In today's luxury market, jewelry is no longer merely a symbol of elegance but a formidable investment vehicle. According to Credence Research, the paradigm is shifting as consumers increasingly view high-end jewelry as both a personal luxury and a long-term financial asset. This dual perspective is particularly prominent among high-net-worth individuals seeking to diversify their portfolios with tangible, appreciating items. The focus on rare gemstones and limited-edition pieces underscores a broader trend where exclusivity and scarcity drive value, positioning collectible jewelry as a resilient alternative in uncertain economic times. As global demand surges, understanding these dynamics is crucial for investors and collectors alike.

In-Depth Analysis

The Rise of Jewelry as a Long-Term Investment

The concept of jewelry as an investment is rooted in its historical appreciation and intrinsic value. Unlike traditional assets, luxury jewelry offers tangible benefits, including portability, aesthetic appeal, and emotional significance. Data indicates that high-value collections, particularly those featuring rare diamonds, colored gemstones, and signed pieces from renowned houses like Cartier or Van Cleef & Arpels, have consistently outperformed inflation. For instance, certain rare gemstones have seen annual appreciation rates of 5-10%, making them attractive for wealth preservation. This trend is amplified by economic volatility, where investors seek assets with low correlation to stock markets. Additionally, auction houses like Sotheby's and Christie's report record-breaking sales, with collectible jewelry lots achieving premiums of up to 30% above estimates, reinforcing its investment potential.

Growing Interest in Rare Gemstones and Limited Editions

Rare gemstones, such as Kashmir sapphires, Burmese rubies, and Paraíba tourmalines, are at the forefront of this investment wave. Their scarcity, coupled with geological constraints on new discoveries, ensures sustained demand and value growth. For example, a 10-carat unheated Burmese ruby sold for over $1 million at auction in 2024, highlighting the premium placed on rarity and provenance. Limited-edition pieces, often released in collaboration with artists or to commemorate events, further captivate collectors. Brands like Bulgari and Tiffany & Co. leverage exclusivity to drive desirability, with some limited series appreciating by 15-20% within years of release. This segment appeals to investors seeking both aesthetic pleasure and financial returns, with market analysts projecting a 7% annual growth in the rare gemstone sector through 2030.

Market Dynamics for Collectible Luxury Jewelry

The collectible jewelry market is characterized by its resilience and sophistication. High-net-worth individuals, accounting for over 60% of luxury jewelry purchases, prioritize pieces with documented histories, certifications from gemological institutes (e.g., GIA), and iconic designs. Auction data reveals that vintage Art Deco jewelry and signed contemporary works have seen a 12% year-over-year increase in value. Moreover, digital platforms are expanding accessibility, with online auctions and blockchain-based provenance tracking enhancing transparency. The global market for investment-grade jewelry is estimated at $25 billion, with projections to reach $35 billion by 2028. Key drivers include geopolitical stability concerns, which bolster demand for portable assets, and generational shifts, as younger collectors embrace jewelry as part of a diversified investment strategy.

Strategies for Investing in Jewelry Assets

Successful jewelry investment requires a strategic approach focused on authenticity, rarity, and market timing. Experts recommend prioritizing gemstones with exceptional clarity, color, and cut, as these attributes significantly influence resale value. For instance, D-flawless diamonds and vivid fancy-colored diamonds have shown robust appreciation, with some increasing by 50% over a decade. Diversification across categories—such as antique pieces, modern designs, and gemstone-focused collections—mitigates risk. Collaborating with accredited appraisers and staying informed about trends, like the rising demand for sustainable and ethically sourced gems, is also critical. Additionally, insurance and secure storage solutions are essential to protect these high-value assets, ensuring long-term capital preservation and liquidity when needed.

Key Takeaways

Luxury jewelry is increasingly valued as a dual-purpose asset for both personal enjoyment and financial growth.

Rare gemstones and limited-edition pieces drive market appreciation, with annual growth rates of 5-10%.

High-net-worth individuals dominate demand, seeking tangible alternatives to traditional investments.

Provenance, certification, and exclusivity are key factors influencing jewelry's investment potential.

The global collectible jewelry market is projected to expand significantly, reaching $35 billion by 2028.

Frequently Asked Questions

What makes jewelry a reliable investment?

