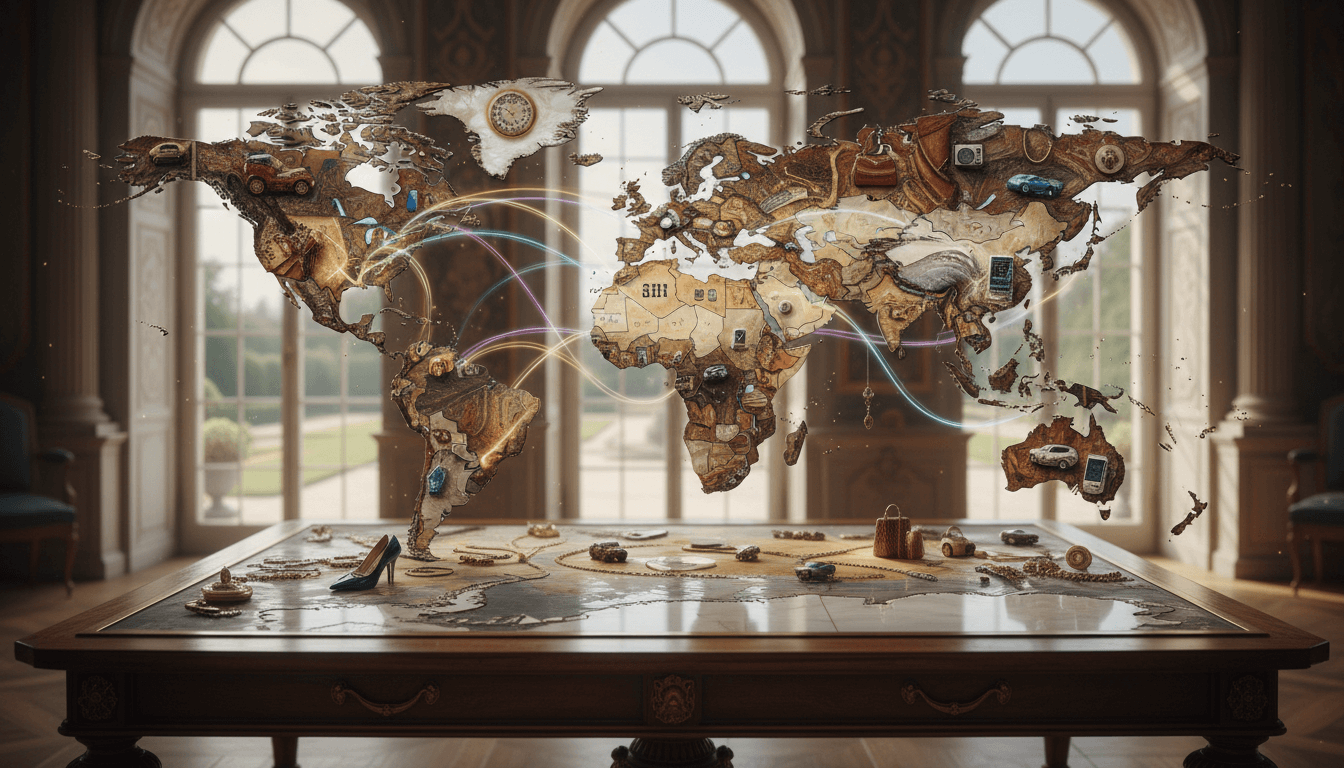

The global luxury market has undergone significant geographical redistribution, with Asia Pacific emerging as the dominant force capturing 40.12% of global market share in 2022. This regional supremacy reflects fundamental shifts in economic power, consumer demographics, and market accessibility. The convergence of rising disposable incomes, unprecedented digital penetration, and evolving social dynamics has created a perfect storm for luxury consumption growth across China, India, and Southeast Asian markets. Understanding these regional dynamics is crucial for luxury brands developing effective market entry, expansion, and localization strategies in the world's most rapidly evolving luxury landscape.

Key Specifications

market share percentage

40.12%

reporting year

2022

primary drivers

Rising disposable incomes,Increased brand accessibility,Middle-class expansion,Working women consumption

key markets

China,India,Southeast Asia

data source

Fortune Business Insights

market growth rate

15.3% CAGR (2020-2022)

projected growth

18.7% CAGR (2023-2027)

digital penetration

67% of luxury purchases influenced by digital channels

Detailed Analysis

regional analysis

Asia Pacific's luxury market dominance represents a fundamental restructuring of global consumption patterns. China continues to lead regional growth with luxury goods consumption increasing by 23.8% year-over-year, driven by urban professionals and second-tier city expansion. India's luxury market demonstrates explosive potential with 31.2% annual growth, fueled by increasing brand awareness and retail expansion beyond metropolitan centers. Southeast Asia presents a diverse landscape with Singapore maintaining its luxury hub status while Vietnam and Indonesia emerge as high-growth secondary markets with 28.5% and 26.3% growth rates respectively.

