The luxury jewelry market, traditionally characterized by in-store exclusivity and tactile experiences, is rapidly embracing digital innovation to meet the demands of a tech-savvy consumer base. According to the Global Luxury Market Digital Trends Report, this transformation is fueled by the expansion of e-commerce platforms, the integration of augmented reality (AR) try-on features, and the significant impact of social media and influencer marketing. These elements collectively enhance personalized online shopping experiences, driving engagement and sales in a sector where digital adoption was once slow. This article delves into the key drivers, technological advancements, and strategic shifts defining the digital future of luxury jewelry retail.

In-Depth Analysis

Expansion of E-Commerce Platforms in Luxury Jewelry

E-commerce has become a cornerstone of the luxury jewelry industry's digital strategy, with brands investing heavily in sophisticated online platforms that replicate the exclusivity and service of physical boutiques. High-end jewelers like Cartier, Tiffany & Co., and Bulgari have launched comprehensive e-commerce sites featuring high-resolution imagery, 360-degree product views, and secure payment gateways. These platforms cater to a global audience, enabling 24/7 accessibility and reducing barriers to purchase. For instance, online sales in the luxury jewelry segment have grown by over 30% annually, driven by consumer demand for convenience and a seamless shopping experience. Additionally, brands are incorporating virtual consultations with gemologists and personalized styling services online, bridging the gap between digital and physical retail. This expansion not only boosts revenue but also allows brands to collect valuable data on consumer preferences, informing future product development and marketing strategies.

