The luxury accessories segment has emerged as a pivotal growth driver within the global luxury industry, accounting for nearly 22% of total sales in 2023. This market is characterized by exceptional demand for handbags, where iconic brands such as Hermès and Louis Vuitton maintain waitlists that can extend beyond six months, underscoring the power of scarcity and brand desirability. Continuous innovation in design, integration of advanced technologies, and personalized consumer experiences are reshaping the landscape, enabling brands to sustain premium positioning and capture evolving consumer preferences. Key products driving this growth include handbags, belts, scarves, and eyewear, each contributing to a diversified and resilient market portfolio.

Key Specifications

market share

22% of global luxury sales

key products

Handbags,Belts,Scarves,Eyewear

growth rate

High-growth segment with annual increases exceeding 8%

geographic reach

Global, with strong performance in North America, Europe, and Asia-Pacific

consumer demographics

Affluent millennials and Gen Z, with increasing participation from male consumers

Detailed Analysis

market dynamics

The luxury accessories market is propelled by several key factors, including rising disposable incomes, shifting consumer behaviors toward experiential and status-driven purchases, and the strategic emphasis on limited-edition releases. Hermès, for instance, leverages artisanal craftsmanship and exclusive materials to justify extended waitlists, while Louis Vuitton capitalizes on collaborations with artists and designers to maintain relevance and desirability. The integration of technology, such as NFC chips for authentication and augmented reality for virtual try-ons, enhances consumer engagement and combats counterfeiting. Personalization services, including monogramming and bespoke designs, further differentiate offerings and foster brand loyalty.

