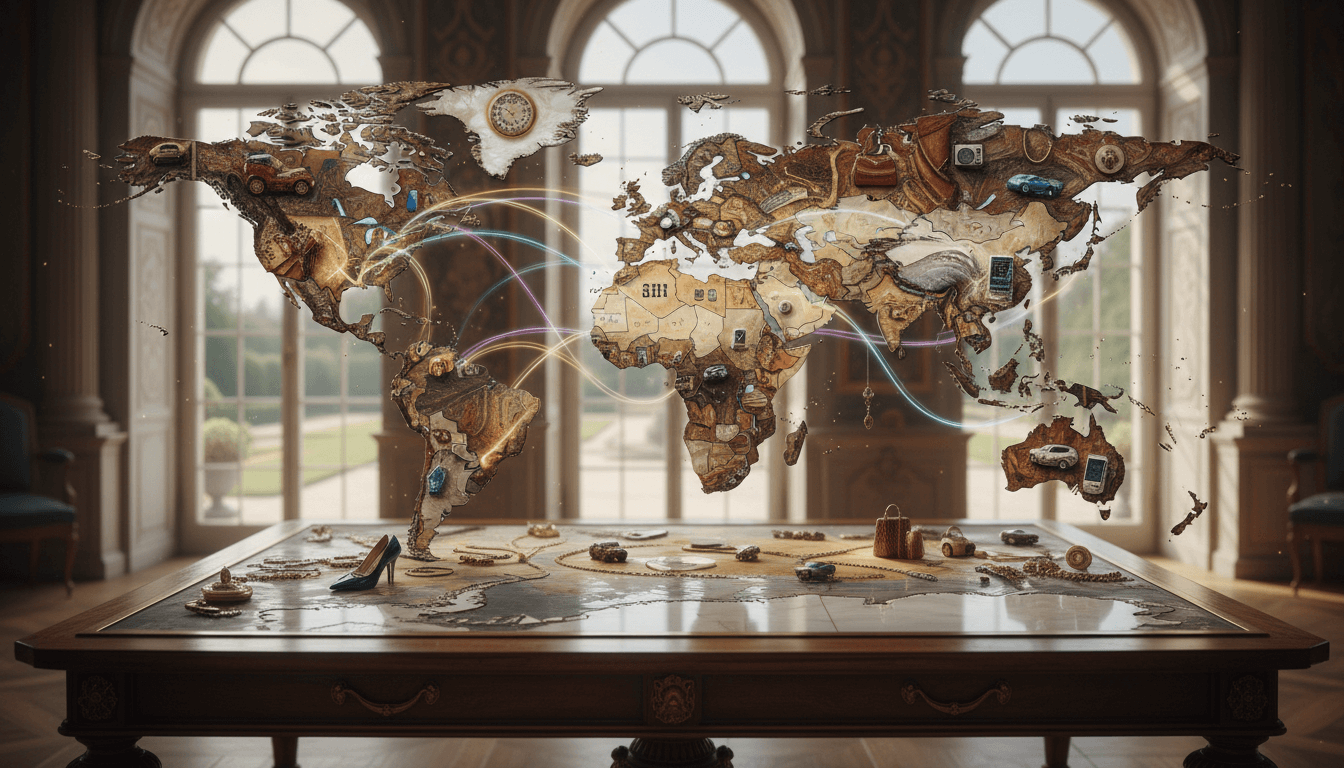

The luxury market's geographical dynamics reveal a complex tapestry of growth and opportunity, driven by regional economic conditions, consumer behavior shifts, and strategic brand initiatives. Western regions, including the U.S. and Europe, maintain dominance with 55% of global revenues, supported by high disposable incomes and brand loyalty. Meanwhile, the Middle East exhibits sustained expansion through tourism and local affluent demand. China's market, though facing temporary headwinds, holds immense recovery potential, fueled by urbanization and digital adoption. The anticipated influx of over 300 million new consumers globally by 2030, with significant concentrations in China and emerging markets, necessitates agile brand strategies focused on localization, omnichannel engagement, and sustainability to capture growth.

Key Specifications

new consumers global

Over 300 million in the next 5 years

key market regions

U.S., Europe, China, Middle East, Emerging Markets

revenue distribution

U.S. and Europe account for 55% of global luxury revenues

projected annual growth

4-6% until 2030

primary source

Bain & Company Luxury Study 2025

Detailed Analysis

western markets

The U.S. and Europe collectively contribute $420 billion annually to the luxury sector, driven by mature retail infrastructures, high consumer confidence, and innovation in experiential luxury. Europe's heritage brands leverage cultural capital, while the U.S. focuses on digital-native campaigns and personalized services.

middle east

Growth in the GCC countries, particularly the UAE and Saudi Arabia, is projected at 8-10% annually, bolstered by tourism diversification, luxury real estate developments, and high-net-worth individual spending. Dubai's luxury retail sector alone saw a 12% increase in footfall in 2024.

china recovery

China's luxury market is expected to rebound by 2026, with annual growth rates of 7-9%, supported by government stimulus, rising middle-class affluence, and e-commerce penetration exceeding 80%. Key cities like Shanghai and Beijing are pivotal, accounting for 40% of national luxury sales.

