In the realm of luxury jewelry, gold and other precious metals stand as timeless pillars, blending aesthetic elegance with tangible value. According to the World Gold Council Report, the global luxury jewelry market, valued at USD 59.7 billion in 2024, is experiencing a renaissance driven by gold's dual appeal as both a decorative element and a strategic investment. With gold prices surging over 25% in the past year and demand in key markets like India rising by 5% in 2024, this sector exemplifies resilience and growth. This article delves into the multifaceted role of gold, exploring its market dynamics, investment potential, cultural roots, and future trajectories, providing a comprehensive analysis for industry stakeholders and enthusiasts alike.

In-Depth Analysis

Gold as a Dual-Purpose Asset in Luxury Jewelry

Gold's unique position in the luxury jewelry market stems from its ability to serve as both a high-end material for craftsmanship and a reliable investment. Historically, gold has been prized for its luster, malleability, and resistance to tarnish, making it ideal for intricate designs from renowned houses like Cartier and Tiffany & Co. Beyond aesthetics, gold functions as a hedge against inflation and economic volatility. The World Gold Council Report notes that gold jewelry accounts for a significant portion of the overall gold demand, with investors often viewing premium pieces as liquid assets. In 2024, the market saw a notable shift, with consumers increasingly opting for 18-karat and 24-karat gold jewelry not just for adornment but as part of diversified portfolios. This trend is reinforced by gold's price appreciation of over 25% in the past year, encouraging buyers to perceive jewelry as a store of value. For instance, limited-edition gold collections from brands like Bulgari have seen resale values rise, aligning with broader economic patterns where precious metals outperform other commodities during uncertainties.

Market Demand and Regional Insights

The demand for gold jewelry is not uniform globally, with key regions driving growth through cultural and economic factors. India, a traditional hub for gold consumption, reported a 5% increase in demand in 2024, fueled by festivals, weddings, and gifting customs that emphasize gold's symbolic importance. The country's affinity for gold is deeply rooted in rituals, where jewelry represents prosperity and social status. Similarly, markets in the Middle East and East Asia have shown robust activity, with China's luxury sector integrating gold into modern designs to appeal to younger demographics. The global market value of USD 59.7 billion in 2024 reflects this regional diversity, supported by rising disposable incomes and urbanization. Data from the World Gold Council indicates that emerging economies contribute significantly to demand, while established markets in Europe and North America focus on high-margin, artisanal gold pieces. For example, in the U.S., sales of gold jewelry grew by 8% in early 2024, driven by sustainable and ethical sourcing trends. This regional analysis underscores how cultural nuances and economic conditions shape consumption patterns, making gold a dynamic component of the luxury landscape.

Cultural Significance and Symbolism of Precious Metals

Precious metals, particularly gold, carry profound cultural weight that transcends mere monetary value. Across civilizations, gold has symbolized power, purity, and eternity, influencing jewelry designs for millennia. In many cultures, such as in India and parts of Africa, gold jewelry is integral to ceremonies like weddings, where it signifies blessings and familial bonds. The World Gold Council Report highlights that this cultural embeddedness drives consistent demand, even during economic downturns. For instance, during the 2024 festival season in India, gold purchases accounted for over 60% of luxury jewelry sales, illustrating its role in tradition. Beyond gold, metals like platinum and silver also hold symbolic meanings; platinum is often associated with exclusivity and durability in Western markets, while silver features in artisanal pieces for its versatility. Luxury brands leverage these narratives to create collections that resonate with heritage, such as Chanel's incorporation of gold in their 'Coco Crush' line, which draws on historical motifs. This cultural dimension not only sustains demand but also fosters innovation, as designers blend traditional symbolism with contemporary aesthetics to cater to global audiences.

Investment Potential and Economic Stability

Gold's role as an investment asset within luxury jewelry has gained prominence, offering stability in volatile economic climates. The over 25% price increase in the past year, as reported by the World Gold Council, underscores its appeal amid inflation and geopolitical tensions. Investors often allocate portions of their portfolios to physical gold, including jewelry, due to its low correlation with equities and bonds. In 2024, the luxury jewelry segment saw a rise in 'investment-grade' pieces, such as solid gold chains and certified vintage items, which appreciate over time. For example, a study by LuxuryMarketGlobal.com found that gold jewelry resale values have increased by an average of 15% annually in key markets, outperforming many financial instruments. Additionally, gold's liquidity makes it a practical choice; auctions and specialized platforms facilitate easy trading of high-end jewelry. The market value of USD 59.7 billion in 2024 reflects this investment-driven demand, with institutions and high-net-worth individuals diversifying into precious metals. This economic stability is further bolstered by gold's finite supply and central bank purchases, which reinforce its long-term value proposition in the luxury sector.

