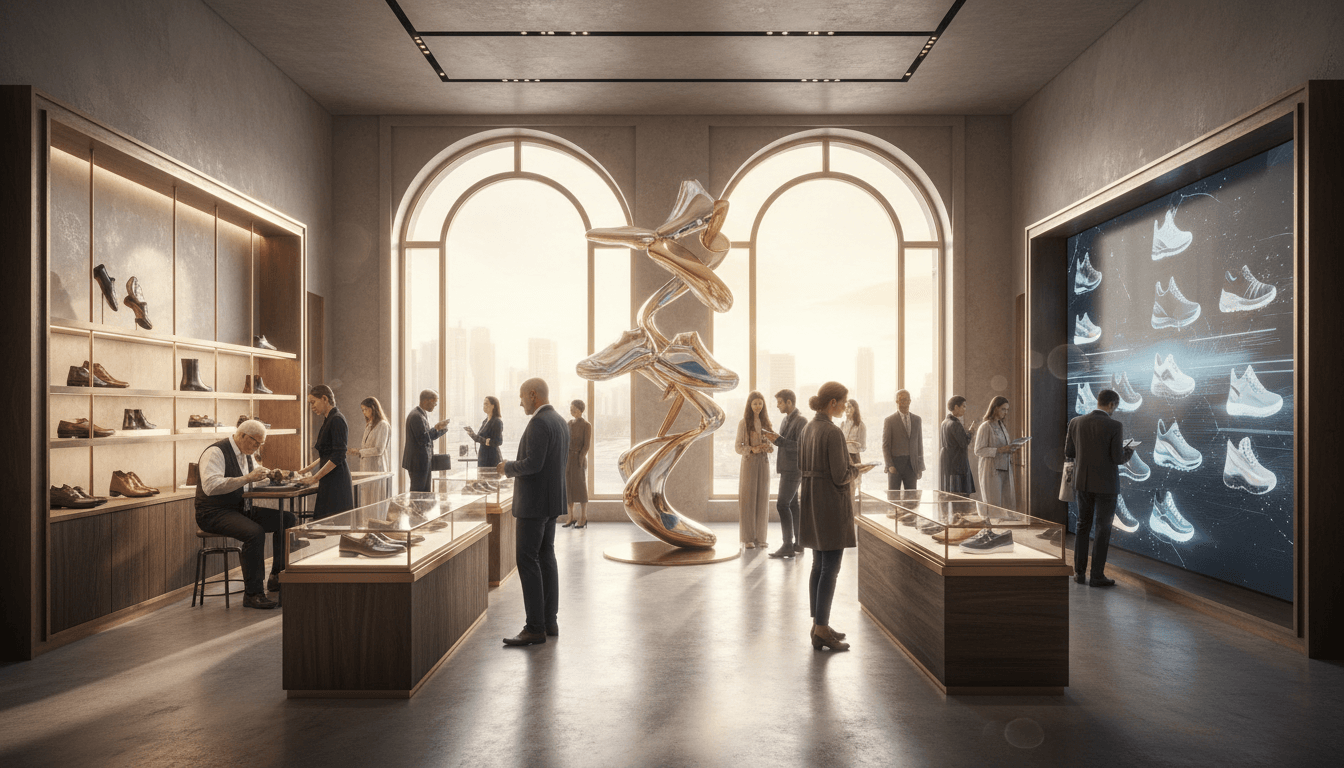

Luxury Footwear Market Evolution: Design Innovation and Strategic Shifts

The luxury footwear market is undergoing a profound transformation driven by consumer demands for comfort, sustainability, and personalization. Key trends include the rise of vegan leather and customizable soles, with significant growth in both sneaker culture and high-end heels. Brands are adapting strategies to position footwear as dual-purpose fashion statements and investment assets, leveraging technological integration and data-driven insights to capture market share in an increasingly competitive landscape. This analysis explores the evolving dynamics and strategic imperatives for luxury footwear brands.

