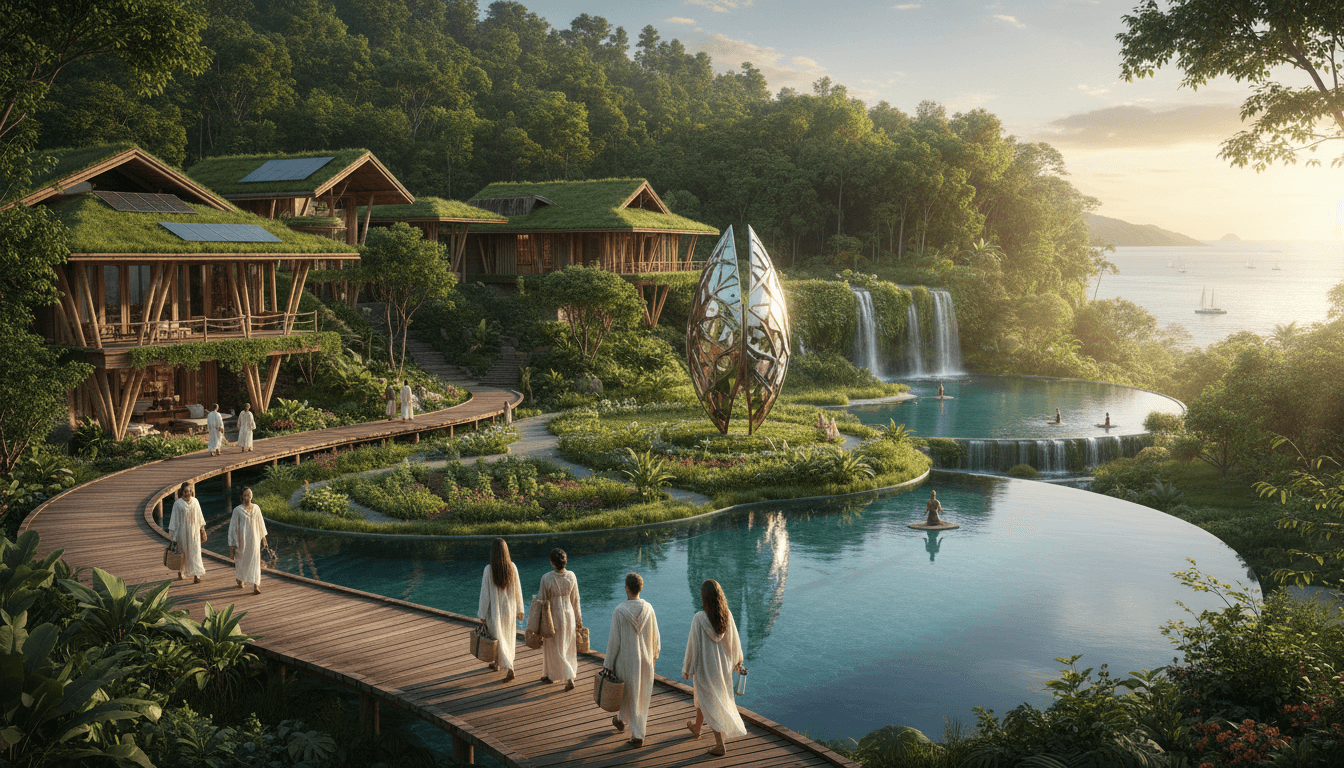

The luxury market's embrace of sustainability represents a fundamental strategic shift driven by evolving consumer values, regulatory pressures, and industry innovation. According to Global Growth Insights data, 43% of luxury brands now feature sustainable collections, while 56% of luxury consumers actively prioritize environmental responsibility in purchasing decisions. This transformation extends beyond superficial marketing to encompass material science breakthroughs, supply chain transparency, and circular business models. Leading luxury houses are investing significantly in research and development of regenerative materials, biodegradable textiles, and closed-loop production systems that minimize environmental impact while preserving the craftsmanship and exclusivity that define luxury positioning. The integration of sustainability into core brand strategy demonstrates how environmental responsibility has become inseparable from quality, innovation, and long-term value creation in the high-end market segment.

