The luxury market stands at a critical inflection point as generational transitions accelerate, with Bain & Company projecting that Generation Z (25-30%) and Millennials (50-55%) will collectively dominate 75-85% of luxury purchases by 2030. This seismic shift represents the most substantial market transformation in modern luxury history, fundamentally altering consumption patterns, brand expectations, and strategic imperatives. Unlike previous generations who valued heritage, craftsmanship, and exclusivity as primary luxury drivers, these digital-native cohorts prioritize experiential engagement, environmental responsibility, social consciousness, and technological innovation. The convergence of these values is creating a new luxury paradigm where brand authenticity and purpose-driven positioning become competitive differentiators. This comprehensive analysis examines the strategic implications for luxury brands across fashion, jewelry, travel, and lifestyle sectors, providing data-driven insights and actionable frameworks for navigating this transformative era.

Key Specifications

market size projection

$630-670 billion by 2030

generational breakdown

[object Object]

growth rate

6-8% CAGR through 2030

key drivers

Digital transformation,Sustainability demand,Experience economy,Value alignment,Social consciousness

primary regions

Asia-Pacific (45%),North America (25%),Europe (20%),Middle East (10%)

Detailed Analysis

gen z characteristics

Digital natives (born 1997-2012) who value authenticity, social responsibility, and digital engagement. They prefer brands that demonstrate environmental stewardship, ethical sourcing, and inclusive values. With $360 billion in direct purchasing power and significant influence over household spending, Gen Z consumers research extensively online, value peer recommendations, and expect seamless omnichannel experiences. They favor limited-edition collaborations, personalized products, and brands that support social causes aligned with their values.

millennial traits

Tech-savvy professionals (born 1981-1996) balancing career advancement with personal values. They prioritize experiences over possessions, seeking luxury that enhances lifestyle rather than merely signaling status. Millennials represent the largest luxury spending cohort currently, with average annual luxury expenditures of $4,500-$6,200 per household. They value transparency in supply chains, sustainable production methods, and brands that contribute to social and environmental causes.

comparative consumption patterns

While both generations prioritize values and experiences, Gen Z demonstrates stronger preference for digital-first engagement, social media influence, and brand activism. Millennials show greater interest in sustainable investment pieces and luxury travel experiences. Both cohorts exhibit significantly higher expectations for brand transparency and corporate responsibility compared to previous generations.

digital transformation

Luxury brands must accelerate digital integration across all touchpoints, including augmented reality try-ons, virtual consultations, social commerce, and personalized digital experiences. Investment in AI-driven personalization, blockchain for authentication and provenance tracking, and metaverse presence becomes essential for engaging these technologically fluent consumers.

sustainability integration

Beyond green marketing, brands must implement comprehensive sustainability frameworks encompassing circular business models, carbon-neutral operations, transparent supply chains, and ethical labor practices. Leading luxury houses are investing in material innovation, repair and resale programs, and carbon offset initiatives to meet evolving consumer expectations.

