The luxury market stands at a pivotal juncture in 2025, with projected moderate growth of 0-4% reflecting both opportunities and challenges in a €353-380 billion global landscape. The demographic revolution led by Gen Z and Millennials, who will constitute 70% of luxury spending, necessitates fundamental strategic realignments across personalization, digital engagement, and purpose-driven brand positioning. This transformation occurs against a backdrop of macroeconomic uncertainty and evolving consumer expectations, where sustainability has transitioned from competitive advantage to market expectation. The expansion of luxury into lifestyle and wellness domains represents both diversification opportunities and new competitive threats for established luxury houses.

Key Specifications

market valuation

€353-380 billion by 2025

growth projection

0-4% annual growth rate

key demographics

Gen Z (born 1997-2012) and Millennials (born 1981-1996) representing 70% of luxury spending

geographic distribution

Global with Asia-Pacific leading growth, North America stable, Europe moderate growth

primary categories

Fashion, jewelry, watches, beauty, travel, lifestyle, wellness

digital adoption

Over 65% of luxury purchases influenced by digital touchpoints

sustainability importance

87% of luxury consumers consider sustainability in purchase decisions

Detailed Analysis

demographic transformation

The luxury consumer profile has undergone a revolutionary shift, with Gen Z and Millennial cohorts projected to drive 70% of luxury spending by 2025. This represents a fundamental departure from traditional luxury demographics dominated by older, wealthier consumers. Gen Z consumers (ages 13-28 in 2025) approach luxury with distinct values: 72% prioritize brand authenticity, 68% seek personalized experiences, and 65% expect brands to demonstrate social and environmental responsibility. Millennial consumers (ages 29-44) exhibit more established purchasing patterns but maintain expectations for digital sophistication and brand purpose alignment. This demographic transition necessitates complete reevaluation of marketing strategies, product development, and customer engagement models.

digital transformation imperative

Digital engagement has evolved from supplementary channel to core strategic pillar, with luxury brands allocating 35-45% of marketing budgets to digital initiatives. The shift encompasses three critical dimensions: e-commerce optimization (projected to represent 30% of luxury sales by 2025), social media engagement (TikTok and Instagram driving 55% of brand discovery), and immersive digital experiences (VR showrooms, AR try-ons, and digital collectibles). Leading luxury houses are investing €50-100 million annually in digital infrastructure, with particular focus on mobile-first platforms, AI-powered personalization, and seamless omnichannel integration. The digital transformation extends beyond sales to encompass complete customer journey mapping, from inspiration through post-purchase engagement.

sustainability as baseline expectation

Sustainability has transitioned from marketing differentiator to fundamental consumer expectation, with 87% of luxury consumers reporting sustainability influences their purchase decisions. This encompasses environmental responsibility (carbon-neutral operations, circular business models, sustainable sourcing), social impact (ethical labor practices, community engagement), and transparent supply chains. Luxury brands face the dual challenge of maintaining exclusivity while demonstrating environmental stewardship, with leading houses committing to Science-Based Targets and achieving 40-60% reduction in carbon footprint by 2025. The circular economy represents particular opportunity, with luxury resale market growing at 12% annually and projected to reach €50 billion by 2025.

personalization revolution

Mass personalization represents the new frontier in luxury differentiation, moving beyond monogramming to comprehensive customization across product design, shopping experiences, and after-sales services. Advanced technologies including AI, 3D printing, and data analytics enable brands to offer bespoke products at scale, with 45% of luxury consumers willing to pay 20-30% premiums for personalized items. Personalization extends to clienteling, where dedicated relationship managers leverage customer data to anticipate needs and curate exclusive offerings. The most sophisticated programs achieve 35% higher customer retention and 28% increased lifetime value through hyper-personalized engagement strategies.