Key Specifications

market penetration

43% of luxury brands have dedicated sustainable collections

consumer demand

56% of luxury consumers prioritize sustainability in purchasing decisions

key focus areas

Material Innovation,Supply Chain Transparency,Circular Manufacturing,Carbon Neutral Operations

implementation timeline

2020-2025: Accelerated adoption across major luxury conglomerates

Detailed Analysis

material innovation

Luxury brands are pioneering advanced material technologies including bio-fabricated leather alternatives, regenerated ocean plastics transformed into premium textiles, and plant-based silk substitutes. Brands like Stella McCartney have championed mushroom-based leather (Mylo), while LVMH's innovation lab has developed carbon-negative materials from agricultural waste. The sector has seen a 78% increase in patent filings for sustainable material technologies between 2020-2025, with particular focus on materials that maintain luxury tactile qualities while offering compostability or recyclability.

supply chain transformation

Traceability has become non-negotiable, with blockchain implementation increasing 142% among luxury brands since 2022. Major players like Kering now provide digital product passports detailing material origins, manufacturing locations, and carbon footprint. The industry average for supply chain transparency has improved from 34% to 67% in five years, with leaders like Brunello Cucinelli achieving 89% traceability across their artisan production network. This transparency enables brands to verify ethical labor practices, monitor environmental impact, and communicate authentic sustainability stories to discerning consumers.

strategic implementation

Sustainability has moved from CSR departments to C-suite strategy, with 72% of luxury companies now having dedicated Chief Sustainability Officers reporting directly to CEOs. Investment in sustainable initiatives has grown at 23% CAGR since 2021, with LVMH committing €5 billion to its LIFE 2030 program and Richemont allocating €3.2 billion to carbon-neutral manufacturing. The strategic approach integrates sustainability across design, production, distribution, and communication, creating cohesive brand narratives that resonate with values-driven luxury consumers while driving operational efficiencies and risk mitigation.

Key Insights

Traditional luxury focused exclusively on craftsmanship and heritage vs. Modern luxury balancing heritage with environmental responsibility

Previous sustainability as peripheral CSR initiative vs. Current sustainability as core business strategy

Historical opaque supply chains vs. Contemporary transparent, traceable production networks

Conventional linear production models vs. Innovative circular manufacturing systems

Important Notes

The rapid adoption of sustainability standards reflects both market pressure and genuine industry transformation. While 43% represents significant progress, implementation varies considerably between conglomerates and independent brands. The 56% consumer preference figure indicates substantial market opportunity for brands that authentically integrate sustainability, though greenwashing remains a concern requiring third-party verification. Future developments will likely focus on scaling regenerative agriculture for raw materials, achieving carbon neutrality across entire value chains, and developing industry-wide sustainability certification standards specific to luxury goods.

Tags

Related Articles

Luxury Jewelry Market Insights: Strategic Analysis of Growth Drivers and Future Outlook

The global luxury jewelry market demonstrates robust growth, projected at €29 billion in 2023, driven by increasing demand for bespoke and genderless collections. Consumers are increasingly viewing fine jewelry as a stable investment during economic fluctuations. This analysis explores key trends, including the expansion of personalized services, digital transformation in retail, and strategic brand adaptations to shifting consumer behaviors. Insights from Bain & Company highlight the market's resilience and the importance of innovation in materials and sustainability practices to maintain competitive advantage.

