The global luxury jewelry market is at a pivotal juncture, characterized by rapid evolution driven by technological innovation, shifting consumer values, and dynamic economic factors. With a projected compound annual growth rate (CAGR) of 7.55% from 2024 to 2032, the market is set to expand from USD 61.01 billion to USD 109.22 billion. This growth is fueled by increasing disposable incomes, heightened awareness of sustainability, and the rising demand for bespoke and inclusive designs. As brands adapt to these changes, the industry is witnessing a significant shift towards digital platforms, ethical practices, and personalized consumer experiences, redefining luxury in the modern era.

In-Depth Analysis

Market Growth and Economic Drivers

The luxury jewelry market's robust growth trajectory, with a CAGR of 7.55% from 2024 to 2032, underscores its resilience and adaptability. Key economic drivers include rising disposable incomes in emerging markets, particularly in the Asia Pacific region, which accounts for the largest market share. The post-pandemic recovery has accelerated consumer spending on high-end goods, with jewelry symbolizing emotional value and investment. Additionally, inflationary pressures and currency fluctuations have influenced pricing strategies, prompting brands to emphasize value through craftsmanship and heritage. The market's expansion is further supported by increasing urbanization and the growing middle class in regions like India and China, where luxury consumption is becoming more mainstream.

Sustainability and Ethical Sourcing

Sustainability has transitioned from a niche concern to a core industry imperative. Consumers are increasingly demanding transparency in supply chains, driving brands to adopt ethical sourcing practices for materials like conflict-free diamonds, recycled gold, and lab-grown gems. According to industry reports, over 60% of luxury jewelry buyers consider sustainability a critical factor in purchasing decisions. Brands are responding with certifications such as the Responsible Jewellery Council (RJC) and initiatives like carbon-neutral production. For instance, leading houses have introduced traceability technologies, including blockchain, to verify origins. This shift not only mitigates environmental impact but also enhances brand loyalty among ethically conscious consumers, particularly millennials and Gen Z.

Personalization and Gender-Neutral Designs

The demand for personalized and gender-neutral jewelry is reshaping product portfolios. Customization options, such as engraved initials, bespoke gemstone selections, and modular designs, allow consumers to express individuality, with personalized pieces accounting for nearly 30% of premium sales. Gender-neutral collections are gaining traction, reflecting broader societal shifts towards inclusivity. Designs featuring minimalist aesthetics, unisex sizing, and versatile functionality appeal to diverse demographics. Brands like Cartier and Tiffany & Co. have launched gender-neutral lines, leveraging social media campaigns to engage younger audiences. This trend aligns with the decline of traditional gender norms in fashion, driving innovation in materials and forms, from titanium bracelets to adaptive clasps.