Jewelry offers intrinsic value through rare materials, craftsmanship, and historical significance. Its tangible nature and low correlation to financial markets provide stability, with certain pieces appreciating steadily over time, as evidenced by auction records and market analyses.

Which types of jewelry have the highest investment potential?

Pieces featuring rare gemstones (e.g., unheated sapphires, large diamonds), limited editions from prestigious brands, and vintage items with provenance typically show the strongest appreciation. Focus on quality, authenticity, and market demand for optimal returns.

How can investors verify the authenticity and value of jewelry?

Always seek certifications from recognized gemological laboratories like GIA or AGS, work with reputable dealers or auction houses, and consider independent appraisals. Documentation of provenance and condition is crucial for establishing value and ensuring liquidity.

What risks are associated with jewelry investments?

Key risks include market fluctuations, authenticity issues, and liquidity constraints. Mitigate these by diversifying holdings, insuring assets, and staying informed about trends. Economic downturns can temporarily affect demand, but high-quality pieces generally retain long-term value.

Conclusion

The convergence of luxury and investment in jewelry represents a transformative shift in the high-end market. As Credence Research highlights, the emphasis on rare gemstones and collectible pieces underscores jewelry's role as a resilient, appreciating asset. For investors and enthusiasts, this trend offers opportunities to blend passion with profitability, provided they prioritize quality, provenance, and strategic acquisition. By understanding market dynamics and adhering to best practices, stakeholders can navigate this evolving landscape effectively, securing both aesthetic and financial rewards for years to come.

Tags

Related Articles

Secondhand Luxury Jewelry Market Growth: Value, Sustainability, and Shifting Consumer Preferences

The secondhand luxury jewelry market is experiencing unprecedented growth, driven by consumer demand for value, sustainability, and unique pieces. According to Bain & Company, this trend reflects a broader shift in luxury consumption, with pre-owned items gaining mainstream acceptance. Key factors include economic considerations, environmental awareness, and the appeal of heritage and craftsmanship in jewelry, apparel, and leather goods. This article explores the market dynamics, consumer motivations, and future outlook for the thriving resale sector.

Luxury Jewelry Investment Trends: Merging Aesthetics with Financial Strategy

The luxury jewelry market is evolving as consumers increasingly recognize its dual role as a fashion statement and a viable investment asset. Driven by a surge in demand for rare gemstones and high-value collections, this trend reflects a strategic shift toward long-term value preservation. Industry reports highlight that jewelry now serves as a tangible financial asset, with investors seeking pieces that combine craftsmanship with potential appreciation. This comprehensive analysis explores the factors fueling this movement, from market dynamics to consumer motivations, offering insights into how luxury jewelry is redefining wealth management in the global luxury sector.