Future Trends and Innovations in Gold Jewelry

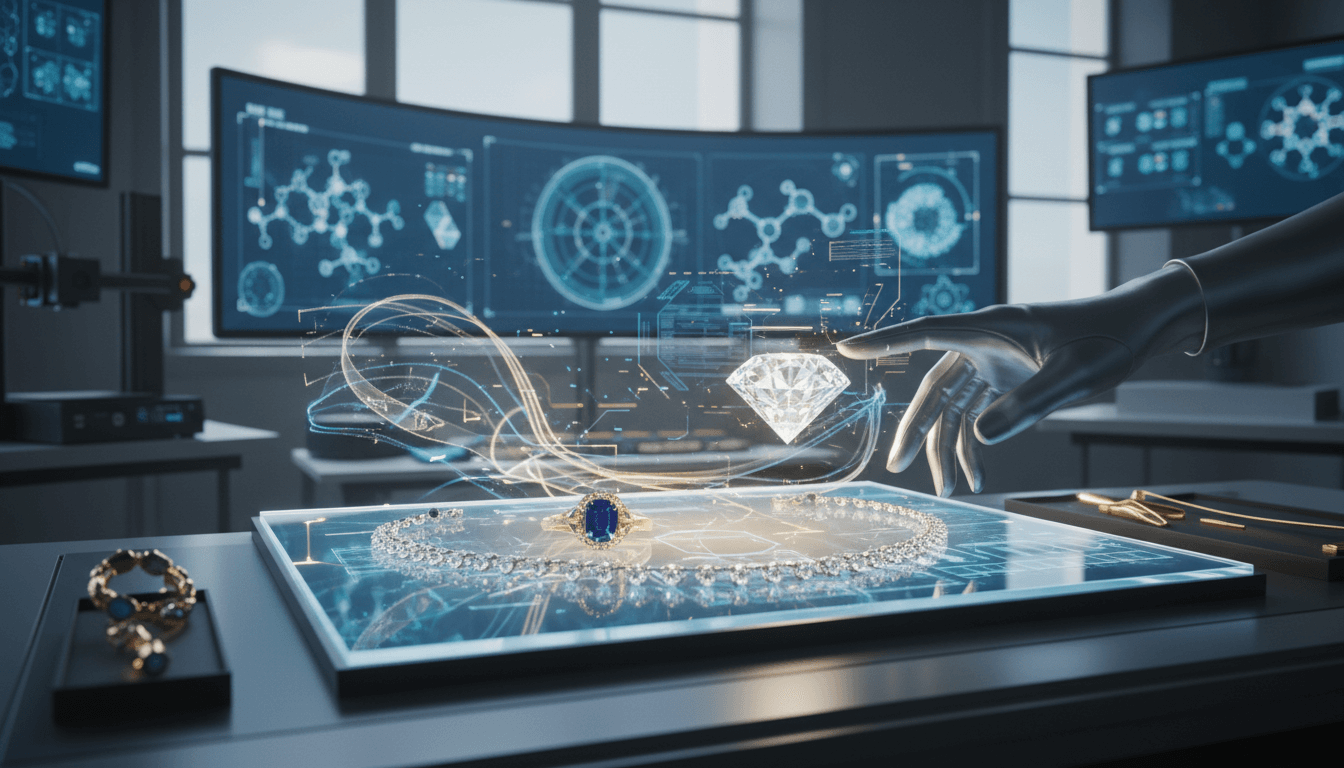

The future of gold in luxury jewelry is poised for evolution, driven by technological advancements and shifting consumer preferences. Sustainable and ethical sourcing is becoming a priority, with brands like Piaget and Van Cleef & Arpels adopting traceable gold from certified mines to appeal to conscious consumers. Innovations in craftsmanship, such as 3D printing and laser etching, enable more intricate designs while reducing waste. The World Gold Council projects that demand will continue growing, particularly in Asia, where digital platforms are making gold jewelry more accessible. For instance, e-commerce sales of gold pieces rose by 20% in 2024, with augmented reality tools allowing virtual try-ons. Moreover, the integration of smart features—like embedded NFC chips in gold jewelry for authentication—enhances security and investment appeal. Looking ahead, collaborations between tech firms and luxury brands may redefine gold's utility, blending tradition with modernity. These trends, coupled with gold's enduring cultural and economic roles, suggest a vibrant future where precious metals remain central to luxury, adapting to global challenges and opportunities.

Key Takeaways

Gold jewelry serves dual purposes: aesthetic adornment and investment, with prices rising over 25% in the past year.

Global demand is strong, led by a 5% increase in India in 2024, contributing to a market value of USD 59.7 billion.

Cultural traditions heavily influence gold consumption, ensuring steady demand across regions.

Investment in gold jewelry offers economic stability, with resale values appreciating significantly.