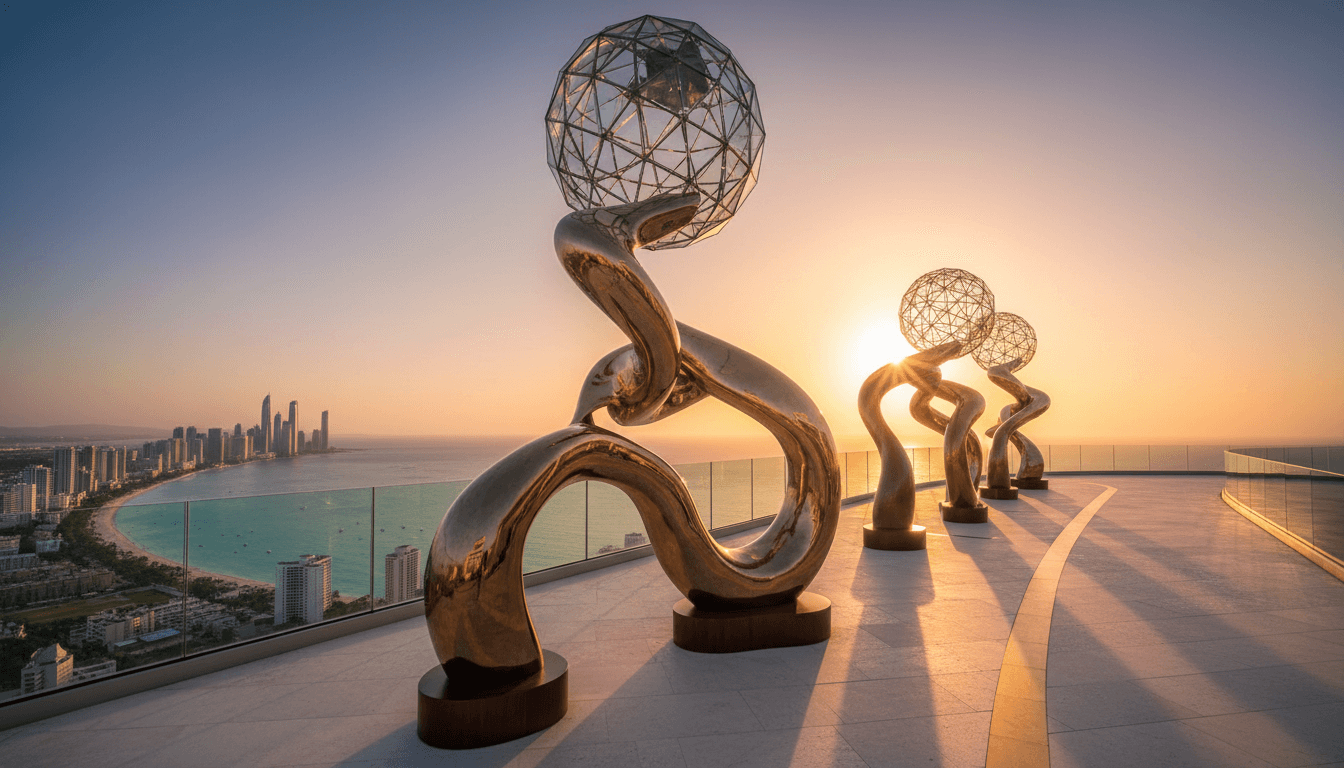

experience curation

The shift from product-centric to experience-centric luxury requires reimagining retail spaces as cultural hubs, creating exclusive events and travel experiences, and developing immersive digital engagements. Successful brands are blending physical and digital experiences through pop-up installations, masterclasses with artisans, and virtual reality brand worlds.

values alignment

Brands must authentically integrate purpose into their core business strategy, moving beyond corporate social responsibility as a side initiative to making social and environmental impact central to brand identity. This includes clear commitments to diversity and inclusion, community investment, and measurable impact reporting.

fashion luxury

Shift towards conscious consumption driving demand for sustainable materials, transparent production, and circular fashion initiatives. Resale market projected to grow 15-20% annually through 2030, with luxury brands launching certified pre-owned programs.

jewelry watches

Increased demand for traceable sourcing, ethical gemstone certification, and heritage storytelling. Smart luxury and personalized pieces gaining traction, with customization services becoming standard across premium jewelry brands.

luxury travel

Experiential travel surpassing traditional luxury hotel stays, with demand for transformative journeys, cultural immersion, and sustainable tourism options. Private villa rentals, conservation-focused safaris, and wellness retreats showing strongest growth.

automotive luxury

Electric and hybrid vehicles dominating luxury automotive growth, with sustainability becoming primary purchase driver alongside performance. Digital cockpit experiences and connectivity features becoming key differentiators.

beauty wellness

Clean beauty standards, sustainable packaging, and personalized skincare regimens driving premium beauty growth. Wellness tourism and integrative health experiences becoming significant luxury spend categories.