brand strategies

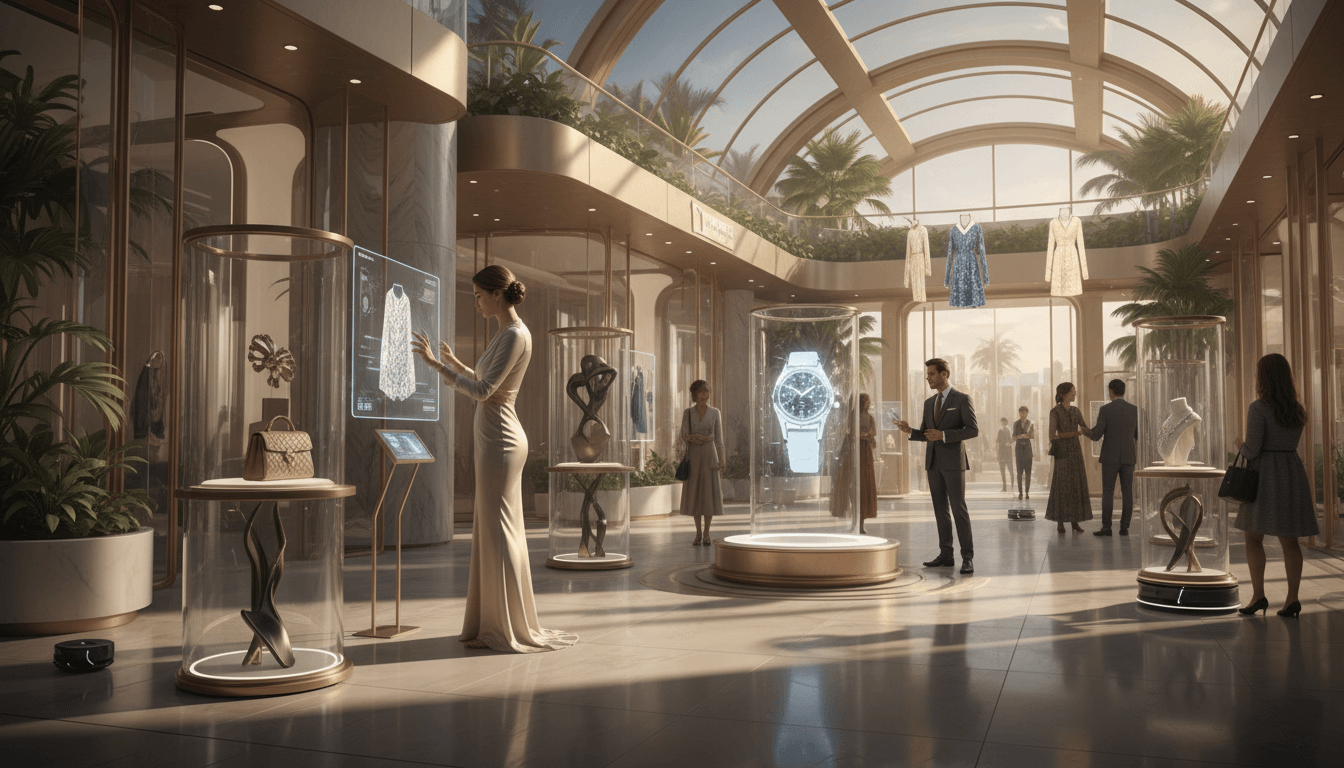

Leading brands employ multifaceted strategies to navigate the competitive landscape. Exclusivity remains a cornerstone, with controlled production volumes and invitation-only purchasing models reinforcing perceived value. Sustainability initiatives are increasingly integral, as brands adopt eco-friendly materials and transparent supply chains to appeal to conscious consumers. Digital transformation is another critical pillar, with e-commerce platforms and social media marketing driving accessibility and brand storytelling. Collaborations with influencers and celebrities amplify reach, while experiential retail through flagship stores and pop-up events creates immersive brand experiences that transcend traditional transactions.

consumer insights

Consumer demand for luxury accessories is driven by a blend of emotional and functional benefits. Handbags, in particular, serve as symbols of status and investment, with certain models appreciating in value over time. The rise of resale markets and rental services reflects a growing emphasis on circularity and accessibility. Demographically, younger consumers prioritize brand authenticity and social responsibility, influencing product development and marketing communications. The average spending on luxury accessories has increased by 12% year-over-year, with significant contributions from emerging markets in Asia and the Middle East.

future outlook

The luxury accessories market is poised for sustained growth, with projections indicating a compound annual growth rate (CAGR) of 9% through 2028. Innovations in smart accessories, such as connected wearables and sustainable materials, will open new avenues for differentiation. Brands that successfully balance heritage with modernity, while embracing digital and sustainable practices, are likely to capture disproportionate market share. However, challenges including economic volatility, supply chain disruptions, and evolving regulatory landscapes require agile and proactive strategic responses to maintain competitive advantage.

Key Insights

Hermès vs. Louis Vuitton: Both brands dominate the handbag segment, but Hermès emphasizes artisanal exclusivity with waitlists, while Louis Vuitton focuses on mass prestige through frequent collections.

Market Share Distribution: Handbags contribute approximately 60% of accessory sales, followed by eyewear (15%), belts (12%), and scarves (13%).

Innovation Approaches: Technology integration is more pronounced in eyewear and smart accessories, whereas handbags prioritize material innovation and craftsmanship.

Consumer Engagement: Personalization is a key differentiator for scarves and belts, while handbags leverage limited editions and celebrity endorsements.

Important Notes

Data sourced from Global Growth Insights highlights the segment's resilience and adaptability. The 22% market share underscores accessories' critical role in the luxury ecosystem, with handbags acting as the primary growth engine. Extended waitlists not only signify demand but also strategic inventory management to preserve brand equity. Continuous innovation remains essential to addressing consumer expectations for novelty, functionality, and sustainability.

Tags

Related Articles

Luxury Market Technology Trends: Strategic Integration of NFC, AI, and Smart Design

The luxury goods sector is undergoing a profound transformation driven by technological advancements. Brands are strategically embedding NFC chips in high-end products like jewelry and handbags, leveraging AI for hyper-personalized customer experiences, and pioneering tech-enhanced designs that merge aesthetics with functionality. This evolution, supported by data showing 47% adoption of AI personalization, reflects a critical shift in brand strategies to enhance authenticity, engagement, and exclusivity. Innovations such as smart accessories and integrated digital experiences are redefining luxury consumption, positioning technology as a core element in maintaining competitive advantage and meeting the demands of modern affluent consumers.