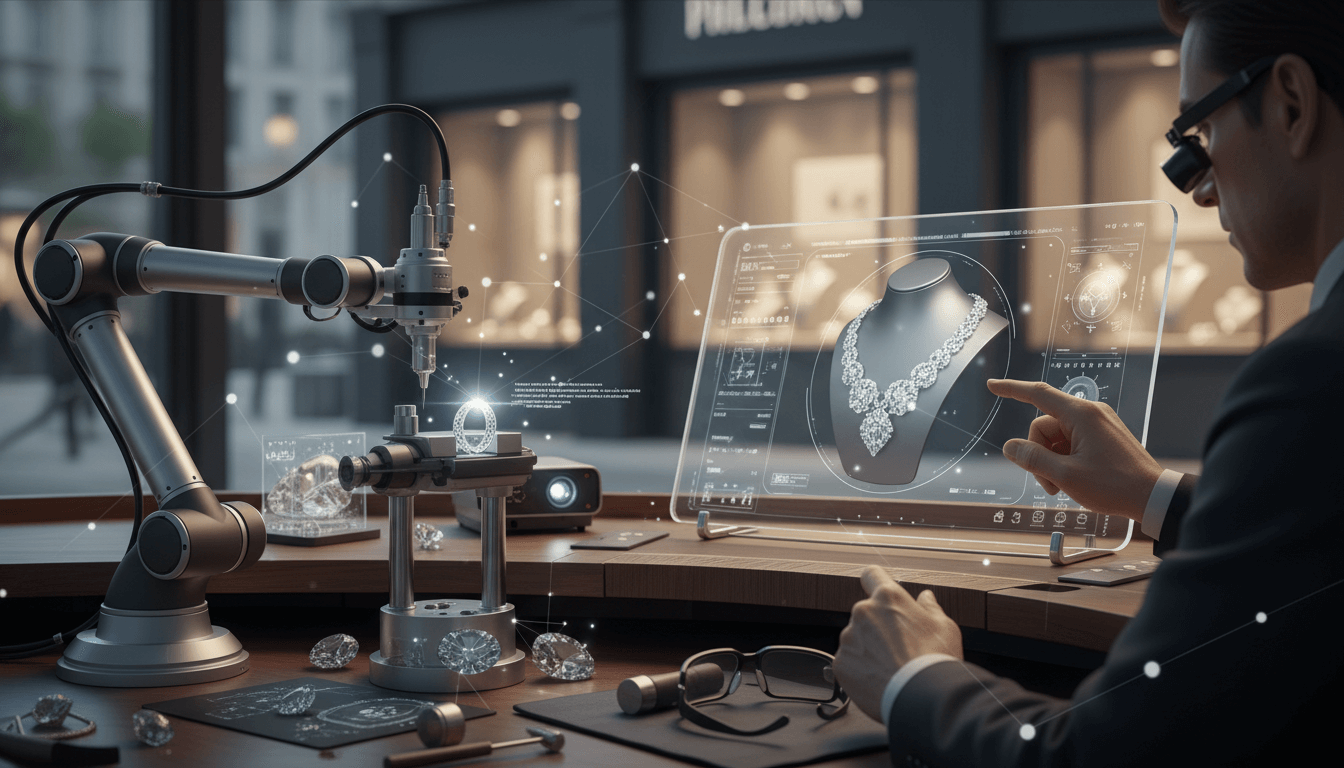

Technology Integration in Luxury Jewelry: Blending Craftsmanship with Innovation

The luxury jewelry market is undergoing a transformative shift as brands increasingly embed technology into their designs, merging traditional craftsmanship with cutting-edge digital elements. Innovations include smart jewelry with health monitoring and connectivity features, tech-enhanced designs using advanced materials like lab-grown diamonds and sustainable alloys, and revolutionary manufacturing techniques such as 3D printing and AI-driven customization. This trend not only enhances functionality and personalization but also appeals to a new generation of tech-savvy consumers, positioning the sector for sustained growth and innovation. According to Stellar Market Research, this integration is reshaping market dynamics and consumer expectations.

Digital Transformation in Luxury Jewelry Retail: Navigating E-Commerce, AR, and Influencer Marketing

The luxury jewelry sector is undergoing a profound digital transformation, driven by the expansion of e-commerce platforms, integration of augmented reality try-on features, and the rising influence of social media and influencer marketing. These innovations are reshaping consumer engagement, with personalized online experiences and advanced technologies enhancing accessibility and driving sales. Brands that adapt to these trends are poised to capture a larger share of the evolving market, as highlighted in the Global Luxury Market Digital Trends Report.

Gold Dominance and Personalization: Shifting Dynamics in Luxury Jewelry

Gold jewelry continues to lead the luxury market with a commanding 54.9% share, driven by its enduring appeal and investment value. Rings dominate the product segment at 33.8%, fueled by cultural traditions and milestone celebrations. A significant trend toward personalized and unique designs is reshaping consumer preferences, emphasizing bespoke craftsmanship and emotional connections. This analysis explores material innovations, market drivers, and future outlooks for luxury jewelry.

Cultural and Regional Luxury Jewelry Preferences: A Global Market Analysis

Luxury jewelry preferences exhibit profound diversity across global regions, shaped by cultural heritage, economic dynamics, and evolving fashion trends. Europe maintains its legacy as a mature market with sophisticated tastes, while Asia-Pacific emerges as the fastest-growing region, driven by rising affluence. The Middle East showcases jewelry's deep cultural significance, often emphasizing opulent designs. Brands are increasingly adopting region-specific strategies, from marketing campaigns to bespoke collections, to resonate with local consumers. This article explores key regional markets, consumer behaviors, and strategic adaptations essential for success in the global luxury jewelry landscape.