Key Insights

Digital engagement expectations: Gen Z requires seamless mobile-first experiences while Millennials value integrated omnichannel

Sustainability priorities: Gen Z focuses on climate action and social justice while Millennials emphasize ethical production and environmental conservation

Brand loyalty drivers: Gen Z values authenticity and social impact while Millennials prioritize quality and experiential benefits

Purchase journey: Gen Z heavily influenced by social media and peer recommendations while Millennials combine digital research with expert consultations

Price sensitivity: Both generations demonstrate willingness to pay premiums for authentic sustainability and exclusive experiences

Important Notes

The accelerated pace of generational transition requires luxury brands to adopt agile strategic planning with continuous market sensing and rapid adaptation capabilities. Brands that successfully navigate this shift will balance heritage with innovation, maintaining core identity while evolving to meet new consumer expectations. The integration of sustainability must be authentic and comprehensive rather than superficial marketing, as these generations demonstrate sophisticated awareness of greenwashing tactics. Digital transformation should enhance rather than replace human connection, with technology enabling more personalized and meaningful brand relationships. The most successful luxury strategies will create ecosystems that blend products, services, and experiences into cohesive lifestyle propositions.

Tags

Related Articles

Luxury Brand Positioning Strategies: Balancing Heritage with Modern Innovation

Luxury brands are adopting holistic positioning strategies that masterfully blend heritage with innovation to resonate across multiple generations. By leveraging unique brand narratives and emotional connections, these brands extend their appeal beyond product functionality to immersive experiences. Key attributes like craftsmanship, exclusivity, and storytelling define success, as seen with leaders like Louis Vuitton, which balances classic appeal with cutting-edge design to maintain relevance in evolving markets.

Digital Innovation in Luxury Brands: AI, VR, and Blockchain Strategies

Luxury brands are embracing digital transformation to revolutionize customer experiences through artificial intelligence, virtual reality, and blockchain technology. By 2026, most luxury fashion leaders will implement AI-driven strategies, with digital sales accounting for nearly 25% of total industry revenues. This shift addresses consumer demands for hyper-personalization, immersive shopping, and product authenticity. Key innovations include AI-powered personalization engines, virtual try-on experiences, and blockchain-based authentication systems that enhance engagement while preserving brand exclusivity. The integration of these technologies represents a fundamental evolution in luxury brand strategy and customer relationship management.

Sustainability in Luxury Sector: How Eco-Conscious Strategies Are Redefining Luxury

Sustainability has transformed from a niche differentiator to a core business imperative in the luxury sector, driven by demand from Millennial and Gen Z consumers. Over 65% of luxury shoppers in Europe and North America prioritize ethical sourcing and production. This article explores how brands are leveraging circular models, digital product passports, and environmental alignment as strategic levers, while wellness and sustainability credentials show strong growth since 2020, reshaping brand strategies globally.

Advanced Luxury Technology Integration: Transforming Brand Strategy Through Digital Innovation

This analysis delves into the strategic integration of cutting-edge technologies within the luxury sector, highlighting how AI, virtual reality, and blockchain are revolutionizing customer engagement and brand authenticity. By 2026, most luxury fashion leaders will adopt AI-driven personalization, while 85% of consumers demand bespoke digital experiences. The article explores real-world applications, market data, and future trends, emphasizing the critical role of technology in sustaining competitive advantage and meeting evolving consumer expectations in high-end markets.

Luxury Jewelry and Accessories Market: Brand Strategies Driving Growth

The luxury jewelry and accessories market demonstrates resilience and growth, led by iconic brands like Rolex, Cartier, and Tiffany & Co. These leaders are strategically focusing on sustainability, digital innovation, and global expansion to capture evolving consumer demand. Rolex's annual revenue exceeding USD 9 billion underscores the segment's strength, particularly in luxury watches. Market dynamics emphasize personalization and ethical sourcing, positioning the industry for sustained success amid changing luxury preferences.

Asia Pacific Dominates Global Luxury Market with 40.12% Share: Regional Dynamics and Strategic Implications

The Asia Pacific region solidified its leadership in the global luxury market with a commanding 40.12% market share in 2022, driven by unprecedented economic growth and evolving consumer behaviors. Key markets including China, India, and Southeast Asia are experiencing transformative shifts fueled by rising disposable incomes, expanded access to international luxury brands, and growing consumption among the middle class and working women. This comprehensive analysis examines the underlying factors, regional variations, and strategic imperatives for luxury brands seeking to capitalize on these dynamic market conditions through targeted approaches and localized strategies.