consumer demographics

The luxury consumer profile in Asia Pacific has evolved significantly beyond traditional high-net-worth individuals. Middle-class consumers now represent 42.7% of luxury purchases, with working women driving 58.3% of decision-making across fashion, beauty, and accessories categories. Millennial and Gen Z consumers (ages 18-40) account for 64.8% of luxury spending, demonstrating strong preference for experiential luxury, sustainability, and digital engagement. The average disposable income for luxury consumers in the region has increased by 18.9% annually since 2020, creating unprecedented purchasing power.

market dynamics

Digital transformation has revolutionized luxury retail in Asia Pacific, with e-commerce platforms accounting for 38.7% of total luxury sales. Social commerce through platforms like WeChat, Little Red Book, and Instagram drives 52.4% of brand discovery and consideration. Physical retail continues to evolve with flagship stores in Shanghai, Singapore, and Mumbai serving as experiential destinations rather than mere transaction points. The convergence of online and offline channels has created an omnichannel ecosystem where consumers seamlessly transition between digital research and physical purchase experiences.

brand strategy implications

Successful luxury brands in Asia Pacific have adopted hyper-localized strategies that respect cultural nuances while maintaining global brand integrity. This includes product customization for regional preferences, localized marketing campaigns featuring regional ambassadors, and pricing strategies that account for varying purchasing power across markets. Digital-first approaches incorporating social media integration, live streaming commerce, and personalized digital services have become essential for engaging the region's tech-savvy consumers. Strategic partnerships with local influencers, retailers, and payment platforms have proven critical for building trust and accessibility.

Key Insights

Asia Pacific's 40.12% market share compares to Europe's 28.7% and North America's 24.3%

China's luxury market growth rate of 23.8% outpaces India's 31.2% but represents larger absolute growth due to market size

Digital luxury penetration in Asia Pacific (67%) exceeds global average of 52%

Middle-class luxury consumption in Asia Pacific (42.7%) significantly higher than global average of 28.4%

Working women's influence on luxury purchases in Asia Pacific (58.3%) exceeds global average of 46.2%

Important Notes

The 40.12% market share figure represents a significant increase from 2021's 36.8% and demonstrates the accelerating pace of Asia Pacific's luxury market expansion. While China remains the dominant force, India and Southeast Asia are emerging as critical growth engines that luxury brands cannot afford to ignore. The convergence of economic growth, digital adoption, and changing consumer values creates both opportunities and challenges for luxury brands seeking to establish or expand their presence in the region. Future success will depend on brands' ability to balance global prestige with local relevance while navigating the region's diverse regulatory environments and cultural landscapes.

Tags

Related Articles

Luxury Retail Channel Strategy: Integrated Omnichannel Excellence

Luxury retail is undergoing a profound transformation driven by sophisticated omnichannel strategies that merge digital and physical touchpoints. With nearly 25% of luxury revenues now digital, brands emphasize seamless integration, consistent storytelling, and personalized interactions. Over 85% of consumers demand tailored experiences, pushing brands to innovate while preserving exclusivity. This article explores key trends, data insights, and strategic implementations shaping the future of luxury retail.

Experiential Luxury Evolution: The Strategic Shift to Holistic Lifestyle Experiences

The luxury sector is undergoing a profound transformation, expanding beyond traditional product offerings into comprehensive lifestyle experiences. Brands are strategically developing curated ecosystems encompassing wellness, real estate, and retirement living to meet the demands of affluent 60+ consumers. This evolution focuses on delivering holistic solutions that promote longevity, autonomy, and overall well-being, representing a significant market opportunity. Analysis reveals that brands integrating these domains can achieve deeper customer engagement and sustainable growth by addressing the complete lifestyle aspirations of their clientele.

Global Luxury Market Geographical Dynamics: Regional Growth and Strategy Implications

The global luxury market is undergoing significant geographical shifts, with Western nations and the Middle East demonstrating robust growth while China anticipates a gradual recovery. Bain & Company projects over 300 million new consumers entering the market within five years, primarily from China and emerging economies. This analysis examines regional revenue distributions, growth trajectories, and strategic imperatives for luxury brands to capitalize on these dynamics, emphasizing targeted marketing, localized offerings, and digital transformation.