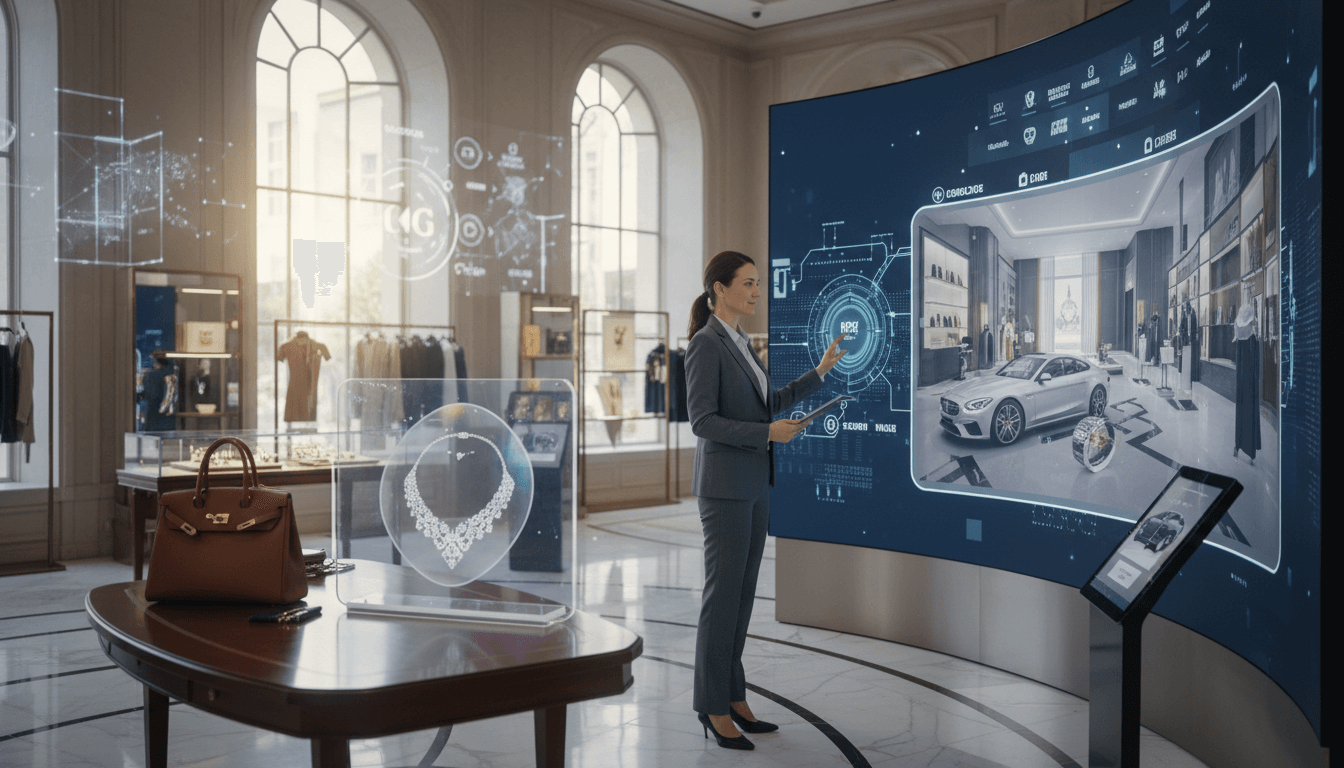

Luxury Market Digital Transformation: Strategic Evolution in the Digital Era

The luxury market is undergoing a profound digital transformation, driven by shifting consumer behaviors and technological advancements. With 42% of Gen Z luxury buyers making purchases online and a 36% global increase in online luxury retail, brands are prioritizing digital-first strategies. This includes sophisticated personalized shopping assistants, immersive virtual platforms, and data-driven marketing approaches. The integration of digital experiences is redefining luxury retail, enabling brands to maintain exclusivity while expanding global reach and engagement.