emerging markets

Regions such as Southeast Asia, India, and Latin America present untapped potential, with consumer bases expanding by 15% yearly. Initiatives like localized product lines and digital payment integrations are critical to engagement.

new consumers profile

The 300 million new consumers are predominantly millennials and Gen Z from urban centers, with annual household incomes exceeding $50,000. Over 60% prioritize sustainability and digital experiences in purchasing decisions.

purchasing behavior

Digital channels influence 75% of luxury purchases, with social media and influencer marketing driving brand discovery. Average spending per consumer in emerging markets is projected to grow by 20% by 2030.

localization strategies

Brands must adapt offerings to regional tastes—e.g., incorporating local aesthetics in product design and leveraging cultural festivals for marketing. In China, success hinges on collaborations with local celebrities and platforms like Tmall Luxury Pavilion.

digital transformation

Investments in AI-driven personalization, virtual try-ons, and blockchain for authenticity verification are essential. By 2027, luxury e-commerce is forecasted to represent 30% of total sales, up from 22% in 2024.

sustainability initiatives

Consumer demand for ethical sourcing and circular economy models requires brands to implement transparent supply chains. Over 50% of luxury firms have committed to carbon neutrality by 2035, aligning with regional regulatory trends.

retail expansion

Strategic store openings in high-growth hubs like Riyadh, Mumbai, and Jakarta, coupled with pop-up experiences, can enhance physical presence while reducing overheads through hybrid models.

Key Insights

Western markets show steady 4-5% growth vs. emerging markets at 8-12%

China's recovery pace lags Middle East but offers larger scale potential

Digital adoption rates: 85% in China vs. 70% in Europe for luxury purchases

Revenue per consumer: $2,500 in U.S. vs. $1,200 in emerging markets

Important Notes

Data sourced from Bain & Company's 2025 Global Luxury Report, supplemented by industry analytics. Regional projections account for geopolitical and economic variables, including trade policies and currency fluctuations. Brands should monitor consumer sentiment indices quarterly to adjust strategies.

Tags

Related Articles

Luxury Brand Collaborations and Innovation: Strategic Partnerships Reshaping the Industry

Luxury brands are increasingly leveraging collaborations and innovative partnerships to maintain relevance and engage younger demographics like Gen Z and Millennials. These strategic initiatives include artist and influencer collaborations, limited-edition collections, and cross-industry partnerships that focus on cultural relevance and innovation. By offering unique, meaningful experiences, brands drive consumer engagement and adapt to evolving market demands. Insights from Global Bay Insights highlight how these approaches are critical for sustained growth in the competitive luxury sector.

Luxury Market Pricing Dynamics: Navigating 2025's Complex Landscape

In 2025, luxury brands face intricate pricing challenges as price increases reach saturation in key markets, particularly impacting aspirational consumers. Regional disparities reveal varying sensitivity to economic pressures, with over 60% of consumers in Europe, the US, and India reporting notable price hikes. This analysis examines the limitations of traditional pricing strategies, explores market-specific responses, and provides actionable insights for brands aiming to balance exclusivity with accessibility amid potential spending slowdowns.

Secondhand Luxury Market Growth: A Strategic Analysis of Value and Sustainability

The secondhand luxury market is experiencing unprecedented growth, driven by consumer demand for value and sustainable alternatives. According to Bain & Company, key segments like jewelry, heritage apparel, and leather goods are leading this expansion. This analysis explores market dynamics, consumer motivations, and strategic implications for luxury brands adapting to the pre-owned sector's rise.

Luxury Brand Social Responsibility: The Strategic Shift to Sustainability, Inclusivity, and Purpose-Driven Approaches

Contemporary luxury brands are undergoing a fundamental transformation, embedding social responsibility as a core element of their strategic frameworks. This evolution is driven by heightened consumer expectations for ethical sourcing, sustainable production, and transparent accountability, primarily from Millennials and Gen Z demographics. Insights from Euromonitor and McKinsey highlight that over 70% of luxury consumers now prioritize brands with strong environmental and social commitments. Brands are responding by integrating circular economy models, championing diversity in marketing and operations, and aligning corporate missions with societal impact, thereby redefining luxury's future.

Luxury Market Transformation 2025: Strategic Shifts in the €353-380 Billion Landscape

The global luxury market is undergoing a fundamental transformation as Gen Z and Millennials are projected to represent 70% of luxury spending by 2025, driving a market valuation of €353-380 billion. Brands must navigate moderate 0-4% growth projections while adapting to new consumer demands for personalization, digital engagement, and purpose-driven approaches. Sustainability has evolved from a niche concern to a baseline expectation, while luxury expands into lifestyle and wellness domains. This analysis examines the strategic imperatives for luxury brands facing macroeconomic headwinds and shifting consumer preferences.

Luxury Brand Heritage and Innovation: Mastering the Balance for Multi-Generational Appeal

This comprehensive analysis explores how leading luxury brands successfully integrate heritage with innovation to engage diverse demographics. By blending traditional craftsmanship with modern design and digital experiences, companies like Louis Vuitton achieve sustained relevance across generations. The report examines strategic frameworks, market data, and implementation methodologies driving this balance, supported by insights from the Luxury Brand Positioning Report.