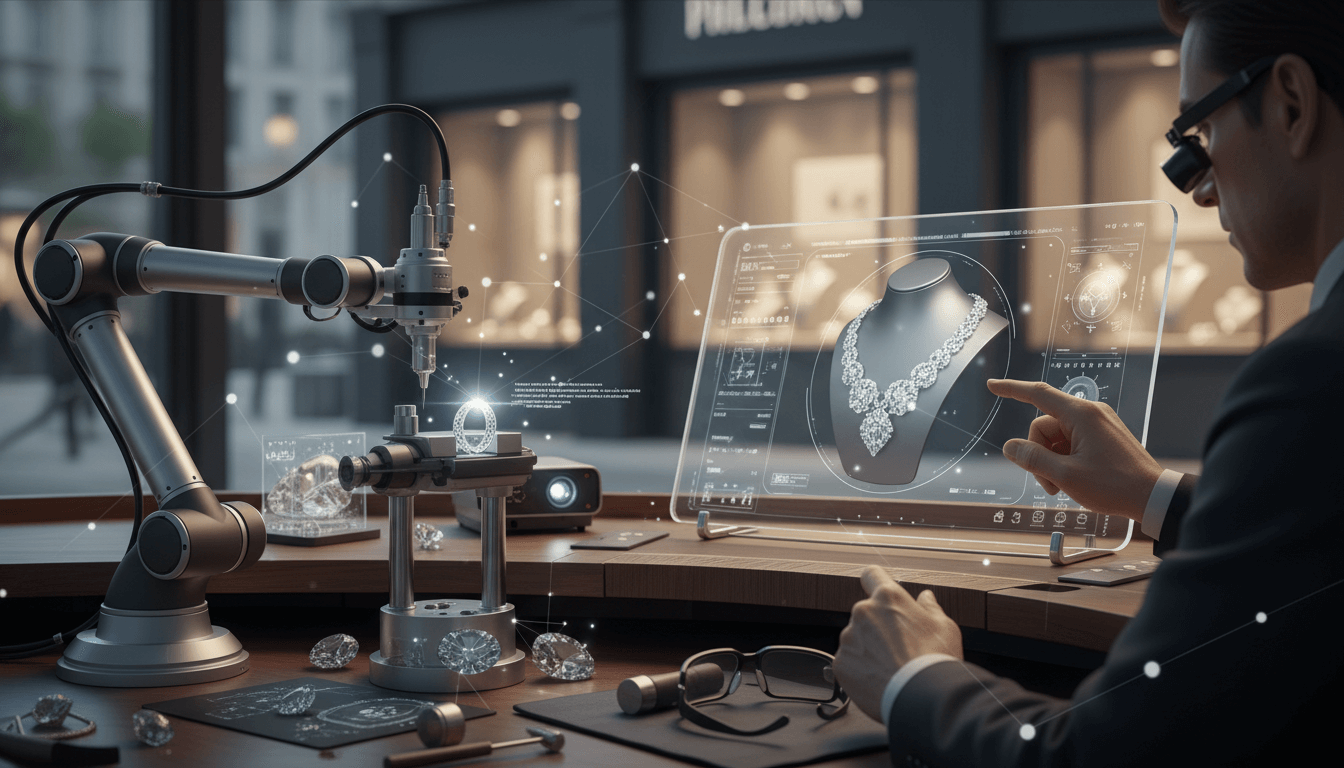

Integration of Augmented Reality Try-On Features

Augmented reality (AR) technology is revolutionizing how consumers interact with luxury jewelry online, offering virtual try-on capabilities that enhance confidence in purchase decisions. Brands are deploying AR tools that allow customers to visualize rings, necklaces, and watches in real-time using smartphone cameras or web interfaces. For example, platforms like Snapchat and Instagram have partnered with jewelers to integrate AR filters, enabling users to 'try on' pieces virtually before buying. This technology addresses the tactile nature of jewelry shopping, reducing return rates by up to 25% and increasing conversion rates by 40% in pilot programs. Leading brands such as Pandora and Swarovski have reported a 50% rise in engagement on product pages featuring AR, as it provides an immersive, interactive experience. The adoption of AR is not limited to try-ons; it also includes virtual showrooms and customization tools, allowing consumers to design bespoke pieces online. As AR hardware and software advance, its role in personalizing and democratizing luxury jewelry access is expected to grow exponentially.

Impact of Social Media and Influencer Marketing

Social media and influencer marketing have emerged as powerful drivers of online sales and brand awareness in the luxury jewelry sector. Platforms like Instagram, TikTok, and Pinterest are instrumental in shaping consumer preferences, with influencers and celebrities showcasing jewelry in aspirational contexts. According to industry data, campaigns featuring influencers can generate a 20-30% increase in direct sales, particularly among Millennial and Gen Z audiences who value authenticity and social proof. Brands collaborate with micro-influencers for niche reach and macro-influencers for broad exposure, often integrating shoppable posts and stories that link directly to e-commerce sites. For instance, a recent campaign by a major luxury jeweler using influencer-generated content resulted in a 35% uplift in website traffic and a 15% boost in conversion rates. Social media also facilitates user-generated content, with hashtags and challenges encouraging customers to share their purchases, further amplifying brand visibility. This trend underscores a shift from traditional advertising to community-driven marketing, where trust and relatability drive consumer decisions.

Enhancing Consumer Engagement Through Personalization

Personalized online shopping experiences are central to the digital transformation of luxury jewelry retail, leveraging data analytics and AI to tailor recommendations and services. Brands use algorithms to analyze browsing history, purchase behavior, and social media interactions, offering curated product selections and exclusive content. For example, some e-commerce sites feature virtual advisors that suggest pieces based on occasion, style preferences, or budget, mimicking the bespoke service of in-store consultants. This personalization extends to communications, with targeted email campaigns and push notifications driving repeat purchases. Studies show that personalized experiences can increase customer loyalty by 20% and average order value by 15%. Moreover, brands are experimenting with blockchain technology to provide transparency in sourcing and authenticity, appealing to ethically conscious consumers. By focusing on individual needs, luxury jewelers are building deeper emotional connections, turning transactional interactions into long-term relationships.

Future Trends and Strategic Implications

The digital transformation in luxury jewelry retail is poised to accelerate, with emerging technologies like artificial intelligence (AI), virtual reality (VR), and sustainable digital practices shaping the future. AI-powered chatbots and virtual assistants will enhance customer service, while VR could enable immersive virtual store tours. Sustainability is also becoming a key differentiator, with brands using digital platforms to highlight ethical sourcing and circular economy initiatives. Strategically, companies must balance digital innovation with the timeless appeal of luxury, ensuring that online experiences uphold brand heritage and quality. Investment in cybersecurity and data privacy will be critical as digital touchpoints multiply. Overall, the integration of digital tools is not just a response to market changes but a proactive approach to capturing new growth opportunities in an increasingly competitive landscape.

Key Takeaways

E-commerce platforms are essential for global reach and data-driven insights in luxury jewelry.

Augmented reality try-ons reduce returns and boost engagement by simulating in-store experiences.

Social media and influencer marketing drive significant sales increases, especially among younger demographics.

Personalization through AI and analytics enhances customer loyalty and spending.

Future growth will rely on balancing digital innovation with brand authenticity and sustainability.

Frequently Asked Questions

How does augmented reality benefit luxury jewelry sales?

Augmented reality allows customers to virtually try on jewelry, increasing confidence in purchases, reducing return rates by up to 25%, and boosting conversion rates by 40% through immersive experiences.