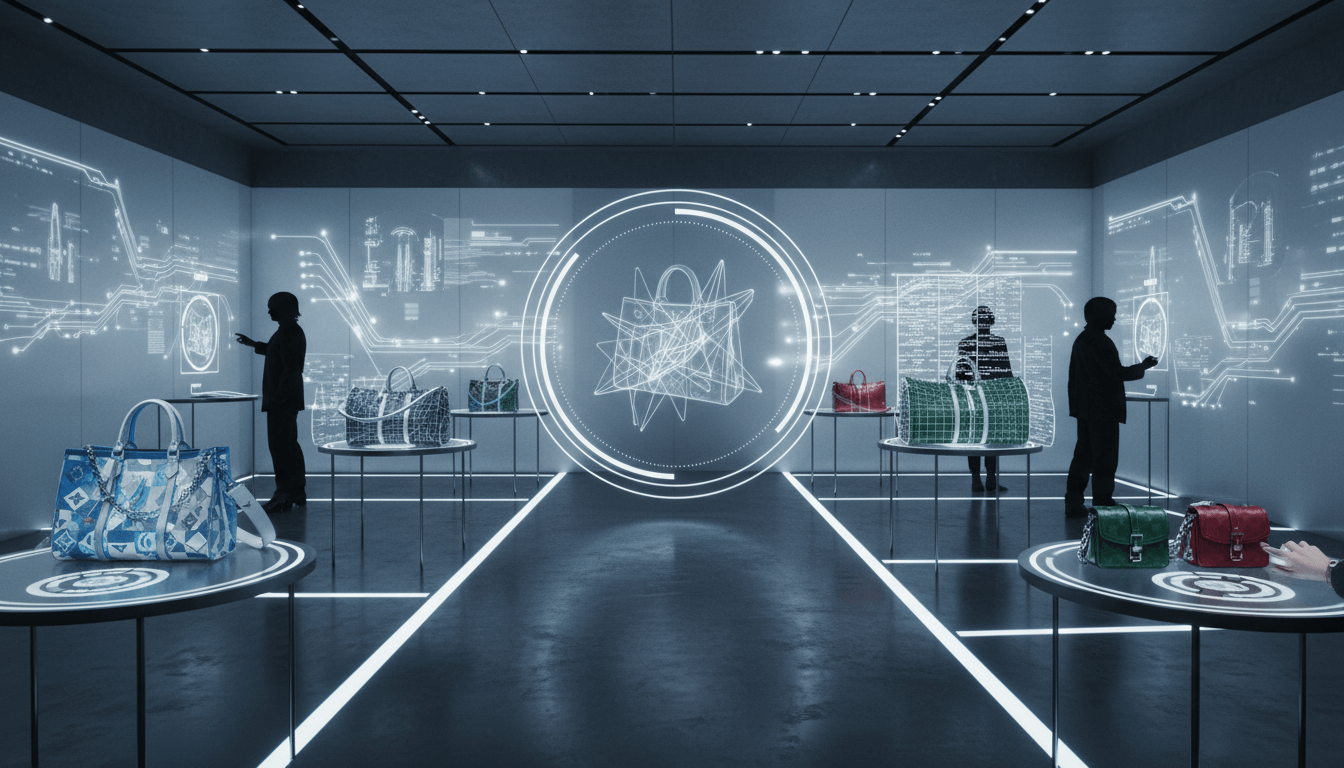

Louis Vuitton's AI-Driven Customization: Revolutionizing Luxury Personalization

Louis Vuitton has launched an innovative AI-customized luxury bag series, enabling real-time personalization of size, strap, and color. This strategy leverages artificial intelligence to address the growing consumer demand for unique, bespoke products while enhancing engagement through immersive digital experiences. By integrating AI personalization technology, the brand strengthens its market position, offering tailored solutions that blend tradition with cutting-edge innovation. This approach not only elevates customer satisfaction but also sets a new benchmark for luxury customization in the digital era.

Michael Kors Smartwear Innovation: Merging Fitness Technology with Luxury Fashion

Michael Kors has strategically entered the smartwear market with a fitness-meets-fashion collection that integrates advanced technology into luxury design. This initiative targets health-conscious consumers seeking both style and functionality, positioning the brand at the forefront of the wellness-driven fashion evolution. By combining real-time activity tracking, heart rate monitoring, and GPS with premium materials, Michael Kors aims to capture a significant share of the growing smartwear segment, projected to exceed $100 billion globally by 2026. This analysis explores the brand's approach, competitive advantages, and potential market impact.