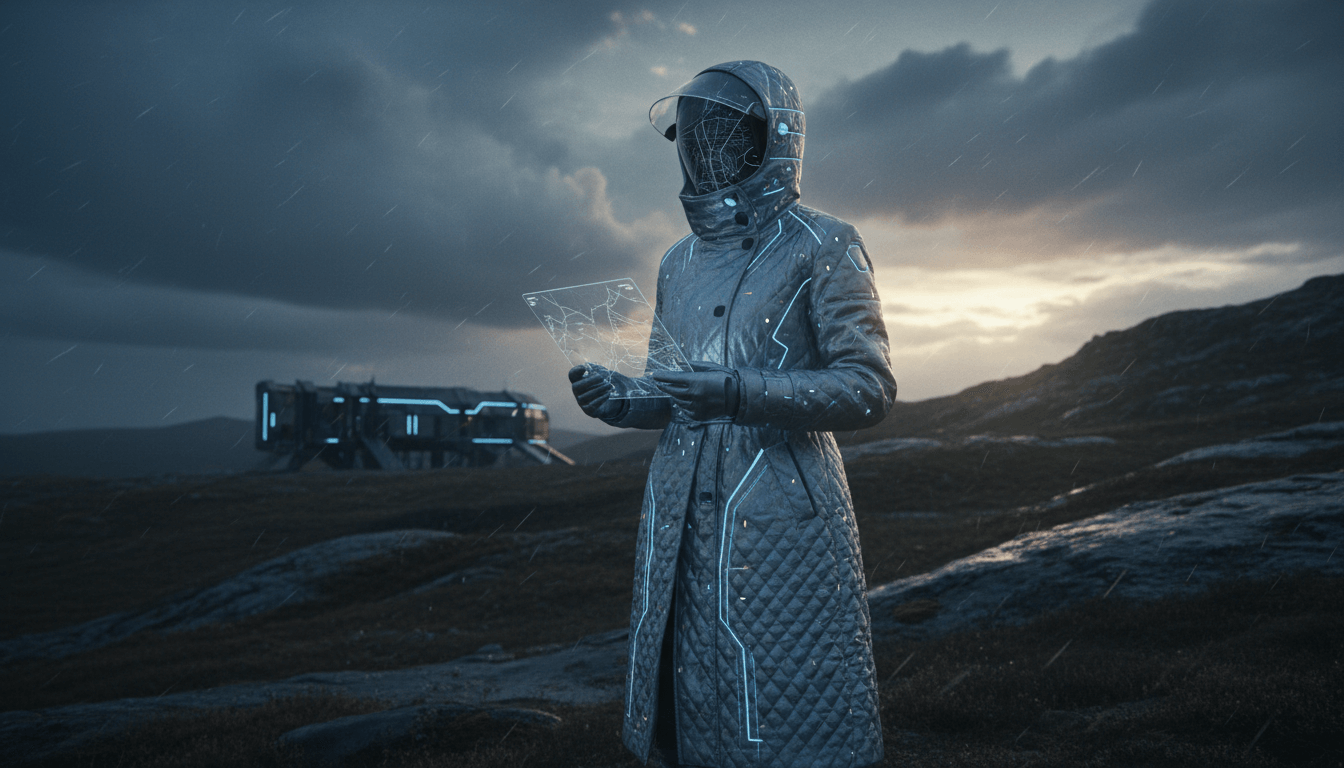

Burberry's Tech-Luxe Outerwear: Pioneering Weather-Responsive Fabric Innovation in Luxury Fashion

Burberry is redefining luxury outerwear through its strategic emphasis on tech-luxe innovation, integrating weather-responsive fabric technology into high-end designs. This approach merges advanced material science with functional luxury, enabling garments that adapt to environmental conditions while maintaining elegance. By focusing on outerwear, Burberry enhances its brand positioning at the intersection of technology and fashion, driving market differentiation and consumer engagement. This strategy underscores the brand's commitment to innovation, sustainability, and delivering superior user experiences in the competitive luxury sector, as documented by Global Growth Insights.