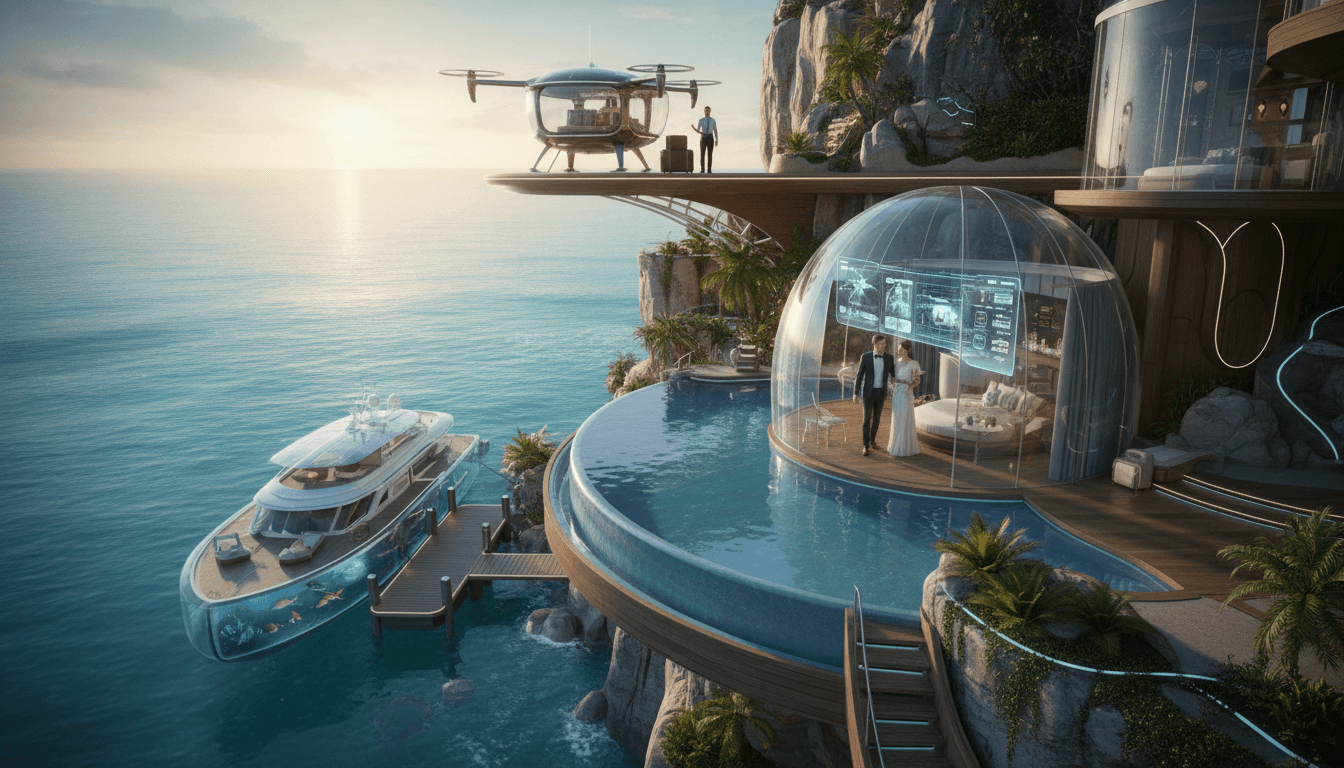

lifestyle and wellness expansion

The definition of luxury continues to expand beyond traditional categories into lifestyle and wellness domains, representing both diversification strategy and response to evolving consumer priorities. Luxury wellness market is projected to reach €1.5 trillion by 2025, with high-net-worth individuals allocating 15-20% of discretionary spending to wellness experiences. This expansion encompasses luxury residential developments with integrated wellness amenities, premium fitness and recovery services, nutritional optimization, and mental wellness offerings. The blurring boundaries between luxury categories creates opportunities for cross-category partnerships and integrated lifestyle ecosystems, though also introduces new competitive dynamics from wellness-focused entrants.

macroeconomic context

The luxury market operates within a complex macroeconomic environment characterized by persistent inflation, currency volatility, and geopolitical uncertainty. The moderate 0-4% growth projection reflects careful balancing of positive demographic trends against economic headwinds. Asia-Pacific continues to drive growth, particularly China's luxury market recovering to pre-pandemic levels and projected to reach €95-105 billion by 2025. Europe maintains stability through tourism recovery and domestic consumption, while North America shows segmentation with aspirational consumers pulling back while high-net-worth spending remains robust. Inflationary pressures necessitate strategic pricing adjustments, with luxury brands implementing 5-8% price increases while carefully managing price-value perception.