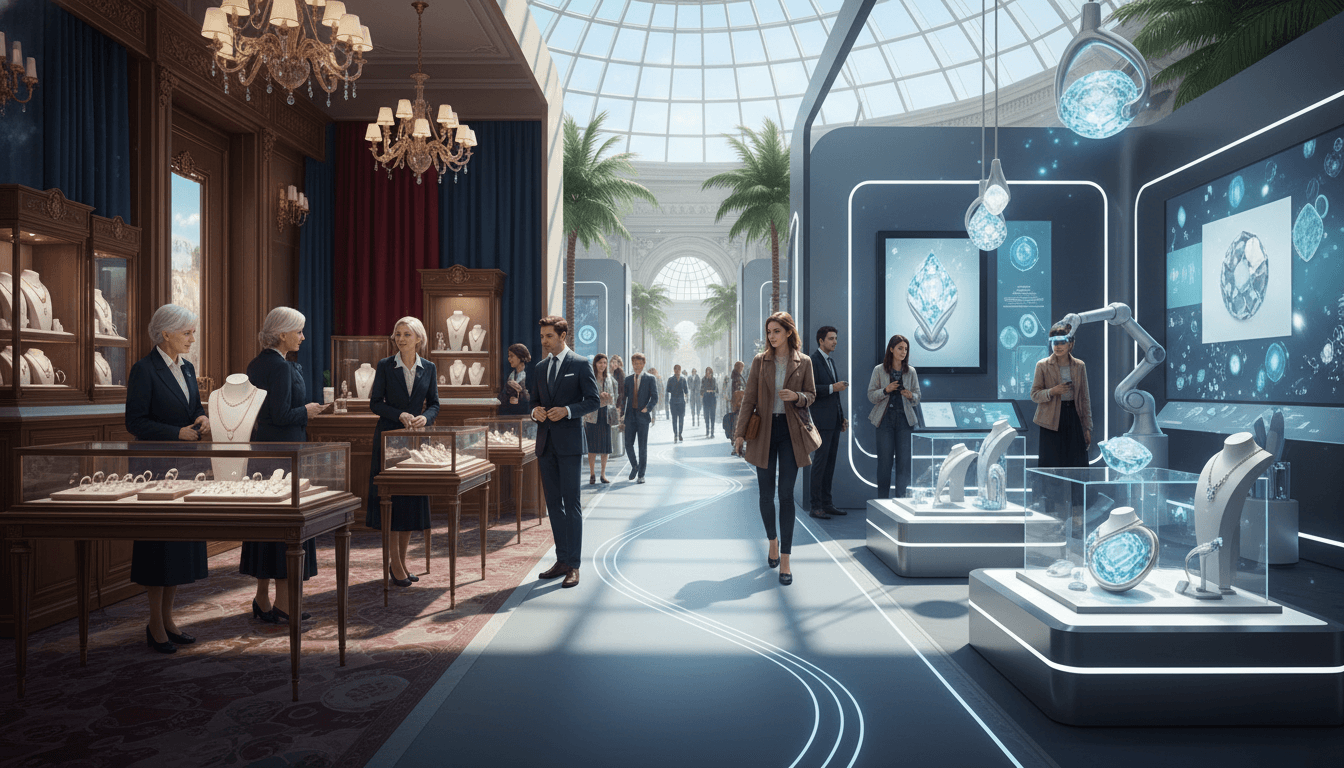

Digital Engagement and E-commerce Expansion

Digital transformation is revolutionizing luxury jewelry retail, with e-commerce sales projected to grow by 12% annually through 2032. Augmented reality (AR) try-ons, virtual consultations, and AI-driven recommendations enhance the online shopping experience, bridging the gap between physical and digital realms. Social media platforms, particularly Instagram and TikTok, serve as key marketing channels, influencing over 40% of purchase decisions. Brands are investing in immersive technologies, such as 3D configurators for custom designs, to foster engagement. Additionally, blockchain is being utilized for authentication and provenance tracking, addressing counterfeiting concerns. The Asia Pacific region leads in digital adoption, with China's luxury e-commerce market expanding at 15% CAGR, driven by platforms like Tmall Luxury Pavilion.

Regional Insights and Competitive Landscape

The Asia Pacific region dominates the luxury jewelry market, contributing over 45% of global revenue, fueled by economic growth in China, India, and Japan. North America and Europe follow, with steady demand for heritage brands and sustainable products. The competitive landscape is fragmented, with key players including LVMH, Richemont, and Swatch Group leveraging acquisitions and collaborations to capture market share. Emerging brands are gaining ground through niche focuses, such as artisanal craftsmanship or eco-friendly materials. Market consolidation is expected, as larger entities seek to integrate digital capabilities and sustainable practices. Regional preferences vary; for example, Western markets favor timeless pieces, while Asian consumers show a stronger inclination for branded, statement jewelry, influencing global design trends.

Key Takeaways

The luxury jewelry market will reach USD 109.22 billion by 2032, growing at a 7.55% CAGR from 2024.

Sustainability and ethical sourcing are critical, with over 60% of buyers prioritizing transparent supply chains.

Personalized and gender-neutral designs drive innovation, capturing nearly 30% of premium sales.

Digital engagement, including AR and e-commerce, is essential for growth, particularly in the Asia Pacific region.

Asia Pacific remains the top market, accounting for over 45% of global revenue, led by China and India.