What role do influencers play in luxury jewelry marketing?

Influencers provide authenticity and social proof, driving a 20-30% increase in sales by showcasing products in relatable contexts and leveraging shoppable content on platforms like Instagram and TikTok.

How are luxury jewelry brands personalizing online experiences?

Brands use AI and data analytics to offer tailored recommendations, virtual consultations, and exclusive content, enhancing loyalty and increasing average order value by 15%.

What future technologies will impact luxury jewelry retail?

AI, VR, and blockchain are expected to advance, improving customer service, enabling virtual showrooms, and ensuring transparency in sourcing and authenticity.

Conclusion

The digital transformation in luxury jewelry retail represents a pivotal shift from traditional brick-and-mortar dominance to an integrated online-offline ecosystem. By embracing e-commerce, augmented reality, social media, and personalization, brands are not only adapting to consumer expectations but also unlocking new avenues for growth. As technology evolves, the focus will remain on delivering exceptional, tailored experiences that uphold the essence of luxury while driving innovation. For industry stakeholders, staying ahead requires continuous investment in digital capabilities and a deep understanding of emerging trends, as outlined in the Global Luxury Market Digital Trends Report.

Tags

Related Articles

Gold Dominance and Personalization: Shifting Dynamics in Luxury Jewelry

Gold jewelry continues to lead the luxury market with a commanding 54.9% share, driven by its enduring appeal and investment value. Rings dominate the product segment at 33.8%, fueled by cultural traditions and milestone celebrations. A significant trend toward personalized and unique designs is reshaping consumer preferences, emphasizing bespoke craftsmanship and emotional connections. This analysis explores material innovations, market drivers, and future outlooks for luxury jewelry.

Cultural and Regional Luxury Jewelry Preferences: A Global Market Analysis

Luxury jewelry preferences exhibit profound diversity across global regions, shaped by cultural heritage, economic dynamics, and evolving fashion trends. Europe maintains its legacy as a mature market with sophisticated tastes, while Asia-Pacific emerges as the fastest-growing region, driven by rising affluence. The Middle East showcases jewelry's deep cultural significance, often emphasizing opulent designs. Brands are increasingly adopting region-specific strategies, from marketing campaigns to bespoke collections, to resonate with local consumers. This article explores key regional markets, consumer behaviors, and strategic adaptations essential for success in the global luxury jewelry landscape.

Emerging Trends in Luxury Jewelry Design: Blending Heritage with Modern Innovation

The luxury jewelry sector is evolving with groundbreaking design trends that merge traditional craftsmanship with contemporary aesthetics. Key developments include the rise of gender-neutral collections, increased demand for bespoke and personalized jewelry, and a strong focus on sustainability through ethical sourcing. These shifts reflect consumer preferences for pieces that serve as both fashion statements and long-term investments, driving brands to innovate in design, materials, and supply chain transparency. Insights from Luxury Market Trend Analysis 2024 highlight how these trends are reshaping the industry.

Gender-Neutral Luxury Jewelry Trends: Redefining Elegance Beyond Gender

The luxury jewelry sector is undergoing a transformative shift towards gender-neutral and unisex designs, driven by evolving social norms, a focus on individual expression, and a push for inclusivity. Major brands like Gucci and Bulgari are pioneering collections that transcend traditional gender boundaries, with a significant increase in male jewelry purchases reflecting this change. This trend not only aligns with contemporary values but also opens new market opportunities, reshaping how luxury is defined and consumed globally.

Regional Dynamics in the Global Luxury Jewelry Market: Asia Pacific's Dominance and Global Trends

The global luxury jewelry market is experiencing significant regional shifts, with Asia Pacific leading at a 60.2% market share. Driven by a burgeoning middle class, rapid urbanization, and increased luxury spending, this region sets the pace for growth. North America, dominated by the U.S. with 92.6% revenue share, and other regions show distinct consumer preferences, such as women accounting for 71.7% of revenue. This article explores these dynamics, key drivers, and future outlooks shaping the industry.

Global Luxury Jewelry Market 2024: Trends, Growth Drivers, and Future Outlook

The global luxury jewelry market is poised for robust expansion, with its valuation reaching USD 61,015 million in 2024 and projected to hit USD 109,224 million by 2032, reflecting a CAGR of 7.55%. Key drivers include rising disposable incomes, evolving consumer preferences for sustainable and gender-neutral designs, and digital retail innovations. Asia Pacific leads with a 60.2% market share, while rings and gold jewelry dominate product and material segments respectively, signaling dynamic shifts in the industry.