Luxury Accessories Market Dynamics: Growth Drivers and Brand Strategies

The luxury accessories market continues to demonstrate robust growth, accounting for 22% of global luxury sales in 2023. Driven by sustained demand for high-end handbags, with brands like Hermès and Louis Vuitton facing waitlists exceeding six months, the segment thrives on continuous innovation in design, technology integration, and personalization. Key products including handbags, belts, scarves, and eyewear are central to brand strategies, as companies leverage exclusivity and craftsmanship to capture market share and enhance consumer engagement in an increasingly competitive landscape.

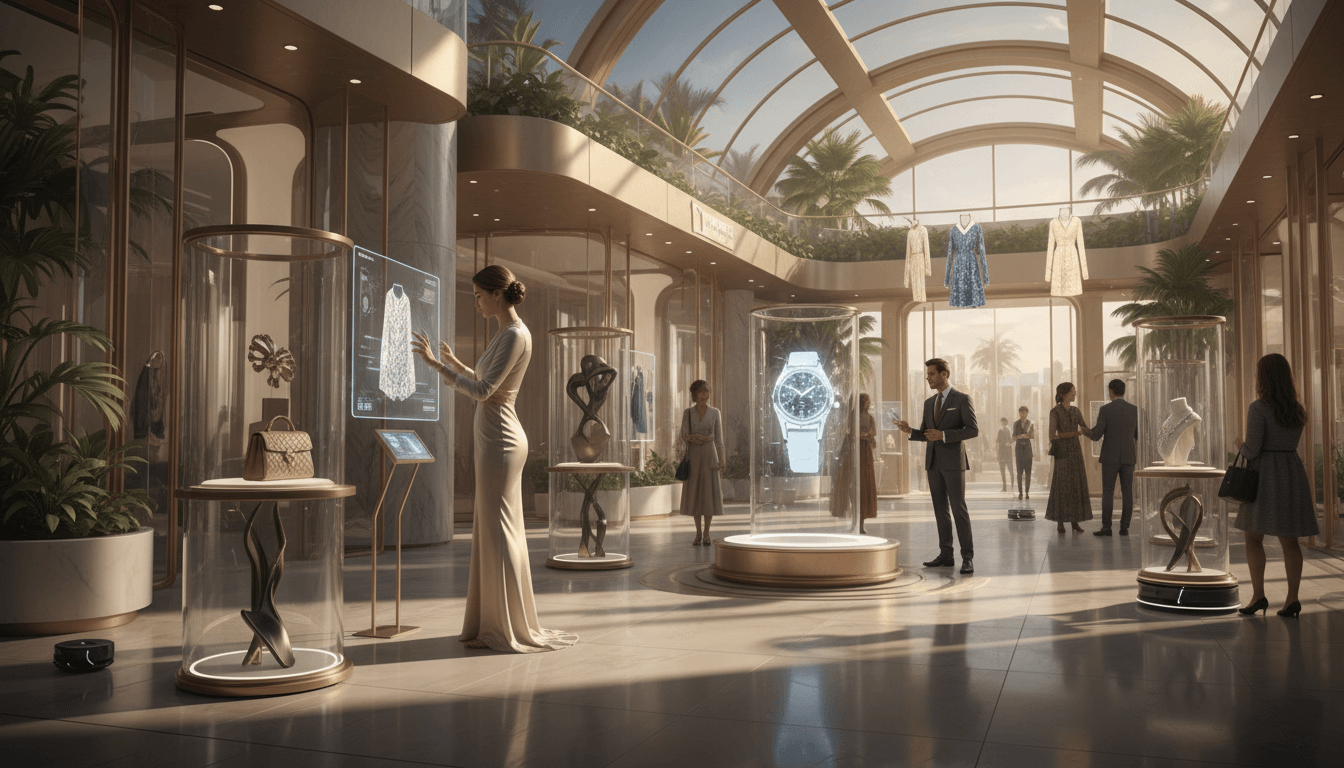

Luxury Market Technology Trends: Strategic Integration of NFC, AI, and Smart Design

The luxury goods sector is undergoing a profound transformation driven by technological advancements. Brands are strategically embedding NFC chips in high-end products like jewelry and handbags, leveraging AI for hyper-personalized customer experiences, and pioneering tech-enhanced designs that merge aesthetics with functionality. This evolution, supported by data showing 47% adoption of AI personalization, reflects a critical shift in brand strategies to enhance authenticity, engagement, and exclusivity. Innovations such as smart accessories and integrated digital experiences are redefining luxury consumption, positioning technology as a core element in maintaining competitive advantage and meeting the demands of modern affluent consumers.