Frequently Asked Questions

What is driving the growth of the luxury jewelry market?

Growth is driven by rising disposable incomes, especially in Asia Pacific, demand for sustainable and personalized products, and digital innovation in retail and marketing.

How important is sustainability in luxury jewelry?

Sustainability is paramount, with over 60% of consumers considering ethical sourcing a key factor. Brands are adopting blockchain for traceability and using recycled materials to meet this demand.

Which regions lead in luxury jewelry consumption?

Asia Pacific is the dominant region, contributing over 45% of global revenue, followed by North America and Europe, due to economic growth and digital adoption.

What trends are shaping jewelry designs?

Key trends include gender-neutral and customizable designs, minimalist aesthetics, and the use of innovative materials like lab-grown gems and titanium.

How is technology impacting the market?

Technology enhances engagement through AR try-ons, AI recommendations, and e-commerce platforms, with digital sales growing at 12% annually and blockchain ensuring authenticity.

Conclusion

The luxury jewelry market's transformation from 2024 to 2032 reflects a dynamic interplay of consumer values, technological advancement, and regional economic shifts. With a projected value of USD 109.22 billion and a CAGR of 7.55%, the industry's future hinges on embracing sustainability, personalization, and digital integration. Brands that prioritize ethical sourcing, inclusive designs, and innovative retail strategies will lead this evolution. As the Asia Pacific region continues to drive growth, global players must adapt to diverse preferences while maintaining craftsmanship and heritage. Ultimately, the market's resilience underscores its ability to blend tradition with innovation, ensuring lasting relevance in the luxury landscape.

Tags

Related Articles

Sustainability and Ethical Luxury Jewelry Trends: Reshaping the Global Market

The luxury jewelry industry is undergoing a profound transformation as sustainability becomes a core consumer demand. Brands are responding with ethically sourced materials, transparent supply chains, and innovative eco-friendly collections featuring plant-based leather and recycled elements. This shift, driven by heightened environmental and social consciousness, is redefining luxury values and competitive strategies globally.