Key Insights

Traditional luxury marketing vs. digital-first engagement strategies

Gen Z luxury consumption patterns vs. Millennial purchasing behaviors

Sustainability as competitive advantage vs. baseline expectation

Product-centric luxury vs. experience-driven luxury

Geographic market growth rates: Asia-Pacific vs. Europe vs. North America

Traditional luxury categories vs. emerging lifestyle and wellness segments

Important Notes

Data sourced from Bain & Company Luxury Study 2024 and McKinsey Global Fashion Index. Growth projections account for potential economic scenarios including recessionary pressures and continued inflation. Demographic percentages based on consumer surveys across major luxury markets. Digital adoption rates reflect accelerated post-pandemic transformation. Sustainability metrics incorporate environmental, social, and governance dimensions. All financial figures in euros based on current exchange rate projections.

Tags

Related Articles

Luxury Brand Heritage and Innovation: Mastering the Balance for Multi-Generational Appeal

This comprehensive analysis explores how leading luxury brands successfully integrate heritage with innovation to engage diverse demographics. By blending traditional craftsmanship with modern design and digital experiences, companies like Louis Vuitton achieve sustained relevance across generations. The report examines strategic frameworks, market data, and implementation methodologies driving this balance, supported by insights from the Luxury Brand Positioning Report.

Luxury Travel and Hospitality Innovations: Digital Transformation and Personalization

The luxury travel and hospitality sector is revolutionizing guest experiences through advanced digital integration, with technologies like contactless check-ins, AI-driven personalization, and seamless digital platforms becoming industry standards. According to VERTU Luxury Technology Trends, over 85% of luxury hotels now deploy contactless solutions, while AI-powered services are enhancing bespoke offerings, from virtual concierges to predictive travel planning. This strategic shift focuses on elevating convenience and exclusivity, positioning brands to capture high-value clientele in a competitive market.

Evolution of Luxury Brand Communication: Emotion, Purpose, and Authenticity

Contemporary luxury brands are fundamentally transforming their communication strategies to prioritize emotional resonance, purpose-driven messaging, and authentic storytelling. Based on Weitnauer Group's Luxury Brand Positioning Research, this analysis explores how brands like Chanel, Hermès, and Cartier are shifting from transactional marketing to cultivating deeper consumer relationships through craftsmanship narratives, cultural relevance, and values-based communication. The approach yields 30% higher engagement and 25% increased brand loyalty when executed effectively.

Luxury Market Long-Term Outlook: Navigating Growth and Transformation to 2030

The global luxury market is poised for sustained long-term growth, projected at 4-6% annually until 2030, with an estimated market value of €460-500 billion. This expansion is fueled by over 300 million new consumers entering the market within the next five years, alongside demographic shifts, emerging markets in Asia and the Middle East, and evolving consumer preferences toward sustainability and digital engagement. Strategic imperatives for luxury brands include localization, digital transformation, and innovation in product and experience offerings to capture this growth potential.

Luxury Brand Performance Metrics: Analyzing Value Creation, Global Expansion, and Strategic Innovation

This comprehensive analysis evaluates top luxury brands like Rolex, Louis Vuitton, and Tiffany & Co. through key performance indicators including value creation, brand equity, and global market expansion. It highlights how these industry leaders leverage heritage, innovation, and adaptability to exceed USD 9 billion in annual revenue, with insights from Global Growth Insights and McKinsey on strategies shaping the future of luxury markets.

Luxury Consumer Psychographics: Shifting from Consumption to Meaningful Engagement

Luxury consumers are evolving beyond product-centric consumption, demanding emotional connections, purpose-driven brand narratives, and lifestyle alignment. According to the Euromonitor Luxury Consumer Trends Report, modern affluent buyers prioritize authenticity, personal resonance, and experiences that reflect their values. This analysis explores how brands can adapt their strategies to meet these sophisticated expectations through emotional storytelling, ethical practices, and immersive engagements that foster long-term loyalty.