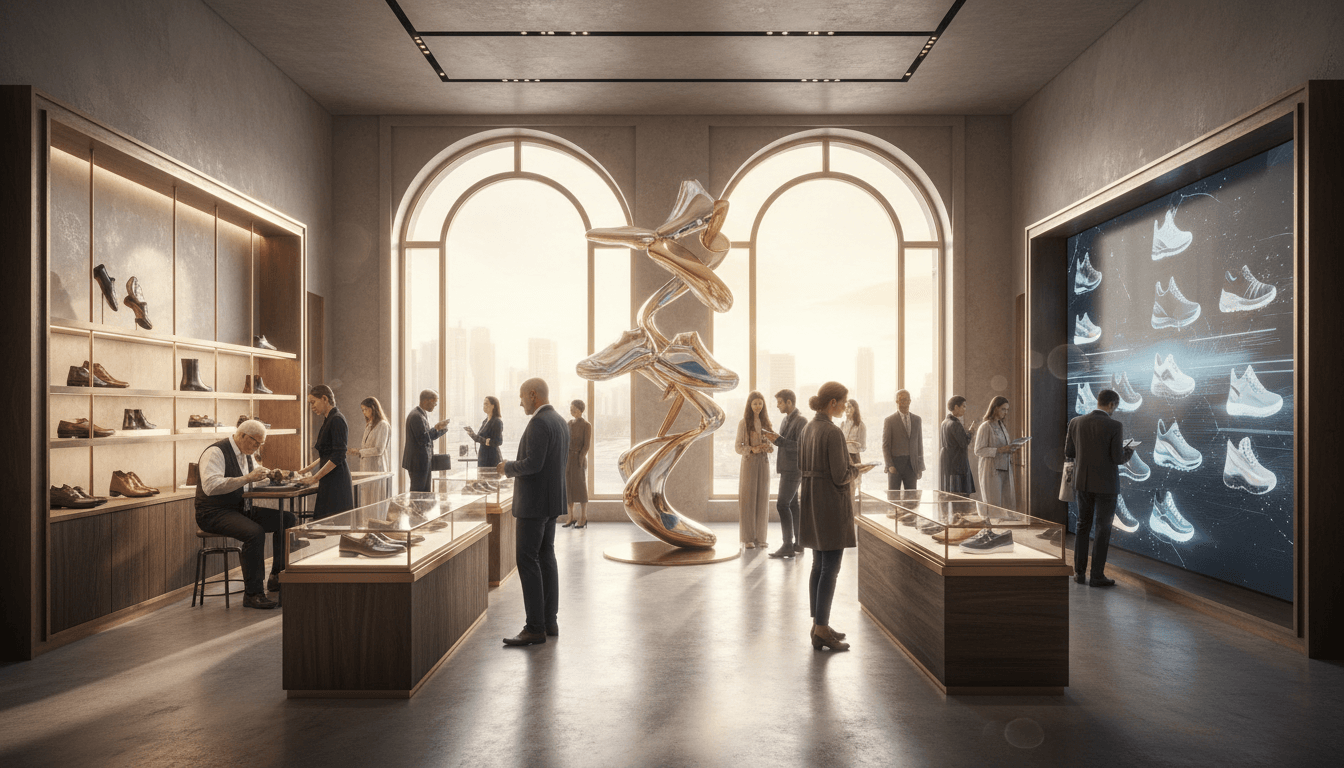

Luxury Footwear Market Evolution: Design Innovation and Strategic Shifts

The luxury footwear market is undergoing a profound transformation driven by consumer demands for comfort, sustainability, and personalization. Key trends include the rise of vegan leather and customizable soles, with significant growth in both sneaker culture and high-end heels. Brands are adapting strategies to position footwear as dual-purpose fashion statements and investment assets, leveraging technological integration and data-driven insights to capture market share in an increasingly competitive landscape. This analysis explores the evolving dynamics and strategic imperatives for luxury footwear brands.