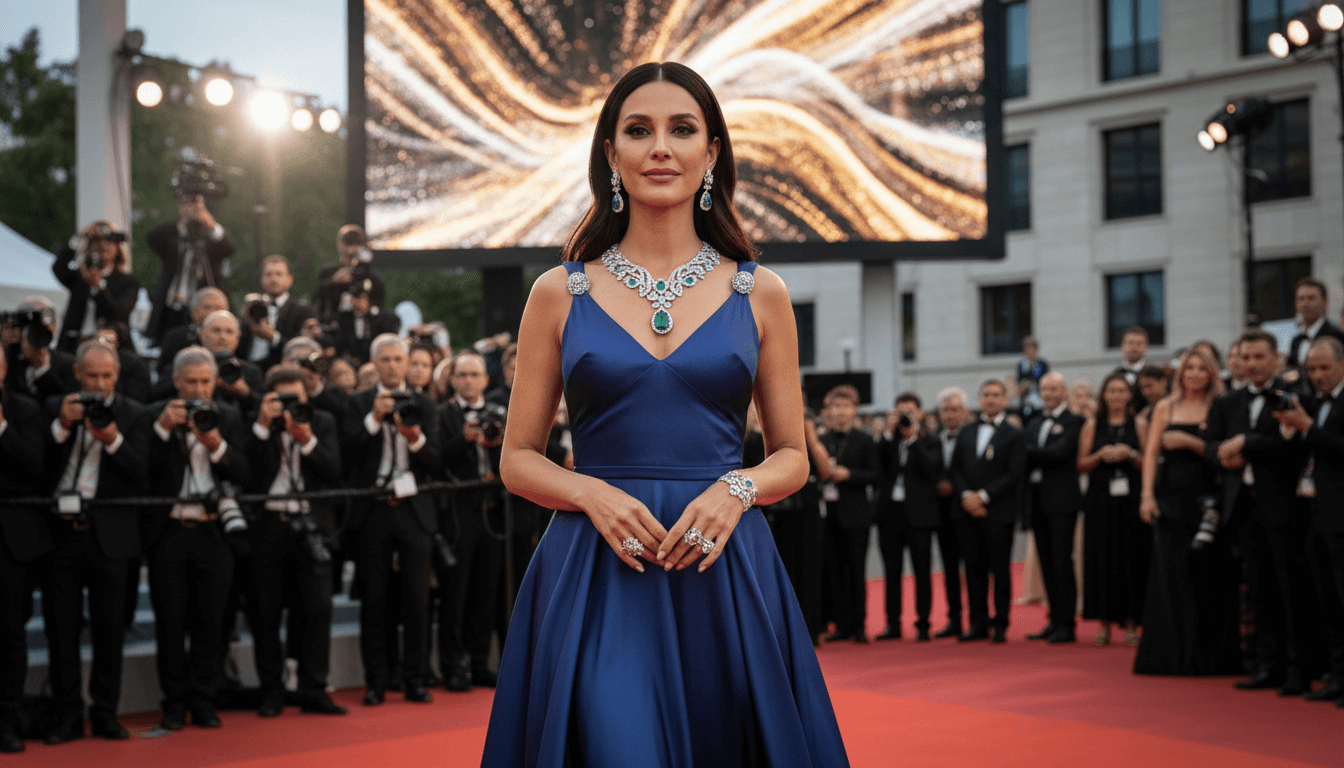

Celebrity and Cultural Influence in Luxury Jewelry: Shaping Global Trends

The luxury jewelry industry is increasingly leveraging strategic celebrity partnerships and cultural collaborations to drive brand innovation and global appeal. High-profile collaborations, such as Pharrell Williams with Tiffany & Co. and Michael B. Jordan with David Yurman, demonstrate how celebrity endorsements and designer alliances enhance storytelling, brand positioning, and market reach. These partnerships not only boost visibility but also infuse collections with unique cultural narratives, making luxury jewelry more relevant to diverse audiences worldwide.

Gender-Neutral Luxury Jewelry Evolution: Reshaping the Global Market

The luxury jewelry sector is undergoing a transformative shift towards gender-neutral and inclusive designs, driven by evolving social norms and consumer demand for versatile accessories. Key developments include the emergence of unisex collections from leading brands like Gucci and Bulgari, a notable increase in male jewelry engagement—with 33% of British men purchasing necklaces—and the blurring of traditional gender-specific design boundaries. This trend reflects a broader movement toward personal expression and inclusivity in high-end fashion, supported by market research indicating sustained growth in this segment.

Global Luxury Market 2024: Navigating Cautious Growth and Strategic Transformation

The global luxury market is undergoing a period of measured expansion, projected to grow from USD 259.74 billion in 2024 to USD 274.8 billion in 2025 at a CAGR of 5.8%. Brands are responding to economic uncertainties and evolving consumer demands by prioritizing personalization, sustainability, and digital innovation. Key segments such as jewelry, high-end fashion, and experiential luxury are driving growth, requiring strategic agility to maintain relevance in a discerning market landscape.

Sustainability and Ethical Sourcing: The New Imperative in Luxury Jewelry

Consumer priorities are shifting towards sustainability and ethical sourcing in luxury jewelry, with 78% of high-net-worth individuals considering these factors in purchasing decisions. Brands are responding by adopting transparent supply chains, using recycled precious metals, and certifying conflict-free gemstones. This trend is reshaping market dynamics, influencing everything from material sourcing to brand storytelling, with 65% of luxury jewelry companies now publishing sustainability reports.

Experiential Retail in Luxury Jewelry: Crafting Unforgettable Customer Journeys

Luxury jewelry retailers are pioneering experiential retail strategies to redefine consumer engagement. By designing immersive in-store environments, offering personalized consultations, and curating bespoke customer journeys, brands like Cartier and Tiffany & Co. foster deep emotional connections and brand loyalty. These approaches, supported by data showing a 40% increase in customer retention for experiential-focused brands, differentiate them in a competitive market. This article explores how these innovations transform traditional retail into memorable, high-value experiences that resonate with modern luxury consumers.