Future trends include sustainable sourcing and technological innovations, enhancing gold's appeal in the luxury sector.

Frequently Asked Questions

Why is gold considered a good investment in luxury jewelry?

Gold is a tangible asset that historically appreciates during economic uncertainties, with prices increasing over 25% in the past year. Luxury jewelry made from gold, such as high-karat pieces, often retains or increases in value due to craftsmanship, brand prestige, and limited supply, making it a reliable store of wealth.

How does cultural significance impact gold demand in jewelry?

Cultural practices, like weddings and festivals in regions such as India, drive consistent demand for gold jewelry as it symbolizes prosperity, tradition, and social status. This embedded significance ensures that gold remains a staple in luxury markets, even during economic fluctuations.

What are the key regions driving growth in the gold jewelry market?

India, with a 5% demand increase in 2024, is a major driver, followed by China, the Middle East, and emerging economies. These regions combine cultural affinity with rising incomes, while established markets in the West focus on artisanal and investment-grade pieces.

How is sustainability influencing the gold jewelry industry?

Brands are increasingly adopting ethical sourcing practices, such as using traceable gold from certified mines, to meet consumer demand for transparency. Innovations like recycling gold and reducing environmental impact are becoming standard, aligning luxury with responsible consumption.

Conclusion

Gold and precious metals remain indispensable in the luxury jewelry landscape, balancing timeless appeal with modern financial relevance. The insights from the World Gold Council Report—highlighting a 25% price surge, 5% demand growth in India, and a USD 59.7 billion market value—underscore gold's resilience and adaptability. As cultural traditions and investment strategies converge, the future promises further innovation through sustainability and technology. For industry players, understanding these dynamics is key to leveraging gold's enduring power in a competitive global market.

Tags

Related Articles

Digital Innovation in Luxury Jewelry: Transforming Design, Personalization, and Engagement

Digital technologies are revolutionizing the luxury jewelry sector by enabling advanced design processes, immersive customer experiences, and unprecedented levels of personalization. Innovations such as 3D printing and augmented reality are driving rapid adoption, allowing brands to enhance craftsmanship and deepen consumer connections. This article examines how these tools are reshaping market strategies and setting new standards for luxury in the digital age.

Women's Role in Luxury Jewelry Market: Driving Growth and Redefining Design

Women are the dominant force in the luxury jewelry market, propelled by rising economic empowerment and shifting social dynamics. This article explores how women's increasing disposable income and evolving lifestyle needs are reshaping consumption patterns, fueling demand for versatile, meaningful designs that reflect personal identity and aspirations. From investment pieces to everyday luxury, female consumers are dictating market trends, with brands responding through collections that emphasize storytelling, sustainability, and individual expression.

Luxury Jewelry Market Transformation 2024-2032: Trends, Growth, and Future Outlook

The global luxury jewelry market is undergoing a profound transformation, projected to grow from USD 61.01 billion in 2024 to USD 109.22 billion by 2032 at a CAGR of 7.55%. Key drivers include evolving consumer demands for personalized, sustainable, and gender-neutral designs, alongside advancements in digital engagement and ethical sourcing. This article provides an in-depth analysis of market dynamics, regional trends, and strategic insights shaping the future of high-end jewelry.

Sustainability and Ethical Luxury Jewelry Trends: Reshaping the Global Market

The luxury jewelry industry is undergoing a profound transformation as sustainability becomes a core consumer demand. Brands are responding with ethically sourced materials, transparent supply chains, and innovative eco-friendly collections featuring plant-based leather and recycled elements. This shift, driven by heightened environmental and social consciousness, is redefining luxury values and competitive strategies globally.

Celebrity and Cultural Influence in Luxury Jewelry: Shaping Global Trends

The luxury jewelry industry is increasingly leveraging strategic celebrity partnerships and cultural collaborations to drive brand innovation and global appeal. High-profile collaborations, such as Pharrell Williams with Tiffany & Co. and Michael B. Jordan with David Yurman, demonstrate how celebrity endorsements and designer alliances enhance storytelling, brand positioning, and market reach. These partnerships not only boost visibility but also infuse collections with unique cultural narratives, making luxury jewelry more relevant to diverse audiences worldwide.

Gender-Neutral Luxury Jewelry Evolution: Reshaping the Global Market

The luxury jewelry sector is undergoing a transformative shift towards gender-neutral and inclusive designs, driven by evolving social norms and consumer demand for versatile accessories. Key developments include the emergence of unisex collections from leading brands like Gucci and Bulgari, a notable increase in male jewelry engagement—with 33% of British men purchasing necklaces—and the blurring of traditional gender-specific design boundaries. This trend reflects a broader movement toward personal expression and inclusivity in high-end fashion, supported by market research indicating sustained growth in this segment.