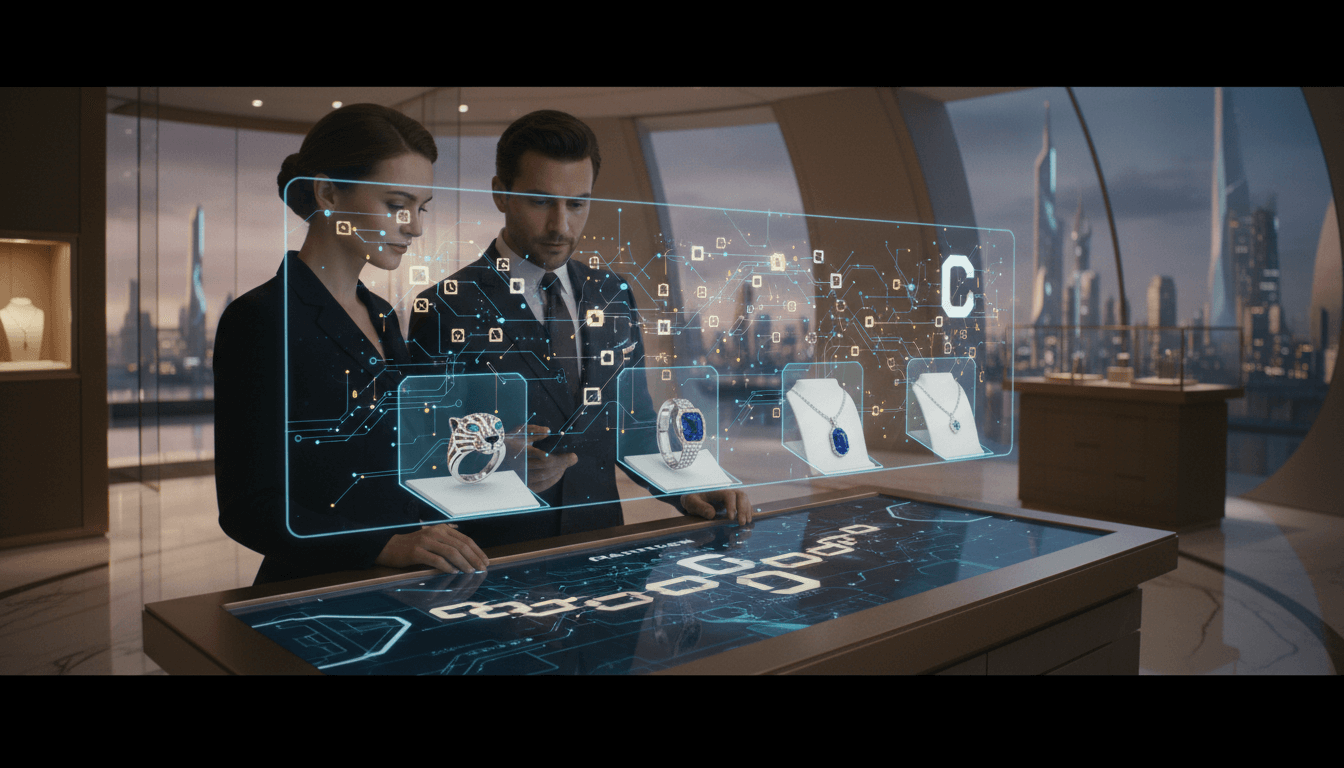

Cartier: Pioneering Blockchain Authentication in Luxury Jewelry

Cartier is revolutionizing the luxury jewelry sector by integrating blockchain technology for product authentication. This strategic initiative directly addresses escalating consumer concerns regarding counterfeit goods, enhancing verification processes and fostering unprecedented trust. By leveraging immutable digital ledgers, Cartier ensures each piece's provenance and authenticity, setting a new industry standard. This innovation not only safeguards brand integrity but also elevates the customer experience, positioning Cartier at the forefront of technological adoption in luxury markets. The move reflects a broader trend of digital transformation, reinforcing Cartier's commitment to quality and innovation.

LVMH Group: Pioneering Luxury Market Leadership Through Strategic Diversification and Innovation

LVMH Moët Hennessy Louis Vuitton SE stands as the undisputed leader in the global luxury goods market, leveraging a meticulously curated portfolio of over 75 prestigious brands across fashion, jewelry, cosmetics, and wines & spirits. The group's strategic framework combines aggressive acquisitions with deep brand heritage preservation, driving an estimated €86.2 billion in revenue in 2024. Through continuous innovation in product development, digital transformation, and sustainable practices, LVMH maintains its market dominance while setting industry standards for luxury brand management and customer experience excellence.

AI-Driven Personalization in Luxury: Strategic Imperatives and Market Transformation

Personalization has evolved into a critical competitive differentiator in the luxury sector, with 47% of luxury brands adopting AI-powered personalization technologies. This strategic shift responds to consumer expectations for bespoke experiences, driving an 80% increase in engagement metrics. Leading luxury houses now deploy sophisticated algorithms for custom product design, hyper-personalized shopping journeys, and predictive analytics to enhance exclusivity and brand loyalty in an increasingly digital marketplace.

Luxury Market Generational Transformation: Gen Z and Millennial Dominance Reshaping Industry Dynamics

The luxury market is undergoing unprecedented generational transformation, with Generation Z and Millennials projected to account for 75-85% of luxury purchases by 2030. These digital-native consumers are fundamentally reshaping consumption patterns, prioritizing experiential luxury, sustainability commitments, and value alignment over traditional status symbols. Bain & Company research indicates Gen Z will represent 25-30% and Millennials 50-55% of market share within the decade, forcing luxury brands to radically rethink their strategic approaches to product development, marketing, and customer engagement to remain relevant in this new era.