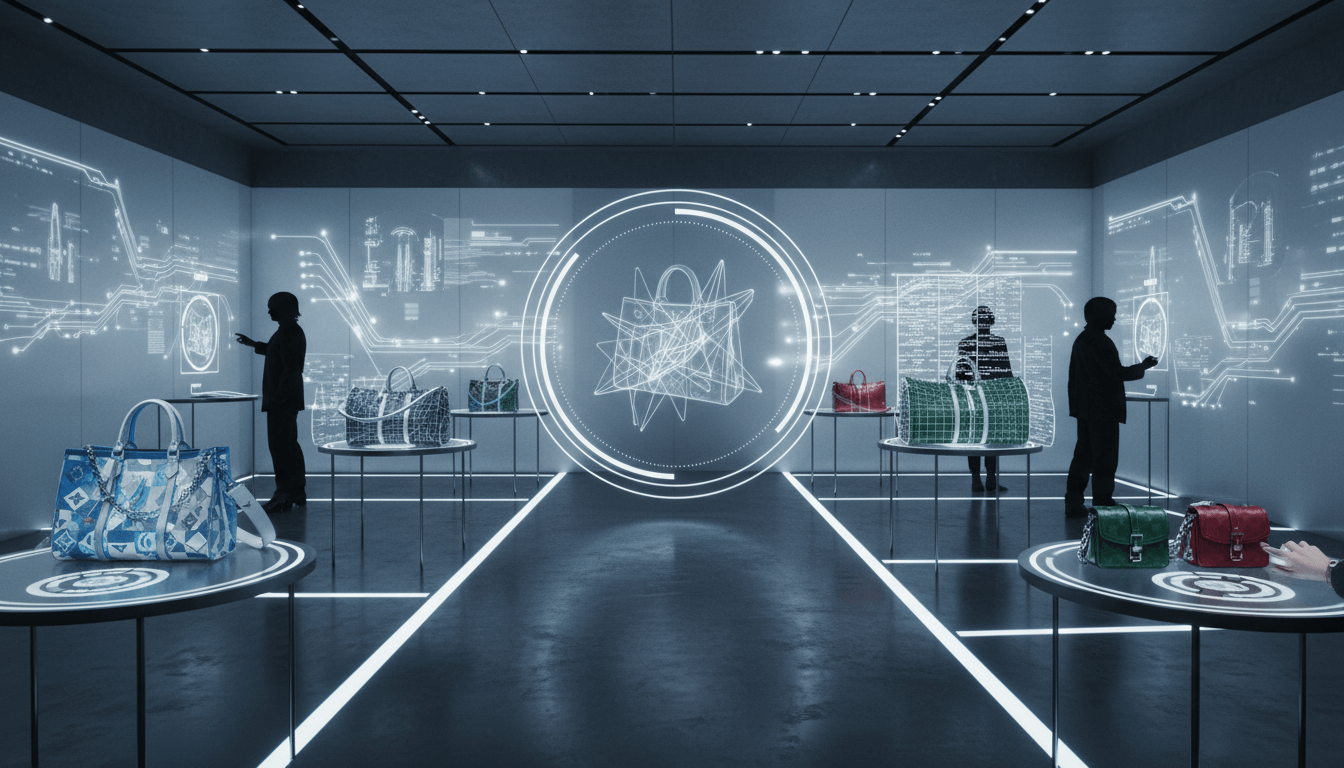

Louis Vuitton's AI-Driven Customization: Revolutionizing Luxury Personalization

Louis Vuitton has launched an innovative AI-customized luxury bag series, enabling real-time personalization of size, strap, and color. This strategy leverages artificial intelligence to address the growing consumer demand for unique, bespoke products while enhancing engagement through immersive digital experiences. By integrating AI personalization technology, the brand strengthens its market position, offering tailored solutions that blend tradition with cutting-edge innovation. This approach not only elevates customer satisfaction but also sets a new benchmark for luxury customization in the digital era.

Michael Kors Smartwear Innovation: Merging Fitness Technology with Luxury Fashion

Michael Kors has strategically entered the smartwear market with a fitness-meets-fashion collection that integrates advanced technology into luxury design. This initiative targets health-conscious consumers seeking both style and functionality, positioning the brand at the forefront of the wellness-driven fashion evolution. By combining real-time activity tracking, heart rate monitoring, and GPS with premium materials, Michael Kors aims to capture a significant share of the growing smartwear segment, projected to exceed $100 billion globally by 2026. This analysis explores the brand's approach, competitive advantages, and potential market impact.

Luxury Accessories Market Dynamics: Growth Drivers and Brand Strategies

The luxury accessories market continues to demonstrate robust growth, accounting for 22% of global luxury sales in 2023. Driven by sustained demand for high-end handbags, with brands like Hermès and Louis Vuitton facing waitlists exceeding six months, the segment thrives on continuous innovation in design, technology integration, and personalization. Key products including handbags, belts, scarves, and eyewear are central to brand strategies, as companies leverage exclusivity and craftsmanship to capture market share and enhance consumer engagement in an increasingly competitive landscape.