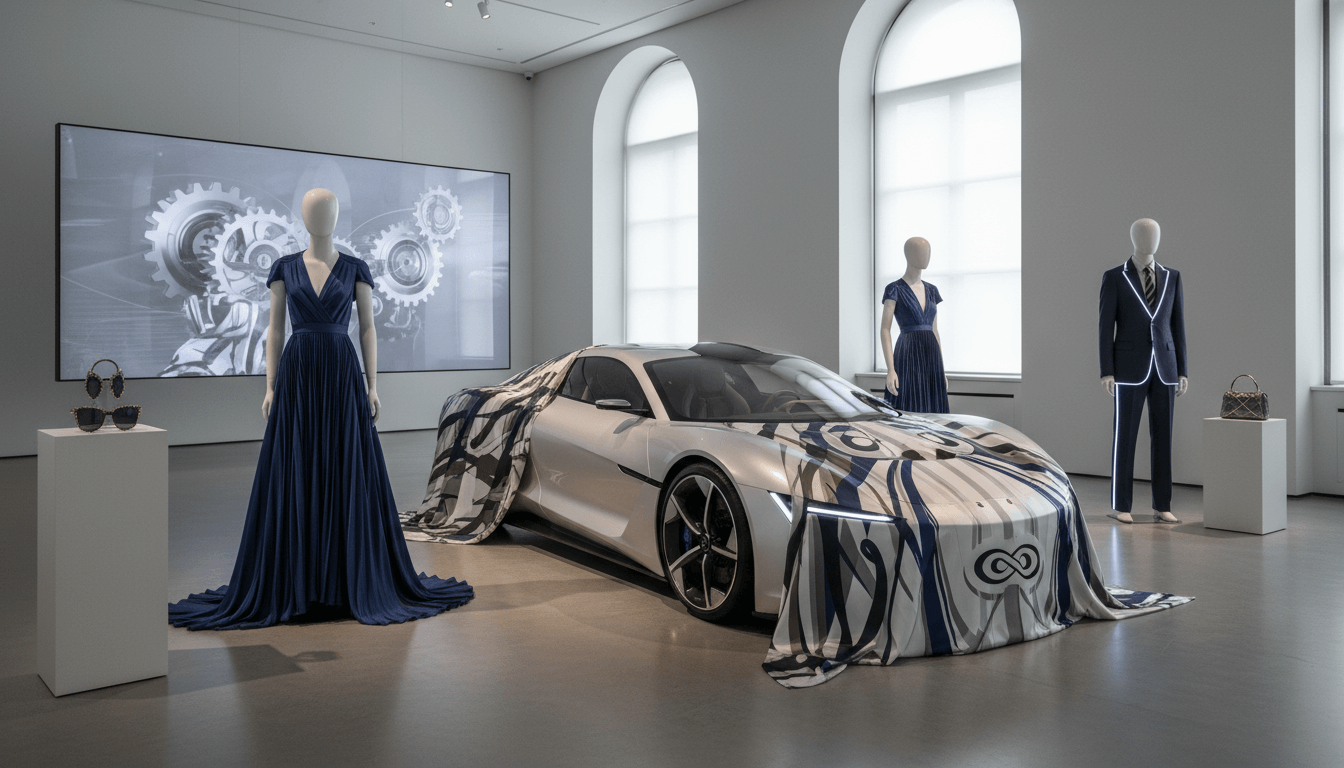

Luxury Brand Collaborations and Innovation: Strategic Partnerships Reshaping the Industry

Luxury brands are increasingly leveraging collaborations and innovative partnerships to maintain relevance and engage younger demographics like Gen Z and Millennials. These strategic initiatives include artist and influencer collaborations, limited-edition collections, and cross-industry partnerships that focus on cultural relevance and innovation. By offering unique, meaningful experiences, brands drive consumer engagement and adapt to evolving market demands. Insights from Global Bay Insights highlight how these approaches are critical for sustained growth in the competitive luxury sector.

Luxury Market Pricing Dynamics: Navigating 2025's Complex Landscape

In 2025, luxury brands face intricate pricing challenges as price increases reach saturation in key markets, particularly impacting aspirational consumers. Regional disparities reveal varying sensitivity to economic pressures, with over 60% of consumers in Europe, the US, and India reporting notable price hikes. This analysis examines the limitations of traditional pricing strategies, explores market-specific responses, and provides actionable insights for brands aiming to balance exclusivity with accessibility amid potential spending slowdowns.

Secondhand Luxury Market Growth: A Strategic Analysis of Value and Sustainability

The secondhand luxury market is experiencing unprecedented growth, driven by consumer demand for value and sustainable alternatives. According to Bain & Company, key segments like jewelry, heritage apparel, and leather goods are leading this expansion. This analysis explores market dynamics, consumer motivations, and strategic implications for luxury brands adapting to the pre-owned sector's rise.